Decentralized finance (DeFi) is undoubtedly one of our era's most innovative and revolutionary developments. The benefits of DeFi over TradFi or CeFi are tenfold, and for the first time in history, people have a way of genuinely taking control of their financial health without the need for boundary overstepping, greedy and corrupt authorities, which have proven time and time again to be untrustworthy. Are these the people we want to trust with our trading and financial activities?

The past few days have been a constant stream of dramas from major exchange owners in the market. Sam Bankman-Fried, CEO of FTX, has officially announced bankruptcy with a $9 billion hole. The reason has not been officially revealed, but it seems that the rumors that this young CEO did not respect the terms, arbitrarily used the user's funds as collateral, and continued to borrow liquidity for Alameda Research, a leading market maker in crypto.

FTX exchange has locked deposits and withdrawals for more than 24 hours, causing many users who are storing assets to risk losing their assets. More reason for us to worry about where to store and trade assets without being controlled.

“Decentralization doesn’t matter, until it does.”

So why don’t the platforms where we trade reflect our values of freedom and trustworthiness? That is just one of many things DeFi is positioning to overcome CeFi. That’s where the DEXes (decentralized exchanges) came in and dYdX is one of the top projects that we’ll be covering today.

I. What is dYdX?

Outlook of dYdX

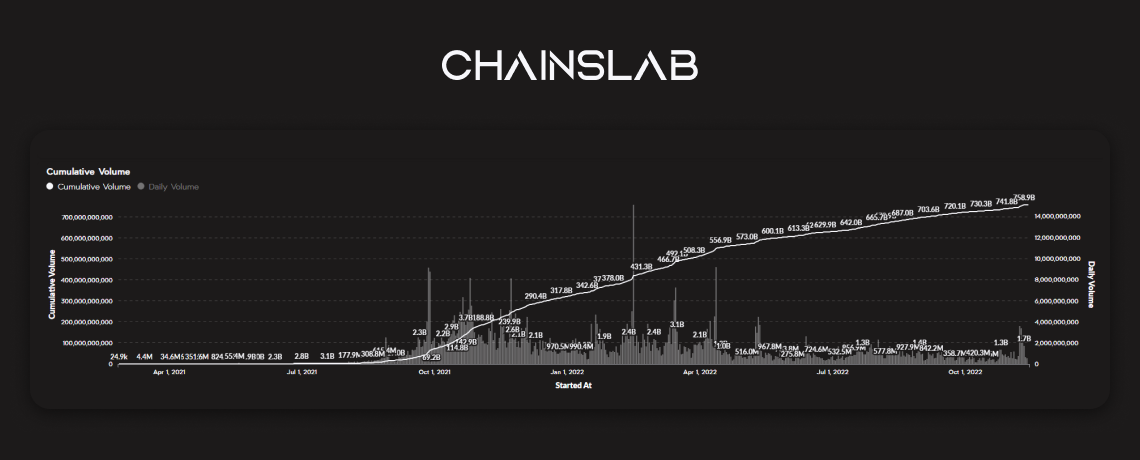

The exchange currently has 36 trading pairs with ~$2 billion of trading volume. ~$400 million of TVL, making it a top 20 DeFi project regarding TVL according to DeFiLlama, and the #1 DEX according to CoinMarketCap.

