The year is 2030.

Crypto has now reached the stage of mass adoption, with ETFs available for the top 30 coins on CoinMarketCap (25 of them are memecoins).

However, there are 10 active Layer 1s, 300 Layer 2s, and around 50 on-chain users rotating their funds across these chains to farm loyalty points and wait for airdrops later.

The biggest dApp is still Uniswap. The second biggest is a bridge like Wormhole or something similar. The third is pump.fun, where degens endlessly ape into memes and devs rug and bail after 30 minutes. The daily market volume is now $40B, but nothing really catches the eye of the average Joe, as he doesn't use crypto for anything other than these apps, and, well, to pay for his porn subscription.

Okay, I might be exaggerating. That future seems too bad to be true. Except it's our current industry situation. Look around and you'll see it. Ethereum on-chain activities are dead, L2s have 7 users and 6 of them are farmers. Look at Starknet stats before and after the airdrop, and you'll see my point exactly. zKsync is now a wasted land after the airdrop and TGE failed while Blast is holding their breath. Near, Avalanche and BSC is not in the spotlight anymore since forever, although there are still users left.

Solana is capturing all the attention recently, but besides memes, their DeFi dApp volume is kinda meh. Don't get me wrong, there's nothing wrong with memes. They are exactly what “builders” must learn from, and this article will dive into that.

So, to meme or not to meme? Let's find your answer right below.

Ghost towns

Where I'm from (Vietnam), there are lots of ghost towns. These are abandoned cities built but never inhabited, a haunting concrete jungle left forgotten. I believe this isn't the only case for our country, but for other parts of Asia as well, especially China. Meanwhile, central cities are always overcrowded with people, prices are sky-high, and people are miserable there. Yet they stay. Why?

There are millions of reasons for this, but they all boil down to one thing: It does not meet market demands. Those cities were once built because of demand from speculators and investors, not from the real needs of citizens. When the speculation wave receded, they were left there, naked, useless, waiting to be demolished. A gigantic waste of human effort.

Now, if you can, draw the parallel between this and our industry situation. Things may not be that grim right now, but there are dangerous signs. If you're looking for metrics and stats, I have all kinds to show you.

Over the past year, Near Protocol and Avalanche have shown signs of decline in key on-chain metrics, such as new user growth, project launches, and transaction volumes. Despite efforts to improve user onboarding and enhance their ecosystems, Near's new user growth and project launches have stagnated, with on-chain transactions decreasing significantly, indicating reduced user engagement and capital flow. Avalanche has faced similar challenges, with declining transaction volumes and total value locked (TVL), reflecting difficulties in retaining user interest and developer activity.

In contrast, the memecoin sector, particularly on Solana, has experienced vibrant activity and substantial market capitalizations. Memecoins like Bonk, Dogwifhat, and Book of Meme have seen significant price surges and high trading volumes, driven by community engagement and speculative interest. For instance, Bonk's market cap reached $2.26 billion with a 24-hour trading volume of $608.78 million, and Dogwifhat's value increased by over 14,000% since launch. These memecoins showcase strong community-driven growth, contrasting the challenges faced by infrastructure-focused blockchains like Near and Avalanche.

Optimism and Arbitrum have also faced fluctuations but generally show a strong presence in the Layer 2 space, with combined transaction volumes surpassing Ethereum’s mainnet. However, like Near and Avalanche, these platforms must continuously innovate and attract users to maintain their growth. Meanwhile, zkSync and Starknet continue to develop robust ecosystems, although they too face challenges in user adoption and transaction throughput.

With all of that in mind, if you've read this far, ghost towns won't be that much of an issue in the upcoming bull run. New money flooding in will allow new dApps to thrive.

But all those stats, compared to meme coins, are nothing. Every day there is a new memecoin breaking through all-time highs. Every day there is a new chain announcing that they will have their own memecoins, their own culture, and such.

So is that it? Is our industry a meme now? There are countless billions being deployed into Blockchain and Crypto in the last few years, and they are all losing to memes. To the point that now everything is a meme, including founders. They steer their way to founding meme projects, making themselves a meme.

So, to meme or not to meme?

To meme

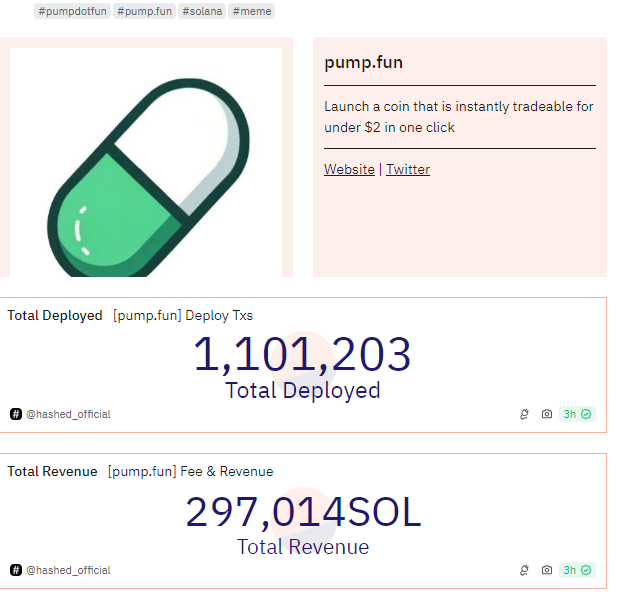

If you look at Dune for pump.fun, the largest meme casino, you will see that memes are the new DeFi. They are the next big thing, the savior of the dry crypto season. At the time of writing, there are 1.1m memes deployed on pump.fun. Like I said, every day a new meme is born, with meme founders trying to catch that narrative.

