Last week was one of the craziest weeks in the Crypto space, perhaps the craziest from the beginning until today. We have experienced Mt.Gox, THE DAO hack, the Bitconnect collapse, the 2018 Hashwar, the 2020 Covid Crash, the 2021 NFTs craze, and most recently, LUNA/UST death spiral. Still, the downfall of FTX seems to break all those records and will most likely change the whole crypto industry as we know it.

Some people already know a few key events of this story, some don’t. Some were confused, lost, and angry because of what happened. Some stood on the sidewalk, spitting, criticizing, and waiting for a chance to destroy this whole industry like what they have been trying to do since the birth of Bitcoin. One thing in common, no one seems to REALLY know 100% what happened and what will happen NEXT.

I am a man who laughed and cried with crypto for the last 6 years. I want to share with you what happened from the view of an insider, an investor, a man who wants to walk a long route with this industry, and a believer.

I. The Early Days of FTX

Sam Bankman-Fried, the golden boy, was one of the fastest-rising stars in crypto space. Most crypto enthusiasts still didn’t know who he was by the year 2019. And FTX is nothing on the map, its name wasn’t noticeable up until 2021.

I still remember the first time I heard about FTX was at a promotional event that took place in Hanoi in the closing days of 2019. After 2 years of downtrend accumulation, the timing was an extremely competitive period in the crypto space, especially for derivatives exchanges. At the time, most crypto traders in Vietnam didn’t know about or have a clue whatsoever about derivatives trading (maybe a small number of players trading on Bitmex are). In Vietnam and other SEA markets then, the most famous derivatives exchange was SnapEx, with a generous affiliates program. At the same time, other derivatives exchanges come to the surface and offer high commissions rates, eye-catching UI/UX, copy-trading features, and even commodity trading to abstract traditional forex traders.

What makes FTX think they can compete with the forerunners in the local market? I raised that question at the event and got some general answers with no specific points. The only memorable thing at the event was they gave out condoms with the FTX logo and a few creative sex jokes.

Of course, at that time, I didn’t know FTX backer was Alameda, one of the key market makers on Binance. And, of course, I didn’t realize that Alameda was raising capital for FTX. I am sure that the whole crypto market at that time had the same awareness about FTX as mine.

Until the last couple months of 2020, I started to notice FTX and make trades on the exchange. I decided to put money in FTX only to bet on the 2020 US presidential election. Instead of writing down the normal betting rate, FTX tokenized the election's outcome. FTX was also the first to introduce the leverage token (BTCLONG, BTCSHORT, ...), one of their first and most effective “meat grinders.”

FTX was building up some reputation but not until 2021, SBF and FTX then saw an enormous burst, thanks to 2 surprising factors: Defi and Solana.

II. The Rise of SBF

In the 2018-2019 period, the Crypto market was a wasteland with no attractable dApps, no real usage, and no real use case whatsoever. The whole market was a giant speculation bubble. Uniswap and MakerDAO is boring with just a little number of users. DeFi and Yield Farming was the new summer breeze needed to wake up the boring sleepy market.

The concept of early Yield Farming projects was simple. If you know a few basics of blockchain and have some idle cash, deposit it in our protocol. After a short period, you will get your money back with some yummy extra yield. No work, no MLM, no nothing, just stake and get rich.

The concept of Yield Farming was innovative, but it became one big ass Ponzi game. To thank the liquidity providers (aka provide the temporary buy pressure), the project pays them with LP tokens (aka future selling pressure).

Under the impact of macro conditions (quantitative easing coming from FED), Yield Farming was a duck in the water. What would you choose between 2 options, APR of near 0% from traditional finance and APR of at least 50% (early Yield Farming projects even offer 200%-500% return)?

Of course, a hungry Sam Bankman-Fried cannot miss out on this opportunity. Alameda Research was one of the first VCs to take advantage of early DeFi protocol to either exploit their loopholes or make a lot of money (usually by farming the most tokens and dumping it on the unlucky retailers).

Talking about unlucky, we have to mention Cream Finance. In September 2020, Alameda used FTT and SUSHI as collateral to borrow CREAM and a few other tokens. After that, Alameda processed to dump those tokens, a new creative way to short selling at the time. And yes, all Yield Farming projects got REKT.

Later, Sam came out and “saved” Sushi Swap. He became the hero, and Sushi Swap successfully ground the meat. The irony came up recently.

Anyway, the thing in crypto community that makes you famous and have lots of followers is that you either give good trading signals or pump the bags of many people. And Sam has successfully in doing so, attracted a following cult with Solana.

Talking about Solana will take a lot of time. But the biggest success of SBF and Alameda is to pump $SOL from $0.8 to $240, making an illusion about Solana Summer and attracting a significant number of builders, although Rust was an unbearable complicated yet immature program language compare to others in the industry.

