Agoric is one of the startups which was sold out in the public round on CoinList, a fundraising platform helping blue-chip crypto projects with a wide variety of token holders. Using the most popular programming language to build and deploy DeFi on rapidly. Let’s see how Agoric can onboard the next billions of blockchain developers with JavaScript power.

I. What Is Agoric?

Agoric is an ease-of-use Layer 1 (L1) Proof-of-stake blockchain that focuses on composability in a JavaScript working environment. While most other L1s are built on less web-common languages, Agoric’s approach is to get more Web2 developers into the Web3 development space through increasing the usability of its platform. They intend to reach a state of “exponential composability”, where the ease of construction that JavaScript provides will result in steady development, hopefully leading to a massive increase in development within the protocol. Due to its secure and stable environment, Agoric’s Hardened JavaScript makes it easier to access million JavaScript developers to quickly harden the contracts.

II. Agoric's Technology

The Agoric technology stack integrates proven Byzantine Fault Tolerance (BFT) consensus with a distributed, secure, virtual machine architecture that supports the advanced smart-contract framework and robust crypto economy. It provides a secure foundation for the new forms of voluntary cooperation made possible by blockchains which brings about security and composability. This is done by merging together the following frameworks:

Zoe is the framework for writing smart contracts using JavaScript. Developers can focus on their applications’ economic logic, letting Zoe handle the escrowing of user assets. It enforces offer safety and payout-liveness guarantees, so users either get what they wanted from a transaction or get back what they offered. This significantly reduces the risk to contract parties.

In blockchains such as Ethereum, users do not receive such protection: the user transfers tokens directly to a smart contract, such as UniSwap, as part of the request; if the contract is not executed due to errors, malicious code, etc.d. the user is not able to return the assets provided to them. In contrast, with Zoe on Agoric, the user makes such an exchange request in the form of a proposal: “I will give you X tokens, if and only if you give me Y token,” and provides X tokens with the Zoe smart contract infrastructure, not the contract itself. Then the contract is notified of the proposed exchange and will receive X tokens only if it provides the infrastructure of the Y tokens that the user wants.

The Agoric VM provides a secure, distributed JavaScript runtime which enforces the security architecture for safe composition and code reuse. As we all know, currently, DeFi dApps mainly consist of Web2 front-ends built in JavaScript connected to Web3 smart contract backends built in others like Solidity, with no consistent connection framework. So Agoric would bring the dominant Web2 programming language JavaScript to blockchain. Front-end developers get a safe and familiar language to work in. Back-end smart contract developers get to code in a secure, deterministic and asynchronous language.

Dynamic IBC (Inter-Blockchain Communication) is the best-in-class technology. Agoric chain will initially launch as part of the Cosmos ecosystem, as a sovereign blockchain built on the Tendermint consensus engine. IBC solves the connection between Ethereum and Cosmos assets. IBC gives Agoric chain users access to the protocols, liquidity, and assets based in the Cosmos ecosystem and beyond. IBC provides a bridge to bring external financial assets onto the Agoric chain for participating in DeFi protocols, collateralizing loans, staking and participating in trade and related transactions. It means that Agoric assets and smart contracts are available to other chains.

III. Internal Economy

The Agoric chain features two native tokens, defining as the construction of a deflationary currency pair economy comprised of:

- BLD is a staking token supporting economic activity within the Agoric ecosystem. It ensures the chain’s security increases in tandem with the network’s economic activity.

- IST is an IBC-enable stable currency designed to maintain parity to the USD. It acts as a medium of exchange to facilitate transactions, as well as a stable token for the entire IBC ecosystem.

Agoric is launched with the IBC enabled and integrated into the platform. Agoric chain assets, BLD and IST, will be available in IBC applications, including Osmotis DEX, Evmos and other ICB-enabled environments. Cosmos users will be able to use IBC assets such as ATOM, EVMOS and OSMO on the Agoric platform.

The way that CEO Dean Tribble wants us to see the Agoric economy is similar to visiting a foreign country that you’ll need to trade into the local economy to use a local currency. Since the local currency is stable through a USD peg, you don’t need to worry about the fluctuating cost of gas seen in other protocol economies. IST is usable in exchanges outside of Agoric based on its collateralization in the form of BLD in vaults on the Agoric network. The Agoric chain has three tightly coupled systems:

- The dApp economy is where value creation occurs. Market participants transact with each other, have the ability to create digital assets, build new DeFi protocols and connect other components.

