The current state of Layer 2 solution buil;t on Ethereum is rapidly evolving and expanding. Layer 2 scaling solutions are designed to address the high fees and slow transaction times on the Ethereum mainnet by moving transactions off the main chain and onto secondary networks that are faster and cheaper. There are several different Layer 2 solutions being developed, optimistic rollups, zk-rollups, plasma, etc. each with their own approach and trade-offs.

One of the most popular layer 2 solutions, at the moment, is the Optimistic Rollup, which uses optimistic execution to enable fast and cheap transactions without sacrificing Ethereum’s security. Optimistic Rollups have gained a lot of traction in recent months, with several projects as Synthetix, Uniswap and Chainlink launching or planning to launch on Optimistic Rollups. Other layer 2 solutions like Arbitrum, zkSync, StarkWare, etc. are also gaining popularity and seeing increased adoption.

As more projects move to layer 2 solutions, the Ethereum ecosystem is becoming more decentralized and accessible. The benefits of launching a layer 2 are clear, with faster transaction time and lower fees enabling more users to participate in the DeFi ecosystem. However, there are also concerns about fragmentation and interoperability between different layer 2 solutions, as well as the need for continued development and improvement of the underlying technology.

And recently, one more promising layer 2 solution that has recently gained attention is Base, which was incubating inside Coinbase, the top 2 US-based exchange on spot volume. As the Ethereum ecosystem continues to evolve, it will be interesting to see how this layer 2 solution plays a role in the process of decentralization for Coinbase’s on-chain products.

In this article, we will find out what exactly Base is, why we need it and feel some personal thoughts on the new launching.

I. What is Base?

Base was founded within Coinbase using expertise gained over the last ten years of building cryptocurrency products. Being built on Optimism’s OP Stack to create a standard, modular, and rollup-agnostic Superchain that is powered by Optimism.

Due to being constructed entirely on the structure of Optimism rollups, therefore, there will be no difference between the two Base and Optimism in technical aspects. For more understanding and clarification about what Optimism Rollup is, please refer to this article.

One of the things that Base really uniquely is its whole suite of products both on the developer side and on the consumer side. With these things together with Base kind of at the center of it, it’s going to make it easier for two things:

- One is, it’s going to make it easier so that when developers build applications, they can actually connect those applications to mainstream audiences.

- Two, on the consumer side, it’s still too hard to actually use crypto and Coinbase is going to be able to integrate base into its products, making everything by default. So that users are increasingly less nervous about: Am I picking the right chain? Am I paying the right gas fees? And instead they’re able to access the applications that they actually want to.

