Sudoswap, a platform for trading NFTs, has experienced extraordinary growth since launching its NFT marketplace in July 2022, even in the bear market. And it's showing no signs of slowing. With the rapid increase of its NFT pools and its removal of creator fees, Sudoswap is already having a noticeable impact on the ecosystem. From nowhere, they now have become a powerful competitor to OpenSea, the largest NFT marketplace right now.

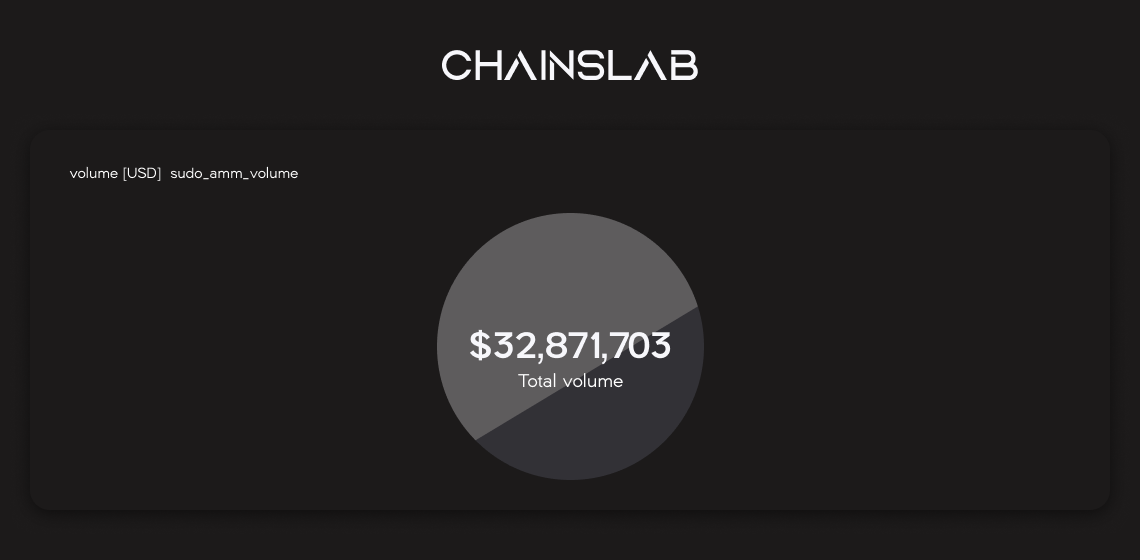

SudoAMM has piqued the interest of NFT users with its rapid development in volume and users since August. The overall trading volume of NFT AMM SudoSwap is 16,876 ETH, the 7-day average trading volume is 604.13 ETH, and the number of users is 20,122, according to Dune Analytics by @0xRob. The total volume on the Sudoswap AMM has already surpassed the $30 million mark. Messari claims their transaction volume has increased from 1% to 10% of OpenSea's.

There are many reasons, not least, that Sudo does not charge any royalties on their trades. This is especially advantageous for those interested in short-term speculating. In contrast, OpenSea charges a fee on each trade (about 2.5%), and several collections frequently demand significant royalty fees on their platforms.

I. What is sudoswap

Trading NFTs can be fun, but it can also be frustrating. If you have tried to day-trade NFTs before, there's a good chance you've experienced the frustration of poor timing, lack of liquidity, and more.

The amount of liquidity required and the time spent waiting for locked-up money to become available might cost you significant opportunities. (And a bear market might make things feel even worse.) It's also bad for the entire NFT ecosystem because the current status of NFTs makes markets far more liquidity-inefficient.

Say hello to Sudoswap, the first decentralized, liquidity-efficient NFT marketplace to run on an automated market maker (AMM) model on Ethereum. Yes, you heard it right. AMM is like what we experience in Defi.

According to their document: "The sudoswap AMM is a minimal, gas-efficient AMM protocol for facilitating NFT (ERC721s) to token (ETH or ERC20) swaps using customizable bonding curves. Liquidity providers (LPs) can deposit into single-sided buy or sell pools, or provide both sides with a spread to capture fees."

