Market context.

The end of 2020 is a relatively challenging period, not only for the crypto market but for others also.Many news releases every day is a challenge for traders in this season. However, the bizarre thing is that DeFi seems to be a relatively "hot" topic.

Just two weeks ago, Binance launched Alpha, one of the most active new projects in the DeFi Yield Farming field. Today, October 12, Binance announced the next IEO on Launchpad: Injective Protocol. It's not surprising that Injective is a project in the DeFi segment. More particularly, they compete directly with Binance because Injective's main product is Decentralized Exchange.

Project overview/objectives.

If you have not heard of DEX or do not understand what DEX is and its importance, you can read my article on Serum (SRM) or DeFi. DEX is an exchange where users can directly trade without intermediaries or send money straight to the exchange.

Of course, DEX has many advantages; however, it is also quite inferior to traditional CEX exchanges. If you are still unsure, I suggest you reread my articles.

At first glance, as a new type of DEX, Injective seems to want to compete directly with Serum (SRM) rather than a simple AMM-using mechanism like Uniswap.

According to the Injective team, they are a Layer-2 exchange capable of supporting cross-border financial systems, particularly to the trading of margins, derivatives and futures contracts. It is a distinct feature of the project. Whilst most popular DEXs desire to buy and invest traditional altcoins, Injective seeks to focus on leverage and derivatives trading, which is a considerable challenge for DEX.

Why is it a challenge? The reason is, as we all know, when you trade on a traditional exchange such as Binance, each transaction is just a number. As for the money that is deposited in or withdrawn out, the exchange is in charge. For example, if A buys 5 BTC from B, then the exchange will record the transaction. If A wants to withdraw 5 BTC to his wallet, the exchange will be the licensee. If the exchange does not allow it, 5 BTC does not yet belong to A. As the exchange manages it, the trade will take place almost immediately.

In terms of DEX, things will be more straightforward. When A buys 5 ETH from B, those coins will be transferred directly from B's ETH wallet to A's ETH wallet on the Ethereum blockchain. Security, privacy, and security are there; however, unfortunately, ETH runs relatively slow. If A buys 5 ETH from B, sometimes, it takes 30 minutes for the money/coins to be available in the wallet. It is acceptable for traders who do not use leverage. For those who use leverage, the problem is unacceptable. If the traders close the position late by only 1 second, there will be a relatively massive difference between loss and profit, not to mention 30 minutes.

Therefore, there are not many DEXs that focus on the mentioned market segment. Injective may be the first excellent project that focuses on this field that I have ever seen. Of course, to succeed, they also need their weapons.

Core products.

Injective Protocol is not only an "exchange". It has three main products: Injective Chain, Injective Exchange and Injective Futures. These three products are in the same ecosystem and will work closely together to provide users with products that have the security of DEX and the fast and easy-to-use experience of CEX.

