When it comes to the legitimacy and maturity of different financial instruments, derivatives have proven time and time again to be a crucial piece of infrastructure necessary to support the long-term growth of any asset class.

As it relates to the realm of cryptocurrencies like Bitcoin ($BTC) and Ether ($ETH), the introduction of future, forwards, options and swaps provided a vital opportunity for investors to short and hedge risk against historically volatile assets. Thanks to the advent of smart contracts, tokenized derivatives can be created without the need for a third party. But, there is a problem.

The crypto space is so complex for an average user. In order to mass adoption, everything needs to be user-friendly in the front end.

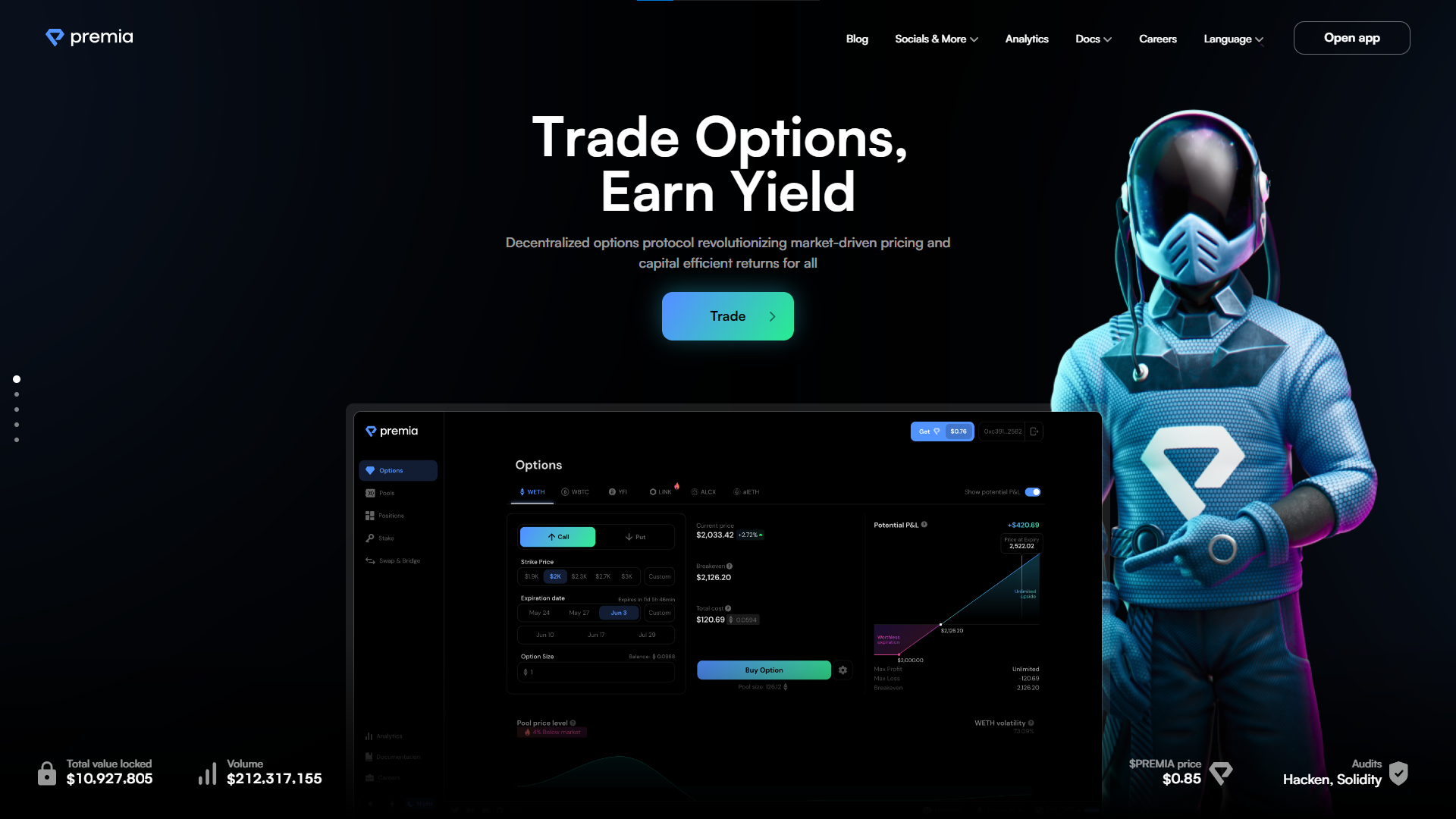

A project in the Defi Options Category, Premia Finance, is doing just that, giving users one of the best UI/UX ever. Beyond that, Premia also utilizes an AMM, where users can buy puts or calls while liquidity providers can earn Premium from underwriting these options.

