I. Introduction

In recent years, on-chain analysis has become increasingly sophisticated and valuable. With the growing popularity of cryptocurrencies and the expanding blockchain networks, there is a wealth of data available for analysis. Researchers and analysts are leveraging this data to gain insights into various aspects of the crypto space, including market trends, investor behavior, and network activity.

On-chain analysis is a powerful tool used in the world of crypto to analyze and extract valuable insights from the data recorded on a blockchain network. It involves studying the transaction history, addresses, and other relevant information stored on blockchains to gain a deeper understanding of the network’s activities and dynamics. It has proven to be particularly useful in detecting and combating illicit activities in the crypto space. This has led to increased collaborations between blockchain analytics firms, law enforcement agencies, and regulatory bodies to prevent financial crimes and maintain the integrity of the crypto ecosystem.

The Blockexplorer, an early Bitcoin explorer tool, played a crucial role in enabling individuals to explore the Bitcoin blockchain and gain insights into its workings and token transfers. It significantly contributed to building trust and transparency during the initial stages of the network, serving as a foundation for the widespread adoption of crypto and blockchain technology.

As the cryptocurrency industry and blockchain networks expanded, there arose a greater need for improved market intelligence. Investors and traders required better tools to make well-informed decisions concerning the market and individual assets. Blockchain analytical tools have emerged to address this growing demand by providing more comprehensive insights and features for analyzing and comprehending the data present within blockchain networks.

There is large and growing demand for blockchain intelligence as crypto users become more sophisticated. There is also a large and growing community of blockchain sleuths who gather blockchain intelligence. However, there is not a market that matches these buyers and sellers, so crypto users miss out on valuable information and sleuths aren’t paid for their work.

Last week, Binance announced the launch of the IEO for Arkham, labeled as the world’s first on-chain intelligence marketplace. Let’s explore the potential of Arkham and see if the project could become a pioneer in issuing tokens for similar analytical tools like Dune and Nansen and the trend of intel-to-earn.

II. What is Arkham?

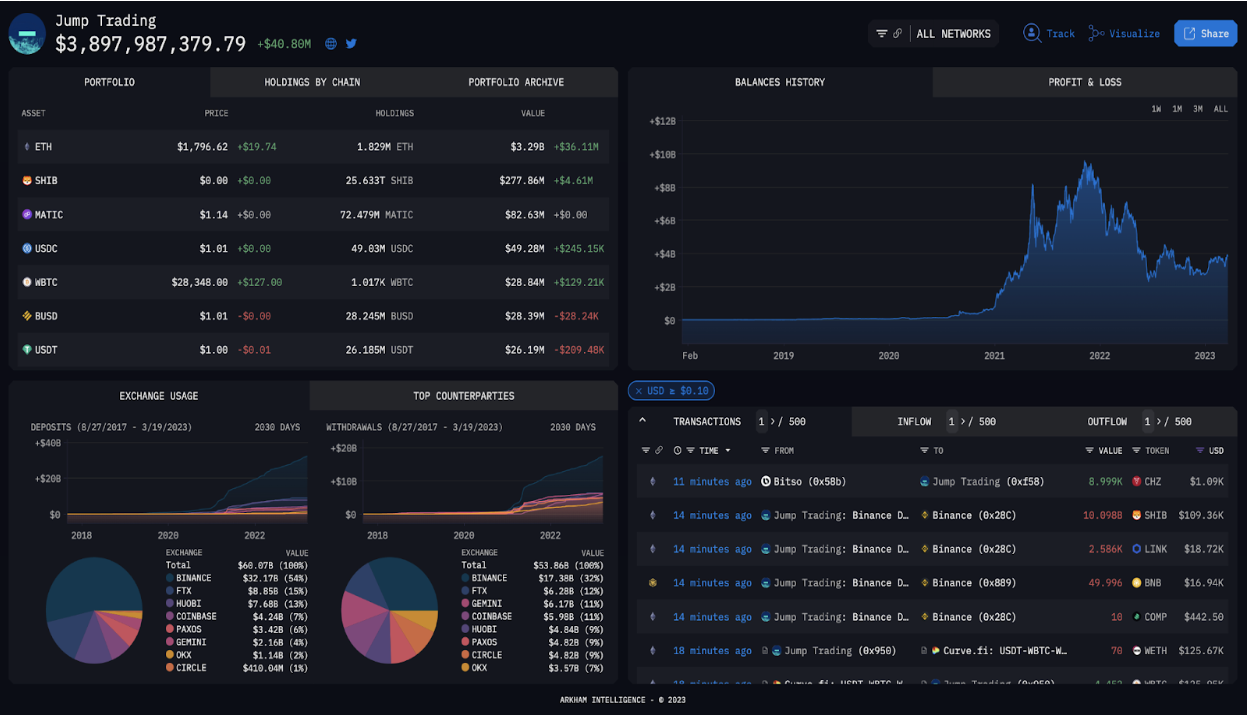

Arkham is an advanced on-chain data query tool and intelligence trading platform designed to offer insights into the real-world entities and individuals involved in cryptocurrency market activities. It operates on the fundamental belief that labeling entities on the blockchain has the potential to unlock an unparalleled level of transparency, thereby propelling the industry towards widespread adoption. This core premise serves as the driving force behind Arkham’s mission to drive positive change and foster the growth of blockchain technology on a global scale.

