Imagine living in a world with no central banks. You don’t need to reveal your identity every time checking payment. You don’t need to maintain a credit score every time borrowing money. You don’t even need to worry about forex rates every time traveling to another country.

Several years after the introduction of the blockchain network and the cryptocurrency craze in recent years, various concepts and words are being coined every day. DeFi is one of those words that has attracted a lot of attention to it, especially in late 2020.

Otherwise, crypto traders and normies alike are still struggling to comprehend what DeFi is all about, the way DeFi works remains baffling even for degens. Read on to find out what DeFi is and how DeFi works?

I. What Is DeFi?

The term DeFi, short for decentralized finance, was born in an August 2018 Telegram chat between Ethereum developers and entrepreneurs. They were discussing what to call the movement of open financial applications being built on Ethereum.

Decentralized Finance (DeFi) is a financial service using cryptocurrencies that can be programmed through smart contracts to build exchanges, lending services, insurance services, and more without centralized authorities.

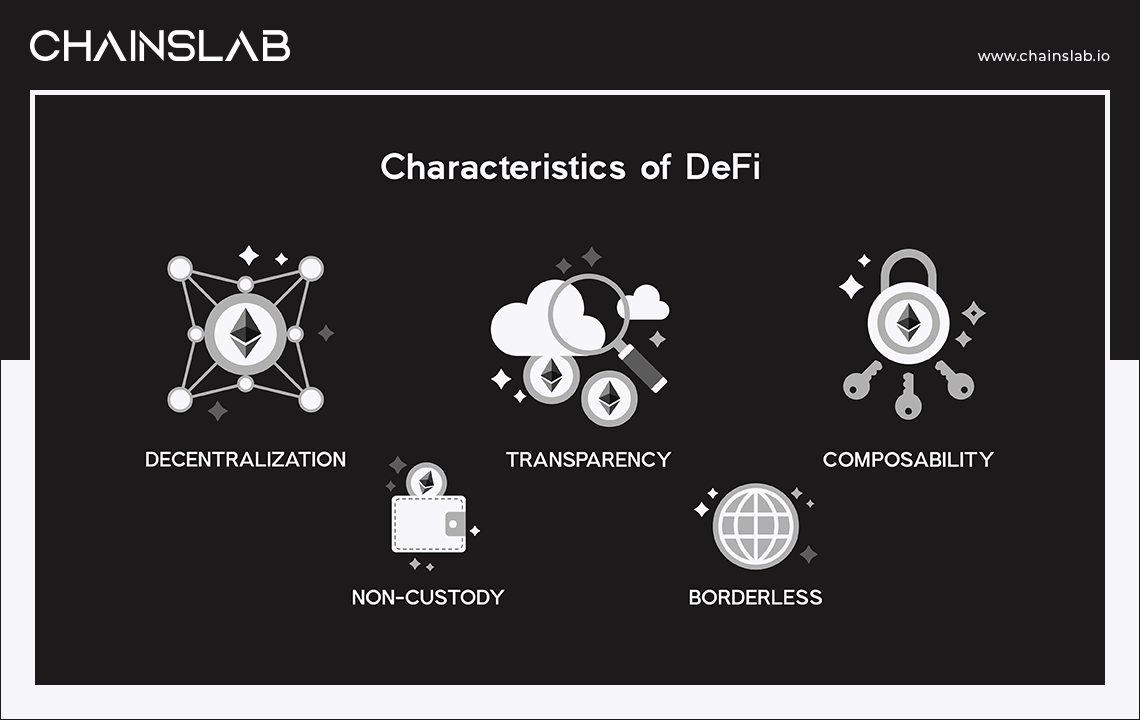

Characteristics of DeFi

- Non-Custody

These distributed networks allow people to have control over their own assets and data and for value to be transferred from one person to another, without the need to use intermediaries like banks and other financial institutions. Users are the only ones who hold the keys to their wallets and control their funds. The term used to describe this feature is that DeFi apps are “non-custodial,” as they don’t have custody of your assets, but you do.

- Borderless

These networks are also global, which means there are no borders in this parallel financial system, and everyone can access it. It's like the internet, but instead of information being transferred globally, seamlessly and creatively, the same is happening with money. It’s an internet of value.

- Transparency

The code for these financial applications is open for anyone to see and inspect. This is important because anyone is able to verify how the applications and protocols work, and track exactly where their money is.

- Composability

Open-source code also enables developers to build on top of others’ applications, accelerating innovation and allowing these applications to become like lego pieces, leveraging each other’s value, hence the term, “money legos.” And if users don’t like how one application is being built, they can copy the code and build a new app.

