Options are derivatives, like perpetual contracts. Options is a powerfull tool used by more advanced investors for income, to speculate, and to hedge risk. Options trading may seem overwhelming at first, but it's easy to understand if you know a few key points. If implied perfectly it will bring more profit than traditional trading while also reducing your risk.

So, let's begin.

What is Options Trading?

For your imagination, Options Trading looks something like this:

- Alice tells Bob: "Hey Bob, I want to buy your car, but I don't want to buy it now. 2 months from now, I want to buy the car at the price of $1000. If you agree, we can make a contract and I can pay you $100 for that contract now."

- Bob agrees and receives $100 cold hard cash. 2 months pass.

- First case scenario, the car's price goes up to $1200, and the contract is executed, Alice pays $1000 for the car and then sells it on the market for $100 profits (minus the $100 upfront for the contract).

- Second case scenario, the car's price goes down to $500, and Alice chose to not execute the contract because she had the right to do so. She takes the loss of $100 (upfront), not the whole $500 if she did buy the car 2 months ago.

Did you get the idea? Now, take a look at the Options Trading Definition:

Options are contracts that give the bearer the right - but not the obligation - to either buy or sell an amount of some underlying asset at a predetermined price at or before the contract expires.

At first glance, Options seem a little confusing, but they’re not as complicated as they appear. To understand options, you just need to know a few key terms:

- Derivative. Options are what’s known as a derivative, meaning that they derive their value from another asset. Take stock options, where the price of a given stock dictates the value of the option contract.

- Call option and put option. A call option gives you the choice of buying an asset at a predetermined price by a specified date while a put option allows you to sell a security at a future date and price.

- Strike price and expiration date. That predetermined price mentioned above is what’s known as a strike price. Traders have until an option contract’s expiration date to exercise the option at its strike price.

- Premium. The price to purchase an option is called a premium, and it’s calculated based on the underlying asset price and values.

- Intrinsic value and extrinsic value. Intrinsic value is the difference between an option contract’s strike price and the current price of the underlying asset. Extrinsic value represents other factors outside of those considered in intrinsic value that affect the premium, like how long the option is good for.

- In-the-money and out-of-the-money. Depending on the underlying security’s price and the time remaining until expiration, an option is said to be in-the-money (profitable) or out-of-the-money (unprofitable).

Traders typically enter into a Call Option when they anticipate an increase in the underlying asset’s price and a Put Option when they expect the underlying price to decline.

Why trade Options?

The 1688 book Confusion of Confusions describes the trading of "opsies" on the Amsterdam stock exchange, explaining that "there will be only limited risks to you, while the gain may surpass all your imaginings and hopes."

Options are powerful because they can enhance an individual’s portfolio. They do this through added income, protection, and even leverage. Depending on the situation, there is usually an option scenario appropriate for an investor’s goal. A popular example would be using options as an effective hedge against a declining stock market to limit downside losses. In fact, options were really invented for hedging purposes. Hedging with options is meant to reduce risk at a reasonable cost. Here, we can think of using options like an insurance policy. Just as you insure your house or car, options can be used to insure your investments against a downturn.

Imagine that you want to buy technology stocks, but you also want to limit losses. By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. For short sellers, call options can be used to limit losses if the underlying price moves against their trade - especially during a short squeeze.

Options can also be used for speculation. Speculation is a wager on future price direction. A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis. A speculator might buy the stock or buy a call option on the stock. Speculating with a call option - instead of buying the stock outright - is attractive to some traders because options provide leverage. An out-of-the-money call option may only cost a few dollars or even cents compared to the full price of a $100 stock.

Upside

The biggest advantage to buying options is that you have great upside potential with losses limited only to the option's premium. However, this can also be a drawback since options will expire worthless if the stock does not move enough to be in-the-money. This means that buying a lot of out-of-the-money options can be costly.

Options can be very useful as a source of leverage and risk hedging. For example, a bullish investor who wishes to invest $1,000 in a company could potentially earn a far greater return by purchasing $1,000 worth of call options on that firm, as compared to buying $1,000 of that company’s shares. In this sense, the call options provide the investor with a way to leverage their position by increasing their buying power. On the other hand, if that same investor already has exposure to that same company and wants to reduce that exposure, they could hedge their risk by selling put options against that company.

