On-chain asset management, also known as blockchain-based asset management, is an emerging concept that has gained significant attention in recent years. With the advent of blockchain technology, managing assets on a decentralized platform has become possible, eliminating the need for traditional intermediaries such as banks and other financial institutions. On-chain asset management involves the use of smart contracts, which are self-executing agreements that run on the blockchain, to manage assets and automate investment processes.

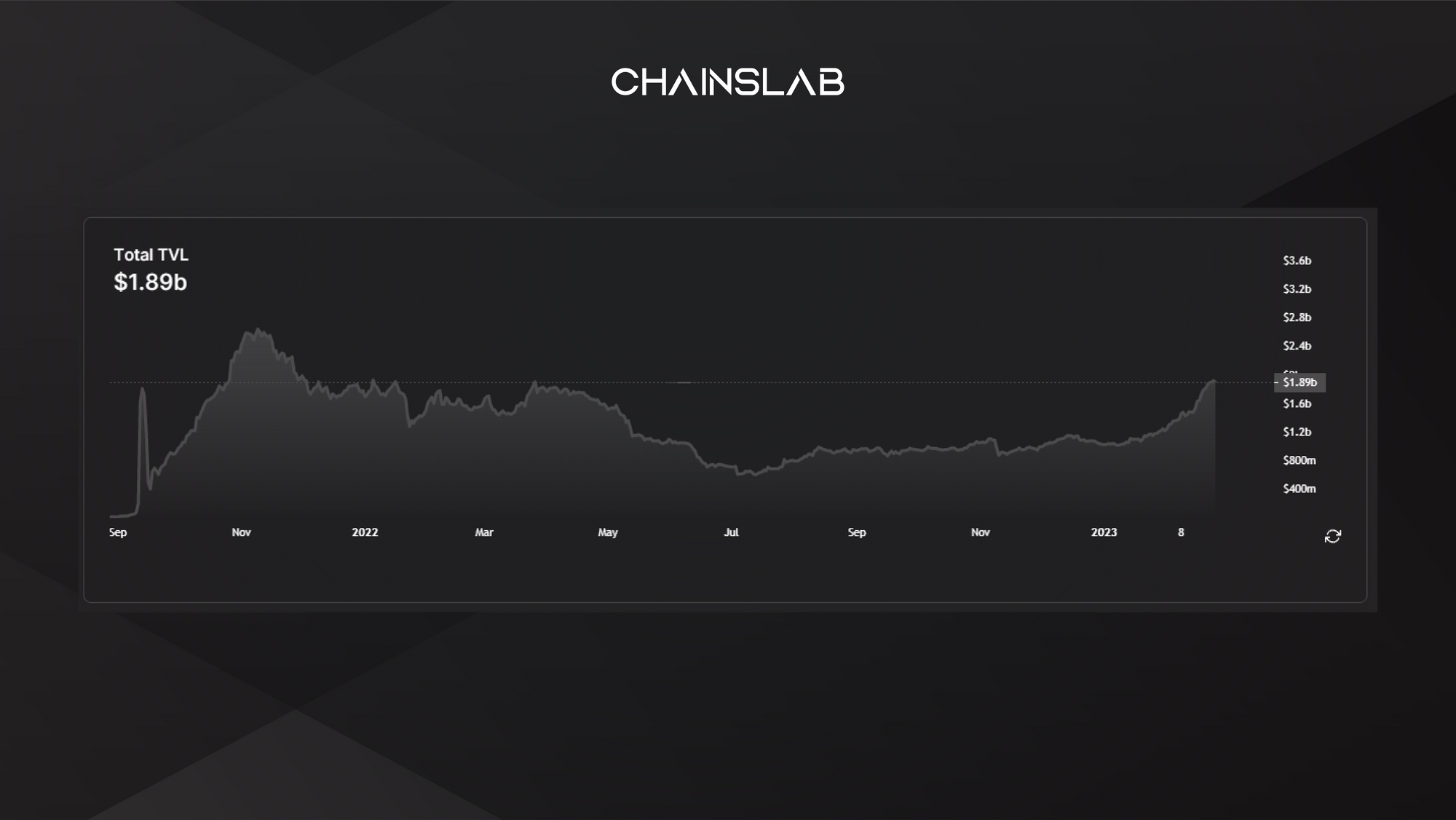

The DeFi space on Arbitrum has been growing rapidly since the launch of the mainnet in September 2021. Currently, there are a range of DeFi protocols and applications available on Arbitrum, the TVL is currently worth around $1.8 billion, which ranks at number 4 at the time of writing. Meanwhile, the protocols or dApps on Arbitrum are still incompetent to attract such a large amount of money. Being born much later also helps a lot with DeFi protocols built on Arbitrum in developing business models as well as integrating different platforms for cooperation and development.

However, like any nascent technology, on-chain asset management faces a set of challenges that need to be addressed for its successful adoption. While on-chain asset management has significant potential to revolutionize the asset management industry, it must address the challenges of scalability, cybersecurity and regulatory compliance to achieve widespread adoption. The solutions proposed provide a foundation for future innovations in the field, creating a more secure, efficient, and transparent asset management ecosystem.