In fact, Alameda and FTX were the sole investors of Solana and most of the projects on Solana. At the time, with the market craze, nobody paid attention and questioned why a medium exchange could invest that much. Although the number could be faked, the money put into this ecosystem comes mostly from Alameda and FTX. And does this come from FTX users' pockets? That we cannot know by now, but one thing is for sure, a typical Solana project back in 2021 will have a list of backers like so:

What a beauty. At this point, SBF and Alameda scheme becomes pretty clear, and it works something like this.

First, launch a project to the market with a high Total Supply but with a low Initial Market Cap, as well as a low Initial Supply. For example, a project has a total supply of 1 billion tokens, 10 million tokens will be issued at TGE (Token Generation Event). With a starting price of $0.1, this project's initial cap would fall to $1,000,000, a small number when it is backed by a giant like Alameda. The token price will easily get pumped to at least 10x, even 100x. With 10 million tokens initially, the capitalization of the project will fall in the range of 10 million dollars.

Now, 10-20 million dollars in liquidity can be more than enough to push the token price up to $5-$10, and the market cap will be around 50-100 million dollars, not too big for a bull market.

But normies and plebs, even experienced traders, will forget the FDV, which can climb up to multi-billion dollars. With the token price sitting at $5, FDV will be 5 billion dollars. That means, in bad market conditions, the token price will likely be divided by 10 and then divided by 10 two more times.

Take MAPS for example. It is one of the many projects that SBF listed on the FTX and Alameda asset list.

By what level of audacity for SBF and Alameda to list a token with the below stats to a value of $616 million, I had no idea.

One thing is for sure, this is the static of 90% token on Solana that is backed by Alameda and FTX. And with that operation, I can guess how Alameda functions and why FTX collapsed.

III. The Contagion.

Alameda might be unprofit for a while, especially after the LUNA/UST crash... Even if somehow, they generate profit, it can never be enough to sponsor FTX Arena or the Mercedes F1 team. The main source of Alameda capital after the LUNA crash comes from fundraising and FTX users' funds - which is something they DO NOT HAVE THE RIGHT TO TOUCH.

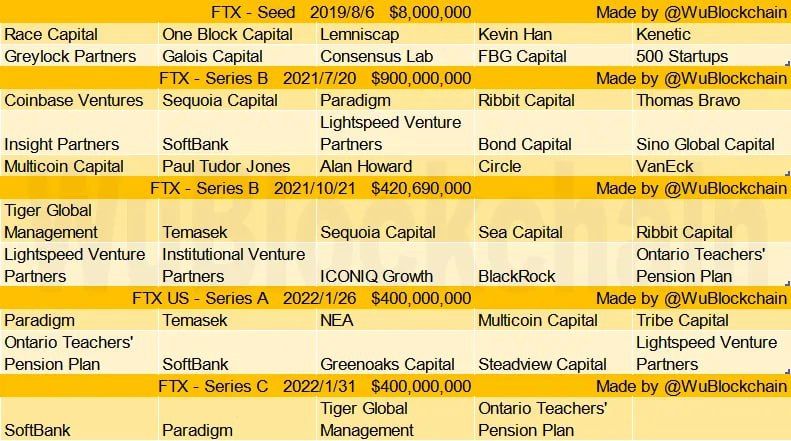

Particularly, FTX 2's most recent capital raise include $1 billion in Series B rounds in July 2021, 420 million in Series B-1 rounds in October 2021, and $400 million in Series C rounds in early 2022, raising its valuation to $32 billion. And FTX lent $10 billion to Sam's affiliated trading firm, Alameda Research.

With deals like Voyager and Blockfi, FTX and Alameda raising capital from other investors to buy these near-bankrupt or insolvent companies. Then, FTX continuously forces these companies to deposit users' money (from savings or custody services) to FTX. It’s just a freaking Ponzi game because Sam has setup multiple backdoors in order to use that money, users' money.

The irony is FTX and Alameda themself ended their own game. Of course, when you make a Ponzi game, the only matter is time. But only after LUNA/UST collapsed and 3AC and many other VCs fell, then Alameda Research and FTX collapsed, due to contagion.

Technically, Alameda was one of the attackers and short-selling UST when TerraForm Labs changed from 3pool to 4pool (FRAX-UST-USDC-USDT) on Curve. As we already know, UST depeg, and LUNA collapsed. And you might or might not know, Alameda was in-profit. But short selling with an account worth a million or billions of dollars is not as easy as an account with $500. Alameda cannot simply close their position like nothing ever happened. Contagion is here, and contagion takes down the whole market.