Overview

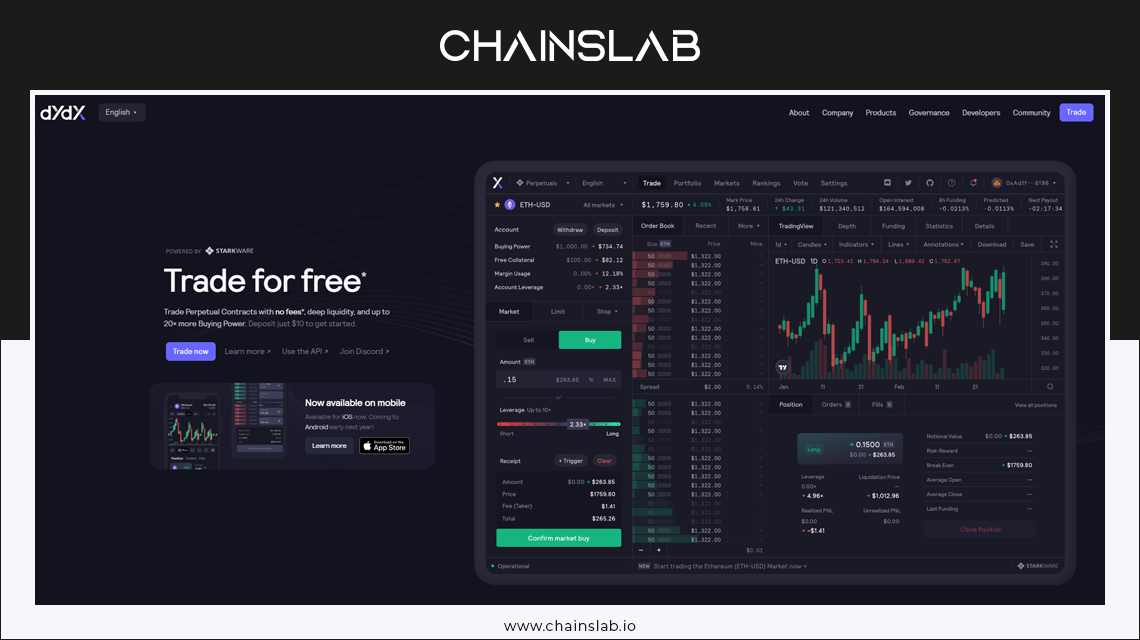

dYdX is a leading decentralized exchange created in 2017 by California-based entrepreneur and ex-Coinbase engineer Antoni Juliano under the company name dYdX Trading Inc. The DEX supports perpetual trading with up to 20x leverage. The platform runs on smart contracts on the Ethereum blockchain and leverages a layer 2 solution to provide traders with highly efficient and low gas fee trading.

It is important to note that dYdX is undergoing some pretty serious transformations and evolutions in its protocol and platform offerings. The platform has recently ceased spot trading functionality and shifted its key focus to perpetual trading, which is why that feature was the first tradable instrument made available on the StarkWare layer 2 in-house protocol upgrade.

dYdX is building what they claim will be the next generation of DeFi exchanges and it is easy to see why they are able to make that claim boldly. The platform leverages StarkWare, which is one of the most advanced and powerful Ethereum Layer 2 solutions, to provide traders with a lightning-fast and seamless trading experience.

dYdX is also aiming to migrate away from Ethereum and develop its own blockchain built on the Cosmos SDK network, which will power the platform in the future.