- Decentralization

DeFi protocols are built on public blockchains like Ethereum. These blockchains, the rails to this new financial system, are run by thousands of nodes. Computers running the blockchain’s software spread out across the globe, so that it’s almost impossible to censor or stop them.

On top of this base layer of decentralization, DeFi platforms are built to be managed by a community of users, and not centrally controlled. Users become owners of their financial applications; they’re able to participate in major decisions, including by proposing changes themselves, and benefit from their growth and success. No centralized party can unilaterally take control of funds or change the rules of the game.

II. A Brief History of DeFi

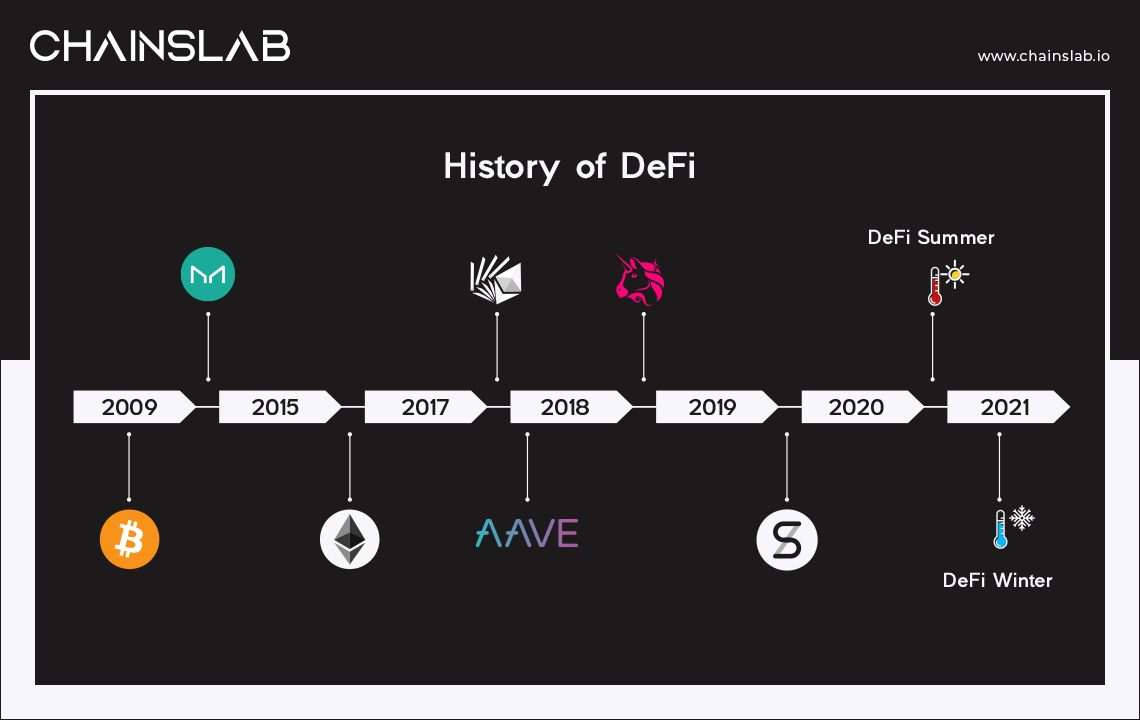

One could argue that DeFi started with Bitcoin in 2009. BTC was the first-ever peer-to-peer digital money; the first financial applications built on blockchain technology.

But the turning point for financial applications allowing users to do more with their money than send it from point A to point B happened in December 2017, when MarkerDAO launched.

MakerDAO is an Ethereum-based protocol that allows users to issue a cryptocurrency that’s pegged at 1-to-1 to the value of the U.S. dollar by using digital assets as collateral. This mechanism effectively allowed anyone to borrow the Dai stablecoin against Ether (Ethereum’s native cryptocurrency). It created a way for anyone to take out a loan without relying on a centralized entity. It also created a dollar-pegged digital asset, which didn’t rely on holding dollars in a bank, like USDC, USDT and other stablecoins.

The MakerDAO lending protocol and its Dai stablecoin provided the first building blocks for a new, open, permissionless financial system. From there, other financial protocols launched, creating an increasingly vibrant and interconnected ecosystem. Throughout 2019, DeFi continued to grow, and in 2020, a year with some rather unsavory worldwide events, it was also the year that DeFi exploded. Uniswap which is the biggest AMM Dex, Curve which is the biggest stablecoin dex, and Yearn Finance, which is the biggest yield aggregator, all launched in 2020.

