While the world of non-fungible tokens (NFTs) is rapidly growing and expanding, there are still a number of issues and challenges that are emerging along the way of trading and use of these digital assets. It has revolutionized the way digital assets are bought and sold, creating new opportunities for artists, musicians, and creators to monetize their work. However, the NFT marketplace is still in its early stages, and there are several challenges that need to be addressed to ensure a fair and sustainable trading environment.

One of the major problems facing the NFT marketplace is the lack of connectivity and standardization. With a lack of clear guidelines on pricing, verification and trading, the market can be difficult to navigate, making it challenging for buyers and sellers to negotiate deals that are beneficial to both parties. This can result in overpriced NFTs or even fraudulent transactions, damaging the reputation of the NFT market, in general.

Another issue is the fragmentation of the NFT market, with multiple marketplaces, and platforms competing for users and liquidity. They do not have any connection with each other, no mother liquidity pool for all and this can make it challenging for users to discover new NFTs and can lead to fragmentation and lack of the depth of liquidity in the market.

Finally, the high transaction fees, slow trading speeds associated with NFT trading and the environmental impact of blockchain technology has also been a concern for the community. These issues have prompted calls for greater transparency and sustainability in the NFT marketplace to ensure its continued growth and development.

As personal thoughts, the NFT marketplace continues to grow and evolve, a new solution to the problems of fragmentation, the inability to connect and the trading environment has emerged in the form of NFT aggregators. These platforms bring together various NFT marketplaces and platforms, providing users with a single destination to discover, buy and sell NFTs from a variety of sources.

In this article, we would like to introduce the rising competitor of OpenSea - Blur, an NFT aggregator that transforms the experience for professional NFT traders with its advanced features and functionality.

I. What is Blur?

Launched in October 2022, Blur has already made great strides to elevate the NFT trading experience. Blur is an NFT platform that is catered to the pro traders, and it has since gained traction among seasoned JPEG slingers for its zero trading fees, marketplace “floor sweeping”, reveal sniping and advanced analytics. Blur is a well-designed marketplace and NFT market aggregator that offers advanced analytics, excellent portfolio management capabilities and the ability to compare NFTs on multiple marketplaces. Such capabilities make this marketplace increasingly preferred by professional NFT traders.

Blur is a unique NFT marketplace that offers several features to improve the trading experience and assist traders in maximizing their profits. It stands out from other comparable platforms by providing faster NFT sweeps and snipes. Additionally, Blur has several advantages, including real-time price feeds, a user-friendly interface with a sorting function based on price, and zero trading fees for NFT sales. Moreover, it serves as an aggregator and connects with different platforms such as X2Y2, OpenSea, and LooksRare.

