Since its launch in Sep 2021, GMX has released several products aimed at improving cryptocurrency trading and investing. It is a novel cryptocurrency spot and perpetual contract trading platform built first on Arbitrum - a layer 2 scaling solution on Ethereum. The ultimate goal is to take their unique 0-fee perp trading experience and deploy cross-chain, which we have seen already starting to happen with their move onto Avalanche blockchain.

GMX is highly rated with its impressive tokenomics and reward system for traders and liquidity providers, low trading fees, no price impact and a superb user experience thanks to the high throughput blockchain technology and optimized protocols that power the platform.

The bear market has been kind to the sector. According to DeFiLlama, the derivatives are practically the only category enjoying significant TVL growth these past few months, in which, the leader GMX has nearly half of a billion dollars in TVL. If indeed crypto is gambling, what if we just embrace that and get freaking good with it?

GMX is one the few cryptocurrencies to have risen in value since the start of 2022. Along with their recent popularity, a new narrative grew surrounding them. It is Real Yield. To better appreciate the reasons behind its exposure, let’s get through it all below.

What Is GMX?

In short, GMX is a decentralized exchange on Arbitrum and Avalanche blockchain that provides spot and perpetual futures trading with low fees and zero price impact trades, allowing users to leverage up to 30x on their positions.

THe AMM model is the most popular liquidity-provision setup used by cryptocurrency exchanges. It solves the main limitations of the orderbook model, and has become ubiquitous in the industry. GMX is one such project that employs a unique multi-asset liquidity model that’s an interesting modification to the default AMM.

What Makes GMX Unique?

A distinct feature of the platform is its multi-asset AMM model. Liquidity providers invest in on-platform index assets and in exchange for the investment, receive the platform’s liquidity cryptocurrency.

GMX isn’t the first decentralized perpetual trading platform, but it is unique in several ways. It shifts the paradigm with extended leverage and a decentralized, multi-purpose liquidity pool.

Trading is supported via a unique multi-asset liquidity pool that generates rewards from market making, swap fees, leverage trading (spreads, funding fees and liquidations) and asset rebalancing which are channelled back to liquidity providers.

Due to their unique value proposition, GMX is positioning itself to be a leader in this derivatives product offering space because of two main points:

- Strong value accrual to token GMX holders and liquidity providers, denominated in ETH.

- A non-inflationary tokenomics model: GMX liquidity model (GLP) doesn’t require inflationary (farm and dump style) token incentives.

In addition, GMX is powered by Chainlink oracles. It uses an aggregate price feed from leading volume exchange to reduce liquidation risk from temporary wicks. A liquidation occurs when a user’s collateral becomes insufficient to maintain a trade. The platform then forcefully closes the position and pockets the deposit to cover its losses.

When users want to go long, they can provide collateral in the token they’re betting on. Any profits they receive are paid in the same asset. For shorts, collateral is limited to GMX’s supported stablecoins and profits are paid in the stablecoin used.

Shared Liquidity Mechanism

GMX is differentiated from its competitors through its liquidity pool mechanism, GLP, which acts as the central clearing house for leveraged traders. GLP is a multi-asset pool containing all the tradable assets on the platform, similar to a crypto index ETF with target weights for each constituent asset. The platform’s target weights are adjusted dynamically as a function of net open interests among perp traders. For example, if more long ETH perp positions are opened, GLP’s ETH target weight will simultaneously increase.

Liquidity providers are incentivized to add liquidity by swapping their assets for GLP tokens (new minting). A swap fee is algorithmically determined to incentivize trades in the direction of bringing the actual weight closer to the pool’s target weight. For example, if ETH’s actual weight is lower than the target weight, users are incentivized to sell ETH to mint GLP with lower swap fees. This pool of assets serves as liquidity for perp traders whilst LPs are rewarded through swap fees.

Perp traders on GMX trade against the GLP asset pool rather than against another trader in the order book, hence drawing similarity to a central clearing house. Since LPs act as the counterparty to perp traders, they earn both trading fees and mark-to-market P&L as position takers. The risk taken by GLP LPs is a combination of the GLP index weight design and perp traders’ net open interest. If perp traders’ net positions lose money, LPs would benefit from the distribution of wealth effects.

Zero-sum Structure

Perp traders on GMX trade against the GLP asset pool rather than against another trader in the order book, hence drawing similarity to a central clearing house. Since LPs act as the counterparty to perp traders, they earn both trading fees and mark-to-market P&L as position takers. The risk taken by GLP LPs is a combination of the GLP index weight design and perp traders’ net open interest. If perp traders’ net positions lose money, LPs would benefit from the distribution of wealth effects.