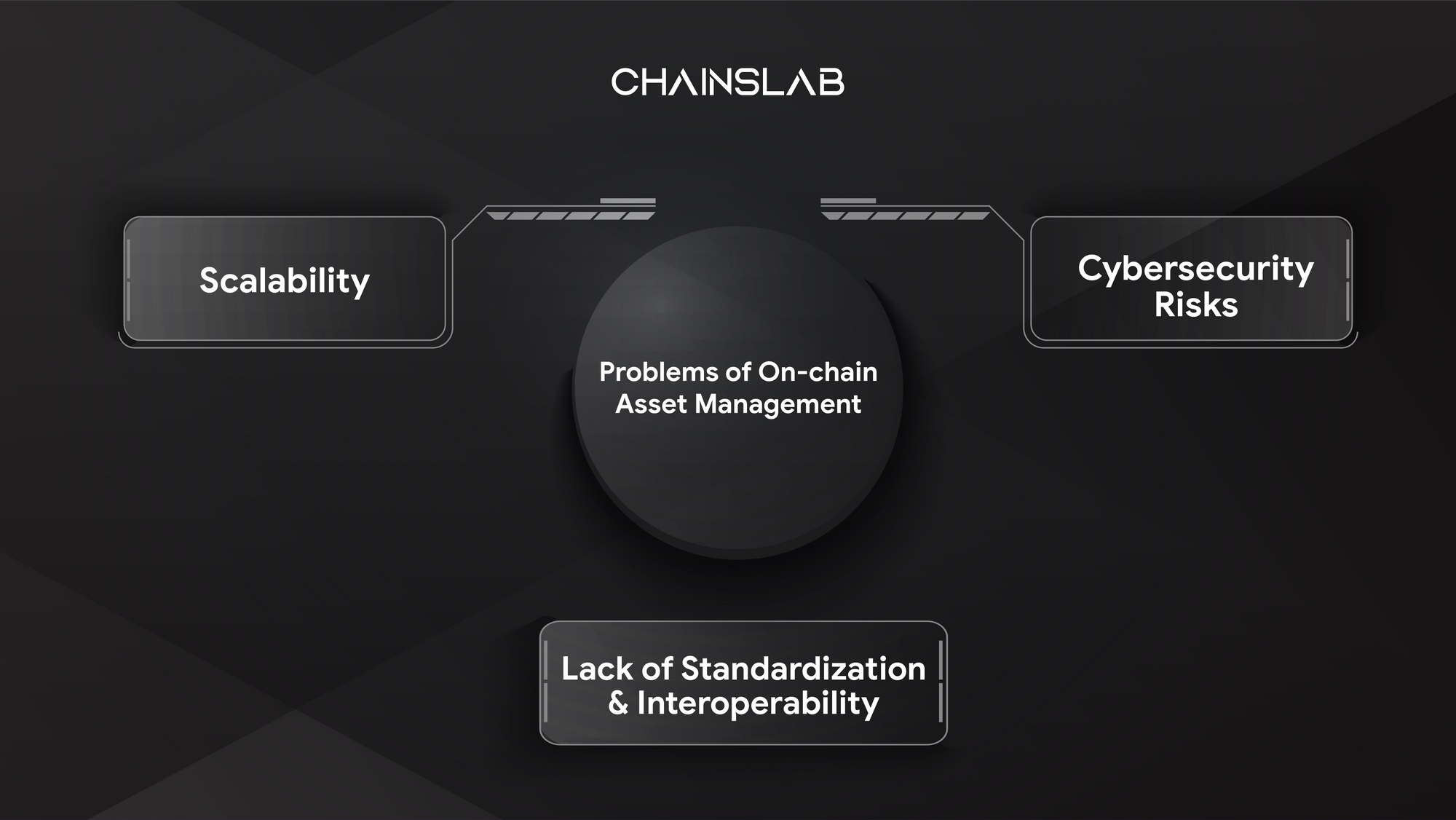

I. Current Problems of On-chain Asset Management Sector

One of the primary challenges is scalability. The current blockchain infrastructure has limitations in terms of its capacity to handle a large number of transactions. This poses a significant challenge to on-chain asset management solutions that require high-speed, high-volume transaction processing.

Moreover, the cybersecurity risks associated with on-chain asset management are also a major concern. Smart contracts and other blockchain-based solutions are vulnerable to hacking attempts, which could lead to the loss of valuable assets.

Additionally, the lack of standardization and interoperability in the blockchain ecosystem also poses a significant challenge to the adoption of on-chain asset management solutions. The fragmented nature of the blockchain industry, with various protocols and standards, makes it challenging to develop a universal solution that is widely adopted by the industry.

In summary, the current market problems of on-chain asset management include scalability, regulatory uncertainty, cybersecurity risks, and lack of standardization and interoperability. Addressing these issues is crucial to unlock the potential of on-chain asset management and enable its widespread adoption in the asset management industry.