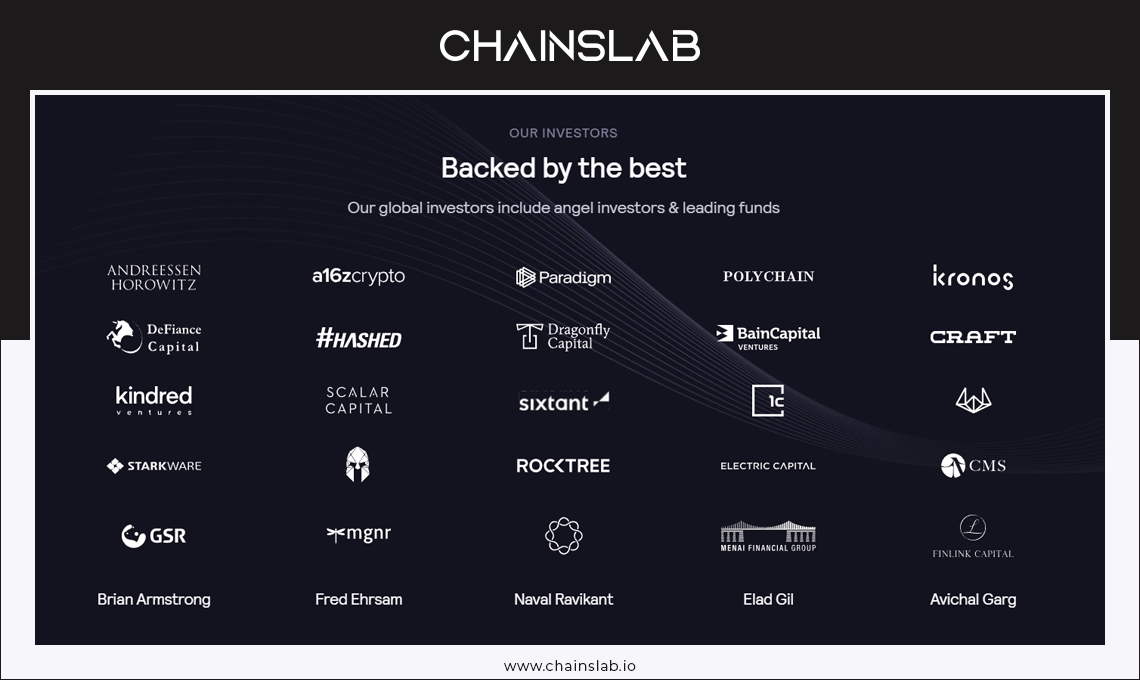

dYdX is one of the top decentralized platforms for trading perpetuals and accessing leverage. This highly ambitious platform is a real powerhouse in the DeFi industry, backed by some of the largest players in the space, such as Andreessen Horowitz, a16z, Brian Armstrong of Coinbase, and more.

II. Key Features of dYdX

As with many DeFi financial products, dYdX is available to anyone to access and even build upon, as it is open-source. Innovative contract applications completely manage, run, and store users' assets. The platform promises transparency and security, and they deliver on those promises. In crypto, there is a common mantra that goes, “don’t trust, verify”, and thanks to the open-source code and transparency of the team, dYdX fulfills this crypto ethos.

StarkWare Layer 2 Scalability Infrastructure

dYdX has partnered with StarkWare, a leading Ethereum layer 2 scaling solution in order to significantly increase efficiency and make gas fees nearly obsolete. StarkWare utilizes ZK-Rollups to bundle or “rollup” transactions into a single batch, which are then posted to the Ethereum blockchain alongside a proof, attesting the validity of the bundled transactions.

ZK-Rollups offer high throughput, instant finality, self-custody, and trading privacy, which makes it well suited for the dYdX exchange. Thanks to this collaboration, dYdX enjoys the following benefits:

- Significantly reduced gas & trading fees.

- Reduced minimum trade sizes.

- Cross-margin capabilities.

- More trading pairs support Instant trade settlement.

- Higher performing price oracles.

- Higher leverage & lower liquidation penalties.

dYdX Chain

The choice for a DeFi protocol to move away from Ethereum and create its own separate chain is not something that frequently happens in the world of crypto. dYdX chain will be built using the Cosmos SDK and Tendermint Proof-of-Stake consensus protocol. This will open dYdX to the Cosmos ecosystem, which is an interconnected system of application-specific blockchains. This update will mark dYdX V4, and is set to be completed by the end of 2022.

Native Decentralized Mechanism

Unlike most DEXs that run an Automated Market Maker (AMM) or RFQ system, dYdX decided that an orderbook-based protocol was crucial to the trading experience that pro traders and institutions look for in a platform. The team also found that no existing off-chain orderbook systems met their criteria as there were either no matching engines or they were based on centralized matching, which led to dYdX realizing that they needed to build their own off-chain and decentralized orderbook and matching engine from the ground up.

No Gas Cost

Thanks to the StarkWare upgrade, dYdX gas fees are already extremely low, but once the shift to V4 happens, a benefit of Cosmos is that traders will not need to pay gas fees to trade. Instead, they will be able to pay fees based on trading volume, similar to how fees are structured on centralized exchanges. The fees would accrue to validators and their stakers. Traders on dYdX will be able to trade without gas fees.

III. Core Products of dYdX

dYdX provides investors three main kinds of trading products: Spot, Margin & Perpetual. But on November 1 2021, the protocol officially disabled the spot, margin trading and borrowing.

There are very few decentralized protocols out there offering derivatives or margin trading, with enough liquidity, which is what makes dYdX massively popular among crypto traders and why they are one of the fastest-growing DEXes in terms of adoption and TVL.

Perpetual Trading

Perpetual trading is the flagship offering of dYdX and allows users to trade open markets with non-expirable contracts. Traders can hold their buy or sell positions indefinitely until the predetermined trade conditions are met.

Traders can trade contracts with up to 20x leverage and go long or short on over 36 different assets. One strength of dYdX is that traders can get started with as little as $10, which is one of the lowest minimum trade sizes in all of DeFi, with lower liquidation risks.

In addition, the protocol has all the basic trading features, such as placing market/limit/stop limit orders. However, a limitation compared to decentralized exchanges is that dYdX does not yet have TWAP (time-weighted average price), or set tactics for trading bots, allowing investors more choices in automatic trading.

Furthermore, unlike CEXes, based on fees paid, every trader gets incentivized. By doing this, the protocol accelerates market liquidity deeply and overall product usage.