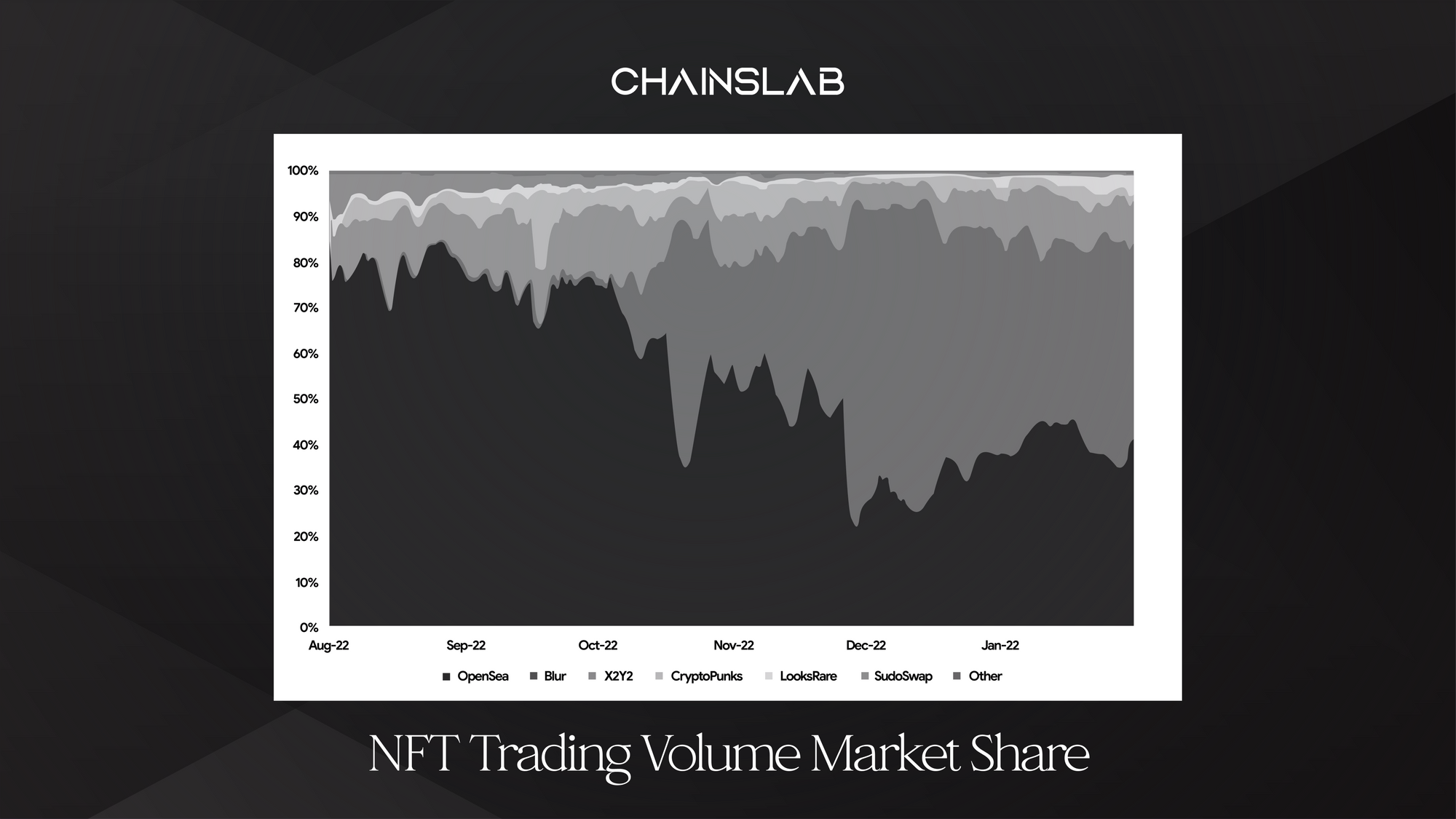

As a litmus test for the willingness of its users to pay fees, Blur started enforcing a mandatory minimum royalty fee and nevertheless, it has already outpaced OpenSea and competitors, which has shrunk to a market share of over 40% as of this writing. Basically, the mechanism of NFT trading on Blur is not too different to mention, so we will switch to some comparison.

II. Blur vs OpenSea and Magic Eden

Blur vs OpenSea

While OpenSea has been a dominant player in the NFT marketplace for several years, Blur is becoming increasingly popular among professional NFT traders due to its well-designed interface. Unlike OpenSea, where traders need to switch between tabs to access their account data, Blur offers a more convenient experience by providing analytics, sales history, and other information on a single page. It also includes standard features like price feed for ETH, gas fee tracking, and dark-light modes.

Blur has the added advantage of operating faster than OpenSea with updates occurring every four seconds, which is particularly advantageous for sniping. In-depth analytics on NFTs' rarity, trading history, and other factors save traders time while also providing accurate data. Furthermore, traders can often outperform those using other exchanges due to Blur's gas priority presets. Additionally, traders can benefit financially from Blur's competitive gas fee structure. It's worth noting that the marketplace recently found a way around the blocklisted collections on OpenSea.

Blur vs Magic Eden

Magic Eden and Blur are two NFT marketplaces that operate on different blockchain networks. Magic Eden is built on the Solana blockchain, while Blur is built on the Ethereum blockchain. While they differ in their underlying technology, they share a common goal of supporting and empowering NFT creators.

