To crypto enthusiasts, the Summer of 2020 was The Defi Summer of Defi. As you may or may not know, that summer, Decentralized Finance (Defi) has taken the crypto space by storm. The industry started the year at a valuation of $1 billion but added at least an extra $1 billion every week during the summer.

The concept of yield farming and liquidity pools is mainly responsible for the DeFi boom. Advantage from the power of compounding, investors enjoy profit from both the price change and the interest they offer.

The market was growing at an astonishing rate, new protocols were created every day, and the return yields varied enormously each day. There must be a tool to find which protocols offered the highest yield. Yearn Finance was born to address that and become a compass in this treasure hunt.

I. Yearn Finance Definition

Yearn.Finance is an open-source, decentralized finance (DeFi) lending protocol based on the Ethereum blockchain. It works as a yield aggregating platform to maximize the user’s investment by automatically moving the user funds between DeFi lending protocols, such as Compound, Dydx, Curve, or Aave.

In simple words, Yearn Finance is a doorway to several Defi products, allowing users to profit the most interest for their money.

Yearn Finance products aim to simplify the complexity of Defi with “money robots” that work to maximize returns for a fee.

Money robots refer to automated trading strategies executed by Yearn across Ethereum-based DeFi platforms. There are countless investment strategies that can be deployed on a growing number of DeFi protocols. For example, a Yearn "money robot" can earn trading fees on the Curve protocol, borrow money using Aave’s flash loans, and lend assets to Compound.

Users simply deposit money in Yearn Finance smart contracts and the algorithm automatically invests in different DeFi protocols which have the most yield. The Yearn Finance algorithm is considered a trading robot that automatically moves/invests your money in different protocols in order to maximize yields and generate as much interest as possible.

The whole concept was born when Andre Cronje, at this time, was examining and comparing DeFi protocols that provide the best APY to maximize his crypto earnings. Compound, Aave, Fulcrum, and dYdX were the most popular.

However, it got to the point that Cronje found the whole process monotonous and boring, so he started creating the first version of the Yearn protocol. The idea behind the project was to automate the process of exploiting the optimal performing strategies to maximize annual percentage yields (APYs) for stablecoins.

Since the summer boom, Cronje and his team have expanded the project, which as of January 2021 comprises a lending bot, a yield bot, an insurance protocol, and a governance protocol. This governance protocol led to the launch of its native token, YFI.

II. How does Yearn Finance Work?

Yearn Finance maximizes the return by constantly moving users' assets between Defi products such as Aave, Dydx, and Compound... whichever have the most APY.

It works by deploying YFI’s contracts on the Ethereum blockchain to provide optimum services for users. This way, YFI monitors the funds on the connected decentralized exchanges to ensure that they remain in the liquidity pools that offer the most profitable yield.

There are 3 main products of Yearn Finance, which are Vault, Labs, and Iron Bank.