II. What is FactorDAO?

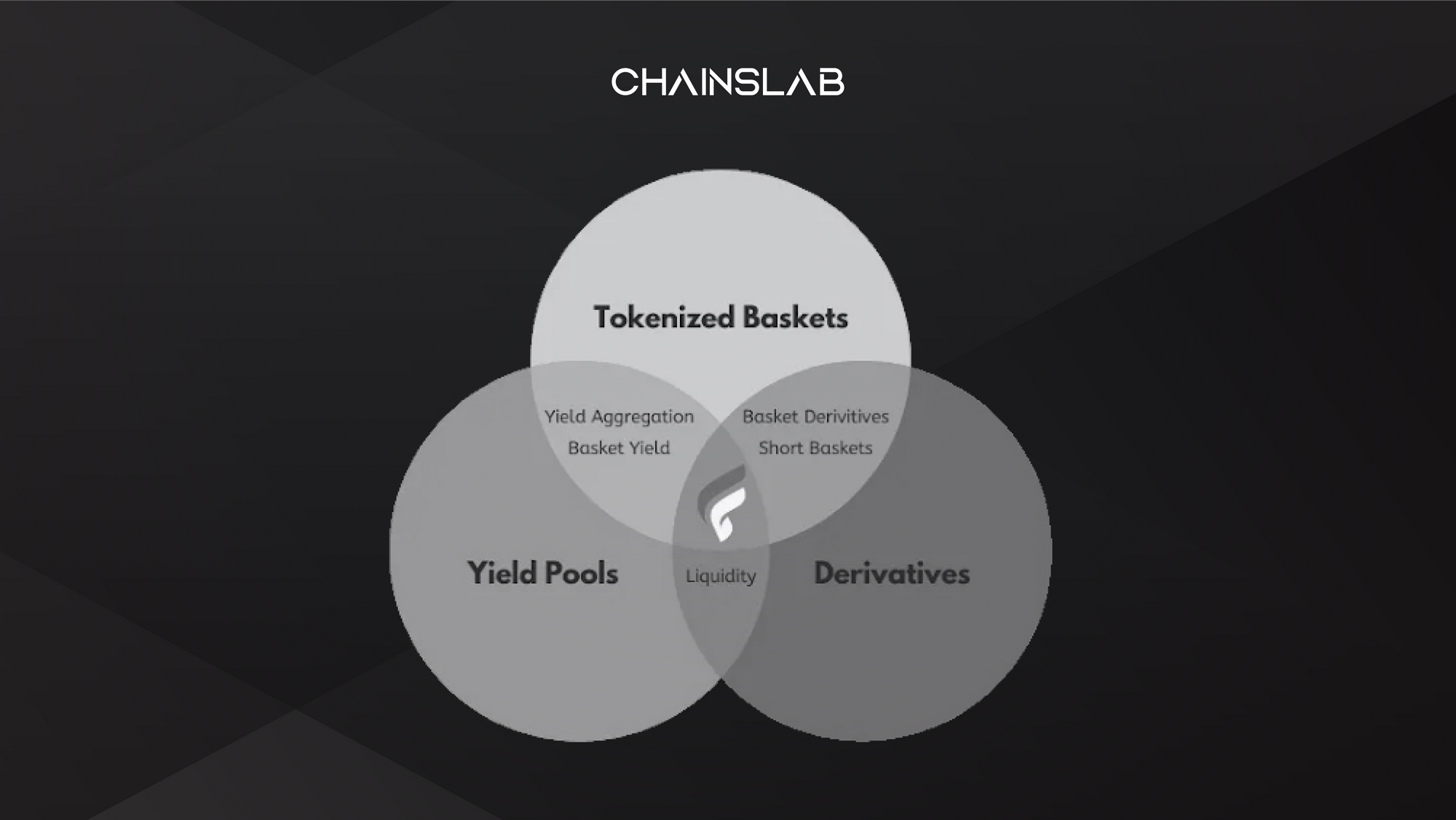

As described, FactorDAO, a liquidity hub, aims to connect the market directly to its participants and make it easy to access any kind of digital asset classes, thanks to its modular asset management framework. It is revolutionizing decentralized on-chain asset management by providing a robust framework that gives innovators the tools to create and manage powerful financial instruments.

All existing DeFi assets aggregated under one roof, enabling the creation of novel instruments and strategies. A one stop solution for protocols looking to boost TVL, treasury managers looking to hedge exposure and generate yield, or aspiring asset managers looking to build on-chain track record.

Main Products

Due to the flexibility of the Factor infrastructure, it can cater to a number of users. Factor can bring a product market fit across a number of target users to lay the foundations for widespread institutional and retail adoption of DeFi.

Factor offers a modular, no-code infrastructure and liquidity platform for DeFi that integrates multiple DeFi assets under one roof. Vault creators can easily build their strategy, set management and performance fees, and set permissions to create their vault. Factor offers permissioned and permissionless vaults for any protocol, treasury, or individual requirements, allowing the creation of novel assets to drive TVL, hedge positions, generate returns, and earn revenue.

For builders, Factor eliminates the need for them to create their own infrastructure. Factor middleware offers access to fundamental asset management components, allowing innovators to build their own protocols. Serving as a white-label platform, it expedites market entry, provides scalability, and revenue generation services for creators.

Working with Factor via integrations and vaults offers a variety of benefits to existing protocols. Integrations enable them to gain wider exposure, volume, and TVL for their products. Custom vaults expand their use cases and product portfolio, offering an additional revenue stream, as well as the potential to earn $FCTR incentives.

For DAO or protocol treasuries, on-chain funds, and individual asset managers, Factor offers easy access to the widest possible range of markets and tokens, as well as the ability to create totally novel instruments. This offers hassle-free treasury and fund management through the easy creation of personalized vaults via a no-code interface.