In other words, you can trade your NFTs for tokens like ETH without ever needing to find a buyer or seller. This provides instant liquidity as an NFT trader and makes trading NFTs similar to trading any regular token.

The sudoswap AMM is intended to provide a novel method of trading NFTs. The idea is to ensure that anyone can add liquidity to an NFT collection while earning trading fees.

The usage of AMMs to improve market efficiency has been used in DeFi for numerous years, but never with NFTs.

People can supply liquidity in return for LP tokens on Uniswap, Sushiswap, Pancakeswap, Trader Joe's, and various other decentralized exchanges. Rather than Order Book exchanges, the AMM concept enables dynamic liquidity provisioning by reflecting changes in supply and demand within the pool itself.

Poor liquidity and slippage have long tormented NFT markets. A CryptoPunk might sell for $100,000 on one day but not garner similar offers for weeks or months — leaving investors confused over exactly how much it's worth.

Sudoswap is trying to solve the pain point in the NFT industry, liquidity. It is at the forefront of innovation, breaking the NFT liquidity and trading paradigm.

Sudoswap is doing an awesome job of evolving the NFT metagame.

— Jack Niewold 🫡 (@JackNiewold) August 15, 2022

NFTs have always been pure liquidity games, only moving when there's a marginal buyer available. The bid leaves and the collection dumps, the NFT becomes illiquid.

Sudoswap enables a perpetual bid.

0-1 innovation

Sudoswap was created by a pseudonymous developer better known as the inventor of 0xmons, an experimental pixel monster collection, initially introduced as an over-the-counter (OTC) swap for NFTs in April 2021. With no additional fees, it enables anyone to trade ERC-20, ERC-721, and ERC-1155 assets.

SudoAMM, Sudoswap's own brand of AMM, was launched in July 2022. The platform enables NFT traders to buy and sell without waiting for an offer. Sudoswap, unlike OpenSea, allows sellers to contribute NFTs and ERC-20 tokens (now only ETH) as liquidity to assist in smoother automated deals. This ensures that orders are resolved on-chain rather than one-to-one within the chosen pool.

Using this AMM concept for NFTs is difficult, given that traditional AMMs function precisely because the tokens are fungible.

II. How it Works

SudoAMM has applied the x * y = k formula from classic DEXes to the NFT liquidity problem. And the mechanism is not very complex.

If you're familiar with DeFi (for example, Uniswap), you'll recognize the x*y=k function curve. In Uniswap V3, the LP allows users to make a market against TokenA-TokenB within a predefined price range. Similarly, SudoAMM cleverly treats NFT as TokenA and ETH as TokenB, allowing users to trade against NFT-ETH on SudoAMM at a predetermined price. Buyers and sellers can trade instantly through the pool, while sellers can sell in an order transaction similar to OpenSea. Liquidity Providers (LPs) can choose bilateral market making for NFT-ETH, similar to V3, to earn transaction fees or unilateral market making for NFT or ETH to earn ETH or NFT.

Sudoswap's most inventive sector, where it controls the value of the NFTs traded through its pools and rewards LPs with transaction fees, much like Defi.