Downside

The main disadvantage of options contracts is that they are complex and difficult to price. This is why options are often considered a more advanced investment vehicle, suitable only for experienced investors. In recent years, they have become increasingly popular among retail investors. Because of their capacity for outsized returns or losses, investors should make sure they fully understand the potential implications before entering into any options positions. Failing to do so can lead to devastating losses.

There is also a large risk selling options in that you take on theoretically unlimited risk with profits limited to the premium (price) received for the option.

How to trade Options?

There are four basic things you can do with options:

- Buy call option

- Sell call option

- Buy put option

- Sell put option

Put it this way, buying stock gives you a long position, and short-selling a stock gives you a short position.

While buying a call option gives you a potential long position and buying a put option gives you a potential short position in the underlying stock.

Vice versa, Selling a call gives you a potential short position, and selling a put gives you a potential long position in the underlying stock. But, there's a catch.

People who buy options are called holders and those who sell options are called writers of options. Holders always pay the Premium to Writers. Here is the important distinction between holders and writers:

- Call holders and put holders (buyers) are not obligated to buy or sell. They have the choice to exercise their rights. This limits the risk of buyers of options to only the premium spent.

- Call writers and put writers (sellers), however, are obligated to buy or sell if the option expires in the money. This means that a seller may be required to make good on a promise to buy or sell. It also implies that option sellers have exposure to more and (in some cases) unlimited risks. This means writers can lose much more than the price of the options premium.

Options are often considered a more advanced investment vehicle, suitable only for experienced investors. It’s best to have a pretty solid understanding of trading under your belt before you dive into options. Then you should outline what your investment objectives are, such as capital preservation, generating income, growth or speculation.

As with any other type of investing, it’s best to educate yourself thoroughly before you begin and use online simulators to get a feel for how options trading works before you try the real deal.

When you’re ready to begin options trading, start small—you can always try more aggressive options strategies down the road. In the beginning, it’s best to focus on an asset you know well and wager an amount you’re comfortable losing.

