I. The Context

Crypto narrative hype cycles are driven by a pattern of increasing attention and price growth, followed by excessive speculation. The hype is fuelled by a narrative that promises innovation, disruption, and opportunity for financial gains.

- 2017-2018 was called The ICO Boom. This narrative promised a new era of decentralized investing and disrupted traditional fundraising methods.

- 2020 was the Summer of DeFi with a vision of creating an open and permissionless financial ecosystem.

- 2021 was the Rise of Alt Layer 1. Solana, Avalanche, and even Terra (Luna) aimed to provide scalable and high-performance blockchain solutions, challenging the dominance of Ethereum.

- 2022 was the year of NFT and 2023 can be known as the year of MemeCoin.

- What will be the center point in the next bull run? We can only guess. And my bet is on SocialFi.

SocialFi is currently one of the hottest terms on the market. It is the combination of Social Media and Decentralized Finance. It is the bridge that connects Web 2.0 and Web 3.0. It powers the paradigm shift toward a creator economy.

Binance, the largest crypto exchange today, might have the same bet as mine. The most recent projects on Binance Launchpad are Hooked Protocol, Open Campus, Space ID, and Arkham. All fall into the SocialFi category.

But not every SocialFi project has Binance’s attention. Social infrastructure like Lens Protocol or Cyber Connect is one of them. Binance is looking at dApps that have a purpose, aiming to solve an end-user problem. And we should do the same.

The game is slowly shifting toward dApps with real usage and real users.

The realm of dApps continues to flourish, with Friend Tech being the latest sensation sweeping the crypto community. It is a decentralized social media application built on Base, that allows users to tokenize their social network and sell “shares” of themselves.