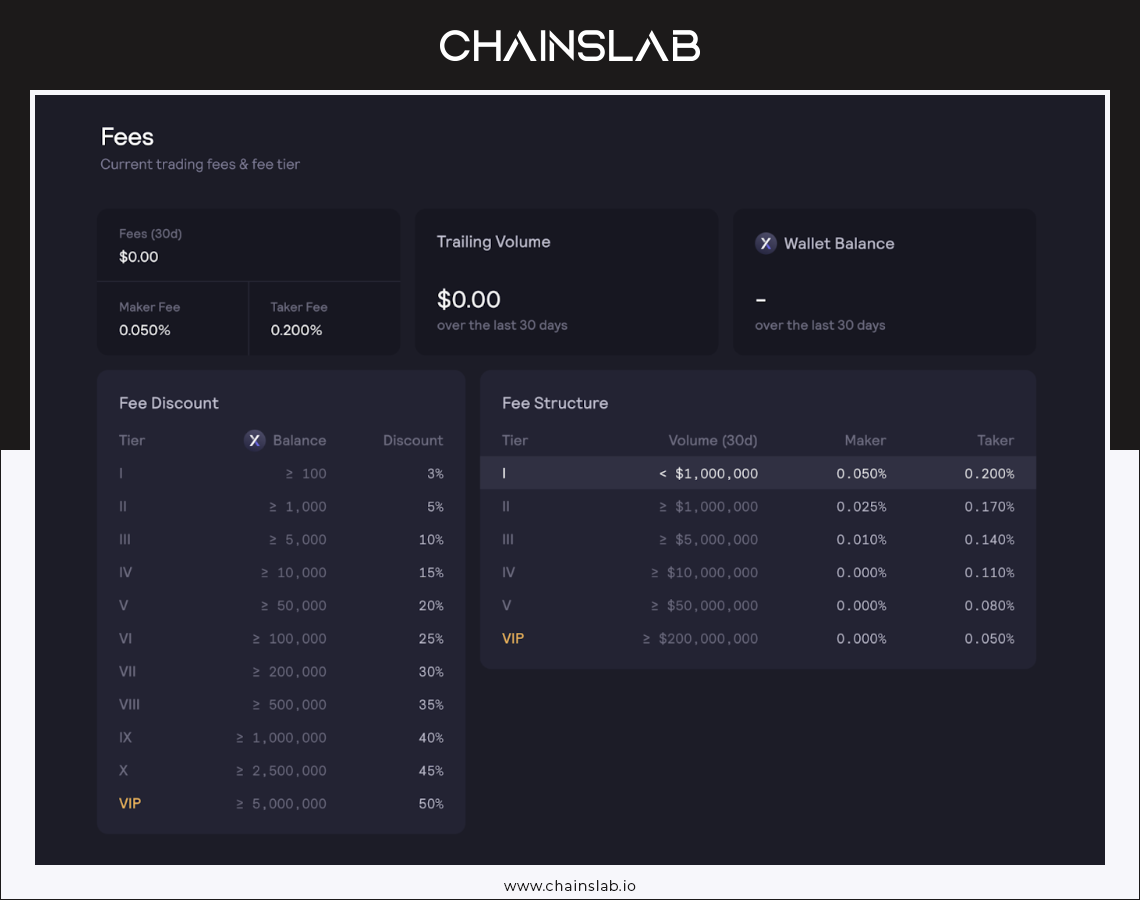

For protocol fee, dYdX has a structure that seems more attractive than CEXes mostly. First $100,00 in volume every month enjoys no trading fee. So, it’s a way of encouraging more retailers, no trading fees and no gas cost. A plus to protect traders and prevent front-running bot, the taker fee is usually higher than the most exchanges, at 0.2%.

dYdX Hedgies

dYdX offers an NFT collection called Hedgies, a collection of animated hedgehogs designed by two independent digital artists. dYdX’s NFT collection went live in February 2022.

Hedgies are distributed to users based on their trading statistics and community interactions. Owners of the Hedgies NFTs are entitled to certain perks such as trading fee discounts and as a way to flex among the community. They were created to award users on various occasions and for their achievements and contributions to the community.

All hedgies in the initial distribution were free to mint and can serve as avatars for dYdX users. Hedgies have utility on dYdX and are filled with references to crypto and trading, celebrating the culture of Web3.