Premia is unique in that unlike prominent options protocols such as Dopex and Lyra, it uses American Options, or options that can be exercised anytime before their expiration date.

The protocol has attracted $7.7M in TVL and is governed by the PREMIA token, which currently trades at ~$0.8 on several DEXs.

TL;DR

- Premia is a Defi Options Protocol.

- Premia UI/UX is one of the best out there, it is clean, neat, and easy to understand, even for a newbie.

- Premia offers American-style Options, distinct from prominent protocols that only offer European-style Options.

- The Premia AMM solves the problem of providing a robust options market infrastructure in the DeFi space, the Market-driven option pricing.

- Premia Pool-to-Peer architecture aims to solve the liquidation problem in Defi Option, plus give liquidity providers better use of their capital.

- PREMIA token is now being traded at $0.8, which is an OK price to buy, enjoy both benefits in trading options on Premia and price difference in the next bull run.

What is Premia?

First of all, Premia is a Decentralized Options Protocol, a Defi Protocol that offers decentralized options based on a pool-to-peer architecture to the market, kind of similar to how Uniswap or SushiSwap work but with a focus on options trading.

Options are contracts that give the bearer the right - but not the obligation - to either buy or sell an amount of some underlying asset at a predetermined price at or before the contract expires.

Premia Options are contracts that give the holder the choice to buy or sell the underlying token by a specified date, which represents in the ERC-1155 tokens.

In Decentralized Finance, Options Trading is slightly different from its centralized cousins since there is no central entity or a bookie. When trading options in Defi, you interact with a pool rather than a book marker.

And just like other Decentralized Finance products, the main obstacle is liquidity. The Premia AMM was born to solve the problem of providing a robust options market infrastructure.

Premia aims to democratize options trading with the help of blockchain technology and decentralization. Instead of having one centralized platform that benefits from trading fees Premia enables anyone to become a liquidity provider and a trader.

Premia Finance claims to bring in these innovations:

- Market driven options pricing - Premia ensures optimal pool utilization at fair prices by taking into account the relative supply and demand of capital in each pool.

- Liquidity sensitive returns to LPs - return on liquidity is calculated based on supply/demand in all pools. Higher demand = higher returns for LPs.

- Granular liquidity provision - LPs have control over which markets they underwrite, as opposed to underwriting the entire volatility market. LPs can implement customized strategies to granularly provision their liquidity only to the pools (and options) they desire.

- Self-incentivizing initial liquidity - Lower slippage at the time a pool launches as well as higher returns, thanks to the automated pool pricing mechanism.

- Dynamic Premia token rewards - Liquidity Providers earn extra rewards in the form of Premia toknes based on the size of their position.

Premia Finance wasn't the first player in the Defi Options Game, nor the Ethereum one. But, compared to other peer-to-pool options protocols, Premia stands out because it prices options on market activity to ensure optimal pool utilization and offers risk management to liquidity providers. Not only that, Premia attract traders with American-style Options, which are options that can be executed before their expiration. On top of that, Premia deliver one of the best UI/UX design in the field, giving oldies a simple and pleasant experiment and giving newbies an easy and enjoyable options trading journey.

Premia is now ranked 9th in terms of TVL in the Defi Options category, competing with big names like Opyn, Ribbon Finance, Dopex, Lyra, etc...

The protocol has attracted $7.7M in TVL ($10M include staking). Right now, Premia is available on Ethereum, Arbitrum, Optimism, and Fantom with plans to expand to Polygon, BSC and Avalanche in the future.

What's inside Premia?