Less than three years after MakerDAO placed the first money lego, there are now dozens of DeFi applications, from basic use-cases like enabling lending, borrowing, trading, to crazier ones like creating synthetic assets, streaming payments and playing in a lottery where you can always get your money back/rebase.

In 2021, many DeFi tokens continued to shine in user growth but peaked in pricing by the first quarter and started its downtrend especially against Ether. This is partly due to competition against other tokens such as Metaverses, Memecoins, NFTs, and other blockchain networks which gained TVL faster than Ethereum.

In 2022, many DeFi tokens have now lost up to 95% of its price due to a combination of unrealistic valuations, high token emissions, exploits, regulatory uncertainties and more, but price aside, their core functionality has worked as intended. This has led many DeFi enthusiasts to believe a second DeFi summer is on the way in the form of DeFi 2.0.

III. DeFi vs. CeFi

As the above mentioned characteristics, we can clearly see the difference between the 2 financial systems. The financial system and services today are usually centralized. For example, banks, insurance companies, investment services are controlled or offered by a centralized entity or a person. In other words, your funds in a centralized exchange are managed by a responsible party. It is up to the entity to decide the trading fees you should pay or manage your transactions and activities. It results in a lot of fund risks.

Although CeFi and DeFi aim to facilitate the use of cryptocurrencies for different financial needs, they both are executed differently. Decentralized finance is an open system of finance, which leverages blockchain technology, allows for the facilitation of financial services from peer-to-peer and gives people full control of their assets.

Stipulations for such an agreement on a decentralized application (DApp) can be written in code onto the blockchain through smart contracts. So when the stipulation for the loan is met, the funds will be released. This is just one of many functions Dapps serve. They work in the way that regular applications would, but they are entirely decentralized and without a centralized control based on one single entity.

IV. DApp: Decentralized Application

DApps are built on open-sourced distributed platforms and a decentralized peer-to-peer network where no one has control over the network. It enables you to buy, sell, trade, lend and borrow cryptocurrencies on a decentralized network.

These applications are usually programmed on a platform like Ethereum, Binance Smart Chain, Aptos, etc,. to write automated code - smart contracts and derive the rules on how the financial services will work in a decentralized manner. Once it is programmed, they are immutable, meaning no one will have control over the rules except what was written in the smart contracts.

There are various types of DApps in existence, catering to many different needs of users. The very foundations of a new financial system are being laid, with applications that enable everything from simply making transfers and payments, to lending, borrowing, trading, portfolio management, insurance, etc.

Types of DApps

- Decentralized Exchanges (DEXs)

Through a DEX, users can trade digital assets amongst each other without the need for a central entity to hold their funds or to deposit funds in the first place. Users instead link their wallets to the exchange and then verify the transaction themselves.

blockchain because of its low throughput for transactions. The price of assets on DEXes is commonly determined by automated market makers (AMM), protocols written into the smart contracts of the blockchain which use mathematical formulas to determine the price.

An advantage of DEXes is that because of minimal maintenance; trading fees are also minimal. Additionally, as long as the smart contract is robust, they are considered very safe.

Examples of DEXs: Uniswap, Sushi, Hashflow.

- Margin/Derivatives

Sophisticated investors from traditional finance who are familiar with derivatives will be pleased to know that there are also decentralized derivative platforms. A derivative is a type of contract that derives its value from the price of the underlying asset.

The most popular derivatives are perpetual contracts, options, and futures contracts, which already have decentralized counterparts in DeFi. Similar to decentralized exchanges, users self-custody their own fund and allow for anonymous trading, offering privacy to users who desire it.

However, the user experience, variety of tokens, tools, volume, liquidity, and customer service is often better on centralized exchanges.

Examples of margin/derivatives DApps: dYdX, GMX, Gains Network, Premia Finance.

- Borrowing and Lending

With borrowing and lending DApps, you can do what you probably expect to borrow and lend cryptocurrencies. While the loan agreement is arranged through a smart contract. From the lender’s point of view, using these DApps has the advantage of being able to earn interest on the crypto you lend, and due to over-collateralization, there is only a minimal risk of the assets not being repaid.

From the borrower’s point of view, using these DApps has the advantage of there being no credit checks, low transaction fees, and instant settlement.

Examples of borrowing and lending DApps: Compound, Aave

- Decentralized Stablecoins

Stablecoins are cryptocurrencies pegged to the price of a stable asset, such as the US dollar. By offering price stability and low volatility (two factors that can notoriously plague cryptocurrencies), they reassure users when performing transactions on DApps.