$FTT, $SOL, $SRM drop in price, along with those existing problems of Solana, making it harder for Alameda and FTX to raise more liquidity to pay for their expenses. The Endgame moment was FTX had to bail out Alameda secretly. These funds, as we now know, come from the FTX user's pockets. And when users try to withdraw their funds, Sam hits the panic button.

“When it rains, it pours” - Sam's emotional speech when his master plan fails.

In addition, much information is suggested about the political relationship between SBF and the Joe Biden administration. Just two weeks after Biden announced his presidential campaign, SBF lobbied and supported the political campaign for Biden's administration with an amount of up to $5.2 million. Moreover, SBF is the 6th most donor when it has spent nearly $40M to support Democrats.

- When FTX went bankrupt, much information suggested that there was a connection between FTX personnel, Sam's relatives, and the Biden government, they seemed to have an "overnight" with each other, making the Bankman-Fried family the biggest donors to Biden:

- Sam Bankman-Fried, son of Barbara Fried (Stanford Professor and co-founder of political fundraising organization Mind-the-Gap). This fund used to have the plan to spend $140M to support Democrats, determined to beat Trump down.

- Gabe Bankman-Fried, brother to Sam (also a former Jane Street trader), is the director of Guarding Against Pandemics which was founded by Sam. He was a Legislative Correspondent for the US House of Representatives and an advisor to large political donors in the Democrat party.

- The family's Aunt Linda Fried is a WEF member of the Global Agenda Council on Aging.

- The father, Joseph Bankman, is a Stanford professor who has lobbied on behalf of Hedge Fund managers before Congress before (film records exist).

- FTX's Head of Ventures & Commercial FTX Ventures, Amy Wu, started with the Clinton Foundation years ago.

- Nishad Singh, FTX Director of Engineering has spent over 8 million for Dem candidates.

- And finally, Obama's Commodity Futures Trading Commissioner, Mark Wetjen, was literally the head of FTX Policy & Regulation.

- To sum up, Sam took your money, partially donated to Biden, then Biden paid him back through favorable monetary policies incentivizing apes to pump crypto and used your money to pay off your salary later. Smart moves.

- Reports were these organizations wanted to spend over a billion dollars on the Democratic party for 2024. A massive, massive money laundering operation has just been broken open.

The demise of Sam, FTX, Alameda, and most of Solana's ecosystem went bankrupt because of one thing: no decent revenue scheme or overheating, instant noodle-style development without a logical business model. Fundraising is NOT and has NEVER been a business scheme. As liquidity in the markets shrinks, zombie firms die.

I must say, Sam's success comes from building a good image, healthy relationships with the government, and using inflated assets to raise capital. The death of Sam and this new Ponzi empire came from not being able to continue his pyramid scheme. The actual contagion comes from considering Crypto and Decentralization as a keyword to raise capital and build useless things that no one uses. This is an infection that has basically been around for a long time. It only gets worse when a scoundrel like Sam successfully fools the seemingly brightest minds on Wall Street and Washington, as well as most users who dare not imagine the scale of this scam.

The contagion won't stop there. It's already here, and it will stay here until we figure it out.

IV. What’s Left For Us?

It's been a long time since I've seen the crypto market split into two factions like this.

One faction has completely given up, no longer dreaming about the market's future. Or simply, they were just too tired. Belief is gone when those who seem to be heroes turn out to be scammers.

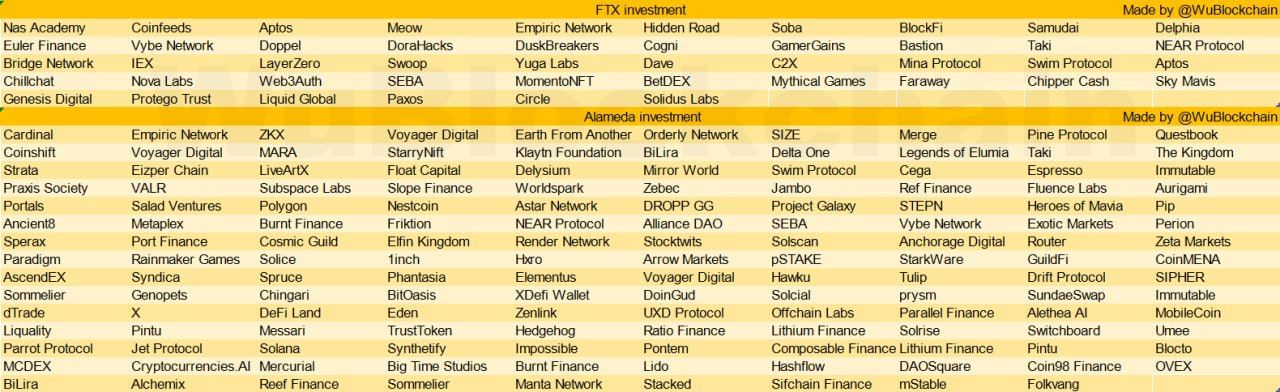

The contagion is spreading. FTX is insolvent, along with Alameda, Blockfi, Voyager, Solana ecosystem… Many VCs, including sharks and whales, have put money into it and lost it all. They will have to liquidate other investments to make up for the losses. Projects are struggling with maintaining their treasury in the bear market, now they are facing more challenges. Below is the list of VCs and investments that being affected and have connection with Alameda Research and FTX.

