Cryptocurrency market has rebounded drastically over the past week, with all attention on The Merge, which will consolidate the current Ethereum Mainnet with the Beacon Chain proof-of-stake confirmed to take place around September 19. And this led the Ethereum price to outperform other competitors with an increase of nearly 60% month-to-date, from around $1,000 to over $1,600.

Ethereum price in the last 30d -CoinMarketCap

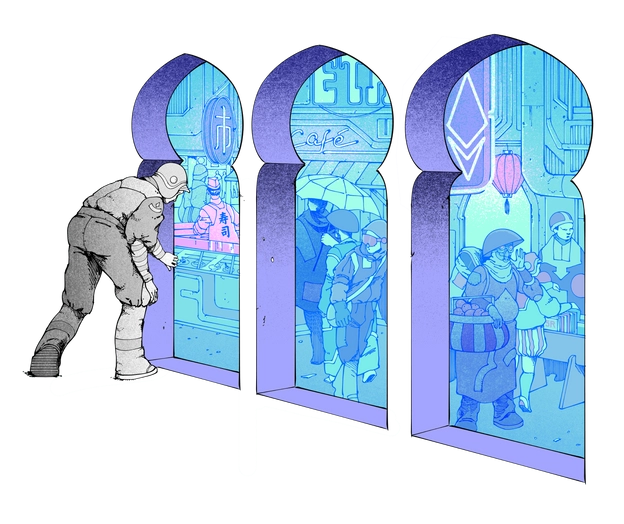

What is The Merge?

The Merge represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake consensus layer, the Beacon Chain. It eliminates the need for energy-intensive mining and instead secures the network using staked ETH. A truly exciting step in realizing the Ethereum vision – more scalability, security, and sustainability.

The Merge presents the official switch to using the Beacon chain as the engine of block production. Mining will no longer be the means of producing valid blocks. Instead, the PoS validators assume this role and will be responsible for processing the validity of all transactions and proposing blocks. The Beacon chain (ETH 2.0) will be the consensus engine for all network data, including execution layer transactions and account balances while the Ethereum Mainnet (ETH 1.0) will be the execution layer which handles transactions and executions.

The Merge is not meant to completely replace the existing ones, the two of best systems will work together. The Ethereum Mainnet contains all its network accounts, balance, smart contract, state and continues to be secured by proof-of-work (PoW) under mining power of miners. Meanwhile, the Beacon chain runs in parallel, using proof-of-stake (PoS) that is secured by staked ETH in value of billions of dollars.

So What Will Ethereum Actually Get?

Everyone can access the papers published by the Ethereum team, but probably won't be able to fully understand. So the author is going to interpret in our language. To be specific, the Merge will bring two main things to the network. Security and Efficiency.

Security

The first one thing that the author wanted to mention is economic security, which is the amount of money that an attacker would need to perform a 51% attack. And right now to go attack Ethereum network, he needs on the order of let's say five to ten billion dollars and with the transition to PoS this is going to grow to 15 billion dollars and it has a lot of room to grow well beyond that as more if ETH going to be staked and as maybe the price of if goes up.

The economic security which is the total amount of each state has grown tremendously from basically zero at the very beginning all the way to 13.8M ETH today (as stats) which is roughly $20B. And the reason why it’s called Economic Security is that the amount of dollars an attacker would have as a would need, as a budget to go attack the chain to perform a 51% off Pos attack ,it would be the equivalent on PoW to buy enough proof of work of the mining rigs connect them to the grid and go attack Ethereum. Next few months, ETH can completely remove the PoW component and all the transactions which are currently being secured by PoW will then be secured by PoS.

Another big security upgrade is the notion of penalties. PoW only can reward the miners, it is difficult to penalize them. The reason is that there’s basically no way to either retract rewards that the network already gave them or destroy their mining rigs. Whereas, PoS has a setup where every unit of stake and the state can be reduced or completely removed. It means that if there is a 51% attack then the chain can recover. So in the context of PoW if someone can 51% attack for a period of time that can 51% percent attack essentially indefinitely while PoS has a healing mechanism where the chain can identify the attacker and remove them from the system. In the process of doing so, it increases the scarcity of assets because some ETH has been destroyed. One of the properties of this healing mechanism is that we can actually put a bound on the number of times a chain can be attacked so if there is, let’s say 10 million if which is honest and staking. Then in order to perform an attack on the network he needs at least another 10 million ETH and when he does perform the attack, he is going to lose that 10 million ETH.

The end goal for ETH as shared by Vitalik, is to become the settlement layer for the Internet and ideally trillions of dollars of economic security and have a platform where people have enough trust to go build infrastructure on top of it. Personal thought, the economic security after the Merge will make Ethereum become the most secure blockchain on Earth and distinguish itself as a monetary asset and could become the money for the Internet of value.