II. Why Base?

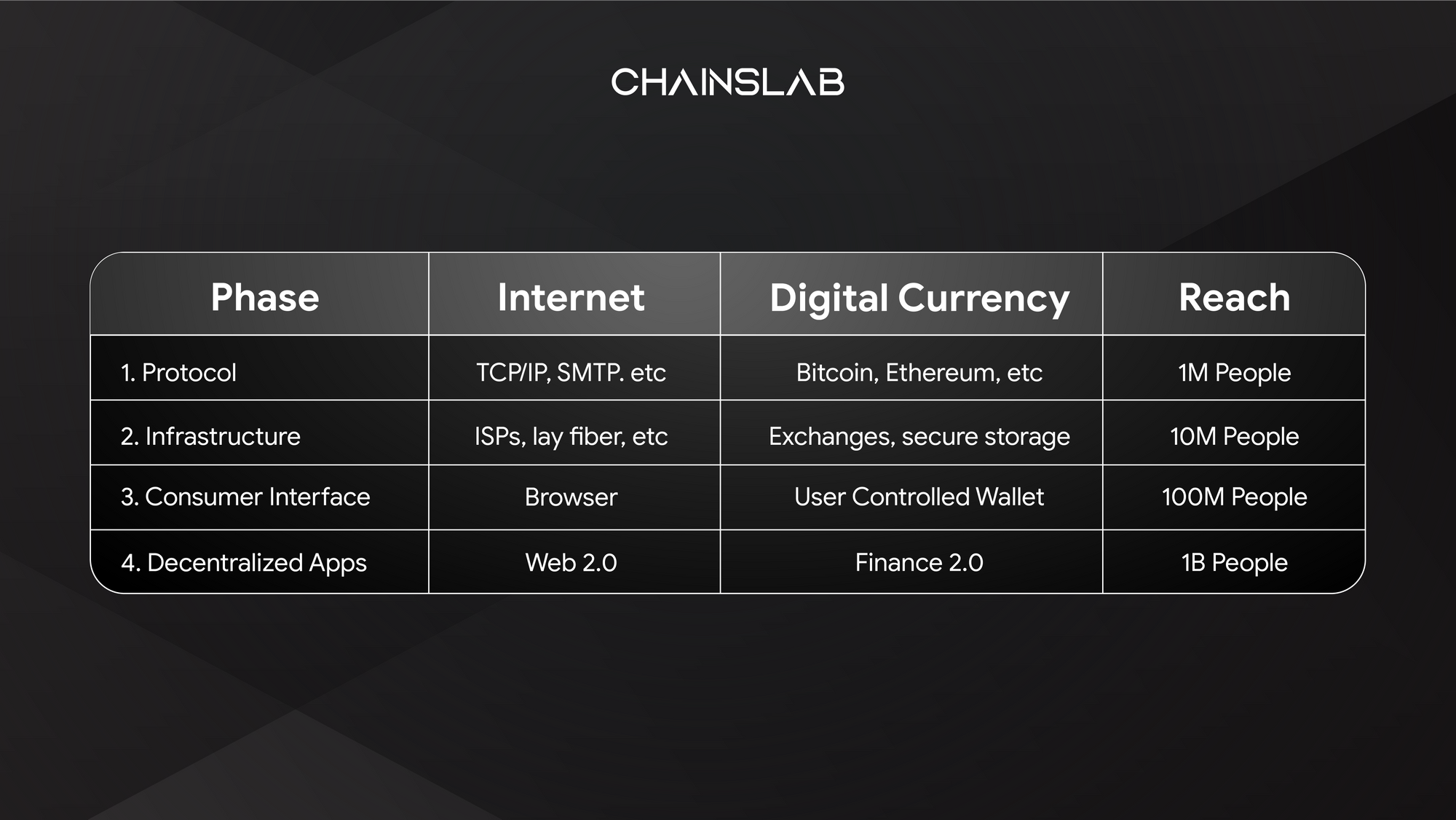

At the beginning, the Coinbase’s secret master plan has been consistent to bring an open financial system that increases global economic freedom, innovation, efficiency and equality of opportunity. The plan was outlined into 4 main phases.

Over the last decade, Coinbase has progressed through the first three stages of what it envisions as necessary to unlock the final stage of creating the apps of the open financial system. These stages include protocols like Bitcoin and Ethereum, building the exchange (Coinbase Exchange) to serve as a bridge to digital currencies, and creating a mass market interface for decentralized apps or “dApps“ (Coinbase & Coinbase Wallet). Coinbase has increasingly focused on unlocking the final stage by understanding what it would take to create an environment where thousands of actually useful dApps can emerge and bring 1B+ users into the global cryptoeconomy.

The company hypothesized that enabling its own teams to build natively on-chain products that leverage the full power of the on-chain environment would position them well to enable other developers to do the same. Initially, Coinbase came at the problem of choosing an L2 with the thesis that a single L2 would emerge as “dominant” and gradually absorb all activity, creating a near monopoly. However, they later concluded that there would be many L2s that would have significant activity, serve as “hubs'' for different ecosystems, and gradually increase their interoperability until they formed a “mesh” or “superchain” that jointly scaled Ethereum. By building Base, Coinbase is expected to bring more activity on-chain, make it easier for its teams to build on-chain, and contribute back to the core infrastructure that has made its business possible over the last decade.

What would Coinbase get from Base?

Every product of course goes to the end goal of generating revenue and making a profit. With positioning as a Bridge, Base has a lot of potential to increase the company's revenue, as well as attract more users outside the Western traders and institutional funds. As Coinbase’s financial report shows that Q4 institutional investors contributed 86% of the transaction value ($125 billion) but only contributed 4% of the revenue ($13.4 million). Meanwhile, retail investors contributed 14% of the transaction value ($20 billion) but contributed 96% of the revenue ($308.8 million).

Due to the contagion of LUNA, 3AC then FTX, users are gradually forming a need to use DeFi products. However, due to DeFi's user experiences, it's still not enough to onboard a large number of customers up to several hundred million people in my opinion, plus DeFi products are currently quite fragmented. There is no association between protocols. This creates a broken experience. Therefore, Coinbase was very wise to both take advantage of the old customer file and create a new revenue stream from on-chain products. So, where does Coinbase's revenue come from, and how much more can it add with Base's presence?