But not all of them succeed. Many narrow-minded founders and even foundation teams shill their own Memecoin, ending up getting wrecked or not having the impact they expected.

So why do some succeed while others don't? Why do some memecoins like $MOTHER reach ATHs of a few hundred million in FDV, while others, even those supported by "industry figures," barely hit a 100 million market cap?

First, you must understand the culture. A meme, by definition, is an idea, behavior, or style that spreads by means of imitation from person to person within a culture. Or in simple words, memes are for specific groups of people.

Pepe the Frog, Doge, and many of the most popular memes are created on the internet and mostly used and adapted by Gen Z. Founders and VCs, mostly born around the 80s, would first look at those things as stupid and couldn't expect them to turn out so crazy. When they realize it’s the new trend and want a piece of the pie, they start creating meme projects. But you can’t copy the culture, especially when you are out of your mental prime. Young crypto gamblers know which memecoins deliver the most r*tard*d culture, and which memecoins deliver their parents’ style.

That's the truth, at least on the surface. But remember my words, only on the surface. Underneath, the reason most founders fail with meme projects (and non-meme projects) is that they can't find a PMF.

Memecoins and related products quickly find their PMF and target the majority of crypto investors: gamblers. Whether we like it or not, gamblers make up the bulk of crypto investors. All the tech talk and vision aside, the main reason they buy project tokens with a 10B FDV, backed by top VCs and exchanges, is because they think it can go to 20B FDV. Simple as that. But they realized during the recent bear market that VCs, founders, and their predatory low float high FDV tokenomics only create downward pressure. Cobie wrote about this; it's good stuff.

Anyway, gamblers are still here, and crypto remains the biggest casino on earth for now. They just refuse to play games they are sure to lose. They would rather put their money in worthless tokens (with no insider selling pressure) than in VCs' games. At least with the former, they have a chance to win big.

So, in my view, this explains why memes are a phenomenon and why foundations, VCs, and founders can't play the meme game, even if they want to. They don't understand the culture, so whatever they put out often comes off as cringe. Plus, they've made a lot of money from soft rugs, so they can't do meme projects with a fair launch mechanism, as it wouldn't benefit them much.

So is that it? Does crypto end here, with gamblers, casinos, and worthless ponzi schemes ruling the space? No more future of innovation? I think not. I'm not really into memes, but founders and projects can learn something from memecoins so we can all move forward into the next cycle.

Not to meme, but to learn from meme.

Here's my personal, and perhaps unpopular, opinion at this time in the cycle: the memecoin trend is nonsense and likely reached its peak in 2024. As the market grows, meme coins will slowly return to their original purpose: fun-only coins. They won’t disappear, but they also won’t be the dominant trend anymore.

The rise of memecoins was driven by a market flooded with projects that have no real products and extremely predatory tokenomics. Naturally, money flows to where it can grow. In 2023-24 crypto, that meant memecoins and gambling.

But our industry is more than memes, jokes, and cash grabs. I truly believe that. The next wave of projects and products will be better, learning from past failures and aiming to deliver the next generation of Uniswap. In my humble opinion, we can also learn something from memes to achieve that.

First and foremost, in the coming cycles, I believe that having a solid product is the most important thing that can help you survive both bull and bear markets. Everything else (marketing, tokenomics, backers, etc.) is temporary. These elements might give you a significant short-term advantage, which is good, but only the best products that consistently find a fit will endure the toughest times.

Your product might not be great at first, and that's okay. Rome wasn't built in a day. But constantly adapting and trying to capture users will be key in the next five years.

Second, let's talk about tokenomics. It's hard to define what makes a "good" one because what looks good to your seed investors and stakeholders might not appeal to speculators or public buyers. We can learn something from memecoins here. Their only product is often their token, and its metrics are usually designed with their community in mind.

But a rule of thumb for the whole market now is that predatory tokenomics are extremely bad. As the market and industry mature, tokens usually become an important part of the product. Delivering a product that doesn’t use tokens as a core part will struggle to gain traction (unless you’re a first mover in a niche like pump.fun). Pushing out a token for a product that no one uses is also pointless.

So with that in mind, remember this: if the product and the token go hand in hand, then the token price and liquidity will significantly affect the product's performance. One simple thing often forgotten by wealthy founders who raise multiple rounds is that you must make sure your early adopters benefit. Otherwise, your chances of having subsequent waves of adopters will reduce significantly. Sure, float might be a function of product maturity. But in reality, especially in a market where liquidity is fragmented and attention is the most important resource, low float and high FDV usually result in failure because the token price will slowly decline along with attention and retention rates.