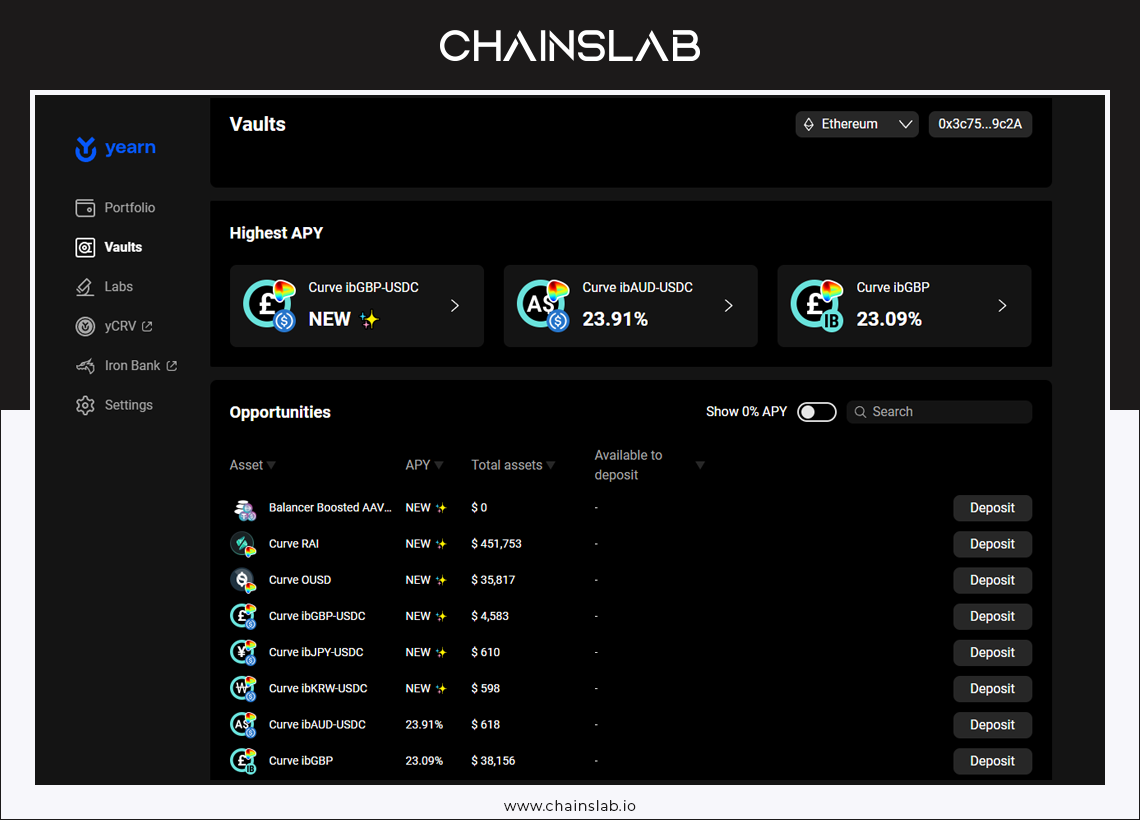

Vault

One major distinct product of Yearn.finance is Yearn Vaults. Basically, Vaults allows users to earn in their investment by using the protocol self-executing code.

Yearn Vault – yVault is something like a savings account for your crypto investments. It receives your capital, processes it through different strategies, then utilizes the best yield available.

Yearn Vaults offer more functionalities than just lending, borrowing, and other basic functions the standard protocol offers. It offers users multiple strategies to maximize users' returns. These strategies often include providing collateral and liquidity, borrowing multiple assets including stablecoins, receiving trading fees, and farming different tokens while selling them for profit.

Notably, each of these Vaults follows an authorized strategy approved by the Yearn ecosystem.

The concept of the Vault was introduced in Aug. 2020, and it has since then improved to version 3.0, which is the latest version. Similar to the standard Yearn protocol, when you invest money into a Vault, you get the equivalent of your investment in yTokens.

Once you have made the deposit, the Vault divides the investment into Vault holdings and strategy holdings. Vault holdings store inactive funds not used by any strategy, while strategy holdings store the active funds.

Anybody can become a strategist. However, to be a validated strategist on Vault, you need to pass through some process that often revolves around mainnet testing, code review, and security review.

Labs

This is another Yearn.finance product, described as a multifaceted DeFi Bank that allows users to earn and carry out essential DeFi functions like borrowing and lending. Furthermore, Yearn Labs enable users to swap their crypto assets with various other diversified assets. The Yearn Labs strategy involves higher risk and higher reward.

