The Hanging Gardens of Babylon are known as one of the seven wonders of the ancient world. They were described as a remarkable feat of engineering with an ascending series of tiered gardens containing a wide variety of trees, shrubs, and vines, resembling a large green mountain constructed of mud bricks.

Terraces lie above the arch, each raised like consecutive stairs, each a garden in its own right. The gardens were irrigated with river water, in the middle of the desert. They symbolized the economic power of Babylon.

And now, in the modern financial world, we have (or had) Babylon Finance, a Decentralized Finance Asset Management Protocol.

TL;DR

- Babylon Finance is an Ethereum-based asset management platform that allows individuals and groups to create custom investment communities known as Gardens.

- Garden strategies can be built through a no-code UI that allows users to mix and match operations from various DeFi protocols (e.g., Uniswap, Aave, Lido, Yearn, Convex, etc.).

- Community members (Garden investors) can either be hands-off and simply deposit their capital or take an active role in voting on and creating strategies, and receive a share of earnings for doing so.

- In the broader DeFi asset management landscape, Babylon has carved out a niche for itself by coupling a transparent, trust-minimized, and decentralized process around investing with the ability to create active strategies.

- Babylon itself and many of its largest Gardens had heavy exposure to the Rari/Fuse protocol before it was hacked, absorbing sizable losses as a result. They will be shutting down in November.

The internet not only opens access to the financial markets but also allows investors to share information and coordinate with others. This led to the rise of robo-advisors, Exchange Traded Funds, and investment communities. These platforms allow investors to perfect their decision with the help of experts and others. In some cases, they have even come up with deliberate, organized, and collective action, like the GameStop short squeeze.

Moving up from that, Decentralized Finance (Defi) enables investors to go one step further. With smart contracts, individuals and groups can now coordinate directly, permissionless, and transparently without having to give up trust.

That is called Defi Asset Management Protocols, and Babylon Finance is a perfect example. Babylon leverages the listed above features, letting individuals and groups create investment communities, allowing them to invest in Defi together.

I. The Creation of Babylon

Legend has it that King Nebuchadnezzar of Babylon had the gardens built as a gift to his wife Semiramis, a Persian princess, to ease her homesickness for the green forests of her homeland.

The inspiration for the creation of Babylon Finance is not as beautiful but because of tiredness.

Ramon Recuero, the founder of Babylon Finance, had become tired of answering the same questions about investing in cryptocurrency from friends and family by late 2020. He made the decision to streamline the process. Recuero invested their money in a smart contract and spoke with everyone about it via a Telegram channel. This strategy was profitable (it returned over 1,000%), but it was also time-consuming.

In order to scale the process, Recuero founded Babylon Finance to allow groups to organize and invest in DeFi together, using Ethereum smart contracts.

Babylon Finance then debuted its gated beta (Settlers Beta) in July 2021.

About nine months later, at the beginning of April 2022, after adding a number of features and integrations, Babylon Finance held its public launch.

Ramon ideated Babylon through his desire to share opportunities in crypto with friends and family. This crowdsourced approach of Crypto investment clubs enables collective wisdom to help outperform individuals.

To ensure Babylon acts in the best interests of its users it uses a DAO model utilizing the BABL token to enable community voting. The community controls the treasury and essential protocol elements such as the fees charged. To promote durable community supports the BABL mining program (50% of the total supply) will be dispersed over 10 years.

Babylon went through seed financing in February 2021 attracting reputable investors such as Semantic Ventures. The latest financing round in November 2021 was an NFT IDO launch of "The Prophets" collection, which also provided Babylon ecosystem perks.

As of today, you are probably heard about it vanquished. But we will get to that later, for now, let's review the architect of Babylon.

II. The Architecture of Babylon

Gardens

Babylon is centered around its investment communities called "Gardens". Any user can create and invite members to their Garden, permissionless, for almost any purpose.

A Garden must have an investment thesis including risk, time, and liquidity preferences. In addition to that, Garden creators can customize a number of parameters, as follow:

- Garden Name

- Garden Description - The Garden thesis and anything else members will want to know

- Reserve Asset - The asset that is used for deposits and withdrawals. Strategies consolidate into this asset upon completion and it's used as a performance benchmark.

- Garden NFT - Gardens receive an NFT that evolves as the Garden grows.