Given the zero-sum structure, the trader’s P&L shows how much P&L LPs make in comparison to holding the assets in the pool (excluding fees) outright. As of Oct 05 2022, aged traders had a cumulative loss of $6.5M which was distributed to the LPs as profit. This profit is distributed in terms of reduced/increased exposure to GLP assets, whichever is more favorable for LPs.

In a simplified example, assume the GLP pool consists of only 2 assets, $100K worth of ETH and $100K USDC, provided by LPs. A trader opens a leveraged long ETH perp position worth $70K, leaving the net exposure of the GLP pool to be $30K ($100K – $70K) worth of ETH. If ETH declines by 10%, the trader's $70K ETH position would lose 10% or $7K. Since the LPs are less exposed to ETH after the trade, a 10% drop in ETH price would only generate a $3K loss to the LPs’ remaining ETH that would have been a $10K loss if the trader did not utilize/borrow the ETH. This leaves the LP with a net profit of $7K.

Zero Price Impact

Beside the shared liquidity mechanism, GMX adopts a mix of Chainlink oracles and CEXs (Binance, FTX) pricing sources to mark perpetual futures. Since no order book exists and all trades are executed against the GLP asset pool, trades are executed at the current oracle price with no price impact, provided there is sufficient liquidity in the GLP pool. In most CEXs, order books are used to “mark” perp prices which could lead to premature liquidation, as exchanges protect themselves from liquidity gaps around the prices where margins exhaust.

Tokenomics

GMX has two native tokens: GMX and GLP.

GMX

GMX is the platform’s native token that has both utility and governance functions. Staked GMX earns 30% of fees generated from the platform’s trading activity on both blockchains, in contrast to GLP, which accrues 70% of fees from just its own single chain. Staked GMX also earn two other types of rewards, which will be elaborated below.

Users who stake GMX receive 3 types of rewards (esGMX, multiplier rewards, and platform trading fees) to incentivize staking and reduce selling pressure.

Firstly, esGMX is earned as a GMX staking reward and can be used in two ways.

- Staked for rewards similar to regular GMX tokens. Each staked esGMX token will earn the same amount of esGMX, multiplier points, and ETH / AVAX rewards as a regular GMX token.

- Vested to become GMX tokens over one year

Through vesting, esGMX are converted into GMX tokens. Vesting is a linear process over one year, and vested GMX tokens can be sold immediately.

In order to start vesting, the average number of GMX or GLP tokens that were used to earn the esGMX rewards must be reserved. For instance, if you staked 1,000 GMX and earned 100 esGMX, then to vest 100 esGMX, 1,000 GMX must be reserved in a vault.

In addition, once esGMX tokens are deposited for vesting, they cease to accrue any staking rewards, but the staked GMX tokens that are reserved in a vault will still accrue rewards.

This is designed to prevent GMX from becoming a typical ‘farm-and-dump’ token as it incentivizes holders to continue staking their rewards and original tokens. It also allows the protocol to continue growing without constant selling pressure, leaving more esGMX locked up.

Secondly, Multiplier Points (MPs) reward long-term holders without inflating GMX supply.

When you stake GMX, you receive MPs at a fixed rate of 100% APR. 1,000 GMX staked for one year would earn 1,000 MPs.

MPs can be staked for protocol fee rewards and earn the same amount of ETH/AVAX rewards as staked GMX tokens.

Ultimately, 30% of fees generated from swaps and leverage trading are converted to ETH/AVAX and distributed to staked GMX tokens. Staked GMX on Arbitrum earns ETH, while those on Avalanche earn AVAX.

GLP

GLP token is structured as a tokenized audit of assets on the GMX network. GLP tokens are minted using any of the approved assets on the GMX exchange. Users lock their assets and mint GLP tokens according to the prevailing conditions as specified by the GLP token distribution algorithm.

The GLP pool services leverage loan requests in the traders’ token of choice. Traders can borrow any asset in the pool but trading profits from short positions are paid out in USDC and profits from long positions are paid out in ETH or BTC. Fees from trading are reserved for GMX and GLP staking rewards.

With this structure, the GLP pool’s return shrinks as traders make profits and grows when traders make losses and trade more frequently. GLP tokens are not tradable and can only be used to redeem the assets locked during the minting process. Minted GLP tokens are automatically eligible for staking rewards of about 25% interest on Avalanche and 31% interest on Arbitrum. GLP holders also receive esGMX rewards and 70% of the fees generated on any of GMX’s products.

