In our previous article about NFTs, we already had an overview of this “seemingly” complex term. In today’s article, we are going to learn about its history and how NFTs can be used to help DeFi develop.

I. Historical development of NFTs

Everything has its own history. Understanding NFTs’ history may not make us rich immediately, but we should at least get a glimpse of how NFTs progressed, what it has achieved as well as will be achieving in the near future.

Early stage: Before the introduction of CryptoKitties

Before CryptoKitties appeared, the Bitcoin system witnessed the appearance of “colored coins”, that is, coins running on Bitcoin’s Blockchain with distinct characteristics. These can be considered as the first NFTs, namely the Rare Pepes (Pepes cards).

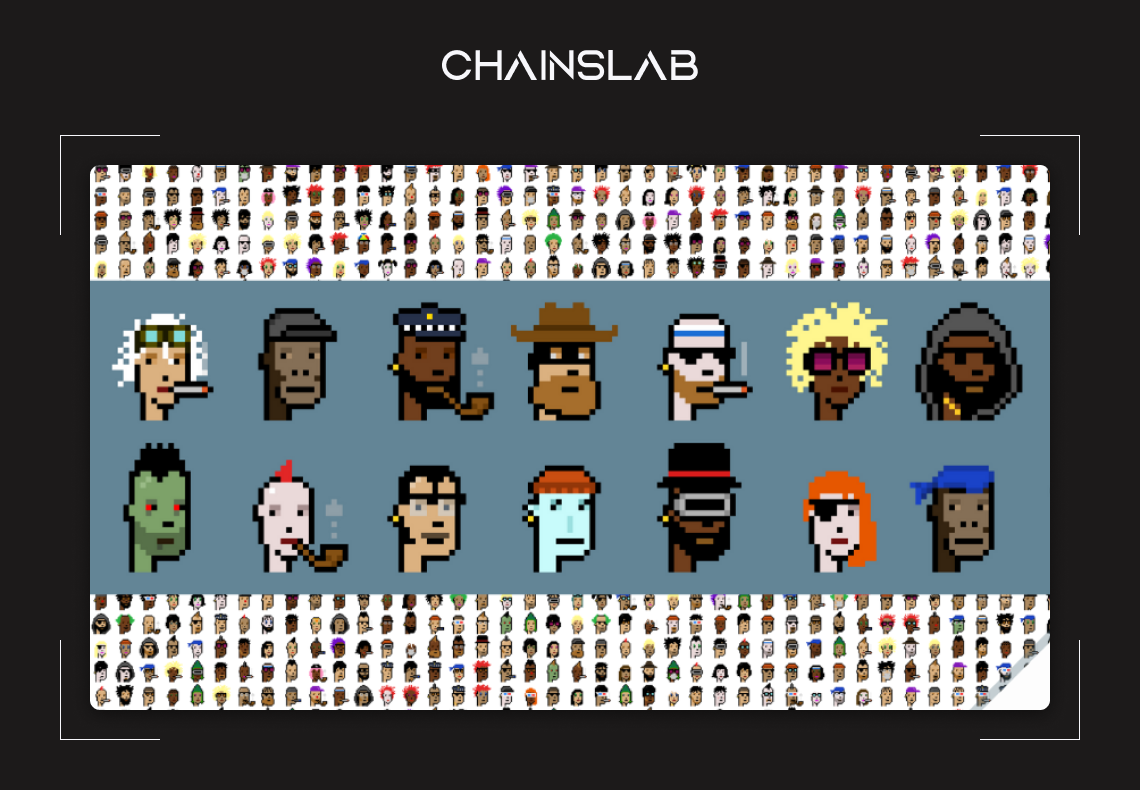

The first NFT project to be built on the Ethereum Blockchain was CryptoPunks, which consists of 10,000 virtual characters built on the ETH platform. Developed by Larva Labs, CryptoPunks also created their own trading market for users to buy, sell, or exchange using MetaMask wallet. Currently, CryptoPunks is still active, however, it is not as well-known as newer projects.

And it was the premise for the most famous NFT, which is CryptoKitties.