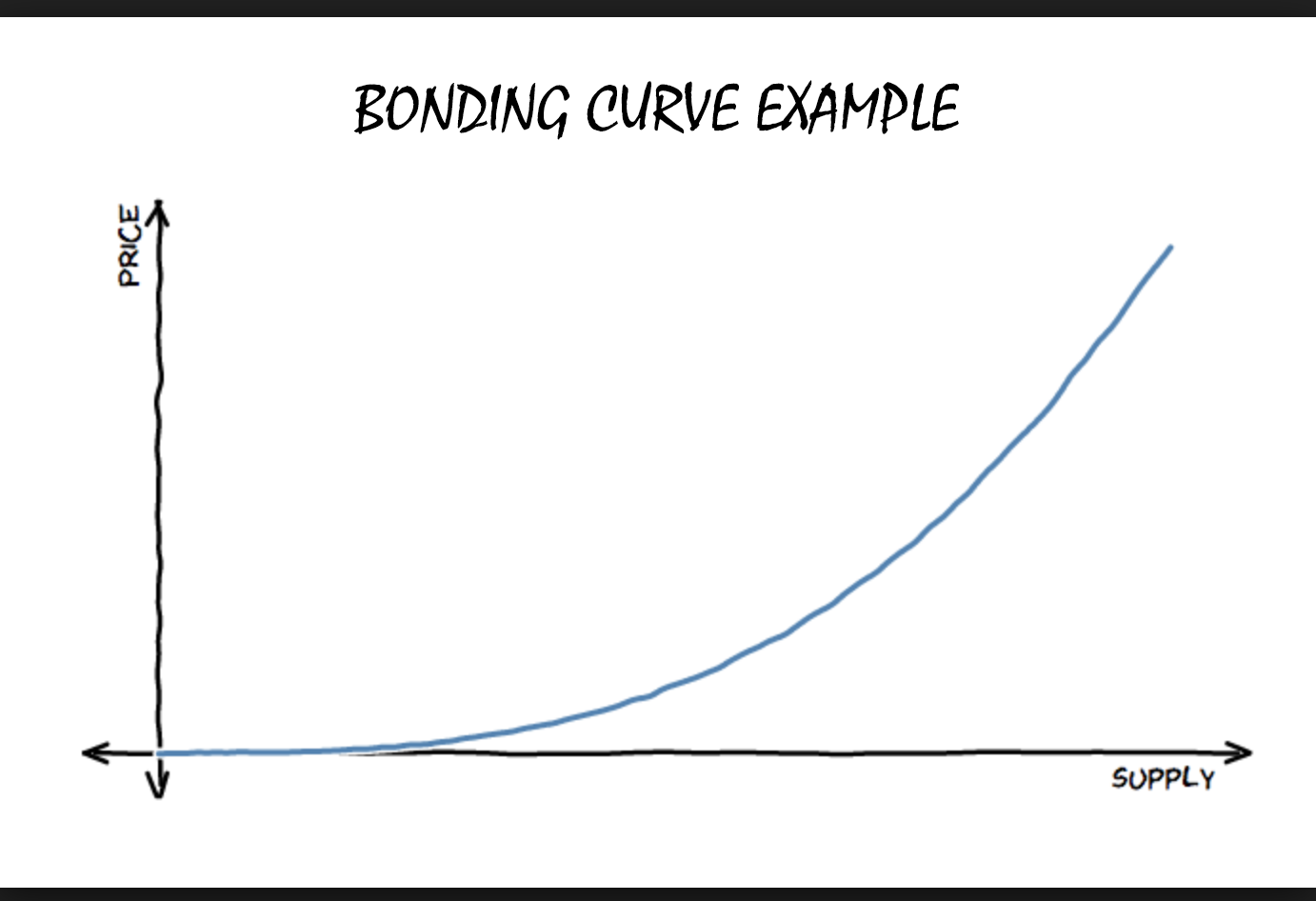

The platform use bonding curves to automatically increase and reduce the bid and ask on each collection based on the number of NFTs purchased or sold. Users can select between two curves: linear and exponential, as well as the delta, which modifies the pool's floor price each time an NFT is bought or sold.

For example, when a user sells an Azuki NFT into a pool, the supply increases, causing the buy price to fall according to the delta value. As more NFTs are sold, the price per NFT falls until the market determines its fair worth.

On the other hand, buying an NFT from a pool steadily raises the cost of subsequent purchases, keeping asset prices in line with demand.

Users are encouraged to trade in lower-fee pools. This generates a "race to the bottom" scenario in which pool creators compete to give the lowest prices, hence benefiting end users.

As mentioned previously, liquidity providers on Sudoswap are given a choice between two bonding curves.

Linear curve

With a linear bonding curve, the price of an NFT fluctuates by a flat amount (delta) every time an NFT is bought or sold from the pool.