- Minimum Member Deposit - The minimum amount of capital a user needs to deposit to become a Garden member.

- Maximum Garden Deposits - The Maximum amount that can be deposited into a Garden by all members.

- Deposit Hardlock - The number of seconds a member has to wait after depositing to withdraw. Flash loan prevention.

- Limit who can join Garden - Makes Garden private or public.

- Early Withdrawal Penalty - Penalty for withdrawing capital from active Strategies.

- Minimum Strategy Duration - Minimum number of days a Strategy must be active.

- Maximum Strategy Duration - Maximum number of days a Strategy must be active.

- % Quorum to Activate Strategy - % of total votes needed to activate a Strategy.

- # Stewards to Reach Quorum - # of people who have to vote to activate a Strategy.

- Strategy Cooldown Period - Hours to wait before activating a Strategy after a quorum has been reached.

- Only assets above this liquidity - Minimum liquidity of assets the Garden can invest in.

Once finalized, these parameters can’t be changed.

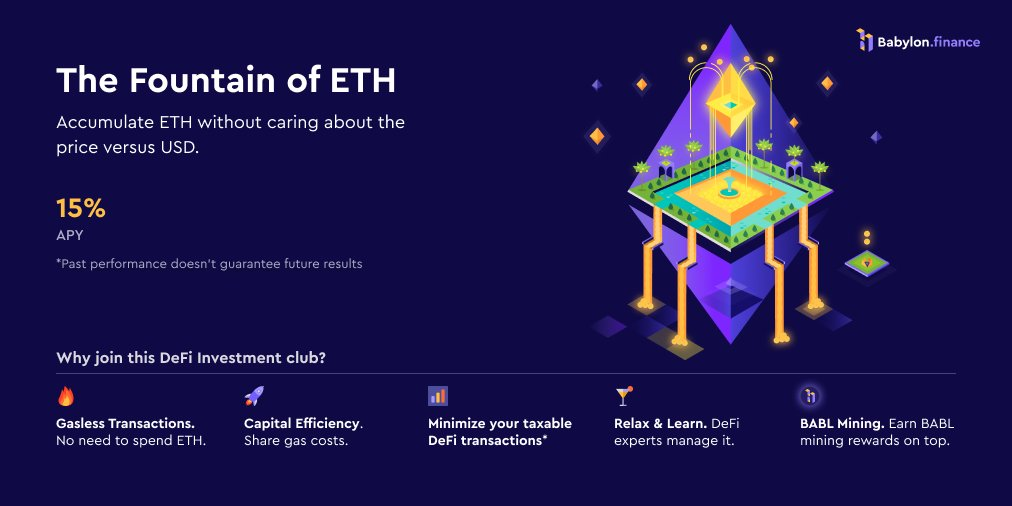

One excellent example, also the most popular Garden on Babylon is The Fountain of ETH. The Garden’s goal is to “accumulate ETH through low-risk strategies without exposure to the fiat price.” Its net asset value (NAV) hovers around 1,500 ETH before Babylon announces its shutdown.

Members

Once a Garden is set up, it needs capital from users to function.

From a user's perspective, Gardens behave similarly to investment clubs or rolling funds. The Garden first had to be open, under its maximum capacity, either public or have a member whitelist, then a user can deposit capital.

Users need to deposit into the community to exchange for Garden tokens and gain access to the Garden. The protocol and the Gardens are non-custodial, which means users still retain ownership of their capital.

Once they are in, as members they can perform the following actions:

- Create Strategy. A member can suggest a Strategy for the community. The member will need to stake a portion of his/her Garden Tokens to be able to create the Strategy.

- Vote on a Strategy. Members from the community can use their Garden Tokens to upvote or downvote candidate Strategies.

- Deposit capital. Members can deposit capital at any time.

- Withdraw. Members can withdraw capital - along with the profits if any - during the redemption window or outside the window by incurring an early withdrawal penalty.

- Claim Rewards. Members of a Garden can claim $BABL rewards earned through their participation in the Garden.

- Discuss. Communities can also integrate an off-chain message board (Telegram, Discord) to host discussions within the community.