Inception stage: The introduction of CryptoKitties

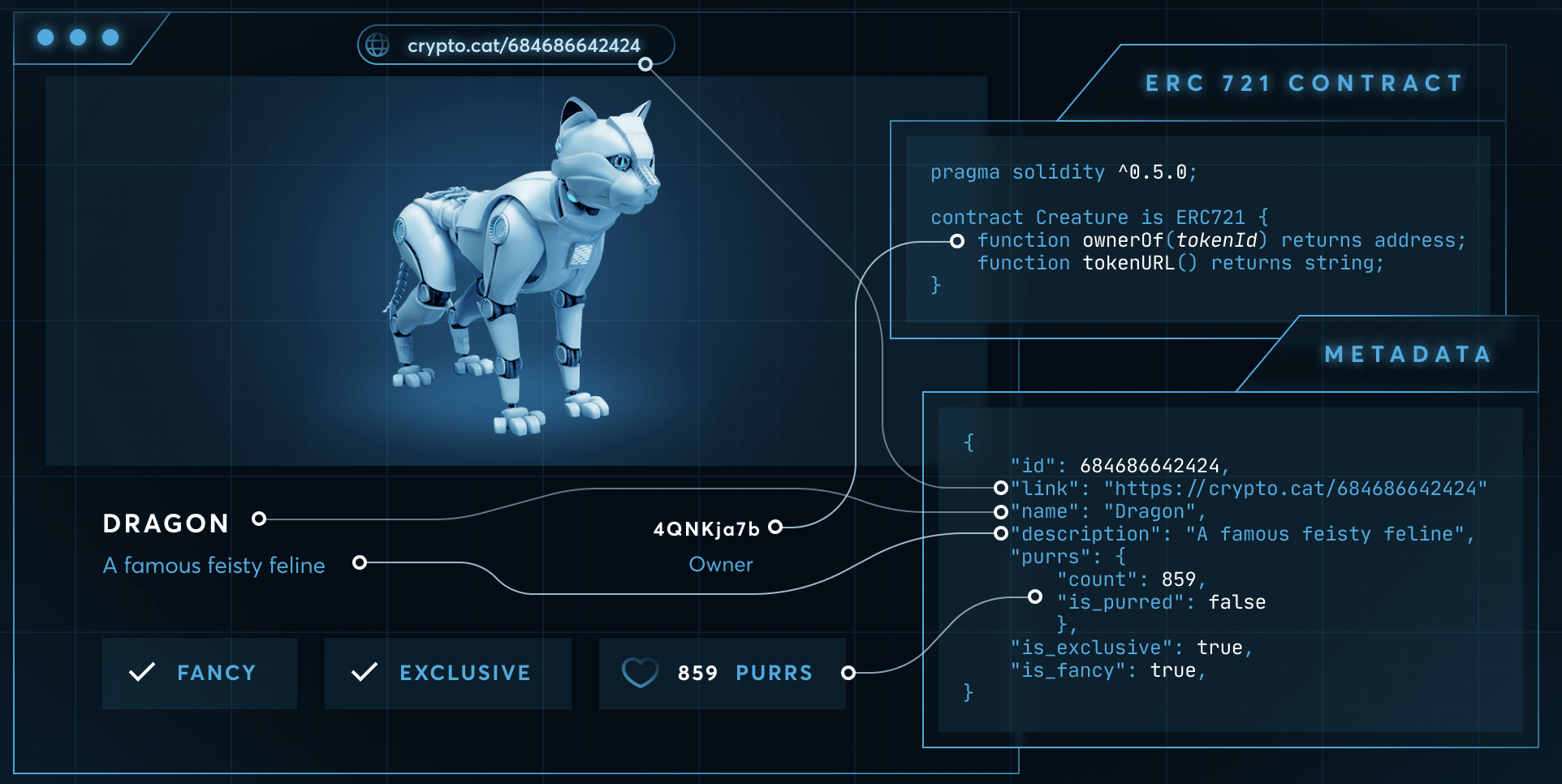

CryptoKitties was the first project to bring NFT to Mainstream. Launched in 2017, CryptoKitties is a virtual cat game, in which you buy or create a virtual cat on ETH Blockchain (ERC721 format). Then, through a special algorithm created by the CryptoKitties team, players can crossbreed cats to create their own NFT, which is a special cat with a unique personality. Although many gamers have criticized that CryptoKitties is not really the same as video games, we think that CryptoKitties is a successful project.

