The DeFi market has experienced explosive growth in recent years, driven by the increasing popularity of cryptocurrencies and the desire for decentralized financial solutions. However, the DeFi market is highly competitive, with many established players offering similar services. To succeed, each platform will need to differentiate itself and offer a compelling value proposition to users. This can be achieved through the development of innovative financial products, strong partnerships, and a commitment to security and stability.

Despite these challenges, the DeFi market is expected to continue its growth in the coming years, providing significant opportunities for Velodrome Finance. Velodrome Finance's integration with the Velodrome virtual world platform provides it with a potentially large and engaged user base, and its use of Optimism offers users the benefits of fast and low-cost transactions. By leveraging its unique features and building a strong community, Velodrome Finance has the potential to become a leading player in the DeFi of Layer 2 space.

In this article, we will discuss why Velodrome Finance can become the crucial base layer of Optimism’s liquidity.

I. What is Velodrome Finance?

Velodrome Finance is a decentralized finance (DeFi) platform built on the blockchain network Optimism. It aims to provide users with a wide range of financial services, including lending and borrowing, staking, and more. In a rapidly growing DeFi market, Velodrome Finance offers a unique and innovative solution for users to manage and grow their digital assets.

The main product is a decentralized exchange AMM model and liquidity marketplace on Optimism, which is a Layer 2 network that resides on Ethereum blockchain. We can compare it to Uniswap of Ethereum, or PancakeSwap of BNB Smart Chain. The Layer 2 season is a highly anticipated development in the blockchain world, and Optimism aims to be a key player in this movement. However, for the benefits of Layer 2 to be fully realized, there must be sufficient liquidity in the market. To meet this need, Velodrome Finance has emerged as a protocol to facilitate liquidity provision and swaps as Optimism gains traction.

Building on top of the groundwork laid out by Solidly, a project with yet another amazing idea but very bad execution, was founded by the “Dad of DeFi” - Andre Cronje. The team behind Velodrome decided to rehash Andre’s idea with Solidly by deploying a deep liquidity protocol on Optimism that uses the Ve tokenomics to bootstrap everything together, to become a liquidity station in Optimism.

Its predecessor, which combined some of the most effective mechanism designs in DeFi, was — by all accounts — a major failure. 6 weeks after launch on Fantom, Solidly reached ATHs of $2.3B TVL before emissions dried up and liquidity fled the ecosystem.

Therefore, how can Velodrome, which is strongly influenced by Solidly, prevent a similar outcome? The protocol has altered some of the crucial parameters, such as token distribution, locking mechanism, and emission schedule, in order to attain what Solidly was unable to achieve: Sustainability. Frankly, Velodrome's products really don't have too many differences in terms of business model as well as technical aspects, so the author will focus on analyzing Velodrome's advantages over competitors in terms of tokenomics design.

II. Velodrome Tokenomics & Metrics

Tokenomics

- VELO

The native token of the Velodrome ecosystem is called VELO acting as the utility token of the protocol. The tokenomics mechanics reflect a combination of 2 famous concepts: Vote-Escrow (ve-token) and 3,3 game theory.