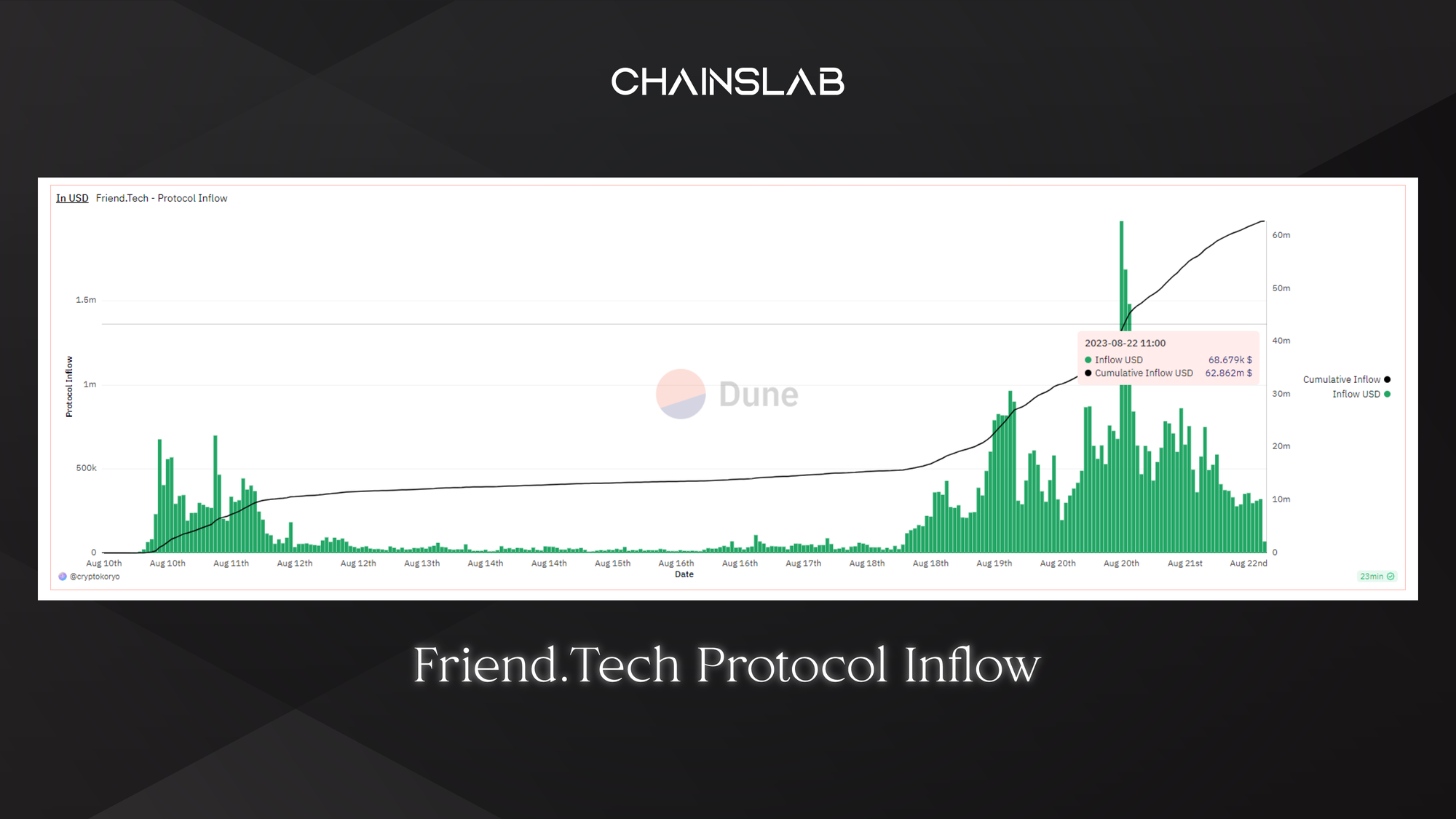

The new social app has driven 4,400 ETH ($8.1 million) in trading volume in less than 24 hours since its launch on August 10th. Until now, it has generated nearly 35,000 ETH (~$60M) in trading volume and more than $3M in Protocol Fee. It has become the most popular Web3 social app, even in its beta phase.

Friend Tech's idea is not new nor innovative, their platform is lagging and lacks privacy policies, their team is anonymous and their roadmap is unclear. But why is it capturing the attention of so many? Let’s find out.

II. What is Friend Tech?

Friend Tech is a new decentralized social media platform that allows users to tokenize their social networks, enabling them to sell "shares" of themselves to followers.

Furthermore, the ownership of a share grants you access to a private chat with the share creator. And the share price fluctuates according to supply and demand, in a unique curve, not an AMM pool.

The platform is built on Base, Coinbase’s Layer 2 Network. It was launched as an invite-only beta on August 10th and has witnessed substantial trading volume, reaching 35,000 ETH (about $60 million) in the last 10 days.

Friend Tech is a definition of SocialFi. It is a combination of social media and decentralized finance. It is an intriguing experiment in monetizing social interactions. These are the key features of Friend Tech:

- Tokenization: Users create a profile to sell shares of themselves.

- Communication: Owning a share gives access to private messages with that user.

- Trading: Share prices fluctuate based on supply and demand.

One thing to keep in mind is, Friend Tech is not the first experiment with creator shares. Friend Tech isn't the pioneer in this domain. It follows the legacy of platforms like BitClout and DeSo Protocol. But what sets it apart? Probably its unique tech approach and market entry tactics.

How does Friend Tech work?

Basic Functions

From the onset of accessing the application, Friend Tech appears very streamlined and very Web2.