- Inter Protocol is governed by BLD holders, used to mint local currency IST. The more economic activity on the chain, the more demand for IST. This generates additional fees which ensures that network security and economic stability scale with economic activity.

- Staking Economy is where BLD holders stake their tokens with validators to ensure the Agoric chain’s security and ongoing operation. Each transaction that occurs on the Agoric blockchain must be executed and confirmed by the set of independent validators. There are two sources of reward for staking: new BLD token and IST protocol fee.

These systems work together to ensure a vibrant crypto economy, where economic activity secures, stabilizer, and rewards participants in the network.

Inter Protocol

Inter Protocol is a stablecoin protocol governed by BLD stakers set to launch in Q4 2022 on Agoric. Inter Protocol’s stablecoin is the Inter Stable Token (IST), which is a fully collateralized stable token, designed to maintain parity with the US dollar (USD). Additionally, IST will be the native fee token on Agoric.

Users deposit collateral into their own vault, allowing them to mint IST against their own collateral, paying a stability fee and a mint fee in the process. The stability fee is dynamically adjusted on a daily basis and all fees are added to a user’s debt.

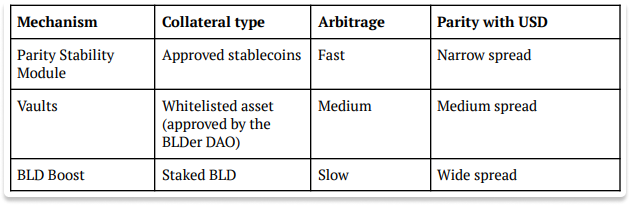

There are three ways to mint IST:

- Parity Stability Module (PSM) — Stablecoins approved by governance may be used to trade with IST, up to a specified limit. For example, a user may provide USDC and receive newly minted IST in return.

- Vaults — Users deposit whitelisted assets to be used as collateral against which they can mint IST. Should the value of a user’s collateral fall below the collateralization ratio, the user is liquidated and the protocol immediately sells the user’s collateral in order to cover the outstanding debt plus a liquidation penalty and any remaining balance is returned to the user.

- BLD Boost — BLD stakers may mint a limited amount of IST by reserving a portion of staked BLD. In this case, the user’s BLD staking rewards will be used to repay the minted IST loan and is not subject to liquidation.