At the same time, CryptoKitties is considered an example for other projects to follow, such as:

- Monetization model: The monetization model of CryptoKitties is quite simple. Build “virtual cats”, “crossbreed” them so that they can breed “new cats”, sell them at a higher price, and then repeat. It is this model that has created a whole “cat farming” community, in which users constantly crossbreed to create new breeds of cats. As long as the community is alive, the game will live and thrive. During its peak, CryptoKitties witnessed 1-day transactions go up to 5,000 ETH and this volume even caused network congestion. Scarce cats such as Founder Cat #18 were priced at 252 ETH (about $100,000 at that time), or Dragon cat that was sold at $170,000. With that high price, many users rush to “feed cats” to make a profit.

- The ability to go viral: One of the things that makes CryptoKitties famous and a role-model for other projects to follow is the ability to go viral beyond the Crypto community. Why is this important? Because NFTs’ ultimate goal is to reach buyers, the more buyers the better, regardless if they know about Blockchain technology or not. And to reach these buyers, projects need to have their own stories. CryptoKitties, for example, their story is a virtual cat game with cats worth tens of thousands of dollars and a large number of players that clogged the Ethereum network. This story has been spread throughout the newspapers, causing many people flocking to search for “virtual cat” to make money.

Construction stage: 2018-2020

This is the period when most of Altcoins Market step into the downtrend which forces developers to work harder, instead of talking about million-dollar projects. With NFTs, it’s a two-layered game, meaning that games will be built on the platform of CryptoKitties. For example, Kitty Race allows you to use CryptoKitties virtual cats to race for money. Or, we have Wrapped Kitties which let users turn virtual cats (ERC721 token) into ERC20 token to trade on DEX like Uniswap.

In addition, we also see the development of many non-gaming related projects such as Digital Art (artworks on digital platforms) or Virtual World like Decentraland and CryptoVoxels. From my point of view, unlike 80% of Blockchain projects that are still struggling to find a foothold, NFTs are actually offering users real products to use.

Next, we will look at the strengths and weaknesses of NFTs.

II. The strengths and weaknesses of NFTs

In essence, NFTs are closer to collectibles such as antiques, artworks, etc, rather than assets like stocks, Bitcoin or gold. Therefore, it has almost the same strengths and weaknesses as collectibles.

Strengths of NFTs:

- NFTs offer companies a new way of making money: Imagine that your favorite football team has a Blockchain product that can be sold directly to you regardless of where you are. It could be a t-shirt with Ronaldo’s signature, sold to you with xxx ETH. That would be interesting, right?

- The ability to access to outside capital

- The ability to buy and sell personal information: As mentioned in the previous article, the customization and personalization capabilities of NFTs are quite strong, so it can be used to exchange personal information through the Blockchain network.

Weaknesses of NFTs:

- Need a lot of time to build a project for NFTs: Blockchain is naturally difficult and takes time, NFTs even requires the development team to manually customize each token

- Take a lot of effort to simplify the knowledge of NFTs: As the target audience may not have knowledge of Blockchain.

- To earn profit from NFTs, you have to choose content that provides real value. For example, interesting game projects can attract many players. And the more players, the more valuable the items