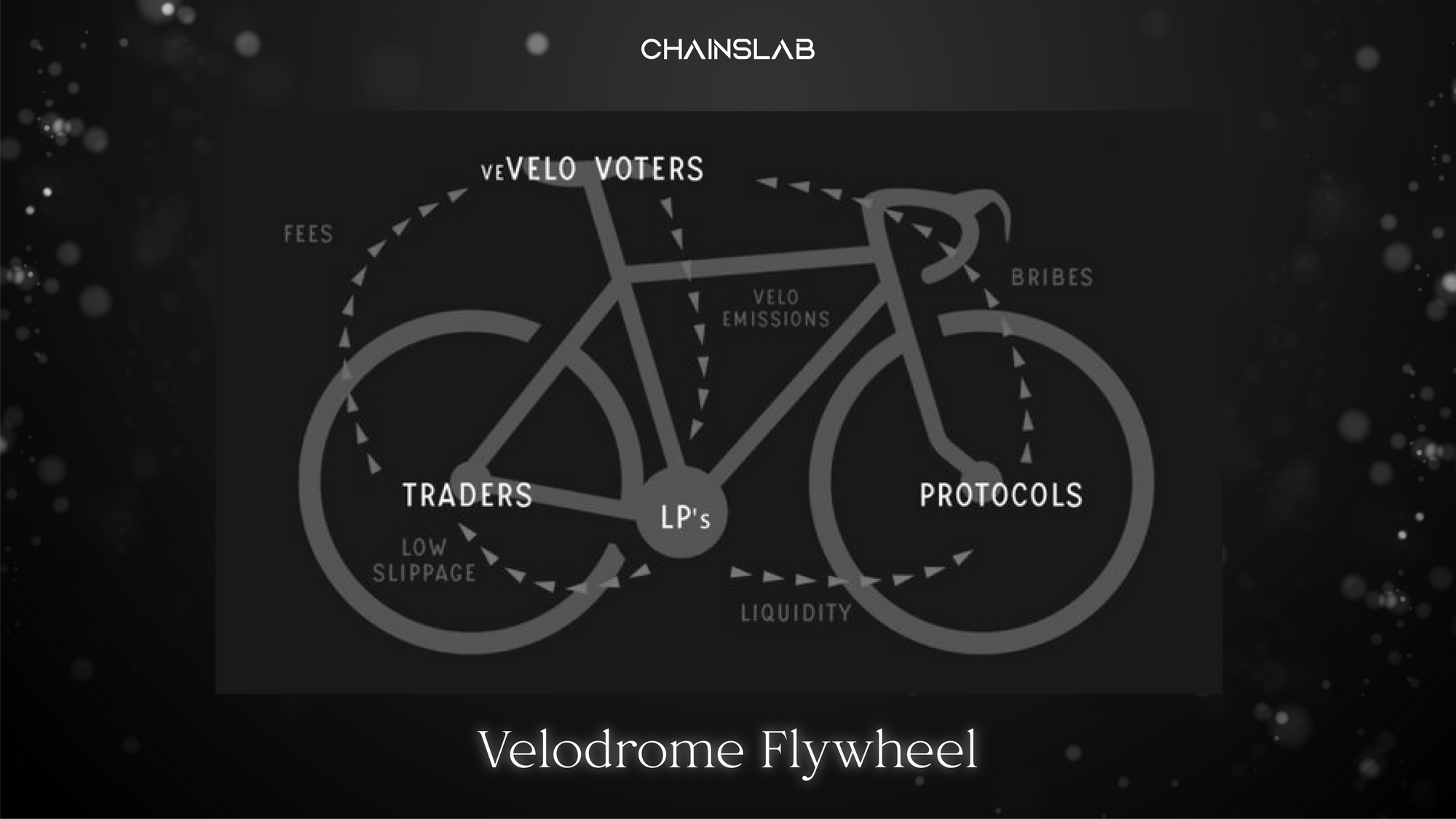

In Velodrome, token holders are able to vote-escrow, or lock, their VELO tokens to receive veVELO. The veVELO holders then have the power to vote on which liquidity pools to support and can be incentivized by bribers to do so. The VELO tokens are distributed among the pools based on the votes received from the veVELO holders. As a result, veVELO holders receive fees and bribes from the pools that they have voted for.

The reason for this design's effectiveness lies in the “3,3 game theory”. veVELO holders will cast their votes for the pools that they believe will generate the highest fees and bribes. If other holders adopt a similar strategy, more VELO emissions will be allocated to these pools. The increase in emissions attracts more liquidity, thereby reducing slippage. This reduction in slippage, in turn, attracts more trading volume and generates additional fees for the pool.

Velodrome incentivizes VELO holders in a way that maximizes their profits by encouraging them to lock, vote, and direct emissions, rather than simply incentivizing liquidity through emissions. As a result, the pools that see the highest levels of usage, both in terms of trades and fees, receive the largest allocations of emissions and attract the most liquidity.

- veNFT

The second token is used for governance, called veVELO or veNFT. Why do we need an NFT? When considering the decision to lock their tokens for governance power and enhanced rewards, users typically face the dilemma of weighing the risks and benefits. One such risk is the inability to quickly respond to market movements as their capital is tied up. It is important to carefully consider this trade-off before making a decision.

The advantage of NFT governance is that it transforms the governance token veVELO into a veNFT that can be traded on the secondary market. This provides holders with an alternative exit option for their locked tokens or enables them to use the veNFT as collateral in other pools. This increased capital efficiency benefits both the token holders and the protocol, as the tokens remain locked regardless of how they are used.