Simple Buyers Flow

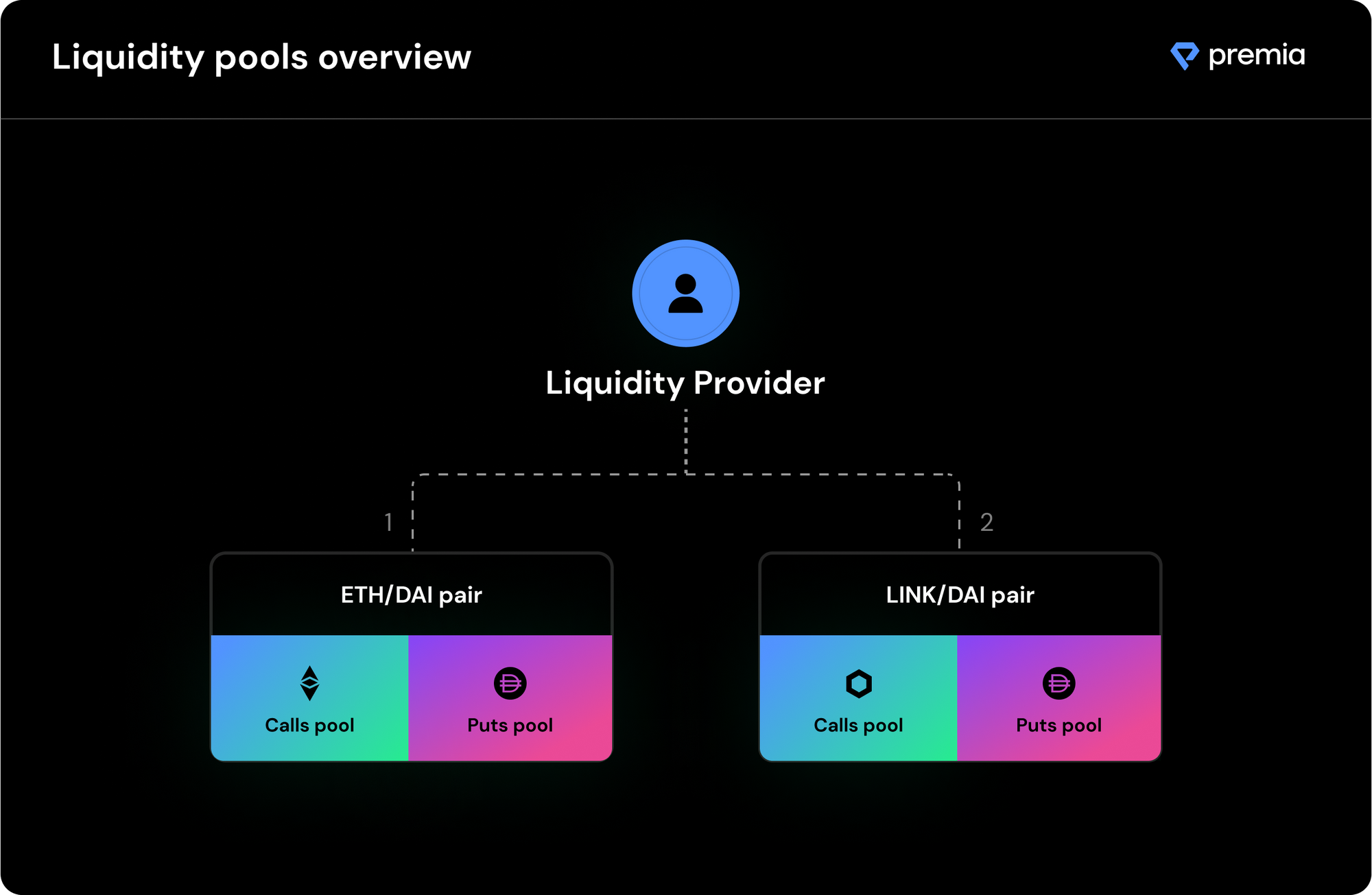

There are 2 pools for each asset pair on Premia: a Call pool and a Put pool.