For example, a pool with a floor price of 1 ETH and a delta of 0.1 ETH would cause the floor price to increase or decrease by 0.1 after every purchase or sale.

This means the floor would increase to 1.1 ETH after the first NFT is purchased, 1.2 ETH subsequently, and vice versa during a sale.

Exponential curve

With an exponential bonding curve, the price of an NFT fluctuates by a certain percentage (delta) every time an NFT is bought or sold from the pool.

For example, a pool with a floor price of 10 ETH and a delta of 50% would cause the floor price to increase to 10 + 50% = 15 ETH after the first purchase and 15 + 50% = 22.5 ETH after the second purchase.

To calculate the equivalent decrease, convert the percentage to a decimal index (e.g., for 50%, the index would be 1.5) and divide the price by this number.

III. Controversy of sudoswap

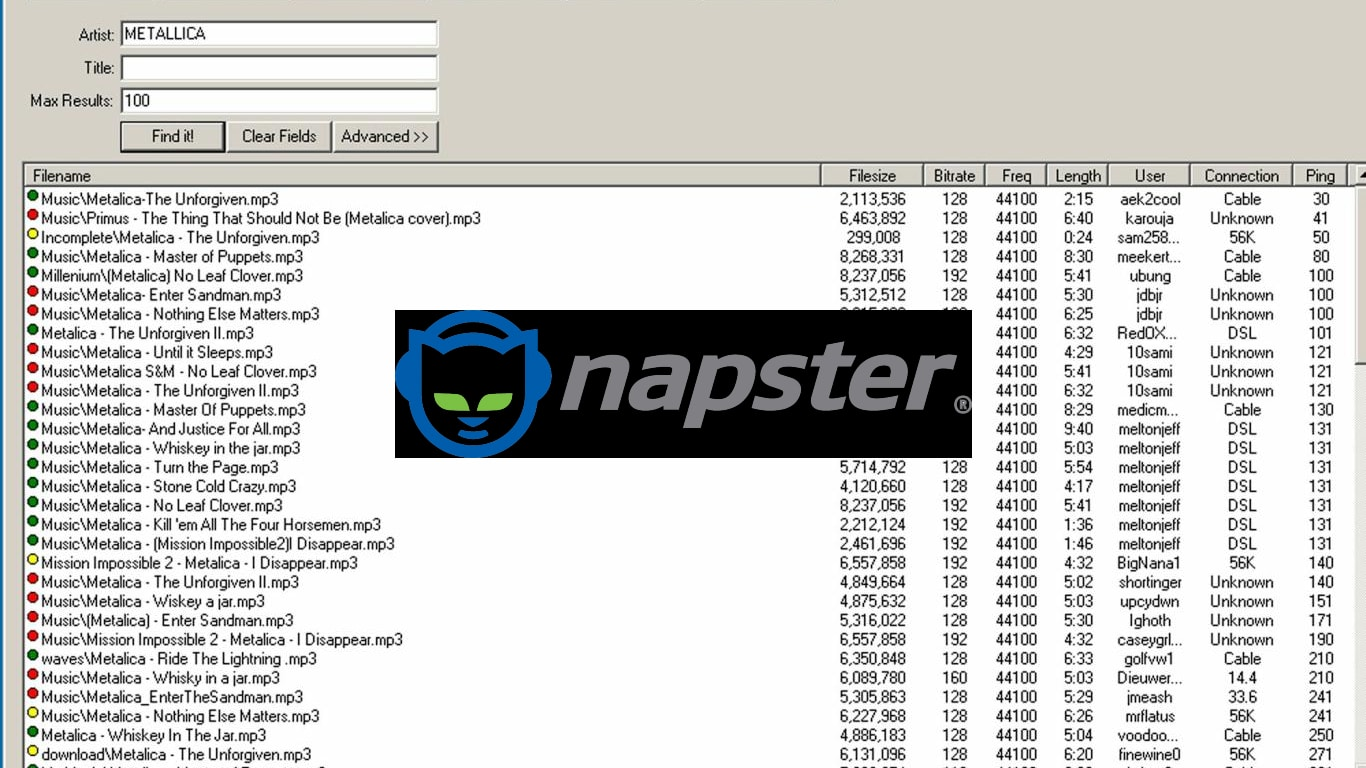

Royalties paid to artists have been under threat and progressively dropping since the days of Napster and other online streaming services.