If a user wants to withdraw his capital, and there is enough liquidity (idle capital) in the Garden, the user can withdraw with no penalty by exchanging their Garden tokens for the commensurate reserve assets. However, if there isn’t enough liquidity available in the Garden, members have to wait for a strategy to end or pay a 2.5% penalty to withdraw immediately (which gets distributed to the Garden). Withdrawing before the Strategy completes also requires giving up any potential profits and rewards that the strategy may return upon finalization.

Strategies

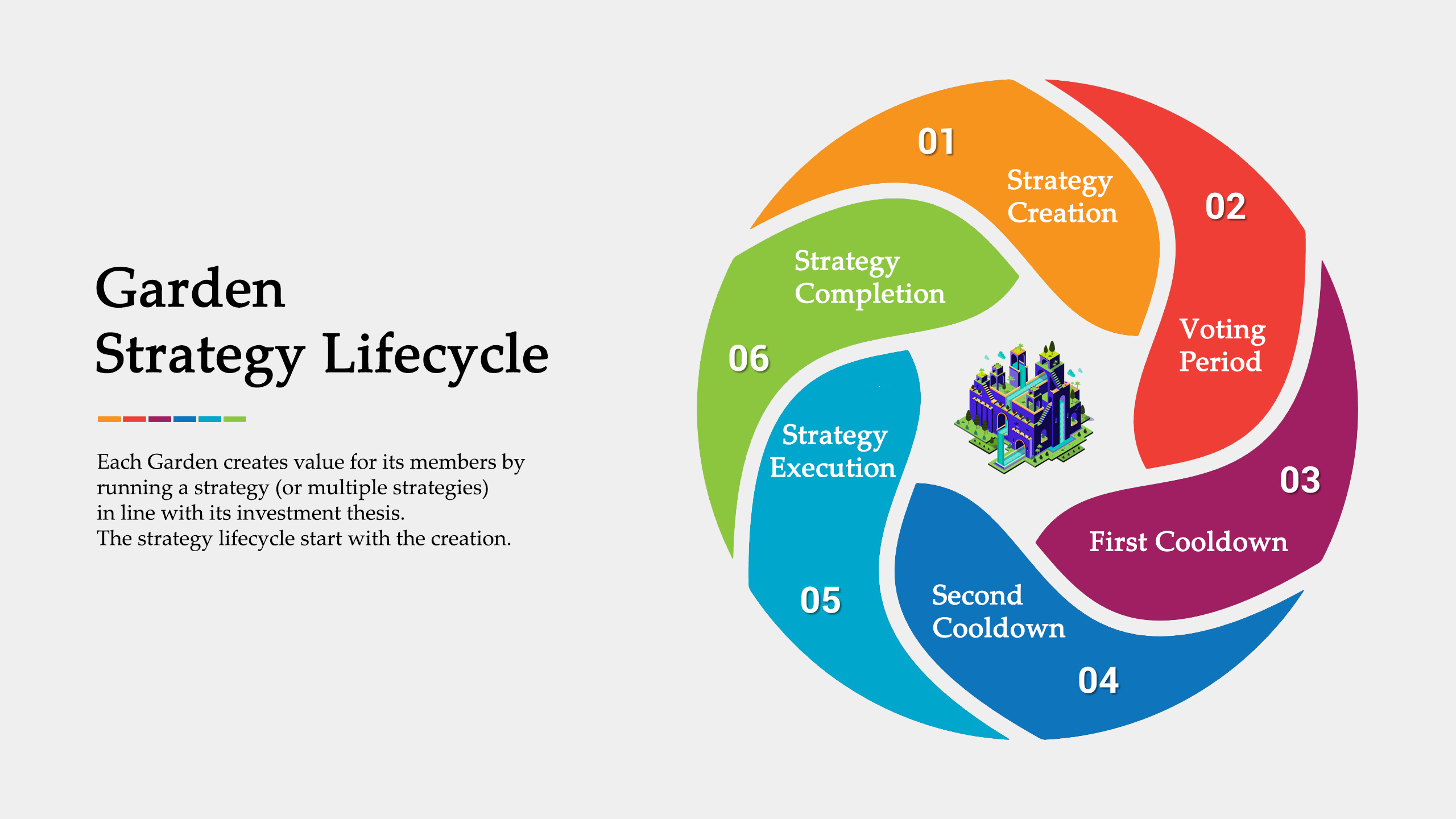

Each Garden creates value for these members by running a strategy (or multiple strategies) in line with its investment thesis. And each Garden have have different permissions for proposing and voting on strategies.