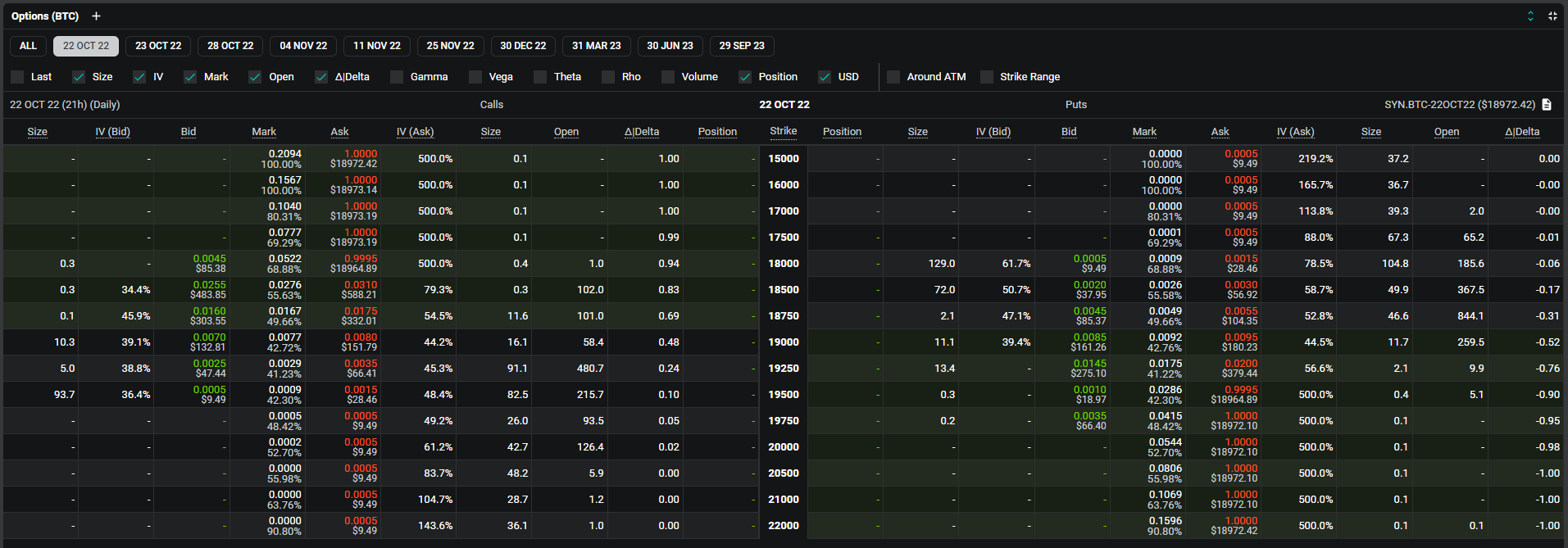

For crypto enthusiasts, you can trade options at a few exchanges, including Deribit, CME, Okex, Bit.com, FTX, Binance, Bybit, etc... Each platform has different policies and fees, remember to read through their paper before beginning with Options. Options Trading is emerging in the Defi space too, and Chainslab will cover this in another article.

Options Trading Strategies

Here we will introduce some famous Options Trading Strategies in traditional finance. These strategies can be applied in modern finance systems like the crypto market too. But, please take these as conferences only, and before applying these strategies, do your own research, and always start small, wager with what you are comfortable losing.