1. Injective Chain.

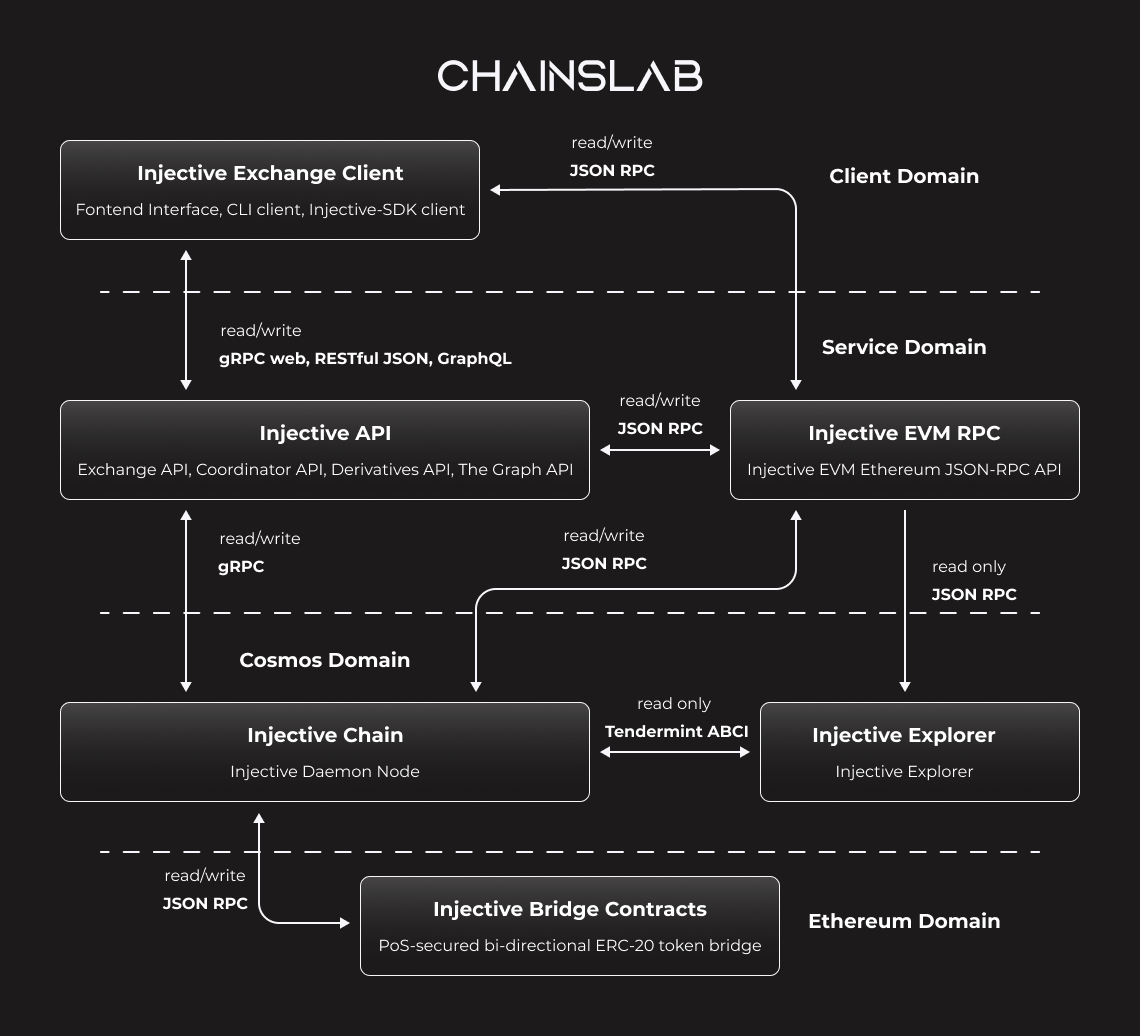

Injective Chain is a Layer-2 sidechain connected to the Ethereum network. Injective Chain was initially built on the Cosmos SDK; therefore, they will probably link cross-chain to other blockchains in the future. By using Layer-2 solutions, Injective Chain can optimize the speed of transactions to serve Injective Exchange and Injective Futures.

Injective Chain uses the Proof-of-stake version of Tendermint (similar to Cosmos), combined with Layer-2, to create the fastest transaction speed on the Chain to deliver the best experience of trading on its Exchanges and Futures. The figure below is a summary of the operation steps of the injection Chain.

2. Injective Exchange.

The Injective Protocol calls itself an Injective Exchange. Of course, this is a decentralized exchange. Like other decentralized exchanges, Injective are bound to face two problems: liquidity and trading volume. When there is no liquidity, it is not simple to attract users to generate volume. When there is no trading volume from users, the liquidity will become weaker and weaker. As a result, neither the exchange nor those who invest in the exchange will receive a cent.