There are different ways to create strategies.

One method is using the no-code user interface (UI) available at Babylon. This layer of abstraction allows prospective strategists to easily mix and match operations on various supported DeFi protocols (e.g., Uniswap, Aave, Lido, Yearn, Convex, etc.).

Another feature allows strategists to code their own custom logic and create adapters to new DeFi protocols. These custom integrations still represent a step change in terms of the design space for strategists.

In addition to designing the mechanics of a strategy, strategists can also specify other features including:

- Expected return

- Duration

- Maximum % to be spent on gas

- Maximum % slippage per trade

- Maximum allocation (% of Garden principal and amount of reserve asset)

- Their own stake (locked for the duration of the strategy)

After submission, Garden members can cast votes for the candidate strategy. Voters stand to gain if a strategy they vote for is executed successfully, sharing a maximum of 15% of the total profit with the strategist. The default breakdown is 10% for the strategist and 5% for voters. One more thing, voters don’t just stand to gain by upvoting strategies, but downvoters get to split the strategist’s stake if a strategy ends up being unprofitable.

Once a given candidate strategy reaches the Garden-specified quorum, it enters a cooldown period before automatically executing (gas fees are split between Garden members). And while each strategy has a preset duration, strategists can unilaterally close their proposed strategy at any point.

After a strategy is completed (or closed), the assets in the strategy will be converted back into the Garden’s reserve assets. In addition to the (up to) 15% slated for strategists and voters, an additional 5% of the profit goes toward the Babylon Finance treasury.

Given the structure of the protocol and the process involved around approval, strategies tend to be designed for the medium-long term (e.g., weeks/months rather than hours/days). In some ways they reflect traditional exchange-traded funds (ETFs), deploying capital in a passive, systematic yet strategic manner.

BABL token

BABL is Babylon Finance’s Ethereum-based, ERC-20 governance token.

Protocol governance takes place on-chain governance using Babylon Governor. BABL holders can submit and vote on proposals regarding treasury management, integrations, system updates, protocol fees, and more.

The BABL mining program is a 10-year program that rewards participation in Babylon. It uses BABL to boost strategy yields for all involved parties (members, strategists, voters, and the Garden creator).

In addition to governance, BABL holders can stake their BABL in "The Heart of Babylon" Garden and receive hBABL in return. Adopts the veCRV model, hBABL is a vote escrow token meaning that the longer the hBABL lock the higher the voting power. "The Heart of Babylon" Garden is also set up to employ a number of popular token economics strategies to generate yield for BABL stakers and generally bolster the protocol.

III. The Death of Babylon

Curse by its name, Babylon didn't last long, especially in the context of the bear market.

31 August 2022, Babylon Finance announce its shutdown.

This is because they were failing to recover from the impact of April’s $80 million exploit on Rari Capital.

As you might (or might not) know that Rari allowed users to supply and borrow any asset in its Fuse pools to earn yields. Users can set up their own pools with a basket of Ethereum-based assets, such as Babylon’s tokens, and other users can deposit funds into those pools to earn yields. The yields are generated as rewards for trading activity on those liquidity pools.

Babylon stored some $30 million in various cryptocurrencies at its peak and was among the top lending pools on Rari with $10 million in user-supplied assets.

Babylon lost $3.4 million during the Rari exploit, and its users withdrew over 75% of their assets in the following days at the time. The situation went downhill after Rari canceled a planned reimbursement to users affected by the exploit.