Other CEXs will also be affected. If they did maintain their integrity and does not touch a dime of users custody funds, they will likely turnout fine. Now the wave has receded, users are finding out whether Crypto.com, Kucoin, Gate, and MXC are still holding onto their pants. Big guys like Binance, Houbi, and OKEx will also have to undergo the stress test. Because when users decide to withdraw, they will unlikely go back in a short time. It will be hard for CEXs to keep up their profit in the near future. With CEXs. and TradFi, losing trust means losing everything. It is a Death Spiral.

But you are not supposed to trust. “Don't trust, verify.” The essence of Crypto and Blockchain is Trustless, which means you believe in the code, not the promises. In fact, what Sam does completely goes against the core of blockchain. FTX is, after all, a Centralized Exchange. We do not know where our custody assets are located, similar to when we deposit them in the bank. We are supposed to go bankless, not the other way around.

And this brings us to the other half of the market, who will double down on everything.

At the beginning of the article, I mentioned that the 2018-2019 crypto market is a wasteland. But in the past three years, everything has changed with the massive inflow of capital. DeFi is no longer a trend. It is the future. Yield Farming won't just come from Ponzinomic. Yield will come from profits. GMX or GNS is one of the names that is doing quite well at this. Both Web3 migrations, NFTs, and NFTs Gaming trends in the future will also do much better than in 2020-2021. The basic elements of decentralization remain the same. The game has been reset, removing most of the bad actors.

I've been joking with everyone for a while now that life rarely gives anyone a second chance. But this time, that second chance is here. If Alameda and FTX didn't burst in the last period but continued to maintain the Ponzi scheme for another 2 years, nobody would know how big it would become. But with Alameda, FTX, and other weak bloods being cast out of the game, the industry has been cleaned up a lot. Now it's time for young and hungry teams to set their eyes on the prizes.

Those who remain, of course, will have to face many challenges. US and EU regulators will make those regions become a living hell for startups that want to apply for a license. The percentage of dApps users who are crypto investors will plummet over the next two years. Difficult funding, economic downturn, as well as lack of liquidity will still basically looming over the crypto market. Regulators used to have intentions to censor every crypto-related aspects and now will start to enforce it at a much higher level. Despite FTX being CEX/CeFi, regulators won’t give a shit about it anyway. They will start with the centralization of Ethereum validators, and crack down on other CEXs on licenses. New CEXs will rise, but this time those CEXs might be actually controlled by big corps and banks.

Old CEXs will remain even though they must face many challenges. Proof of Reserve is now a must for every CEX, which means it will be harder for them to do shady kinds of stuff behind the user’s back. And no shady stuff is equal to harder to grind those normal retailers for profits. The demise of FTX leaves a big hole in the industry, and their competitors like OKX, Bybit, or Houbi will try to abstract users to their sites. The cake will get a little bigger, and winning that piece of cake will be the decisive factor in mass onboarding users for the next cycle.

But a new cash flow is still smoldering outside the market. This is whats called “sitting dry powder.” Next cycle rising projects will have a lean but experienced team, who generate real revenue from the services and dApps that they built. User experiences will also be heavily considered, as the next cycle will onboard mass adoption from Web2 users. Whether it's DeFi, NFTs, Gaming, Entertainment, Payment… or any other field, the next cycle will surely be full of liquidity. One thing is for sure, financial firms and funds love nothing more than a market with global liquidity, so they will return and pump up everything hard.

DeFi will be the key contributor to the rise of the 2024-2025 cycle. With a high possibility that macro factors will be relieved, FED will ease their policies to fight recession, chances are money will be pouring into Def againi. This is the second chance for DeFi to thrive and to prove that it is not just a Ponzi scheme but the future of the financial system.

“All roads lead to Rome”. And decentralization as well. The decentralization thesis will appear in every field, DAOs, Defi, NFT games, Web3 apps… Those who definitely thrive in the future. Not to mention new and revolutionary concepts will appear and dominate the next bull run. For now, you just have to prepare your mindset and skill to catch those next waves. And this time, just don’t miss.