III. How will NFTs help the development of DeFi?

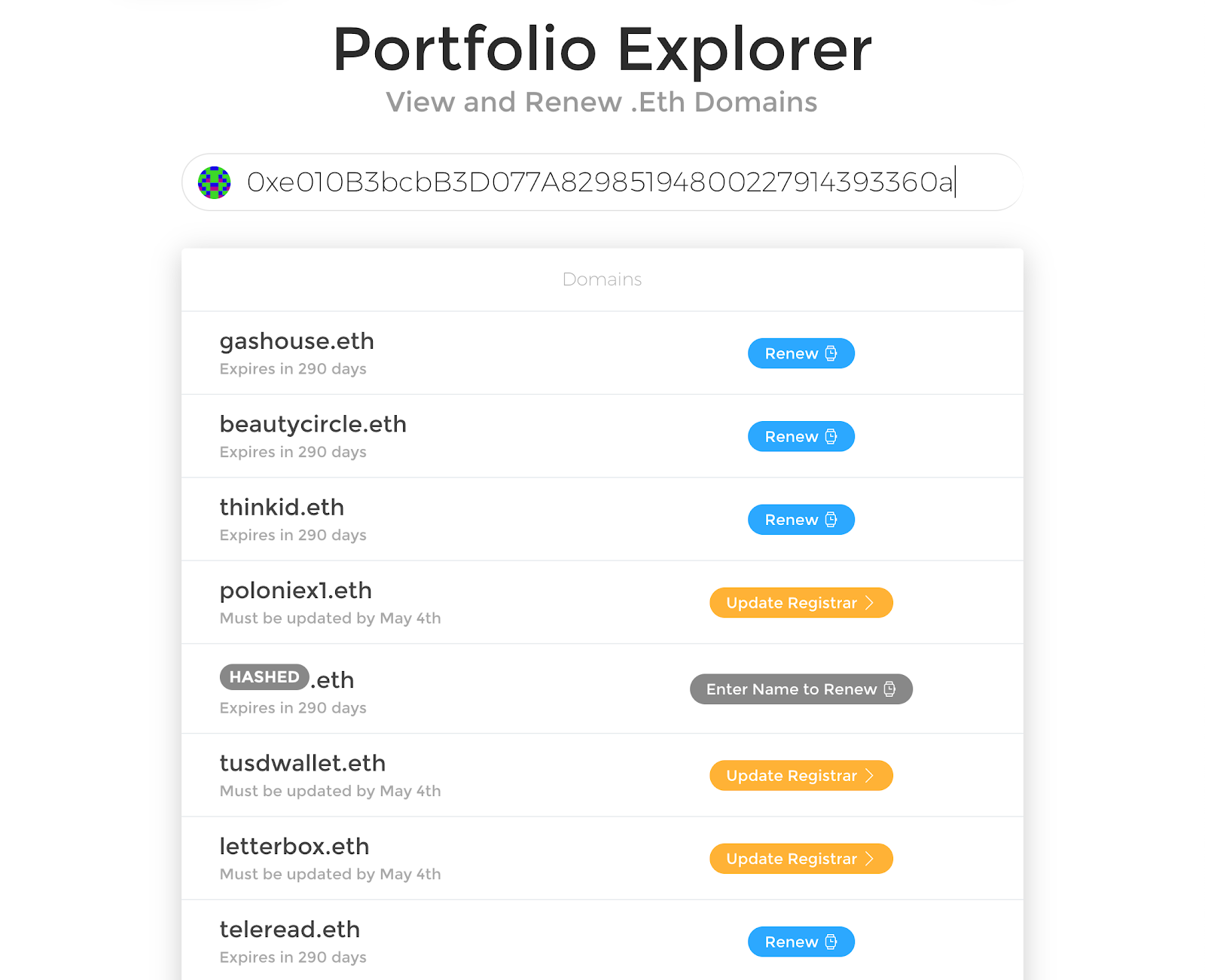

As mentioned, NFTs are mainly used in Gaming and collectibles. For example, in Gaming, NFTs can be used to create rare, high-priced items. In the future, the potential of NFTs is enormous. First, NFTs can be used to issue security tokens. With NFTs, you can digitize real assets into tokens, also known as “tokenization”. This is a trend that will happen in the future when everything has to be digitized (e.g., land, stocks) to make it easier to control. The second potential of NFT is its ability to provide ownership certificates of digital assets. Given if you buy NFTs of Apple Music or Netflix subscription, you will have the ownership of the NFTs and you can even share it to others anytime you want. Think of when you have half a month of Netflix subscription and you do not need it anymore, you can sell it to others. Save a lot of money, right?. Third, NFTs also opens up a new field: Blockchain Domain. There are companies that are aggressively hunting and investing in Blockchain domains. Instead of sending each other long domain addresses such as 0xABCXYZ...., you can have a simple address like @eth.alice or @eth.bob.