Investors can easily build their own customized portfolio, from simple to complex, based on their own criteria and risk tolerance. Factor makes DeFi accessible for all, offering diverse, non-custodial access to the widest range of investment strategies on the market. With just a click of a button, they can create and manage their ideal portfolio.

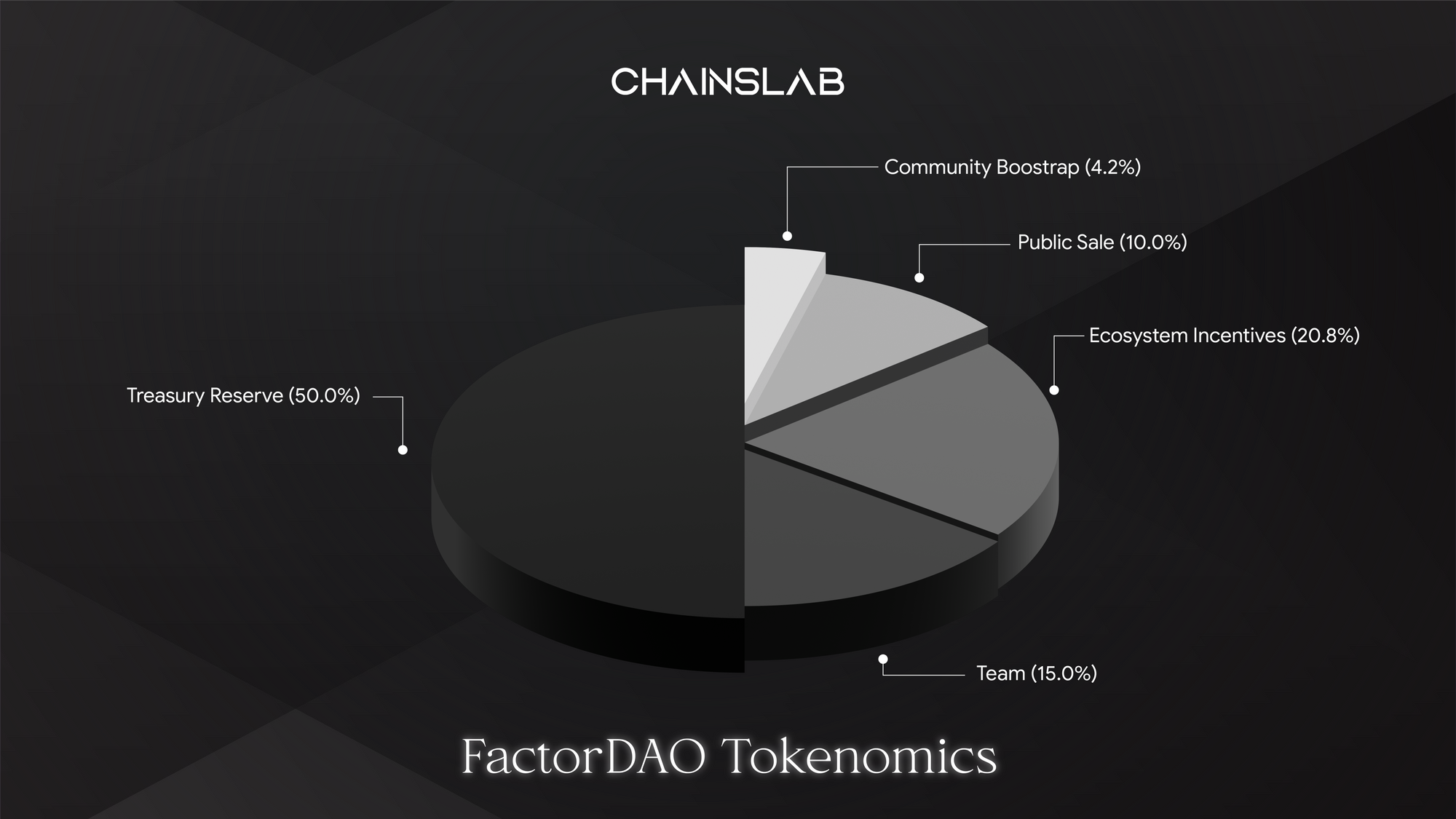

III. $FCTR Tokenomics

Tokenomics