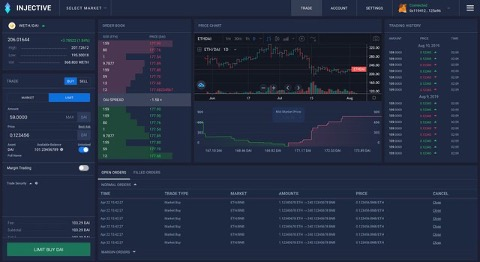

To solve this problem, the Injective team must come up with their solutions or perform better than its competitors. The first thing Injective announces is that they have an order book like other traditional exchanges.

I do not much enjoy using Uni / Sushi Swap because there is no order book. With such an interface, Injective will easily attract new players because they bring a familiar experience.

Injective's second solution is that they attract "relayers" into the liquidity system. By providing liquidity to exchanges, providers can earn commissions of up to 40% of transaction fees. For those who like passive income, this sounds appealing.

3. Injective Futures

The final and perhaps most important Injective's product in the future may be Injective Futures. It is not a coincidence that several derivatives transactions have emerged in the world of cryptocurrencies over the years. Derivatives trading will be the goose that lays golden eggs in the future.

It appears that Injective must rectify the speed problem when playing this battle. Derivatives trading requires very high transaction speed and low latency. If speed is not fast enough, when the market fluctuates wildly, the "beards" (shadow) on the candlestick chart will be long, significantly impacting users.

In this particular point, apart from the solution in Layer-2, I haven't seen any other obvious solutions in Injective's product. The product has not yet been released; thus, it is hard to evaluate. To determine the feasibility of Injective Futures, we may have to wait for the Injective Mainnet to start.

However, there seem to be many "big bosses" who believe in the Injective Protocol, Binance as an example.

Team and partners.

Injective Protocol has a relatively experienced team, followed by big investors/partners. The project CEO, Eric Chen, has seven years of financial experience in several large funding organisations in New York. The project's CTO, Albert Chon, also has more than eight years of Amazon work experience. Most importantly, in 2019, the project was included in the Binance Lab Incubation Program. It is a Binance program to fund potential projects and help promote them. Recently, Injective has officially launched on the Binance Launchpad, which is a huge step forward.

Binance, Pantera, QCP Capital, etc., are all on the project investors list. Mostly, these are initial investors who have invested and bought INJ tokens.

Tokenmetrics và Tokenomics.