In my opinion, the biggest potential of NFTs, which Defi lacks, is its ability to digitize real assets into Blockchain.

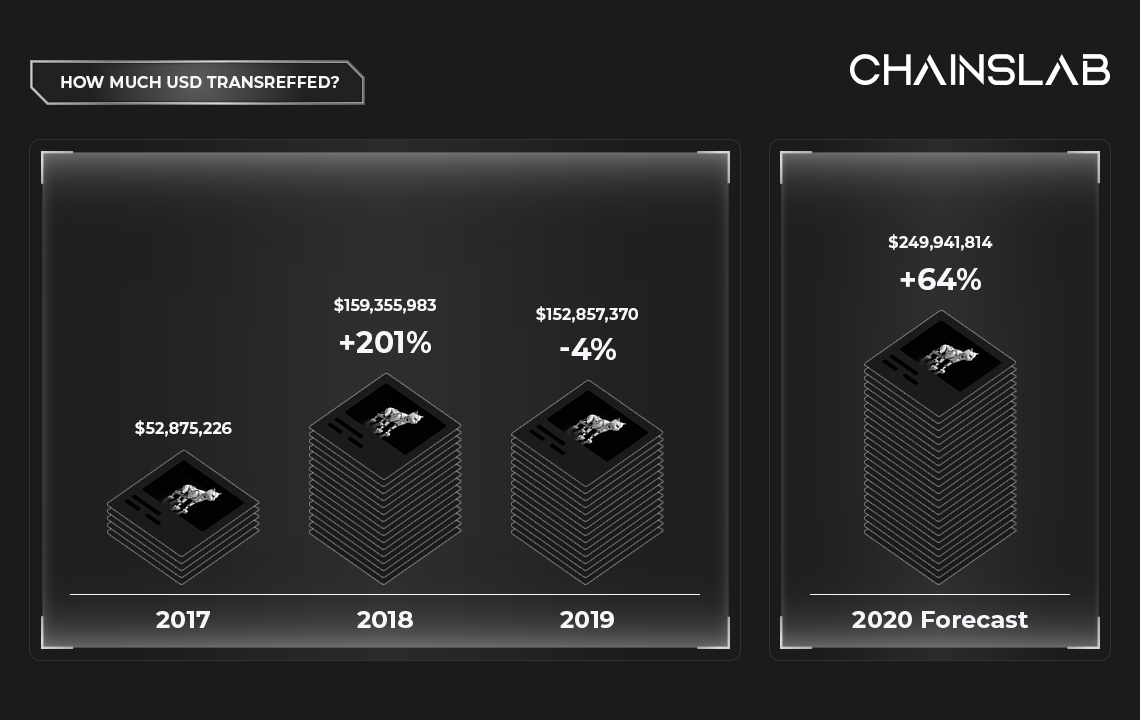

The amount of USD transferred through NFTs was $159 million in 2018 and dropped to $152 million in 2019. However, it is predicted that the growth rate will be around 50%-70% in 2020.

If you read my series about Defi, you will understand the current problem of DeFi, which is debts. For example, A borrows money from B, then lends it to C, secured by “collateral loans”. With this type of debt, when the market crashes, the phenomenon of “chain collapse” will occur and lead to bad debt cannot be paid. At the moment, collateralized assets in DeFi are risky ones such as tokens (e.g., NEO, ETC) and are not considered valuable in the eyes of investors. But, if debts in the DeFi market are guaranteed by safe assets like real estate or securities*, DeFi can be able to get access to a bigger capital.

- Personally, I don’t think securities are safe, but with other traditional investors, they may think differently.

It’s the distant future. But, to make that future a reality, we have to invest in projects that have real potential. In the following article, I will introduce some outstanding NFT projects for you to look at.