Many people thought that embedding royalties into NFT smart contracts would allow artists to receive a consistent cash stream and continue to be compensated for their work even when it was sold on the secondary market.

NFT collections have adopted this method to ensure that they are always producing revenue. Even if no other goods are available, the creator can earn royalties as long as there is a market for the NFTs in question.

Sudoswap, as an NFT AMM platform, does not charge fees for each deal. If consumers had to pay royalties on each trade, the platform would not function nearly as efficiently since there would be so many costs to pay.

As a result, none of the volume created on the Sudoswap AMM is distributed to authors and artists in royalty fees.

Some consider this contentious, but in the context of a high volume of short-term speculators creating a more efficient (and stable) market, it appears to be a reasonable trade-off.

Top art or NFT does not need high liquidity

The lack of liquidity in NFTs is a familiar problem. But for some "blue chip" NFTs, liquidity is not precisely a problem worth solving; therefore, SudoSwap is unnecessary.

The top blue chips may not need high trading liquidity because most owners are loyal long-term Holders. And top blue chips such as BAYC and CryptoPunks will progressively become financial collaterals used in lending and leasing markets. On the trading market, seller orders are expected to be sparse.

SudoAMM is perhaps more suitable for NFTs like cc0/Meme

SudoSwap is the equivalent of trading the entire NFT series as if it were only 10k or a fixed number of NFTs, with less focus on rarity and properties. For cc0, SudoSwap is more like a "platform" that fits highly with its derivative re-creation and Vibe. The biggest pitfall of unofficial derivatives is their vulnerability to being taken down by NFT platforms. OpenSea, the current NFT platform with the best trading depth and visibility, has the centralized power to downgrade or withdraw an NFT at will, which is fatal for all kinds of cc0 protocols of the second creation.

SudoSwap not only provides liquidity support but is also a counter to centralized power. If one day a Meme NFT that OpenSea took down instead sees explosive growth in SudoSwap, it will be the best blow to centralized power from a decentralized protocol.

Gaming NFTs are suitable for SudoSwap, but may not be needed

Gaming NFTs are an excellent target for using SudoSwap. However, the problem is that metaverse games tend to be exclusive. Platforms prefer to control the flow of NFT themselves and form their own NFT market so that, on the one hand, they can collect most of the revenue for themselves. On the other hand, they can control the balance of supply and demand in the secondary market to avoid inflation.

NFT project owners have their own liquidity through SudoSwap

Some project owners tend to set aside x% of their NFTs to increase revenue from additional sales or auctions. Now they can create an official Sudopool on SudoSwap with the reserved NFTs and ETH earned from public sales and earn a 0.5% LP fee, which will no longer rely on royalties for secondary revenue.

SudoSwap's exploration of NFT liquidity focuses on floor price NFT. SudoSwap cannot solve the pricing problem caused by the rarity/attributes of NFT.

In addition, SudoSwap has a massive pool of sellers, and some users just want to use SudoSwap to make a faster exchange, even to the extent that it facilitates some NFTs with unknown prospects, which is also a challenge for NFT loyalty.

IV. Closing Thought

Many people hoped that Coinbase's arrival into the world of NFTs would put Opensea's market supremacy to the test. However, it has been, to put it mildly, a failure. Months of advertising campaigns and millions of dollars spent on constructing and testing their infrastructure have all come to naught.

This is possible due to their lack of innovative approach. On the other hand, Sudoswap is a unique and revolutionary protocol for the NFT ecosystem. NFT traders now have a way for immediate liquidity, something that has seemed difficult to achieve with NFTs. The protocol has already seen increased interest in the past week, and we expect to see even more interest over the coming weeks.