1. Token Metrics.

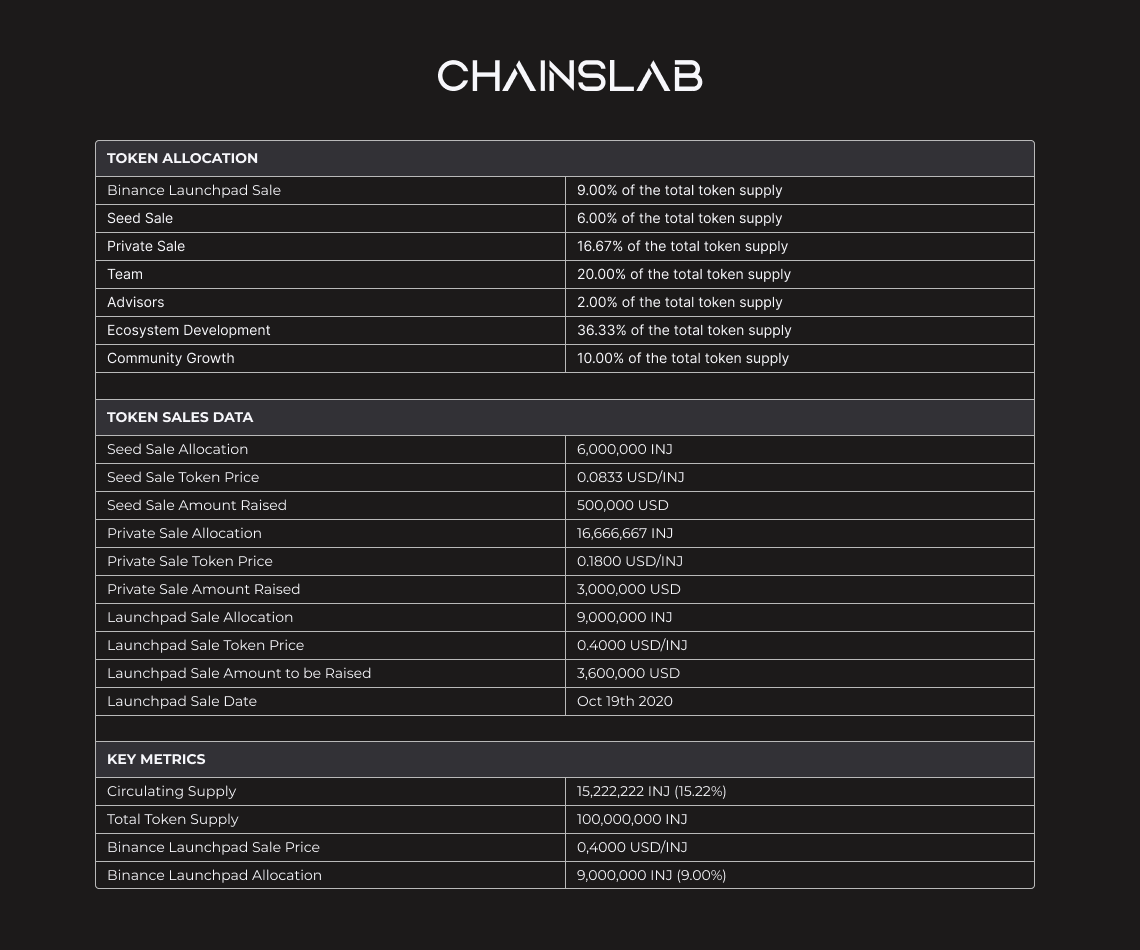

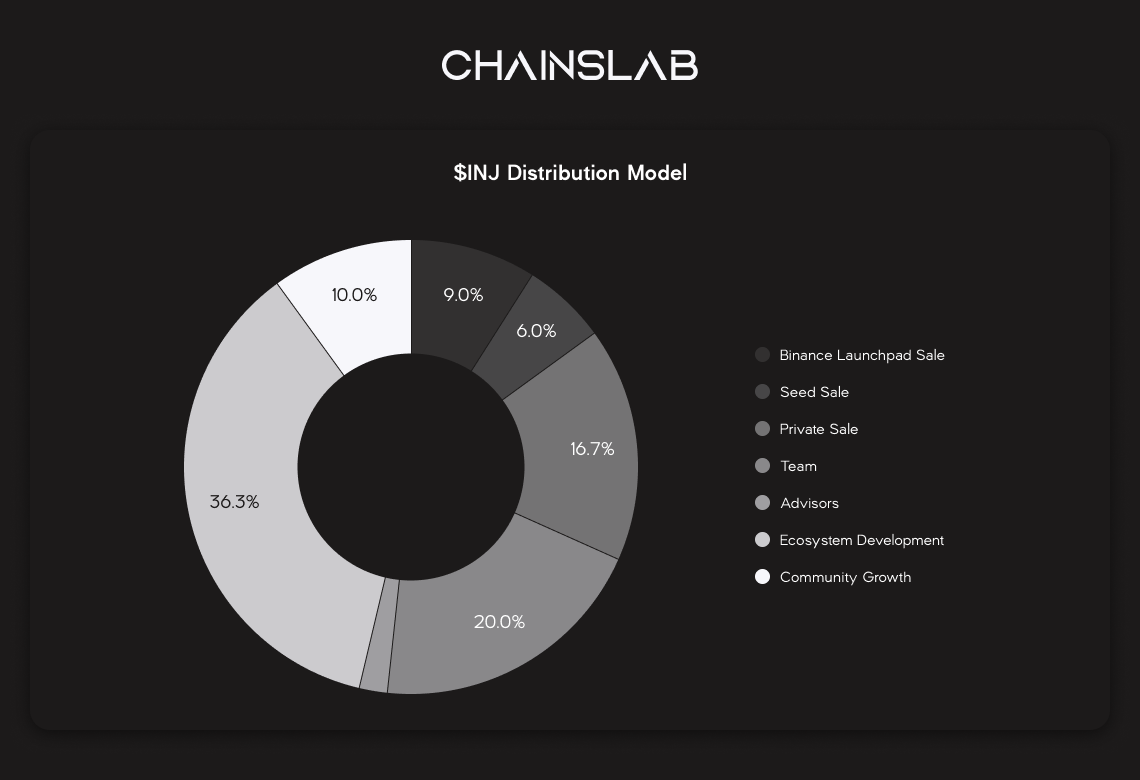

The project token is INJ, and the total supply is 100 million. There are currently 15 million tokens in circulation (accounting for 15% of the total supply). Binance Launchpad will sell 9 million tokens for $0.4, bringing the project's total capital to $40 million, which is relatively large compared to previous projects on Launchpad.

Before launching Launchpad, Injective had raised two rounds of seed sales and private sales. The project sold 6 million INJ in the seed round, with the price of $0.08/INJ and successfully raised $ 500,000 since 2018. The project's private round sold 16 million INJ worth $0.18/token and successfully raised US$3 million. The next launch on the Binance Launchpad will sell 9 million for $ 0.4/INJ, raising $3.6 million.

Note: From personal experience, when a project launches on Binance with the total market value exceeding 30 million U.S. dollars, the probability of the project price being dumped is relatively high. Primarily when INJ used to sell a lot in private sales, anyone who buys private sales has x 2.5 account and x5 account if participating in seed sales. I believe that the price is a bit expensive for a project without a product. Additionally, I am not sure what the market will be like in the last quarter of this year, and the " price pumping" ability is not high. If the price is less than x2 when launching, it will also cause lousy sentiment to investors. Even buying IEO will make a loss the same as for WIN or PERL in 2019.

INJ will be released gradually until 2023. The Seed sale and Private sale teams will receive tokens in 2021-2022, so this is a time when INJ prices will fluctuate strongly. The deadline for unlocking team tokens will occur soon. Only in June 2021, the team already started receiving tokens. The team owns 20% of the total supply, which they will receive from now until 2023.