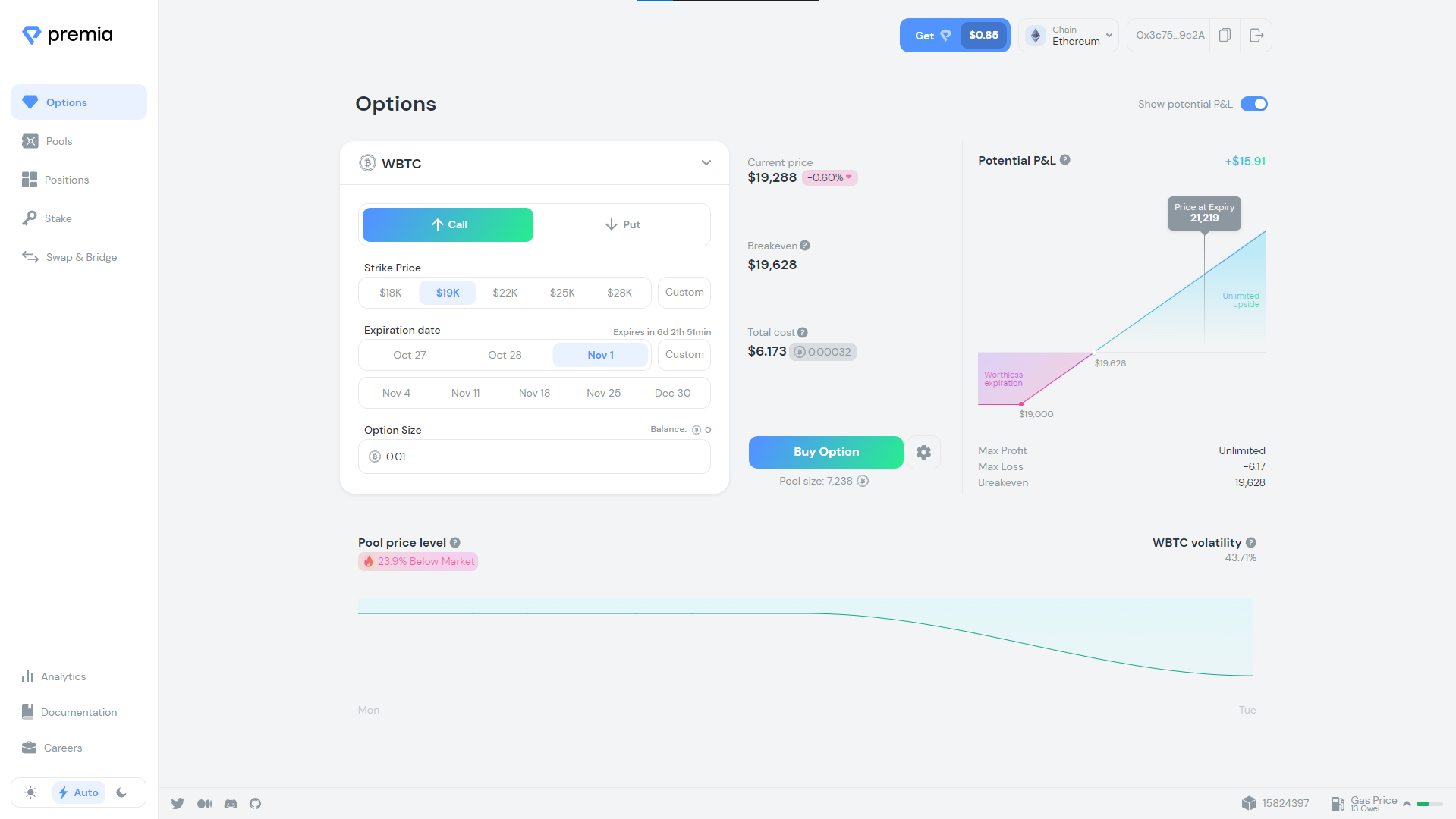

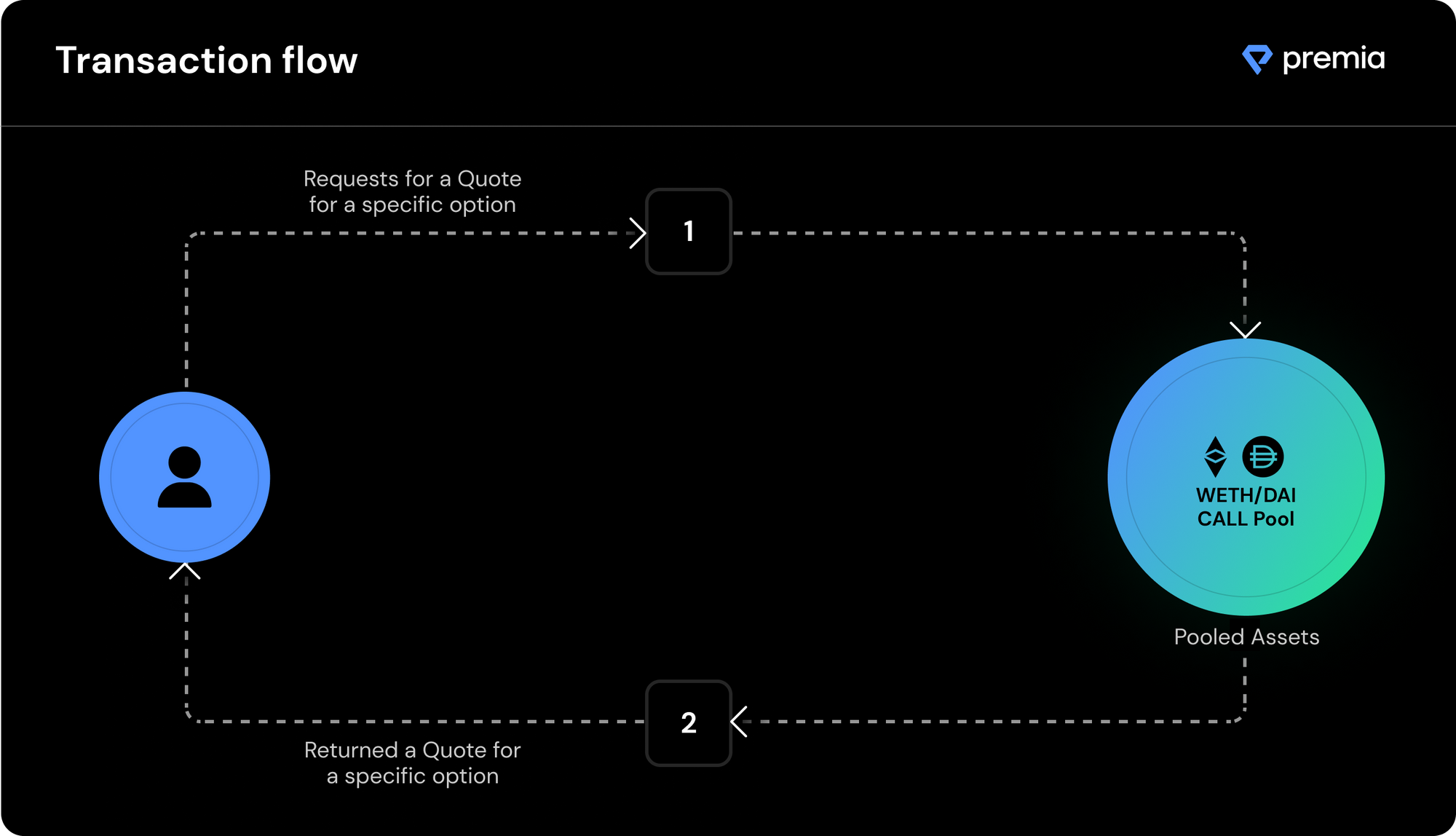

When a user wants to purchase an option from the pool, they can simply send the details of the option they'd like to purchase to the pool, and the pool will return a quoted price for the user's selected size, strike price, and maturity date. If the user agrees with the price, they can execute the trade with an on-chain transaction.

That is how it works in the backend, in the front end, buyers just simply choose the option (call or put), set a strike price, expiration date, and option size, and the protocol will calculate the total cost, breakeven point, and your potential PnL. All will be done automatically and easy on the eyes, thanks to the minimalism of Premia UI/UX.

And since Premia offers American-style Options, buyers can exercise their options at any time after purchase. Options can be exercised in full or in partial amounts over time. If at the time of maturity, an option is In The Money, the payoff is locked in and can be claimed at any time post-maturity by the owner of the option. And Premia Options are Cash settlements, which means that at expiry, the writer of the options contract will pay any profit due to the holder, rather than transfer any assets.