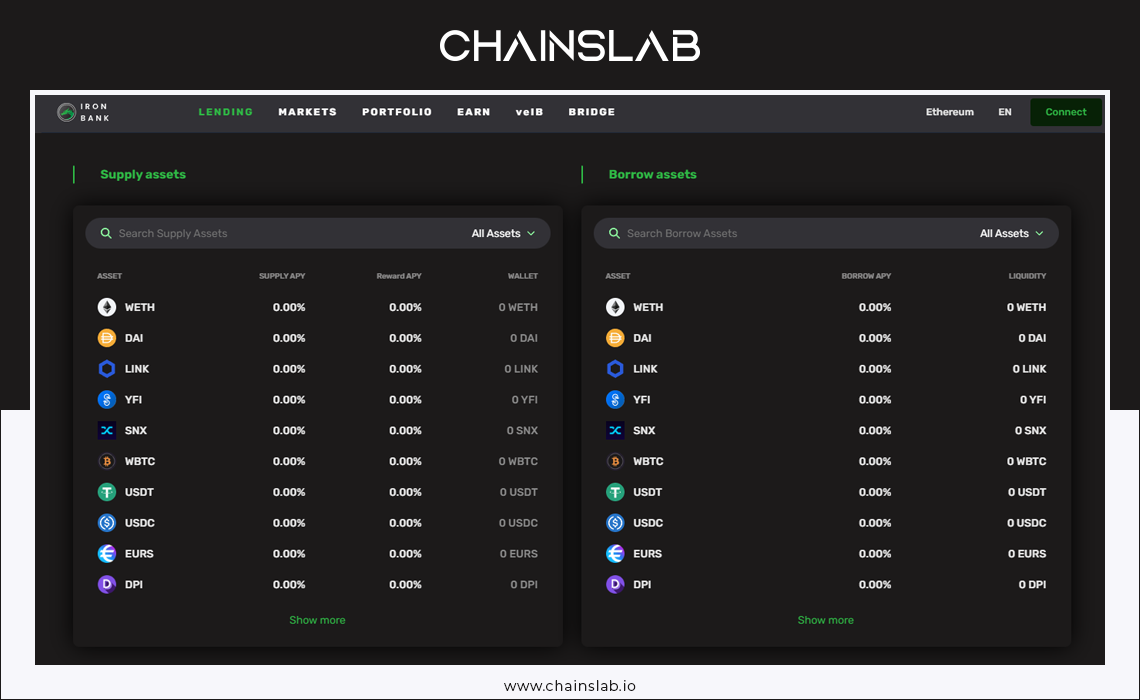

Iron Bank

Generally, Iron Bank is a decentralized protocol to many lending platforms. It enables authorized outlets to borrow funds without collateral. Yearn.finance integrates the use of iron bank, allowing yVaults to come up with the most profitable yield farming strategies and cross-asset strategies.

Yearn aims to boost every Yearn strategy via the Iron Bank. Users will be able to invest their stablecoin assets and borrow an equal worth of ETH. Then enter liquidity pools while utilizing leveraged yield farming products.

YFI

YFI is the native token of the Yearn ecosystem, and it controls the whole system operations. YFI holders can vote on several off-chain proposals and submit rules that govern the ecosystem.

To implement a change, a certain proposal must be greater than 50% of the total vote. It is important to know that while anyone can make a proposal, only YFI holders have the right to vote.

YFI holders benefit from a number of incentives that the ecosystem automatically allocates. These incentives make the YFI token different from other tokens. The token currently has a total market capitalization of ~$300 million, far worst than its peak of more than $2 Billion.

III. The Rise and Fall of YFI

Andre Cronje launched the YFI token in Jun. 2020, just a few months after its main ecosystem launch. The token allocation was based on fair and incentivizing Yearn users. Simply put, users who lock their assets in Yearn.finance and its contracts get YFI tokens as rewards.

To ensure a fair system, the YFI token had no pre-mine, no team reward, and no VCs distribution. All the tokens were given to the users of the ecosystem.