2. Tokenomics

Token INJ has the following five applications, and there may be more in the future:

- Operating system: it will become a DAO in the future.

- To buy back and burn users’ transaction fees.

- To collateral for derivatives: INJ tokens will replace stable coins as collateral for loans in the derivatives market. It is an excellent use case for INJ tokens.

- Commission for Liquid Provider - As a reward for those who provide liquidity for INJ Exchange / INJ Futures, based on user transaction fees.

- Staking

INJ tokens have many use cases. With multiple utilities, there will be more reasons for holders to accumulate INJ tokens and invest in INJ. In the future, according to the development of the Injective ecosystem, there are likely to be more INJ token use cases.

The author’s evaluation.

The first impression that I have while researching Injective is that Binance has launched new IEO continuously. When Alpha was just listed on the exchange a few days ago, it had already announced INJ. Is it in CZ's eyes that DeFi is still "hot" and has lots to do?

Honestly, INJ is not a project with many ideas. They are not the first DEX to have an order book nor the first to target the field of Futures Trading. However, they are the first DEX products to run on COSMOS SDK and launch IEO on Binance. Before that, we had Serum DEX (SRM); however, Serum operated on SOL and launched IEO on FTX. It makes these two projects almost rivals. With Binance as an investment and advisor, INJ seems slightly better. In fact, in terms of price, INJ appears to be much cheaper than SRM.

In general, although there is not much creativity, INJ has a pretty good development facility. They were established in 2018 and have been active until now. With a good team, rich experience and good mentors, they need to work hard to do what they are doing. If INJ Futures is successful, INJ's price is likely to fly much higher than the price sold on Launchpad.