Optimal Liquidity Providers

Traders can not simply sell the options on Premia, they will need to go a longer route, by providing liquidity on options pools.

If you're bearish and want to sell Call options, you provide liquidity in the Call pools, and if you're bullish and want to sell Put options, you provide liquidity in the Put pools. Doing so gives you premiums + $PREMIA emissions but risks capital loss if the buyer exercises options In-the-Money and a 2.5% interest rate pro-rata is charged on LP side.

Currently, Premia Calls pools are underwritten in the underlying asset (WBTC, WETH, LINK, YFI, ALCX, alETH), and puts pools are underwritten in DAI.

Underwriting options on Premia work on a First-In-First-Out basis. This means that the earlier you write the options, the sooner you sold your options. This also means that risk/reward are different among writers. But, thanks to the Premia option pricing mechanism, the difference is not too large.

Market-Driven Options Pricing

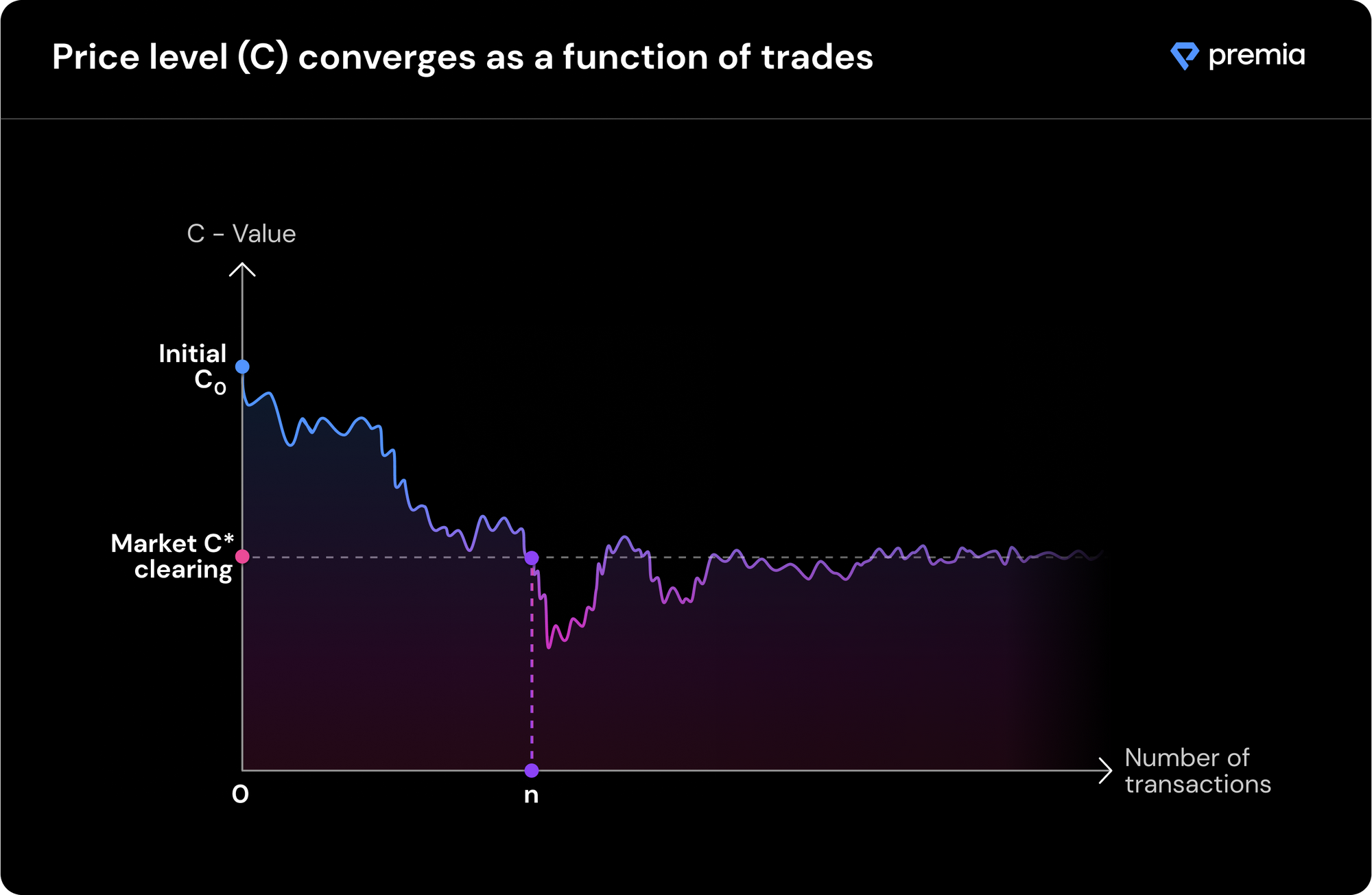

Premia introduces a model that takes into account the relative supply and demand of capital within each pool, allowing market forces to converge to the true market price, even under volatile user behavior.

On Premia, every pool has a C-level (price level) at any given time. C-level is the unique mechanic that regulates the option price levels, according to the relative supply and demand of capital in the pool.