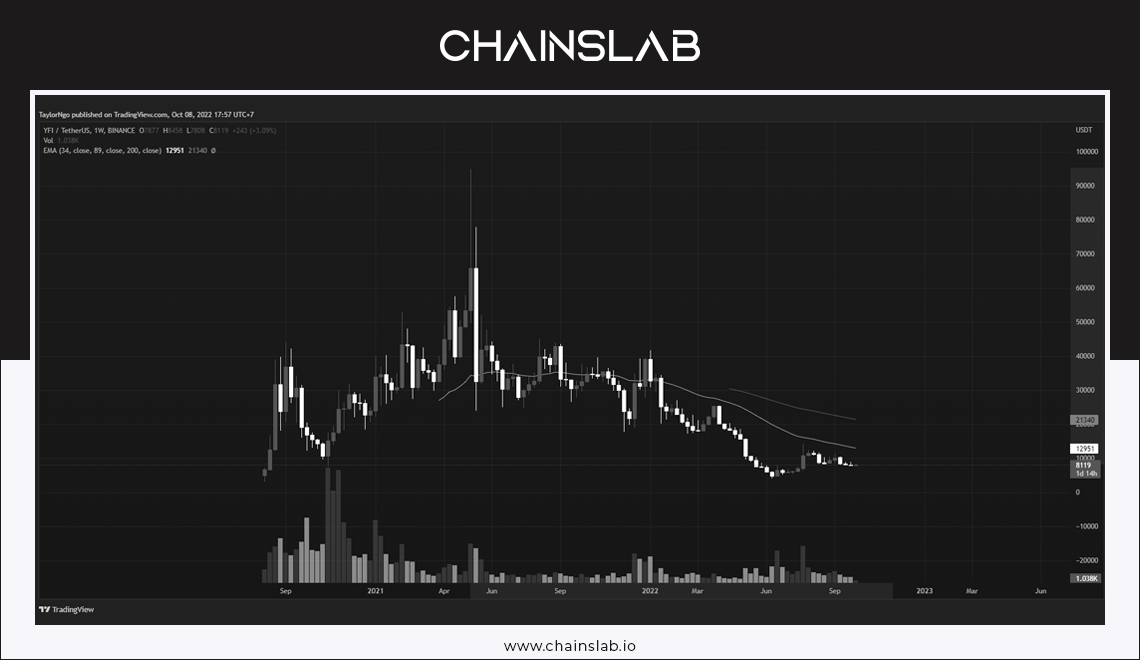

YFI became incredibly valuable at the time. 2 months after the launch, YFI is being traded at around $43k, much higher than Bitcoin. As of May 2021, its All-time High reach $95K, which is 1.3X more than Bitcoin ATH. People then start labeling it as "better than Bitcoin".

In part, that could be explained by there is limited number of YFI tokens in existence; the protocol minted just around 30,000 of them and can’t mint anymore. By contrast, there is about 19 million (and counting) Bitcoin in circulation. The second major difference between YFI and Bitcoin is that while the Bitcoin blockchain is secure, yearn.finance is very risky. The term “beta” is splattered around yearn.finance’s site and founder Andre Cronje says that the project is “experimental.” Upon launching a new protocol, yCredit, Cronje the caveat that his new system could be “economically exploited.”

The hype is real, but YFI is not without its challenges. Because Andre Cronje was the mastermind behind Yearn.finance and YFI for so long, investors are watching his moves with keen intent. This means that if he takes time off, many may see it as a blow to YFI. As such, some argue that the project is still centralized around this key player (at least to some extent).

And indeed, Andre Cronje left. YFI prices proceeded to crumble amid fears of the project shutting down.

Losing its momentum plus the leaving of Cronje and the undeniable downtrend of cryptocurrency, YFI crushed, losing 90% of its value, and is now being traded at around $8000.

In Q2 2022, the decentralized finance (DeFi) market suffered a 74.6% market cap decline, but still the DeFi industry has managed to retain most of its daily active users. This could be a good sign. If the market warms up, Defi will inherently warm up. And money flow should focus on top protocols like MakerDAO, Uniswap, Aave, Dydx, and YFI.

On the bright side, YFI is now sitting at its support level, this could be the accumulation phase of a new cycle. Let's see.

IV. Bottom Line

DeFi is emerging as an exciting new financial technology taking on the centralized banking and finance sector. Unlike traditional finance, where a company, bank or fund is responsible for your money, with DeFi, only you, the investor, are responsible.

But it hasn’t had years of stress-testing at scale to sort out issues. Defi needs time to develop and mature.

In the case of Yearn Finance, the YFI token value is mainly associated with the community around yEarn and reflects people’s confidence in the protocol and the people behind it. That makes it unpredictable and highly speculative.

For now, YFI remains one of the most exciting advances, a perfect case study in decentralized asset management.