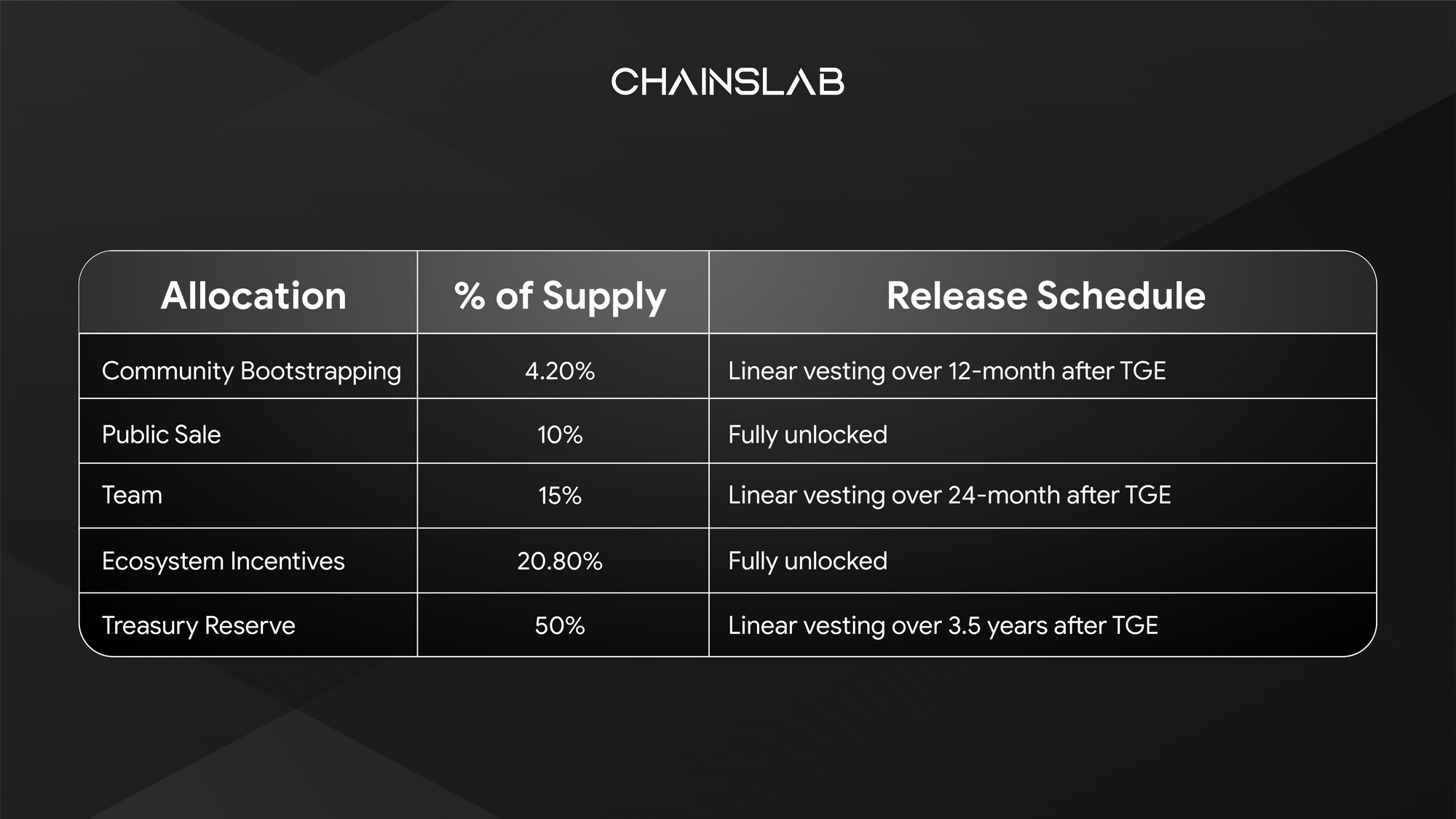

The supply of $FCTR will be capped at 100 million tokens and no inflation. Over 80% of $FCTR’s supply will be distributed directly to the community, which means that the projects focus on the voices of its community. In addition, the tokens have a lock mechanism that really helps prevent the sell sides in the long-term, bringing more incentives and governance rights to the community.