The higher the C-level, the more expensive the options, and the higher the premiums earned on capital by LPs. So the general idea is to provide LP when C-level is high and buy options when C-level is low. This makes the price level reach the clearing point, making the market more efficient.

This implies much higher pool capital utilization (100% at the limit), which in turn translates to higher average returns to LPs without increased prices for buyers.

$PREMIA Price Action

The native token of Premia is $PREMIA, with the main purpose is to incentive Liquidity Providers and sustaining the long-term growth of the protocol.

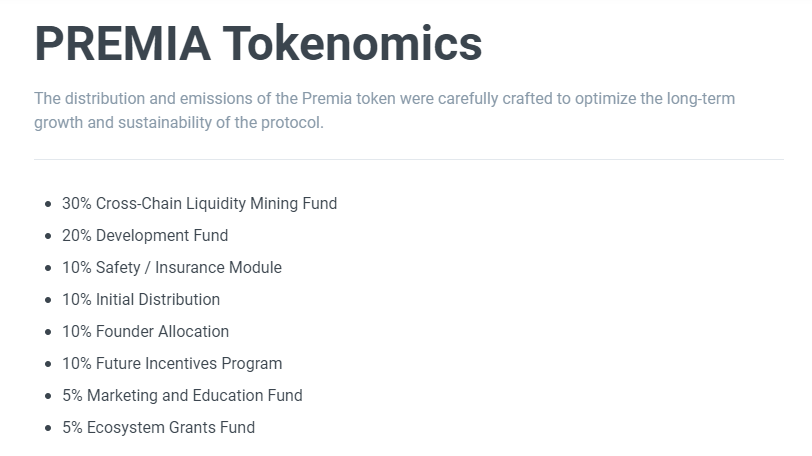

$PREMIA has a total maximum supply of 100 million coins. The original allocation is as follows:

In Q4, they would revise the tokenomics to vePREMIA, following Curve's footsteps. Basically, a longer vesting schedule, higher rewards and voting power.

Premia also offer a staking program, users can stake their PREMIA tokens to get xPREMIA tokens, which accrue PREMIA protocol rewards over time. Exactly 80% of all protocol fees are automatically collected and converted to PREMIA, which is then automatically distributed to xPREMIA holders. Also, PREMIA stakers will get a discount when trading options, based on their stake portion and locking period.