Since its launch in August 2022, despite being in the private beta phase, Arkham has garnered a significant user base, with more than 150,000 users. These users consist of over 3,000 prominent market makers, exchanges, and other services providers within the blockchain space. This impressive adoption rate is a testament to the platform’s value and its ability to attract key players in the industry.

Furthermore, the project is introducing the Arkham Intel Exchange - an on-chain marketplace exclusively dedicated to blockchain intelligence. This platform allows users to submit requests for detailed information regarding a specific cryptocurrency wallet address. On-chain “detectives”, in turn, have the opportunity to fulfill these requests and earn a monetary reward. Its intel-to-earn economy incentivizes the sourcing of data intelligence at scale and makes it available to everyone to provide greater clarity and transparency in the crypto industry.

Arkham’s Intel Exchange

The Intel Exchange effectively addresses these challenges by facilitating connections between buyers and sellers of on-chain intelligence through the implementation of a bounty mechanism. In recent years, there is a notable and substantial demand for on-chain analysis from a diverse range of individuals, including traders, investors, journalists, researchers, and protocols. The existence of a thriving community of highly skilled on-chain “detectives” who require a platform that enables them to monetize their expertise effectively.

Buyers engage in the exchange by requesting intelligence through the placement of bounties, while sellers participate by offering their intelligence through auctions. These bounties and auctions are facilitated using audited smart contracts, ensuring transparency and security throughout the process. Importantly, the platform operates in a decentralized manner, with funds never being held by any centralized entity, thus ensuring the integrity of transactions and avoiding custodial risks.

The Privacy Concerns

The trading of on-chain data represents a distinct field within the crypto industry, separate from existing products like NFTs. The author raises a crucial question regarding the reliability of the information and its alignment with the actual entities in question. While users may have the ability to detect and label entities, there remains uncertainty about the accuracy of such information and its correspondence to the entities themselves. It raises the possibility that the information exchanged is merely based on agreements between buyers and sellers, rather than verifiable facts.

Furthermore, the concept of DeFi emerged with the intention of establishing a financial system that is both transparent and anonymous. In this context, the practice of tracking and labeling individuals within the DeFi ecosystem, while not directly detrimental to them, can be considered intrusive or bothersome. It raises concerns about potentially compromising the privacy and anonymity that DeFi users seek when engaging in decentralized financial activities. Most people won’t feel comfortable moving large parts of their fortune into a publicly exposed glass box. For instance, inhabitants of dangerous places are unlikely to pay a local merchant in crypto if the recipient can immediately learn how much money they have.

To quote Vitalik Buterin: “If your privacy model has a medium anonymity set, it really has a small anonymity set. If your privacy model has a small anonymity set, it has an anonymity set of 1. Only global anonymity sets are truly robustly secure.” At the moment, all transactions on various blockchain are transparent, anybody can see the sender, the recipient and all other details. The author shares the same vision, privacy is an absolute prerequisite for mass adoption. Once the prover technology, or zero-knowledge proof is good enough to add a privacy layer by default without much cost and scalability overhead, there would be challenges for these analytics tools.

III. Arkham Tokenomics

Tokenomics

The ARKM token functions as the primary currency within the Arkham Intel Exchange and supports the intel-to-earn economy. By offering rewards and discounts, it establishes a compelling incentive system that promotes the widespread adoption of the Arkham platform. Additionally, the token acts as the governance token, giving token holders the ability to participate in decision-making processes and shape the platform’s future direction.

Noticing that information about on-chain data is currently being shared within the community for free, raising significant questions about the demand for the exchange. Moreover, sellers face direct competition from other security/data companies such as Nansen, PeckShield, etc. Moreover, Arkham has not clearly defined criteria or mechanisms for pricing the traded information. The buying and selling process lacks established norms, making it challenging for users to determine whether they have purchased or sold information at a high or low price.

If these issues persist, the operation of the Intel Exchange will be compromised, and the role of the token will become increasingly unclear, as ARKM primarily serves as rewards/incentives only for users, so far.