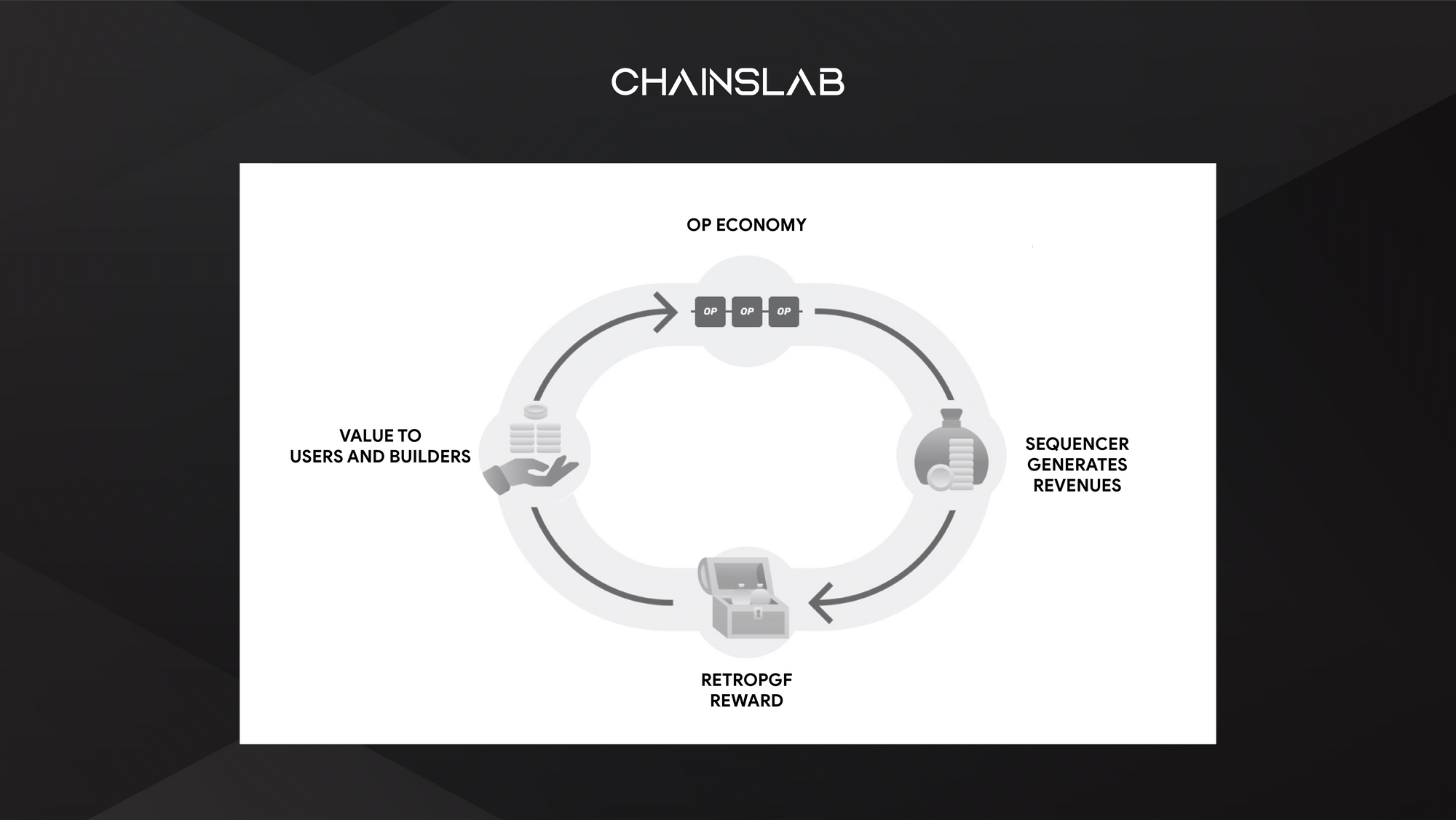

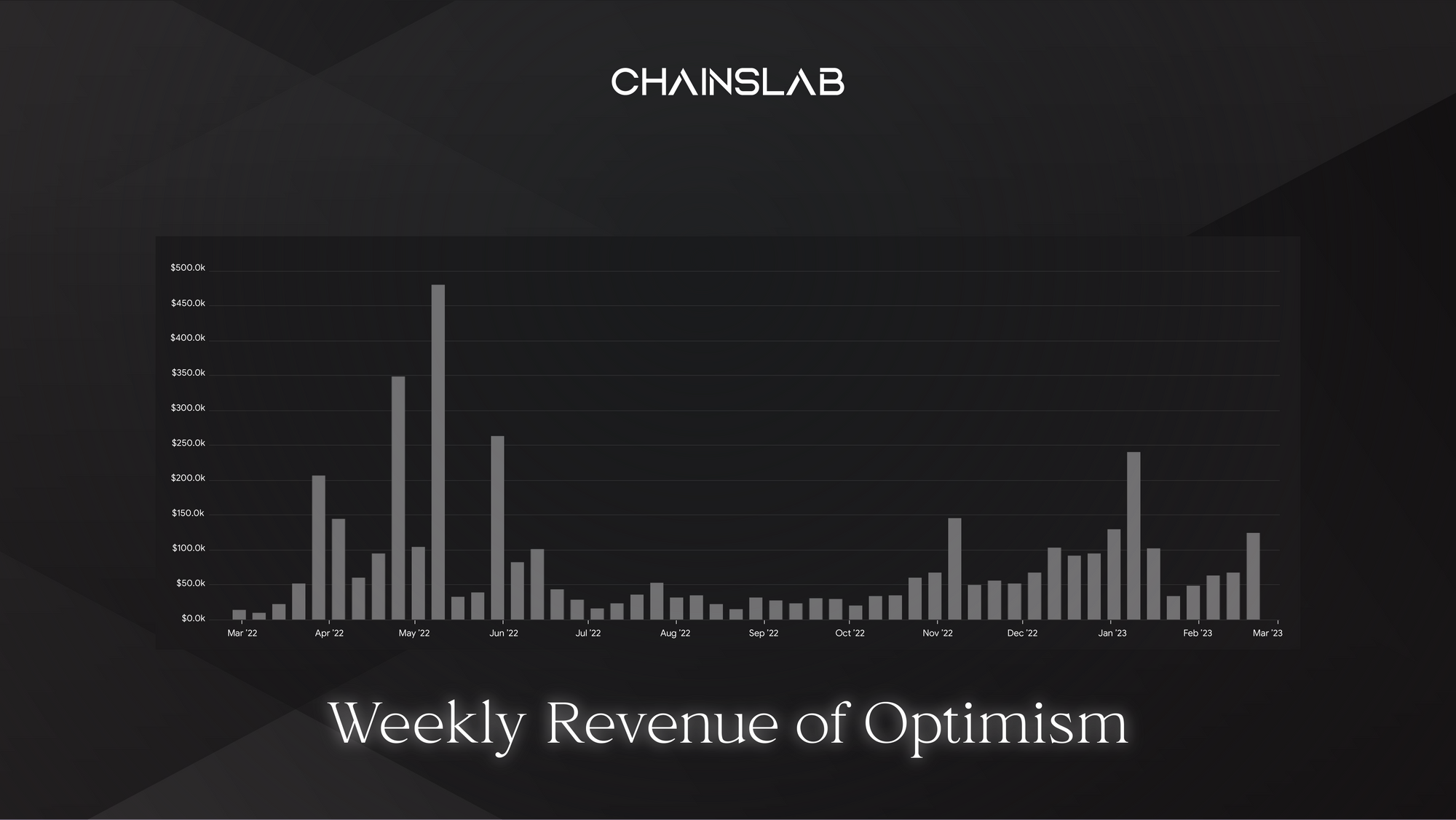

Similar to OP economy, Base’s funding comes directly from centralized sequencer. As announced, Base will distribute a portion of sequencer revenue to OP economy, as it creates ecosystem value and drives demand for OP blockspace on the vision of OP superchain.