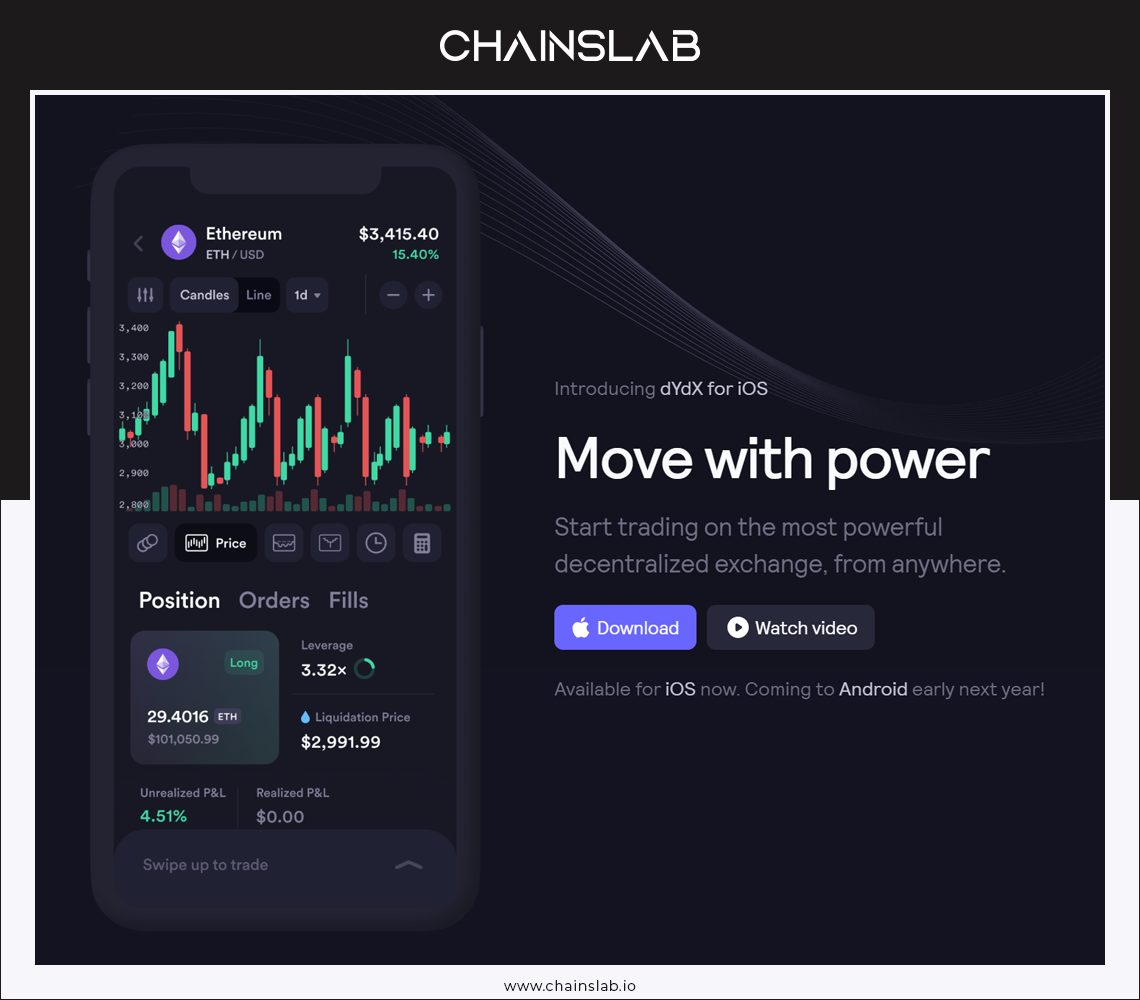

dYdX Mobile App

The dYdX trading platform is available on IOS with plans for Android support soon. This application is great for traders who like to monitor and place trades on the go.

The team designed the app from scratch and did a fantastic job with the UX/UI. The app has all the functionality and features of the web platform and enjoys the same high efficiency as the web platform. Here is a look at some of the features:

IV. Tokenomics

$DYDX is an ERC20 governance token for the dYdX derivatives DEX that can be used in the governance process and provides holders with fee discounts.