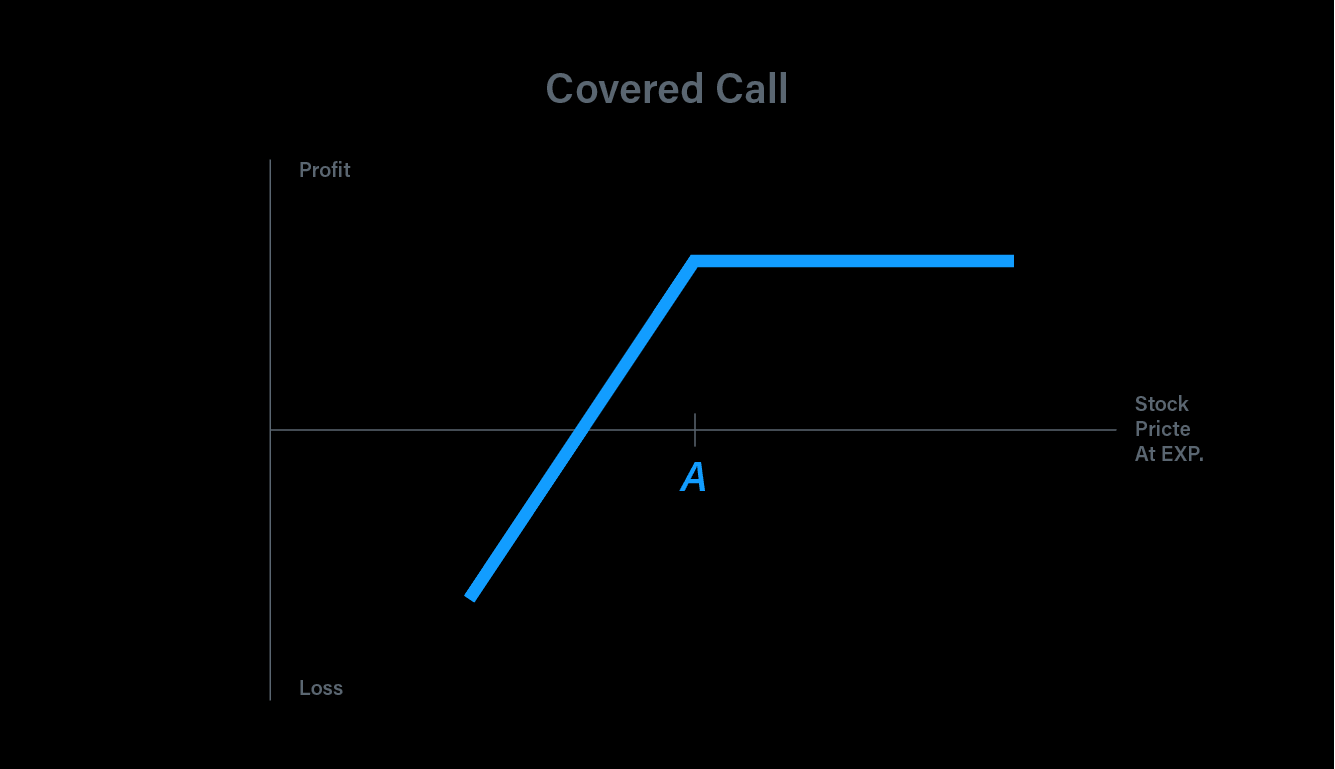

Covered Call

A Covered Call is a very popular strategy, it overlaid onto an existing long position in the underlying asset. It is almost always preferable to naked stock (a stock that had no protection or hedging methods) because it allows traders to profit when the stock does not move at all while reducing their losses if the stock price falls. The trade-off is that you limit your potential profit if the stock price goes up. This is a preferred position for traders who expect no change or a slight increase in the underlying's price and are willing to limit upside potential in exchange for some downside protection.

For example, you buy 1 ETH at the price of $1000 then sell a call option of 1 ETH at a strike price of $1100 for a $100 Premium. 3 case scenarios:

- At the expiration date, ETH price >$1100, you will profit with $1100-$1000 = $100, plus you keep the $100 Premium. So in total, you profit $200 maximum. Even if the price goes up to $5000 per ETH, you will only profit $200 since you sell it to the option buyer for only $1100.

- At the expiration date, ETH range from $1000 to $1100, you will profit from any price difference plus the 100$ premium. This is the best-case scenario for you.

- At the expiration date, ETH price <$1000, you will lose from any price difference but minus the $100 premium. That Premium now acts as your insurance.

Protective Puts

A Protective Put involves buying a downside put in an amount to cover an existing position in the underlying asset. In effect, this strategy puts a lower floor below which you cannot lose more. Of course, you will have to pay for the option's premium. In this way, it acts as a sort of insurance policy against losses. This is a preferred strategy for traders who own the underlying asset and want downside protection.

For example, you buy 1 ETH at the price of $1000 then buy a put option of 1 ETH at a strike price of $900 for a $100 Premium. 3 case scenarios:

- At the expiration date, ETH price <$1000, your losses are capped by $200 ($100 in the difference between the strike price and the 1st price, plus $100 premium)

- At the expiration date, ETH price range from $1000 to $1100, so your losses range from $0 to $100 (Price difference minus Premium).

- At the expiration date, ETH price is over $1100, your profit is unlimited.