One of the standout features of Blur is its royalty-optional layout, which is designed to promote the payment of royalties to NFT creators. The platform actively encourages traders to pay royalties by offering a token reward to those who do so. By incentivizing the payment of royalties, Blur aims to support the original creators and foster a more equitable and sustainable NFT ecosystem.

In comparison, Magic Eden also prioritizes the payment of royalties but takes a different approach. The platform utilizes MetaShield, a tool that enables creators to blur and flag NFTs that have previously been traded without royalty payments. By flagging non-compliant NFTs, Magic Eden encourages buyers to prioritize purchasing NFTs that are royalty-compliant, which ultimately benefits the creators.

Both Blur and Magic Eden currently do not charge any marketplace fees. This is beneficial for creators, as they are able to receive the full value of their sales without any deductions. Additionally, this makes the platforms more accessible and appealing to traders who are looking for cost-effective ways to participate in the NFT market.

III. BLUR Token

Tokenomics

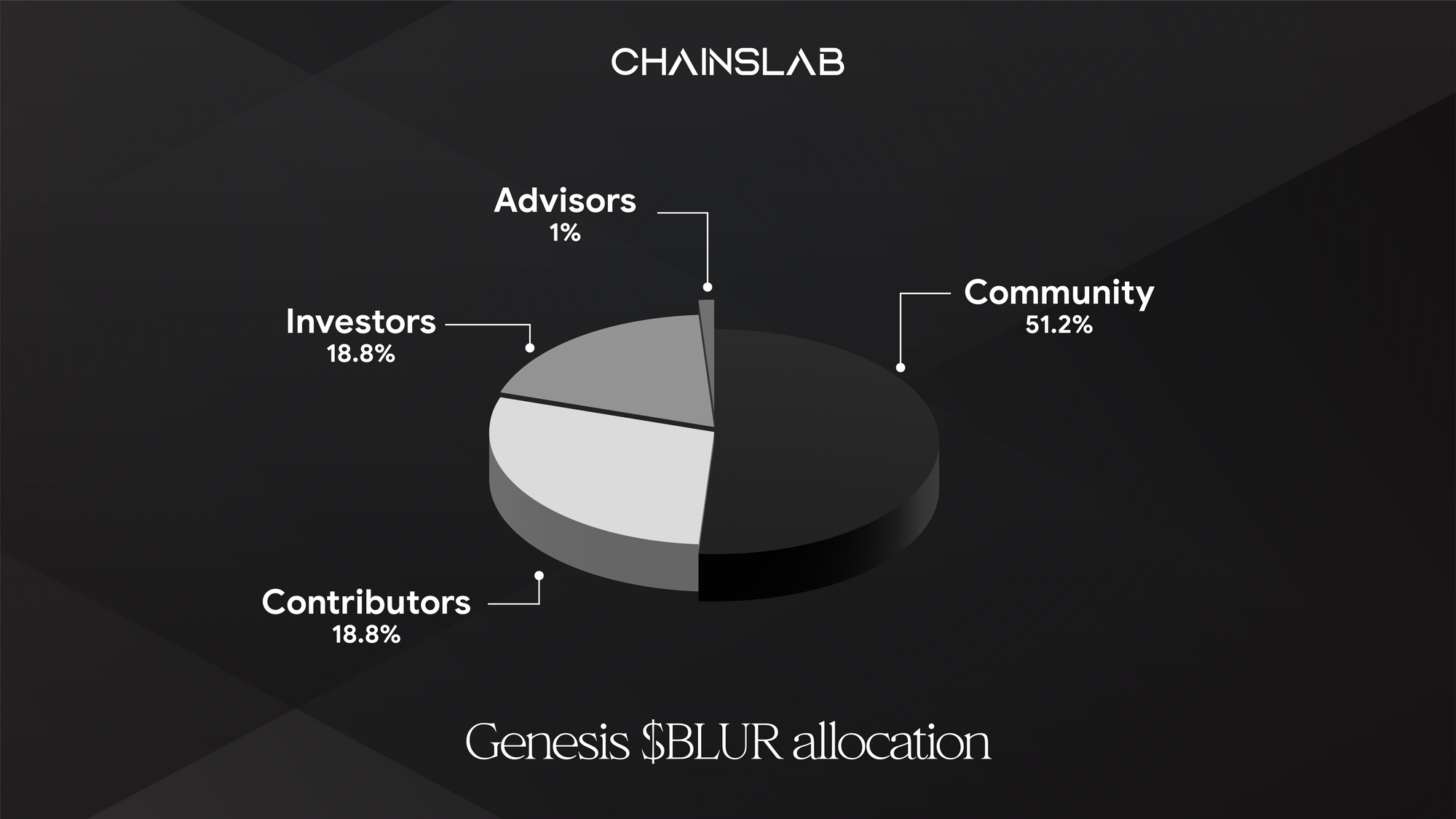

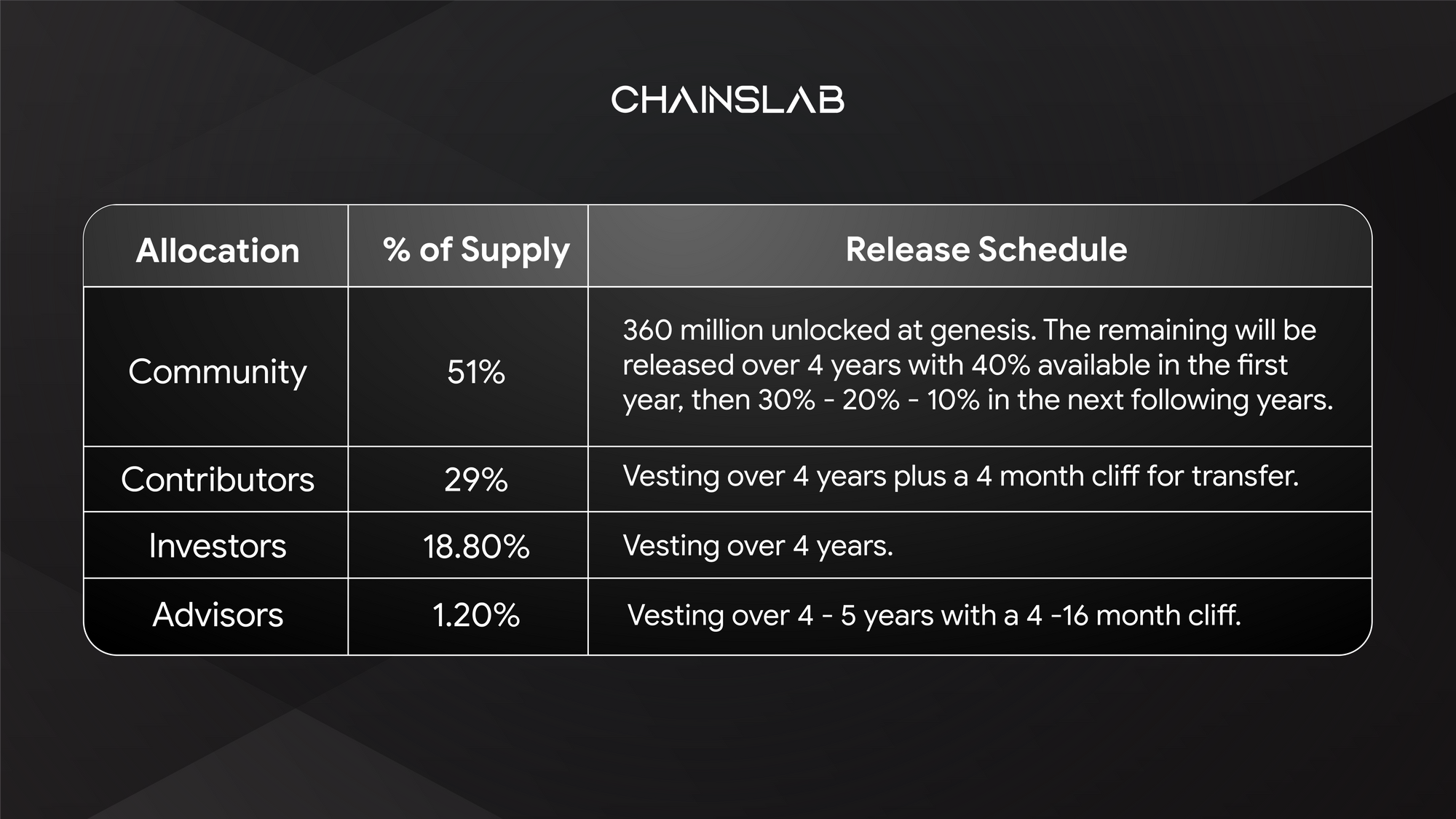

The platform is centered by the token named BLUR which offers governance functionality. Overall, the majority of token is allocated to the community, which means that the Blur foundation aims to facilitate community-led governance and participation in the DAO and assist contributors with the development and growth of the Blur ecosystem.

At its genesis minting, 3 billion BLUR tokens were minted, which will become available over a period of 4 to 5 years. The token release schedule of BLUR is comparable to that of Uniswap, with certain modifications such as additional cliffs and extended vesting for advisors.