By converting the staked $FCTR to locked $veFCTR, liquidity is reduced in the short term but this can help to increase liquidity in the long-term, as users are encouraged to hold their tokens for longer periods, which can help to stabilize token prices and reduce volatility. Furthermore, the ve mechanism can be used to promote good governance practices by incentivizing long-term thinking and decision-making. This can help to ensure that decisions made by token holders are in the best interest of the overall ecosystem, rather than short-term gains.

However, we still have to wait and see the team's actions to the community, whether they will create enough and drive demand for the community to be ready to lock the token and contribute to the project. In return, it also means that their product must be widely accepted, have many users to generate enough revenue to pay back to the benefit of users who are willing to lock tokens for many years.

Token Metrics

32.5% of total supply is instant flow into the circulating supply. In which, the amount of public token sale accounts for 10% of supply and no locks. Using a fair launch model powered by Camelot launchpad - an Arbitrum native decentralized exchange. To be honest, the author does not appreciate this kind of sale.

One side, with a fair launch, there is no pre-sale allocation, which means that there is no possibility of insiders dumping on the market as soon as they become available. This can help to prevent sudden drops in price and increase the perceived fairness of the distribution. And this model can lead to a more engaged and committed community of users, which can help to support the long-term success of the project. In contrast, the price of a fair launch is determined entirely by market demand, it can be highly volatile in the early days. This can make it difficult for early adopters to determine the true value of the token. With no hard cap offers, early investors in the fair launch token have no guarantees of receiving a certain number of tokens or a certain return on their investment. This can make it riskier for investors who are looking for more stability and predictability in their investments.

Earlier, Camelot organized a Fair Launch token sale to Arbitrove and had a large amount of money from the community, up to nearly $ 14 million. Quite impressive, but when dug into the process, we can see it is really not good at all for investors early. See the chart below, and you’ll see.

This chart indicates that, when it comes to the end of the opening time, a large amount of money has been deposited in and has made the selling price increase to 20% within a few hours, from 0.04x to 0.067. According to the author's assumption, it is possible that the amount of money from an organization or an individual whale is related to the project. Pushing the price at the end of the auction session is not good for retails, you can see the price of $TROVE immediately after listing.

As personal experience, NO HARD CAP = NO APE. That’s it.

IV. Closing Thoughts

To be honest, the solution offered by Factor is not entirely new, but it is still not widely adopted by many teams. This may be due to various technical barriers that exist in the DeFi industry. Typically, each project is implemented independently, requiring the creation of its own infrastructure and liquidity. Given the relative novelty of DeFi and the need for improvement, even experienced DeFi experts find it challenging to build on multiple protocols and products across different chains.

Previously, when decentralized trading platforms were not evolved, the accompanying services such as assets management and vault creation could not stand. Therefore, as we have seen, Dex recently became hot, after the contagion 3AC or FTX, users have tended to use DeFi products. Therefore, creating that kind of sub-service for infrastructure that supports asset management will be quite potential in the near future for Factor.

Additionally, users face numerous issues when participating in different DeFi products. It can be cumbersome to track and manage transactions and strategies, requiring synthetic analysis sources from many parties, which creates an unpleasant experience for users. By offering a combination of infrastructure and liquidity sources, Factor creates favorable conditions for developers and end-users alike. It can be considered a one-stop-shop for everyone, allowing end-users to diversify their investment choices while developers deploy easier models or strategies and provide liquidity instantly. Finally, the development of products not only requires the project team to complete the technical details, but also to focus on upgrading the user experience and a network of integration and partner is large enough to be able to set it apart from others.