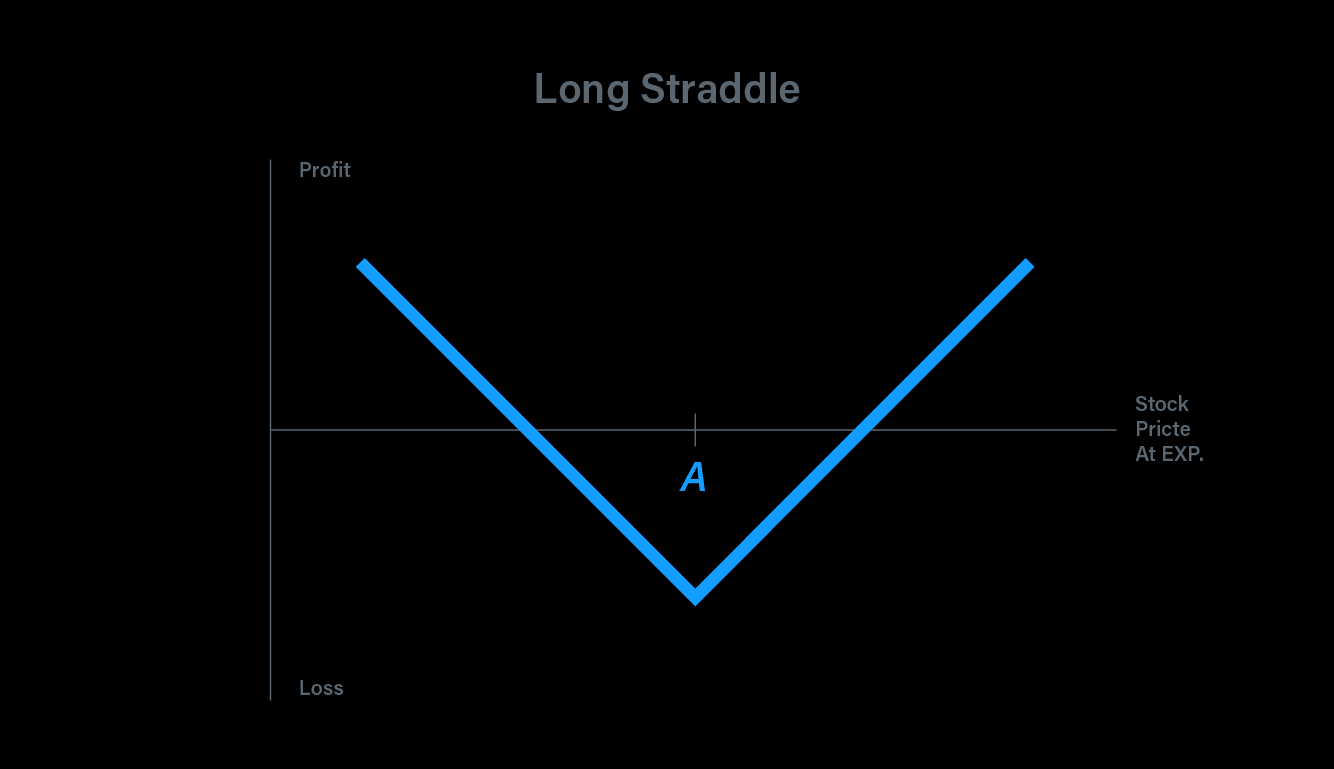

Long Straddle

A long straddle options strategy occurs when an investor simultaneously purchases a call and a put option on the same underlying asset with the same strike price and expiration date. Buying a straddle lets you capitalize on future volatility without having to take a bet on whether the move will be to the upside or downside - either direction will profit. Theoretically, this strategy allows the investor to have the opportunity to make unlimited gains. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined.

For example, you buy a call option and a put option of 1 ETH at a strike price of $1000 for a $200 Premium total. 3 case scenarios:

- At the expiration date, ETH price is over $1200, your profit is unlimited.

- At the expiration date, ETH price is below $800, your profit is unlimited.

- At the expiration date, ETH price is range from $800 - $1200, you will take losses, and the max loss is capped by a $200 Premium (at the point ETH price =1000$).

Other strategies

Here is a brief list of some other basic Options strategies for your conference:

- Married put strategy: Similar to a protective put, the married put involves buying an at-the-money (ATM) put option in an amount to cover an existing long position in the stock. In this way, it mimics a call option (sometimes called a synthetic call).

- Protective collar strategy: With a protective collar, an investor who holds a long position in the underlying buys an out-of-the-money (i.e., downside) put option, while at the same time writing an out-of-the-money (upside) call option for the same stock.

- Long strangle strategy: Similar to the straddle, the buyer of a strangle goes long on an out-of-the-money call option and a put option at the same time. They will have the same expiration date, but they have different strike prices: The put strike price should be below the call strike price. This involves a lower outlay of premium than a straddle but also requires the stock to move either higher to the upside or lower to the downside in order to be profitable.

- Vertical Spreads: A vertical spread involves the simultaneous buying and selling of options of the same type (i.e., either puts or calls) and expiry, but at different strike prices. These can be constructed as either bull or bear spreads, which will profit when the market rises or falls, respectively. Spreads are less costly than a long call or long put since you are also receiving the options premium from the one you sold. However, this also limits your potential upside to the width between the strikes.

The Bottom Line

Options Trading had been there since the 12th century. The first options were used in ancient Greece to speculate on the olive harvest. Me in the 21st century just been exposed to this finance product and find this is an incredible tool for investors if you know how to use it the right way.

People use options for income, to speculate, and to hedge risk. There are advantages to trading options rather than underlying assets, such as downside protection and leveraged returns, but there are also disadvantages like the requirement for upfront premium payment.

Options do not have to be difficult to understand when you grasp their basic concepts. And like any other tools, Options can provide opportunities when used correctly and can be harmful when used incorrectly.