Stablecoins play a fundamental role in different areas of DeFi. One of them is with liquidity pools. Stablecoins are a preferable choice because it provides stability, and hence more liquidity. Also, the lack of volatility in stablecoins provides opportunities for steady yields for investors in DeFi.

Examples of stablecoins: DAI, Frax.

- Wallet

To use DApps, users will need somewhere to store their cryptocurrency and tokens. That’s where wallet Dapps come in. They are downloadable as an add-on on your internet browser. Users can also sync up their wallet Dapps with other Dapps to make transactions quick and easy.

Examples of wallet Dapps: MetaMask, TrustWallet.

- Oracles

Oracle connects blockchain with real-world data. You can imagine the importance of oracle to a blockchain, similar to the importance of the internet to a computer. Oracle brings the outside blockchain data to its smart contracts.

Without oracles, lending protocols cannot determine the price of the collateral to trigger liquidation when needed or synthetic assets cannot exist due to the lack of data about the behavior of the real assets (stocks, indexes...). Therefore, oracle is an indispensable part of the development of any blockchain.

Examples of oracles are ChainLink, Band Protocol, DIA, Tellor, etc.

- Bridges

Bridges connect one blockchain to another. Each blockchain can be compared to a nation having its own regulation of what assets should be used in its territory. Similarly, each blockchain has its own standard of tokens (Ethereum with ERC-20, BSC with BEP-20...) that can be used in its ecosystem.

V. Risk Of DeFi

- Technical Risk

Because Smart Contracts are automated, bad actors are constantly on the lookout for bugs in Smart Contract code that they can exploit. Poorly written code can often mean funds are drained from DeFi protocols in minutes with nothing the user can do.

DeFi recently suffered its biggest ever hack when a bridge between the Ronin network which supports Axie Infinity, a play-to-earn game and Ethereum was exploited for the loss of over $600million.

The problems of Smart Contracts bugs and vulnerabilities are compounded by the fact that DEFI is open source, leading to the common practice of wholesale copying of Smart Contracts that creates an information cascade of in-built errors.

- Asset Risk

Given the volatility of assets and varying amounts of liquidity, swapping two coins using a DEX exposes you to the risk of slippage. Slippage is the difference between a quoted price and the actual transaction price resulting from changes in liquidity.

Those providing liquidity are also exposed to another explicit DEFI risk directly from the volatility of the assets expressed in a euphemism known as impermanent loss.

A flash loan is a way to borrow crypto funds from a lending pool without collateral, provided the liquidity is returned within the space of one block confirmation.

- Procedural Risk

Some of the risks within DEFI relate specifically to the processes and procedures required to access DApps or their absence.

Given that DEFI requires no KYC or account creation when you hit the ‘Connect’ button, you should carefully review what privileges you are granting the service concerning your crypto wallet.

There are no specific regulations that govern how DEFI services work, so you should be constantly vigilant, but there is a real risk that the ongoing nature of DEFI scams and hacks will push regulators to act.

- Financial Risk

DEFI’s unique selling point, the absence of intermediaries and ease of access, is also the source of risk. One of the main justifications for how traditional finance restricts access to financial services is to protect users from danger, whether that is explicit from bad actors or implicit from not being equipped to understand the risk.

DEFI has no such protection. There is no guarantee against the loss of funds and there are no tests to establish whether you understand the risks involved in DEFI. The only way to mitigate the risk of getting involved in something you don’t understand is to do your own research (DYOR). Before diving into high-yielding DEFI practices, learn about tokenomics, as this will give you the tools to understand whether high-yields can be justified.

Given the structural nature of DEFI your research needs to extend to the teams behind projects and their track record. The absence of regulation encourages a particular type of crypto scam known as a Rug Pull.

VI. Conclusion

DeFi has the potential to revolutionize the financial industry as we know it. No longer do people have to rely on central entities for loans, insurance, or making payments. And the decentralized blockchain technology makes the use of DeFi Dapps, for the most part, a very safe experience.

However, security concerns remain, with smart contracts bugs and time to time rearing up and hacks occurring, and they must be dealt with for DeFi to continue its healthy growth. Also, as already addressed, the explosion in the amount of DeFi Dapps has caused scalability issues – but this is something that Ethereum will combat with its roadmap post the Merge.

Whether it will ever completely take over centralized finance is doubtful. Still, as long as appropriate risk mitigation procedures are put in place, DeFi will go mainstream. Its potential is too great.