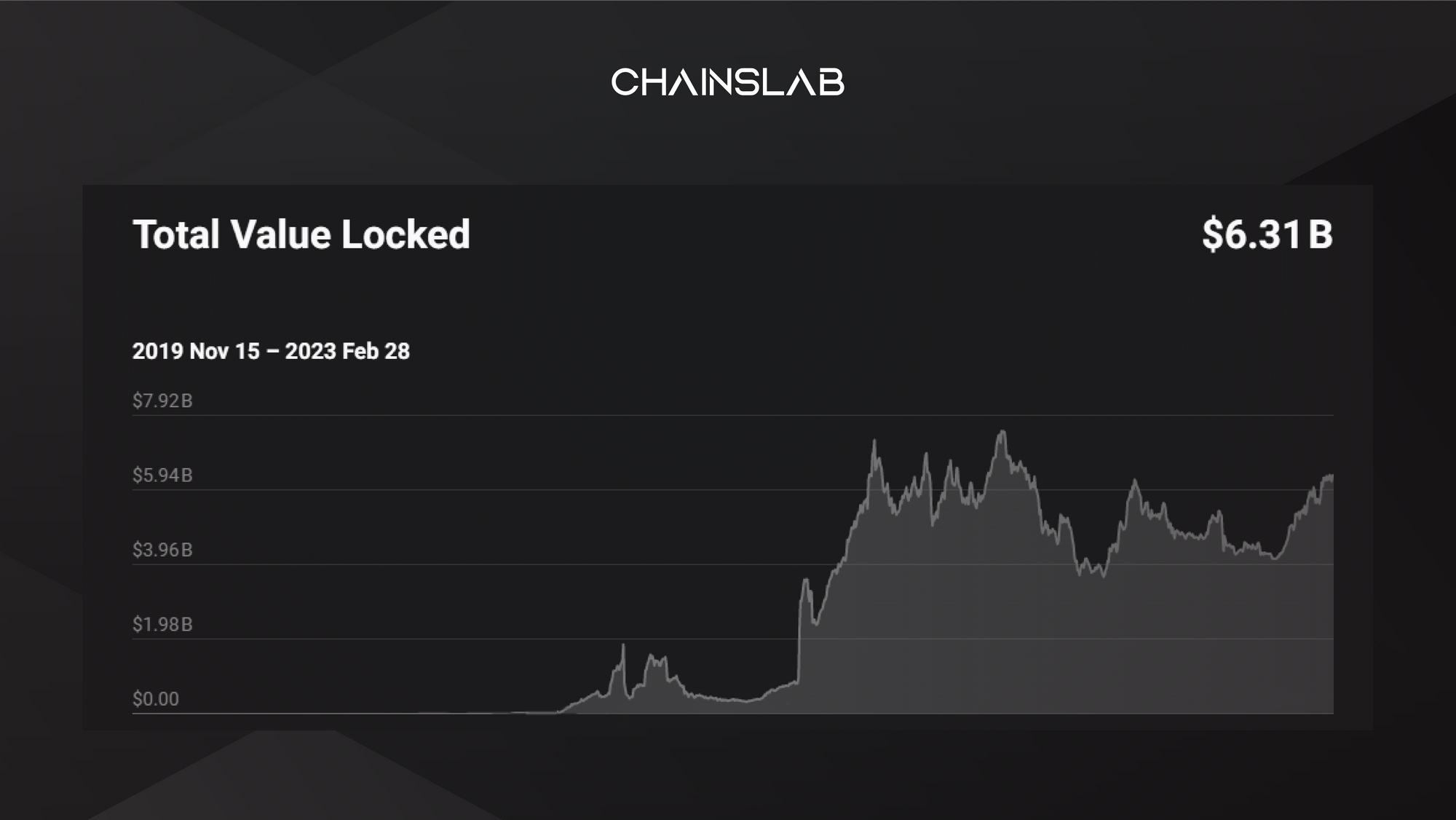

Besides, positioned as a bridge, the revenue from the bridge cost from Ethereum mainnet to Layer 2 is also quite large. Imagine one day, Base has a total TVL of up to $1 billion, applying an average bridge cost of about 0.05% will generate about $500k in revenue for one way. The potential for profit is quite large. Furthermore, with being backed by Circle, the liquidity issue for the Base ecosystem doesn't seem like a big deal.

III. Closing Thoughts

It actually happened, Coinbase is going to be the first exchange, the first US publicly traded company to launch a Layer 2. First off, Coinbase is building an Optimistic rollup to enter the arena alongside Optimism, Arbitrum, Polygon and now Base. You can imagine this is kind of like the Binance Smart Chain but for Coinbase. Honestly, there’s going to be a huge land grab for DeFi apps to be on Base.

A question here is that: Is Base going to be a permissionless validator set as featured without the native token? It is possible. Base needs some sort of collateral to stake and use ETH as part of its sequencer set.

Why does an exchange launch a chain is kind of a big deal? Compared to the most competitor, Binance exchange. Binance controls the two-thirds majority of validators set. Coinbase launched with a Layer 2, there is sequencer, but they cannot steal funds on-chain. They have limited power, because this entire chain settles to Ethereum. So, this is a maximally decentralized and bankless way to actually launch this chain.

The other thing the author would say is that Coinbase has like +110 million verified users, but only a tiny fraction of this, maybe like 1-2% are going bankless and on-chain after they create an account. It is because the tools are really hard, the user experience is not there yet. So Coinbase is going to onboard a vast majority of their verified users. Let’s say 20%, 20 million new people go to on-chain. So many reasons this is so exciting, using ETH as the currency rather than doing like a pump-and-dump token.

Let's wait and see how Base will build a new decentralized empire for Coinbase.