Competitors Analysis

A few factors that may contribute to their rise over CEX counterparts:

- Incentives such as trading fee distributions and liquidity mining schemes, will encourage more users to go to DEX’s over CEX’s. This creates a flywheel that will continue to ramp up as usage increases.

- The market share of decentralized perpetuals remains small compared to the huge source of liquidity and trading activity, and these remain highly represented by CEX’s. As CEX’s continue to enable the onboarding of users to DeFi, they will be effectively loosening their own moat, as users demand easier access to Dapps.

- If regulatory action targets CEX’s (FTX, Coinbase, Binance), volume may move to decentralized derivatives in the short-term, building network effects for long-term growth.

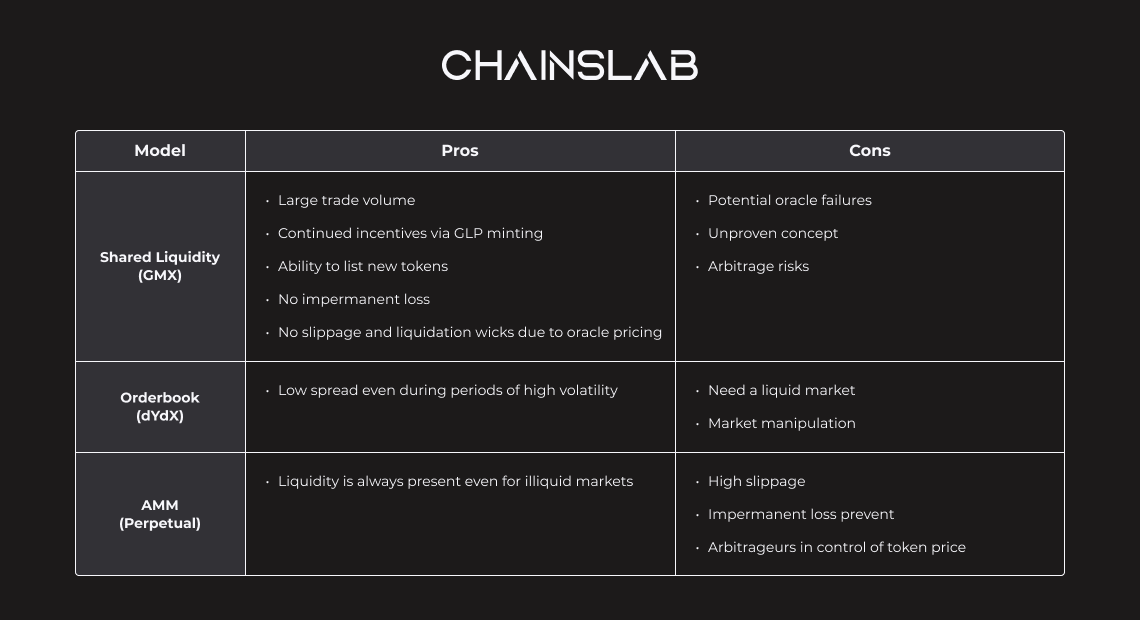

GMX is currently the only protocol that facilitates perpetual futures trading using the shared liquidity model, so far. The table above shows various differentiates of the mechanisms other decentralized perpetual trading platforms currently employ.

Final Thoughts

With over $70 billion in total trading volume and over 116,000 active users (at the time of this writing), GMX is putting up numbers that are almost as impressive as its technology. It is swiftly building itself a reputation in the vast derivatives market.

In the traditional financial space, the derivatives market dwarfs the size of the stock market by controlling almost 10 times the size of the global stock market. GMX exchange aims to tap into this massive market and has seen incredible growth already.

Apart from an opportunity to benefit from the fluctuating values of crypto assets, GMX hands traders and investors a well-developed platform to perform an array of financial activities. Investing, trading, and passive earning.

In one platform, it serves three hierarchies. An exchange platform built on low-fee blockchains and Layer-2 solutions allow cryptocurrency investors to rotate their assets and pay pocket-friendly fees in the process. With the numerous passive income opportunities on the GMX exchange, crypto asset owners can simply lock their assets and ‘make their money work for them’ while enriching the GMX ecosystem.

The rave around GMX’s perpetual contract feature is reasonable. To complement a more secure and interactive way of trading ‘timeless futures contract’, GMX’s 30X leverage goes many steps further from the current leverage limits on other decentralized and centralized perpetual contract trading platforms. By doing so, GMX widens opportunities for traders.

However, be informed that cryptocurrency trading is always a risky venture. An advanced understanding of futures trading is important. Also, exercise caution while interacting with decentralized applications.