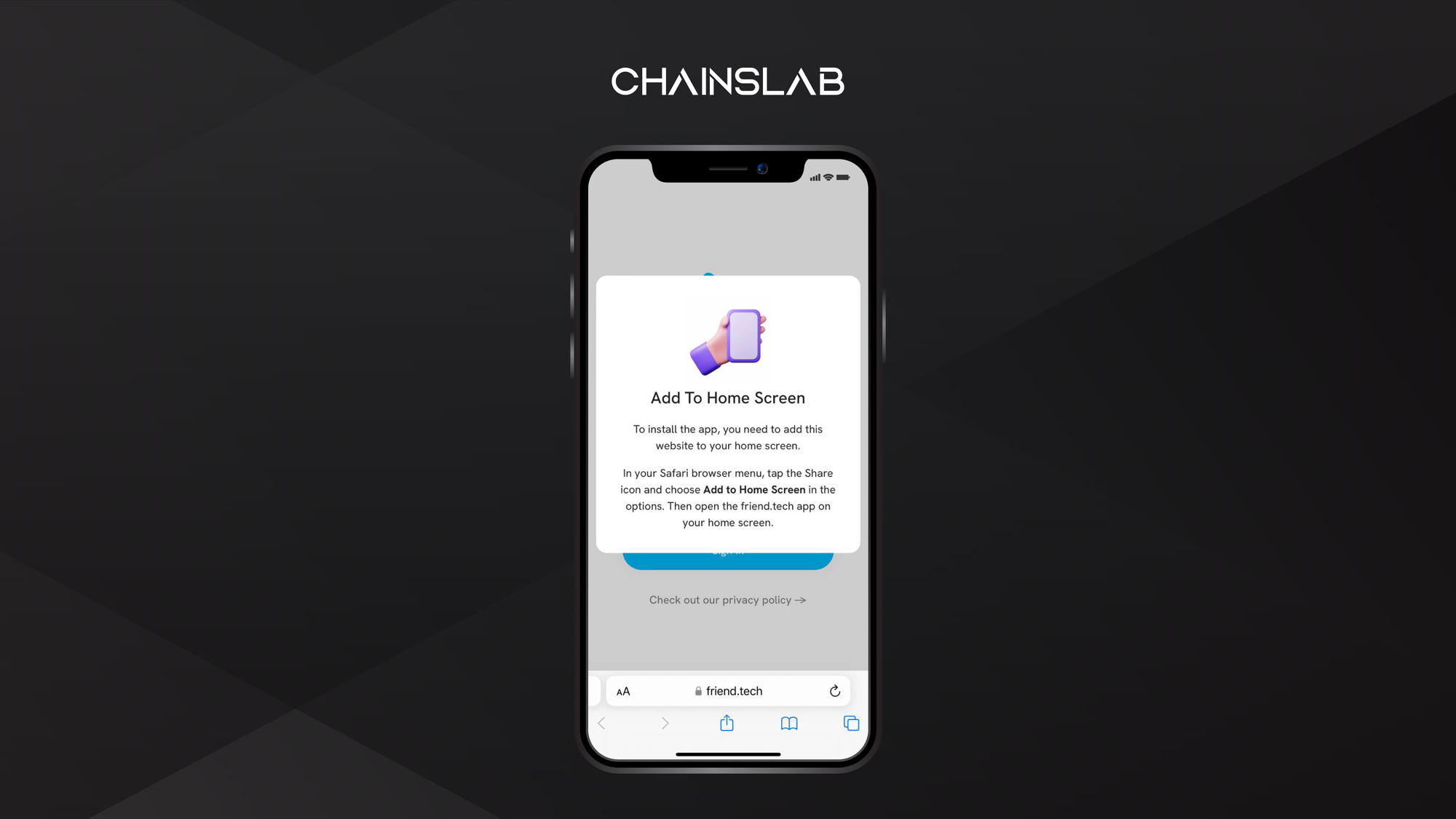

IOS users can simply open the official website on their phones and add it to their home screen, without relying on any third-party downloads. Users then need to obtain an invitation code, link their Twitter account, and inject at least 0.01 ETH into the Base network to access the application.

The essential functions of friend tech are not much different from WeChat groups or Telegram groups, but the organic process of entering and leaving group chats is the core feature of Friend Tech. Users can choose to join a specific group and acquire a share of the group by paying its base price. If they wish to exit the group, they can sell the group shares they own.

As the number of people choosing to join a certain group gradually increases, and as the total quantity of group shares grows, the base price of each group share also rises. This suggests that joining a particular group is not only for social interaction but also holds potential investment value.

Economic Models

Share price begins growing from 0. The only variable influencing the price of each share is the supply of issued shares.

Price in ETH = supply ^ 2 / 16000

As the total supply of issued shares continuously rises, the net price difference between buying and selling shares will grow larger, but the price spread rate (spread/selling price) will decrease. The reason for the existence of this spread is straightforward: since share growth starts from 0, buys inevitably precede sales, and sellers always lag behind buyers. At the Nth share, the selling price equals the buying price at the (N-1)th share. For instance:

At the 1st share, the buy price is 0.0000625 ETH, sell price is 0 ETH.

At the 2nd share, the buy price is 0.00025 ETH, the sell price is 0.0000625 ETH, spread rate is -300%.

At the 3rd share, the buy price is 0.0005625 ETH, the sell price is 0.00025 ETH, spread rate is -125%.

And so forth.

Spent ten minutes putting together a spreadsheet for the pricing model for that platform

— laurence (@functi0nZer0) August 11, 2023

It's pretty simplistichttps://t.co/HL59SaBAGK

Friend Tech charges a 10% fee for each group share transaction, of which 5% is distributed to the group creators, and the remaining 5% goes to the treasury income. At the time of writing, Friend Tech’s treasury has recorded an income of 1775 ETH, valued at approximately $3M.

Incentives

Point incentives are crucial for Friend Tech to transform Twitter users into its app users. It capitalizes on the potential expectations of token airdrops and is equipped with visible points to motivate users.

Friend Tech will distribute a total of 100 million points during the test period of the next 6 months, disbursing them every Friday. These point records are not stored on-chain. On August 19, Friend Tech completed its first point airdrop.