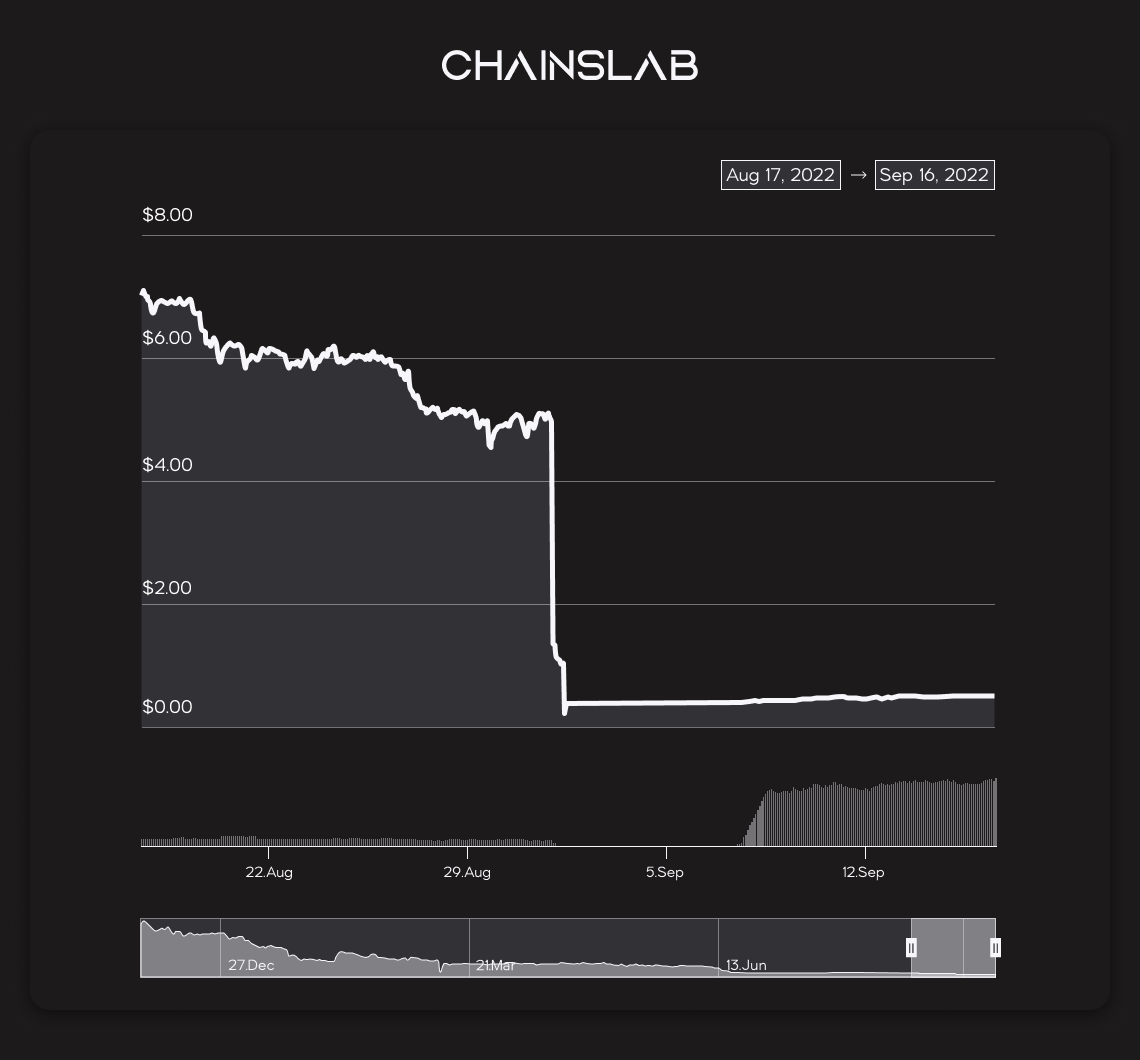

The Rari exploit, coupled with a steep fall in BABL token prices, led to “the point of no return” for Babylon.

The price of the BABL token dropped ~90% on that day.

While sarcastic keep pointing out their overspending, I have my eye on how they manage the crisis. Maybe, they are the only good guys left in this industry.

I believe in what they said, since the event happened the team has been working without salary trying to find ways to solve the problem.

Unfortunately, they fail and they accept it. The team said that they would return all remaining assets to BABL holders in the coming weeks, including all tokens vested to the founders.

Although most other protocols/tokens never wind down and retain in a zombie state, they choose a responsible route, which is closing down the system.

They look like the main character in comic books, a fool yet a hero.

IV. The End

What did Luna do after the collapse? Partying.

Now, look at what Babylon does, they accept their failure, try to fix it, and do moral things.

I must say, the idea and the concept of Babylon are awesome, and it still lives as an open-source project. The founder encourages people to take the source code and use it as they will. Maybe, we will see Babylon 2.0 rise again with its flaw fixed and its feature elaborated.

Maybe, there is still hope in this space.