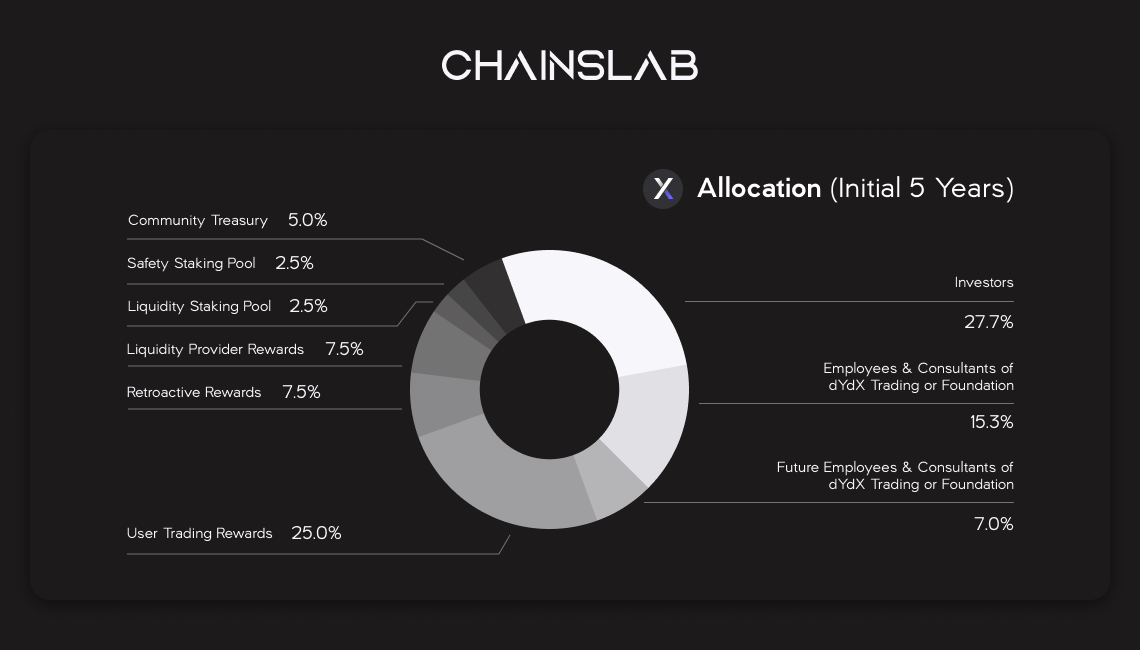

A total of 1,000,000,000 DYDX have been minted and will be released over the span of 5 years, starting on August 3rd, 2021. The initial five-year allocation of the total supply of DYDX will be distributed as follows:

Token holders can enjoy the following rewards:

- Retroactive mining rewards.

- Trading rewards.

- Liquidity provider.

- Trading fee discount.

- Proposal voting.

A maximum perpetual inflation rate of 2.00% per year will increase the supply of DYDX beginning after five years, ensuring the community has the resources to continue contributing to the protocol.

DYDX token launched with an ICO price of $1 and skyrocketed after its public launch (Sep 2021) to an all-time high of $26.74 in just under 1 month. This astronomical rise was incredibly impressive as dYdX may have picked the worst time in history to launch a token. The 2021 bull run had just ended, and DYDX launched just as the crypto markets began their downward plunge.

According to the release schedule of dYdX foundation, 1.5 years from the release, a large number of tokens will be unlocked for investors, the team will start to be unlocked gradually until the 5th year. The next unlocking phase will take place. coming out in about 4 months, will cause the circulating supply to spike up to 37.5%. So, to assess the long-term holding potential, we have to keep an eye on the unlock date.

However, the price is likely to have a very large downward movement on that day, due to the unsupportive market sentiment, the market lacks a lot of liquidity to absorb the entire amount of that token. So, invest with caution.

V. Bottom Lines

dYdX has received a lot of hype as it was among the first platform to present a decentralized alternative to centralized crypto trading platforms. The protocol is highly functional and has very low fees, plus crypto holders get to benefit from self-custodied trading. The platform executed flawlessly on its offerings of a first-rate crypto derivatives exchange with margin and perpetual options, fulfilling an unmet niche in the market.

Many DeFi users consider dYdX to be the best DeFi protocol for trading perpetuals. The fact that traders can access leverage and trade in a trustless, permissionless manner against other traders is a great way to avoid the pitfalls and issues of using centralized trading exchanges. The team and platform firmly focus on transparency and security, which is critical in the DeFi space. The platform and trading engine work incredibly efficiently, and the interface is designed very well. It really does feel like a professional-grade platform for traders.