IV. Tokenomics

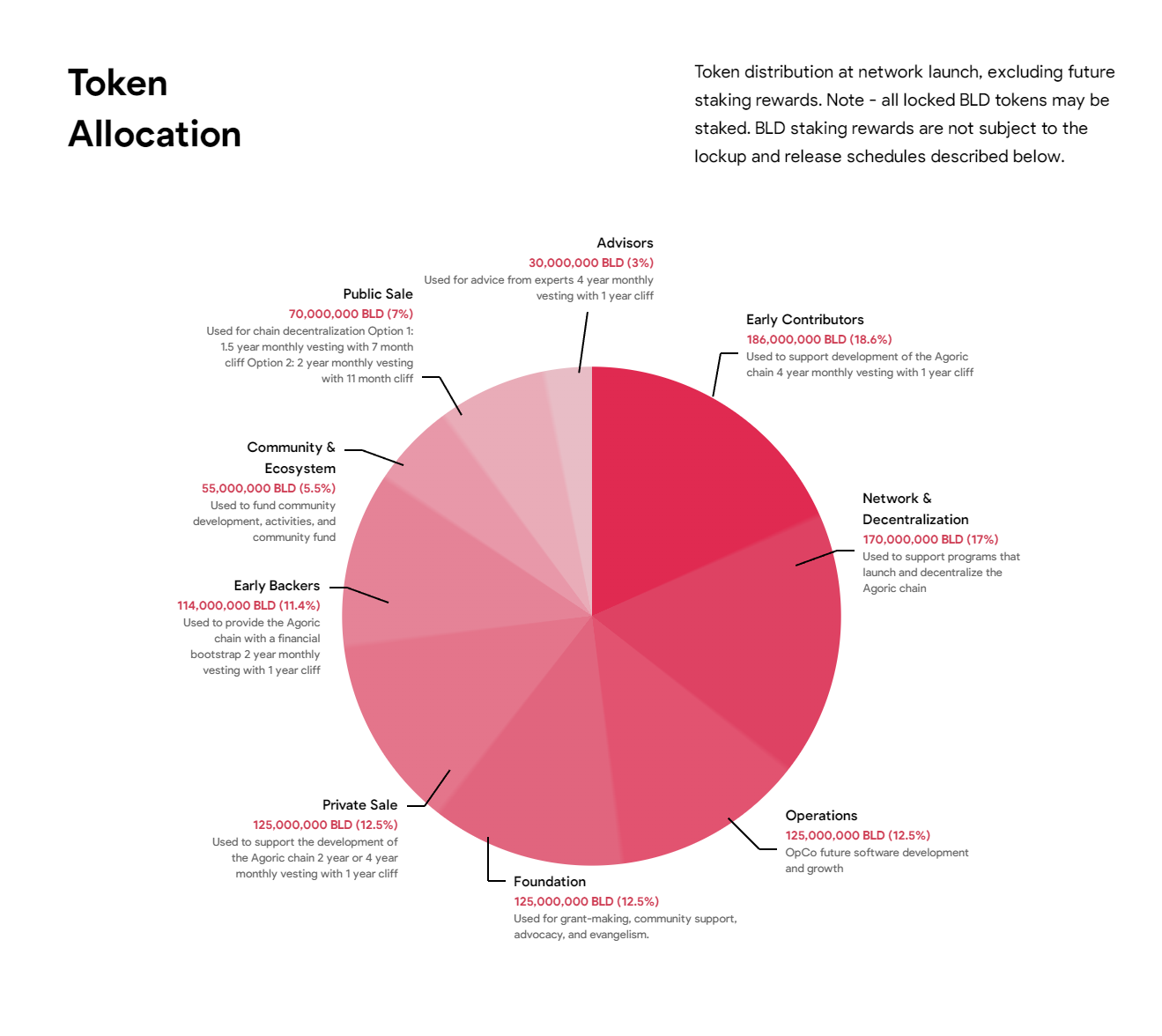

As aforementioned, the blockchain economy has two different tokens, BLD and IST. The BLD token secures and stabilizes the Agoric ecosystem by supporting staking, governance, and decentralization. The total supply of BLD tokens includes an initial distribution of 1 billion BLD, and expected 250 million BLD staking rewards. An interesting point is that all locked BLD tokens may be staked to secure the network and earn reward further. However, as the details of token distribution and release schedule below, you would find that the tokenomics may not expect a “pump” in the first launch date.

Although there is no selling pressure from investment funds or public round buyers on CoinList so far, initial supply accounts for 47.5% or 475M BLD existing in circulating supply until more tokens get unlocked by investors. That number comes from operations, foundation, network decentralization and ecosystem. This is still considered an invisible selling pressure.

Besides, around Nov 1, a large amount of tokens will be unlocked for early investors. This event will lead to a strong increase in circulating supply, huge selling pressure, and difficult to create demand for retail investors at this time.

V. Team & Partners

The Agoric Team was founded in 2018 by Mark S. Miller (Google) and Dean Tribble (Microsoft), the project quickly garnered director level support from the interest of the Electric Coin Company. Initial funding for the project came from behemoths such as Outlier Ventures, Polychain Capital, etc.

VI. Conclusion & Price Prediction

Agoric aims to have a thriving ecosystem of DeFi components available, all built on a web-common language, so that the protocol is easy to enter and scale. In due course, the protocol will expand as incoming users build on the work of previous developers. Agoric’s relationship with the Cosmos network will help the protocol’s internal economy grow as other projects enter the Agoric ecosystem to meet all their DeFi needs.

At the time writing, the circulating supply is around 480 million BLD equivalent to $255 million of market cap, which is quite a high valuation for an early ecosystem like Agoric. In case of short-term trading, we can still expect a rhythm of speculation to cause the price to rise before the token returns to investors. Theoretically, with the amount of tokens being paid out gradually over the next period 1-3 years, the bullish momentum for BLD is not much.