Token Metrics

In March 2022, the platform successfully raised $11 million in Seed round, but the valuation was not disclosed. However, as estimated, the Seed round should be around $300-500 million in valuation. And during the hype of token launching a few days ago, there was a source that announced that Blur is setting to raise at a billion dollar valuation, but potentially went out to backers with a lower price tag of $700 million in mind.

Given that the vesting period is slightly different from UNI (Uniswap), there will be no selling pressure in the market within the initial six months following BLUR’s launch, specifically until August 2023. This, combined with the current market sentiment at the moment, as we are experiencing a major retracement wave for the first time since Bitcoin’s peak in November 2021. The author assumes the price of BLUR should be in speculation, and increase in valuation soon. Notably, at present, only 12% of the total supply of BLUR is circulating in the market. Thus, an opportunity for price appreciation may arise when the airdrop campaign is claimed majority and distributed to the market.

IV. Closing Thoughts

Airdrop is a means of distributing a project’s token supply to the public, and can serve as a part of a larger marketing campaign to increase awareness of the project’s main product or new offerings. Users are not required to make any monetary investment in order to obtain the tokens, which are typically awarded around the time of the protocol’s launch, or retroactively after using the protocol, based on specified eligibility requirements.

As study from HASHED, the majority of projects, accounting for 72%, have not met their initial launch prices. However, there are some notable exceptions where token holders have experienced successful outcomes. One example is $UNI, which was launched in September 2020 and, by Q2 2021 (on day 200), had become the leading DEX in terms of daily trading volume across all blockchain networks.

In addition to having the opportunity to participate in governance proposals, $UNI benefited from favorable market conditions which provided a tailwind for post-airdrop price performance.

As personal thought, airdropping generally does not have the best impact on your long-term price action, but short-term does have. Because the users are willing to sell their airdrop as early as possible, so ideally, the best time to buy some would be months 5-6 post airdropping.

Back to the business, NFT aggregators offer a range of benefits to users, including greater transparency and standardization in the pricing and verification of NFTs, as well as a wider selection of digital assets from across the NFT ecosystem. They can also help to address the issue of fragmentation in the market by providing a unified platform for buyers and sellers to trade NFTs. Moreover, NFT aggregators can help to mitigate the environmental impact of NFT transactions by aggregating transactions across various marketplaces and platforms, reducing the energy consumption associated with each individual transaction. Overall, NFT aggregators offer a promising solution to the challenges and issues facing the NFT marketplace, providing users with a more efficient, transparent, and sustainable way to engage with the emerging world of digital collectibles.

In summary, according to the author's personal assessment, Blur will almost become the leading unicorn in the NFT marketplace space, the growth potential is huge. But let’s see if the platform will retain its popularity going forward.