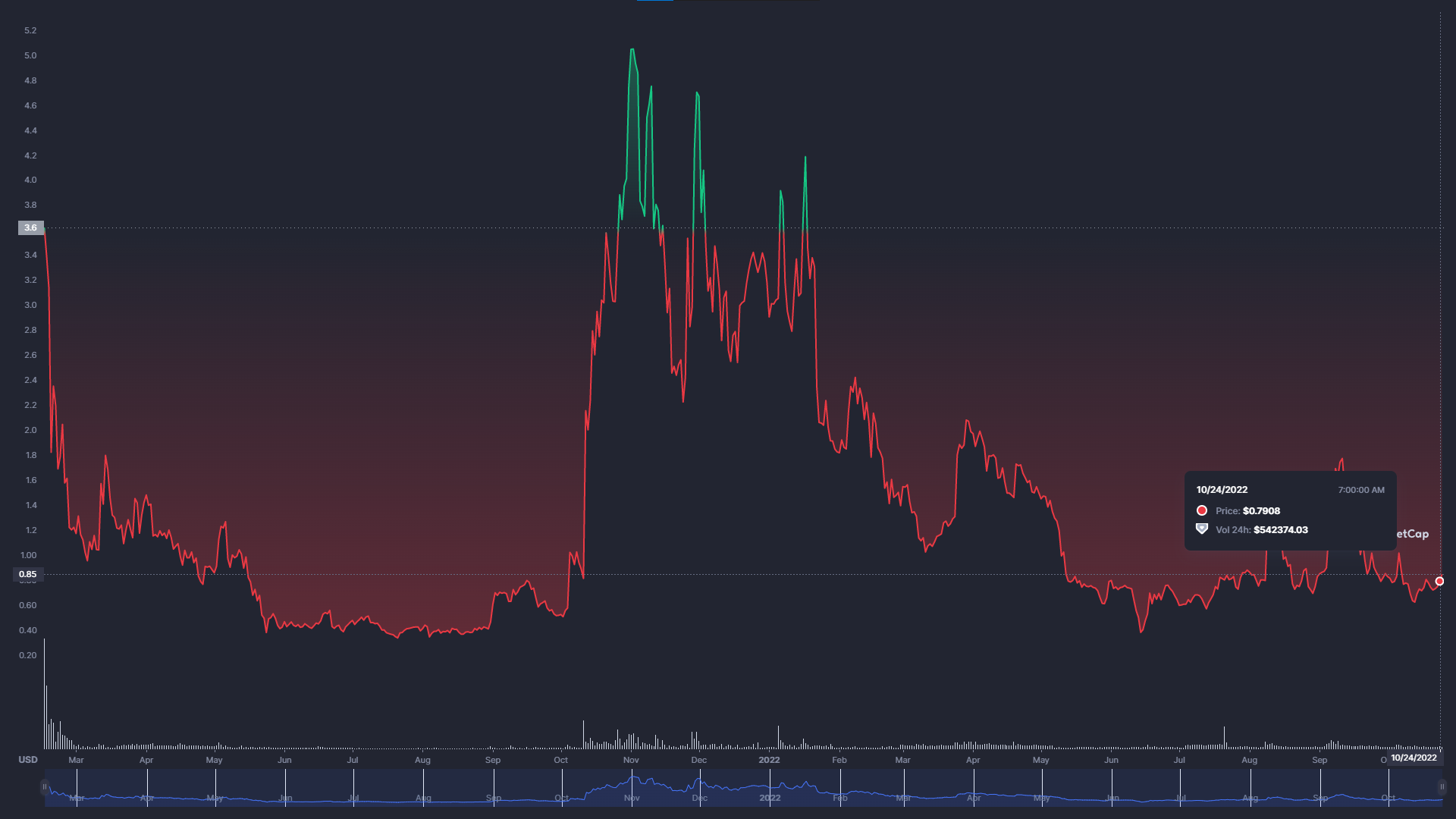

$PREMIA currently can be traded on Uniswap and Sushiswap. The live Premia price today is $0.844953 with a 24-hour trading volume of $392,682.

The token is down more than 80% from its ATH of $5 and in its acumulation phase. As more capital is coming to Premia and the future updates, I believe $PREMIA will reach at least $3.

Right now, if you like to trade options, $0.8 seem like a reasonable price to buy and stake $PREMIA, earning rewards and discounted % on the trading fee.

Bottom Line

For more advanced players, there are a few arbitrage opportunities since Premia offers one-of-a-kind American-style options and a market-sensitive options pricing model. For example, when C-level is high, you can buy an option on other protocols and sell the same option (same strike price, same expiration date) on Premia to earn from Premium and price differences, while also hedging your risk.

For novice options traders, Premia is a good place to start. As I have said, they offer one of the best UI/UX in the field. Users can easily navigate their way through Defi Options.

To me, this is Premia's biggest advantage, which leads to its own attraction and Defi Options' mass adoption.

Can $PREMIA reach $10? Might be, if they are able to gather momentum and gain more users on their platform.