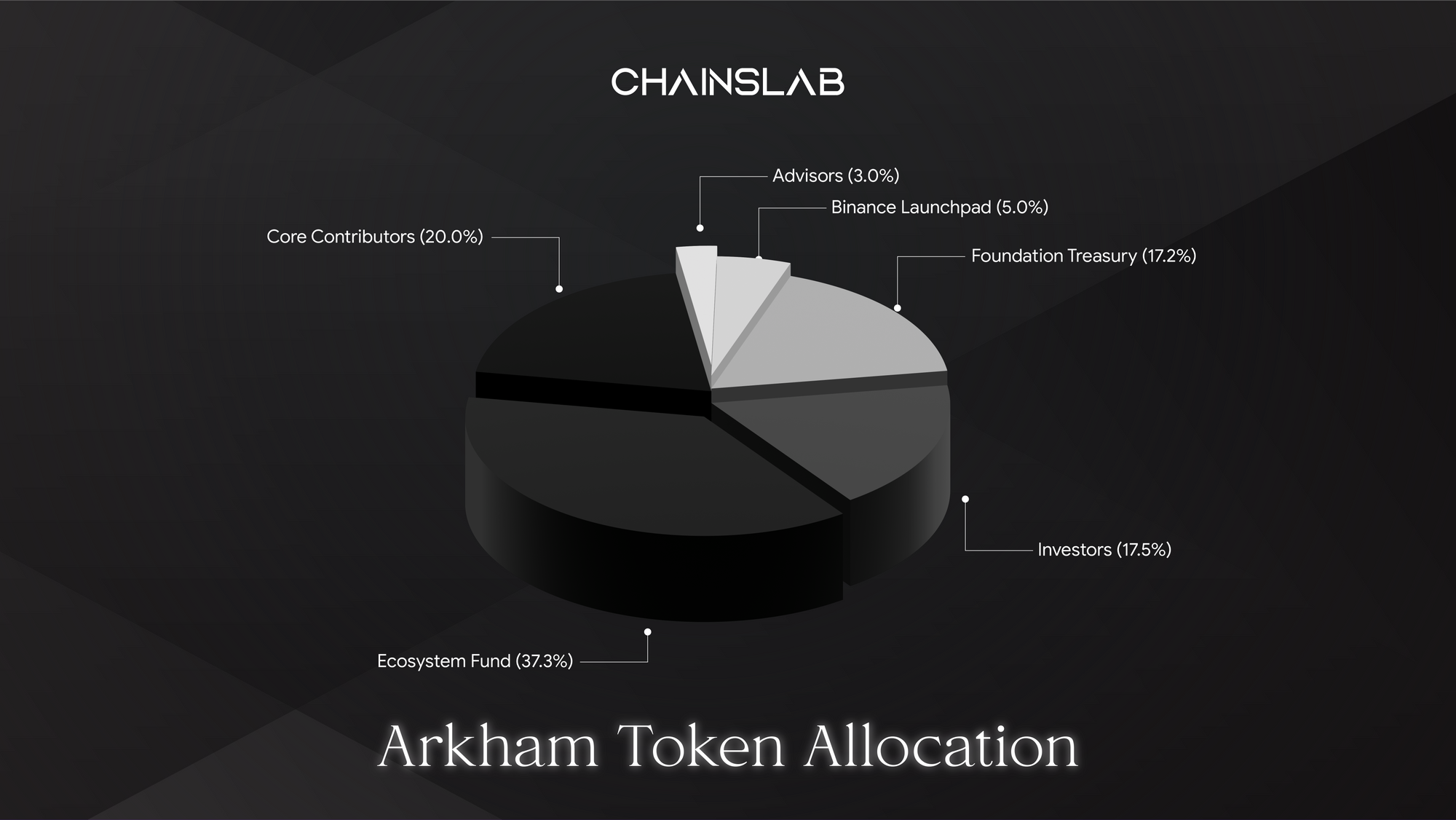

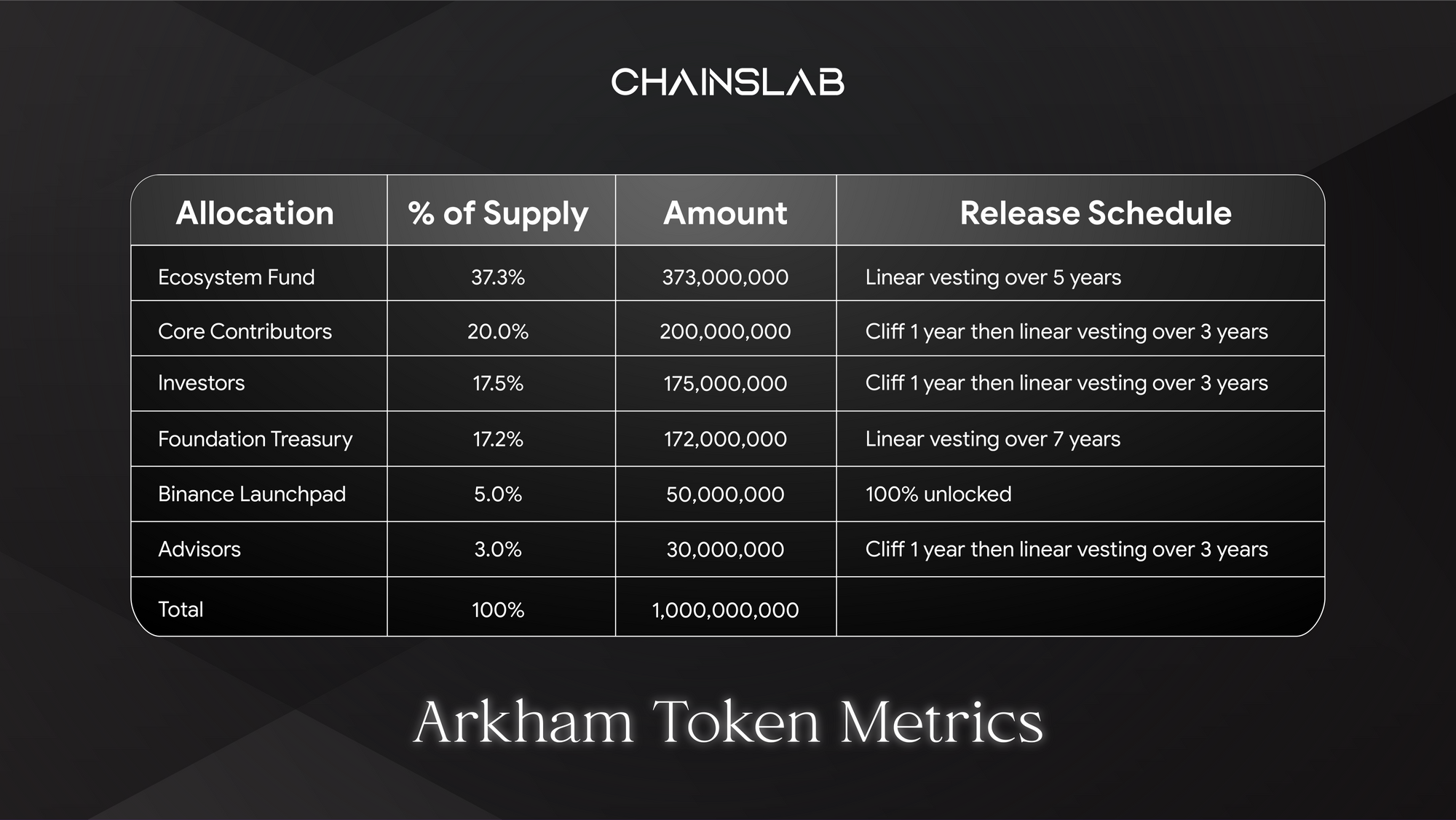

Token Distribution

The total supply of ARKM is fixed at 1 billion tokens, no more emission or inflation that will be fully unlocked over a period of 7 years. The project has already closed $12M in a Series A funding round, valuation does not imply disclosure yet, backed by Coinbase, DCG, and some few angel investors.

Typically, being said earlier, this kind of projects rarely issue tokens as they seem unnecessary in such cases. However, Arkham is taking a different approach, and despite the relatively low initial valuation of $7.5 million and a FDV of $50 million, it is venturing into new territory as a project on Binance Launchpad.

There is 15% of total supply once they get listed on exchanges, of which 7% comes from user airdrop, 5% from Binance IEO, and 3% from Treasury. Hooked Protocol, the latest Binance IEO project since late April, had a remarkable performance. It started with the same FDV and initial market cap compared to $ARKM, and it reached a peak of approximately $1.7, representing an impressive increase of around x34 the opening price.

Amidst favorable market conditions, compared to the Hooked Protocol launch, XRP has emerged as a stronger contender. Notably, XRP achieved a significant victory after years of legal battles with the SEC. Furthermore, there is positive news to highlight, such as a considerable drop in US inflation to 3%, and the FED’s decision to pause interest rate hikes for the first time since November 2021.

Ignoring the shortfalls of token utilities, and a few other project problems, the recent macro effects will likely facilitate the price growth of the ARKM token. If you participate in the IEO, the expected price for this initial pump of ARKM can go up to around $1.5 - $2.0 to take profits gradually. Strategies to buy immediately after listing should be limited as the market is often highly volatile.

Personally, the new concept of Arkham, the author expects doxxing as a service does not become a thing, but it probably will. Doxxing as a service goes against everything that many teams and projects are trying to accomplish with blockchain technology. Finally, ARKM does not have any utility or business model that can motivate long-term holding, just short-term holding and flipping to grab quick profit.