This Friday, we'll begin airdropping reward points to app testers. Points are collected off-chain during the beta period and will have a special purpose when the app enters official release status

— friend.tech (@friendtech) August 14, 2023

100,000,000 points will be distributed over six months pic.twitter.com/MggfM4oitw

III. A Closer Look

Understand the Hype

Friend Tech isn't the pioneer in this domain. It follows the legacy of platforms like BitClout and DeSo Protocol. But the hype was real. Why?

Influencers

The platform is courting influencers who already have large Twitter followings, including influencers Jordan Fish, commonly known as Cobie, and pseudonymous trader Hsaka Trades.

After the launch, it quickly attracted a lot of users, even catching the attention of big-name crypto influencers, NBA players, and OnlyFans creators.

BitClout once shares the same idea as Friend Tech. When it started, the accounts for 15k popular Twitter influencers (including Elon Musk) were already pre-created, and waiting to be claimed. The hype was similar to Friend Tech, but much larger, in a bull market.

Friend Tech shares the same influence energy with BitClout, but different. Friend Tech account is created and managed by real influencers.

Interface

The interface of Friend Tech is simple, very Web2, and looks rather underdevelopment but somehow can win over average users.

You will be presented with the login choice of the phone number, Google account, or Apple ID. However, this Web2 Login is kind of nice, helping new Web2 users easily onboard.

After login, Friend Tech creates an Ethereum wallet for you, automatically with the help of Privy. Another awesome feature for newbies.

After that, everything is a seamless experience, from buying a share to chatting in a private group, you will never need to leave the app itself.

Incentives

Friend Tech has introduced an intriguing "subject fee" mechanism: every transaction involving a person's "share" directly earns that individual ETH. This ingenious model capitalizes on network effects; the more a person is traded, the greater their earnings. Consequently, this setup has spurred Crypto Twitter influencers into a promotional frenzy, distributing invite codes to amplify trading.

Additionally, the platform promises a hefty airdrop of 100 million reward points to beta testers. This is accessible inside the app.

The Controversies

Despite the app’s significant early traction, many people are still skeptical about its viability.

Background

Friend Tech’s origin story is muddled, with potential red flags. According to yuga.eth, a senior software engineer at Coinbase, friend tech was built by a Pseudonymous developer Racer (@0xRacerAlt), the chief developer of TweetDAO and Stealcam.

TweetDAO is an innovative but short-lived foray into decentralized social media. While it garnered initial traction, TweetDAO soon petered out, and its primary Twitter account was eventually suspended.

Stealcam is an image-based (mostly exotic) social application on Arbitrum. It is basically OnlyFans of crypto. Currently, the official Stealcam account has been deactivated, but the website is still in use by some.

Data Privacy

Any platform, decentralized or not, that interacts with personal data should prioritize user privacy. Yet, a visit to Friend Tech’s website raises more questions than answers. The promised privacy policy is still marked “Coming soon!” Such a glaring oversight, especially in the sensitive world of personal data, is a concern for many potential users.

Pricing Model & Monetization

Friend Tech’s share pricing model appears simplistic at first glance. But this raises a bigger question: What’s the real value being traded? If one is buying “shares” in another person’s social presence, how is this quantified, and more importantly, qualified?

And what is in it for the long term? For example, on OnlyFans users need to maintain their subscriber base for a long time, while on Friend Tech, the money is frontloaded which gives creators little incentive to stick around.

Friendtech (FT) isn't the next OF. It's another ponzi shitcoin and you're the exit liquidity into whoever is shilling their bag. People shilling it are grifting, and will walk away clean while you end up poorer and reading a dead chat.

— Alex Wice (@AWice) August 21, 2023

The most important reason it fails in the…

Technical Problems

The platform’s rapid popularity surge also led to multiple technical issues, including network outages, slow response times, and app crashes. Such teething troubles are not uncommon for new platforms but should be resolved quickly to maintain user trust.

IV. Conclusion

Friend Tech’s concept is undoubtedly innovative, decentralizing social interactions and tokenizing personal brand value sounds futuristic. The product itself captures what we missing in the industry: a streamline for average users and a bridge between Web2 and Web3.

However, to become a long-term successful project, it must solve its existing problems, especially in its business model. The Aggressive Price Curve is one of the biggest entry barriers that need to be fixed. The interface also needs to be updated for more usage. Privacy and User data security also need to be taken care of. These problems are not hard to solve. The real challenge will be keeping the momentum on their platform. Good thing they already had a big user traction for the start.

As always, with new crypto ventures, there’s a blend of optimism and skepticism.

Can Friend Tech become the next big thing? Yes, it can. And even if it can’t ever make it, it still sheds some light on the future of crypto, where dApps with real usage and real users take the main stage.