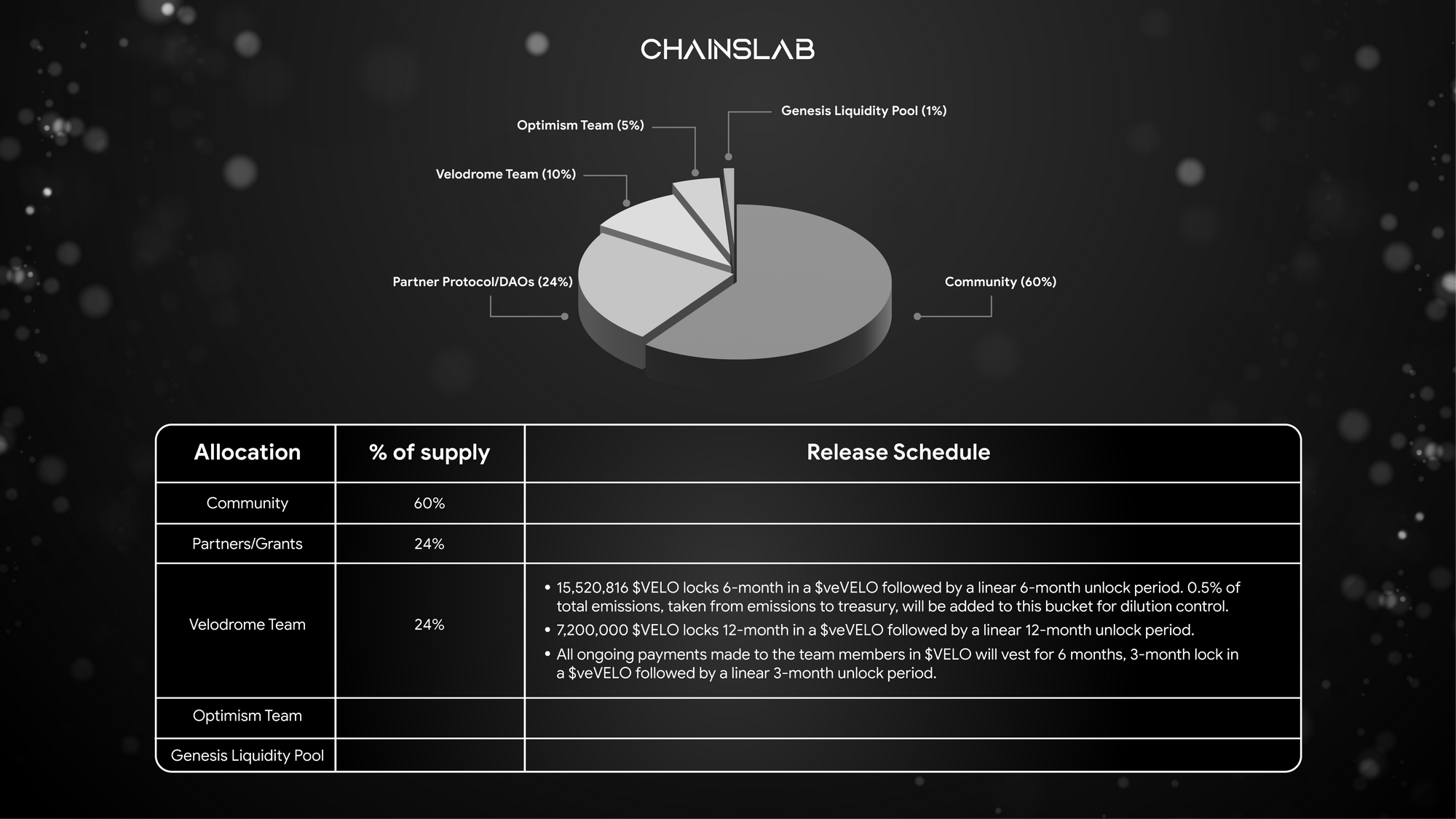

Token Metrics

It can be clearly seen that most of VELO's supply is used to encourage the community, no token sale. The discharge from insiders will mostly come from 2 teams: Velodrome and Optimism. However, so far, only 2 months of vesting tokens have been unlocked for the Velodrome team, corresponding to 5,173,605 $VELO.

The remaining about 10 million will be fully unlocked within the next 4 months, in June 2023. With the current price of ~$0.078, the amount of unlocking is really insignificant, when witnessing the recovery of the entire market and including the Optimism ecosystem.

***Get updated on 14/02/2023 from the Velodrome team: "The team decided to max-locked our team allocation so there will be no unlocks to worry about".

It can be said that we have recognized the narratives shift from Layer 1 to Layer 2, so the growth potential for VELO is huge, when it becomes a liquidity mother pool for the entire 2nd largest ecosystem. in Layer 2 space.

III. Thoughts on Velodrome

The use of veTokens as a solution is becoming a popular trend in protocols. The idea is to create a self-sustaining system where participants are incentivized to draw emissions to themselves. However, the success of this system depends on participants' interest in governance. There are individuals in the market who have been negatively affected by the Solidly situation and may be hesitant to participate in Velodrome's ecosystem. The protocol's success relies on attracting participants who are willing to look beyond this issue and those who were not impacted by the Solidly situation.

The author is cautioning about the possibility of tokens being farmed and dumped, which could be avoided by participating in bribes presented through the Hidden Hand marketplace. Locking up tokens for 4 years is risky as most protocols may not be around for that long and the token may end up being exit liquidity.

However, if the Optimistic summer narrative catches on, Velodrome has the potential to become a successful protocol.