This also explains why the Q2 2024 airdrop narrative from long-awaited, VC-backed projects like Starknet, Zksync, or Layer0 was a disaster. They built too much hype and attracted too much unnecessary attention. Too many users and too many sybils meant that the token and its price didn’t meet expectations, resulting in a PR death spiral. Now, they will have to try their best to regain attention for their projects; otherwise, they will end up in the infrastructure graveyard just like previous cycle L1s.

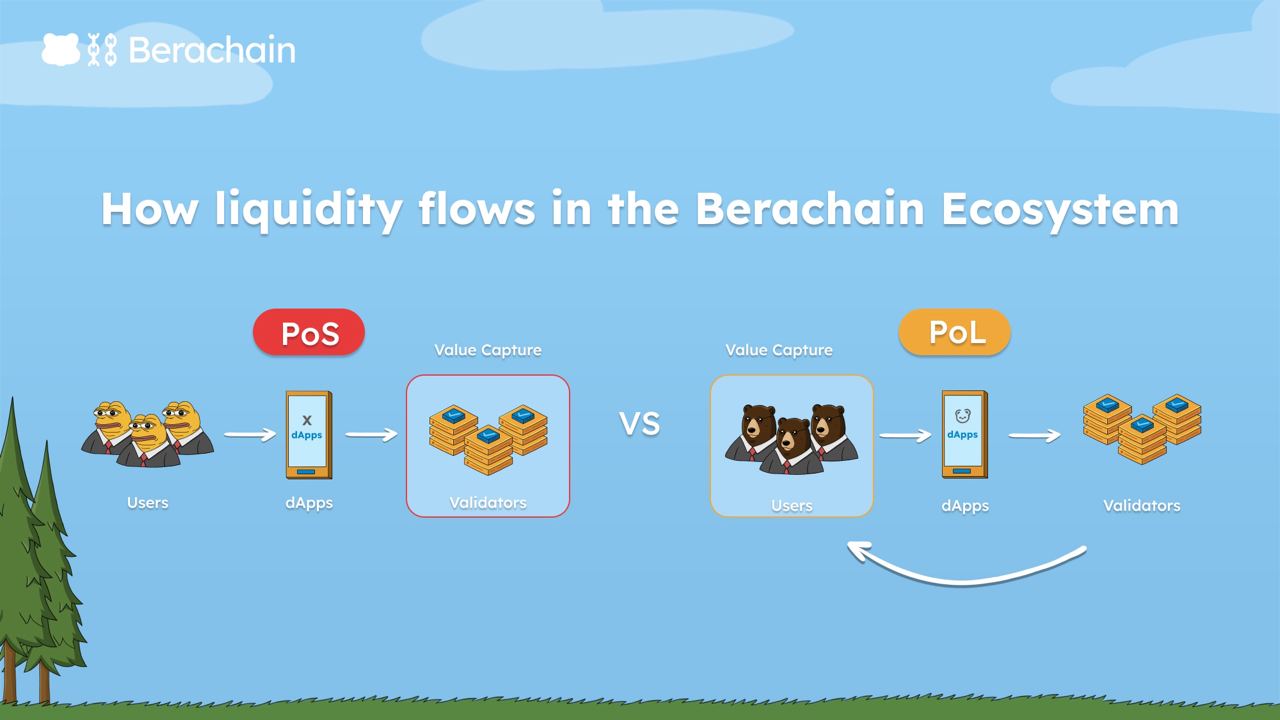

This is also why we're feeling bullish on Berachain. I didn't really believe them when they said they don't do grants, have no marketing, and have no clear plan for an airdrop yet. But it actually makes sense after we had a chance to dive deeper into their ecosystem. They've built a cult-like community where sybil farmers, grifters, and bad actors are ruled out from the start. If their PoL (Proof of Liquidity) mechanism works, it could be the holy grail for any product trying to grow alongside their tokens. Simply put, PoL incentives will help projects within the ecosystem with something they need the most: liquidity.

Conclusion

In the last five years, the Chinese government has been trying to address the effects of the real estate bubble. While they haven't fully succeeded in the short term, they have learned from their mistakes and are working to improve.

One big change is in how new cities are being developed. Instead of focusing on making them big and impressive, the focus is now on how well they can serve their citizens. This means creating cities that are not just large, but also livable and sustainable, with good infrastructure to support a high quality of life.

That will also be one of the most important lessons for the crypto industry in the coming cycle. The focus should be on how well it serves people. There's a lot of talk about adopting one billion users, but the truth is they are still struggling to get 1,000 because they don't know how to provide real value.

The key is to learn from this and focus on benefiting everyone. Projects need to create genuine, tangible value for their users. This means developing products and services that people actually want and need, making them easy to use, and ensuring they improve users' lives in some way. If the crypto industry can do this, it will see much more success.

It's not enough to have impressive technology or make big promises. The industry needs to demonstrate practical benefits. This approach will lead to sustainable growth and help achieve the goal of widespread adoption.