Efficiency

A greener Ethereum. According to the Digiconomist, ETH uses 0.1-0.3 percent of all the electricity produced in the world. After moving to PoS that’s essentially going down ~99.95% to almost zero, at around 0.01 Twh/yr compared to 112 Twh/yr of ETH PoW or 200 Twh/yr of Bitcoin. It’s roughly speaking at a 11,200x reduction in the electricity consumption. The other improvement is related to issuance, that’s created out of thin air to fund and subsidize the security of the chain and incentivize consensus participants to show up. PoS needs roughly 30 times less issuance per unit of security than proof of work. There’s 30x increase in efficiency which means we can have drastically less issuance. In fact, PoW issues 13.5k ETH every single day compared to 1600 ETH after the merge. 8x reduction in issuance as opposed to having to wait 12 years in the case of Bitcoin halving.

The barrier to entry to becoming a consensus participant is definitely reduced and that could lead to more decentralization. For example, you were not previously and you’re currently not a PoW consensus participant but you’re a PoS participant and you can do that from your home on a very low powered computer. ETH distinguishes itself in the sense that it supports many validators so ETH today has over 400k validators whereas the PoW mechanism might only have hundreds or maybe a few thousand validators. So having this capacity to have many validators is kind of one of the requirements for the barriers to entry to be a solo validator.

How The Merge Impacts on ETH Supply?

Ethereum is in a very unique position in the context of money. Because after the Merge, the amount of ETH that is being burnt through transaction fees, for this mechanism we already know EIP1559, is actually greater than the amount of ETH that is being issued on the Beacon Chain.

ETH Supply After The Merge in Stimulation Mode.

Since the burn button was activated on August 5, 2021, the network has burnt 7500 in every single day compared to the issuance of 1600 after the merge. So it’s pretty clear that the supply will start going down and at the point of the merge, the supply will reach a peak at around 120 million. Then it will start going down and find a new equilibrium at lower. It comes out to be deflation.

ETH Supply Projection.

What About Scalability?

As we all know, current blockchain networks are suffering a problem known as blockchain trilemma. When ETH is upgraded to the PoS mechanism, it is possible that as mentioned above, the two issues of decentralization and security have been improved to a higher level. However there is a problem of scalability.

The past year was a pain for DeFi and NFT participants on the Ethereum ecosystem when the fees paid for transaction activities, which have sometimes reached hundreds of dollars and the network is constantly congested. Similar to the scaling story of the Internet 20 years ago, it was maybe difficult to download a video or even an image and nowadays we have instant video chat with a lot of people. There are three 100x scaling technologies in the future.

The first is roll-ups. According to the rollups-centric roadmap was published by the founder Vitalik. It can be said that after completing the Merge, Ethereum will only act as security layer or base layer. Don’t be mistaken with the fact that even after the Merge, the gas fees still have not reduced and transaction speed even faster. The idea here is that we all are only going to use Ethereum to settle the data of the transactions, not to basically agree or not to perform execution. Instead, the execution will happen off-chain either with optimistic rollups or using fancy mathematics called SNARKS. Mostly, with the large amount of transaction demand in a day, like we did in the last bull season, it turns out that most people are willing to pay 1% for the transaction cost and 99% for the execution cost. So with these layer 2 scaling solutions, the network can remove this 99% gas cost for execution. Meanwhile the network gets a 100x scale to skip scalability boost with roll-ups, from technically 10 tps to 1000 tps.

The second improvement is sharding, also known as the brain of Ethereum 2.0. The idea here is to provide the nervous system the information to collect, execute and transmit to the other organs of the body to process. So are the roll-ups, providing more data to consume. Right now, the Ethereum mainnet is in a position where every consensus participant does the redundant work of downloading all the data then the whole Ethereum blocks before they can sign off and validate on them. So the idea of sharding is a clever mechanism where every validator only has to download a very small portion of the block and so that allows us to have much larger blocks. This will also lighten the load for each validator who will no longer be required to process the entirety of all transactions across the network. So the roll-úp can have another multiple, let’s assume 100x more throughput. So that brings us from a thousand tps with roll-ups to a hundred thousand tps.

Source: The Ethereum Team

The third technology is bandwidth. It turns out that we can kind of get it for almost free due to the improvements of the Internet infrastructure from the telecommunication service providers that keeps on growing every single year. When the bandwidth speed is high, it means that data downloading will no longer have the problem that we often call the “bottleneck”.

Source: Internet

The Collapse Of Giants

But so far, we have seen a large amount of ETH staked by putting in pools through exchanges or staking protocols could be mentioned as Lido. And surely everyone remembers the domino effect from the depeg of steth, which led to the downfall of many well-known asset management firms and venture funds like Celcius or 3AC.

Calculate stETH to ETH (stETH-ETH) | CoinMarketCap

There are a lot of risks that come with delegating and going through a pool, around slashing and correlated failures. Just try to think that if an operator starts misbehaving then it’s possible that there could be a case for the community to come together and slash that stake. Basically, it means “not your key, not your coin”.

With so many crypto firms like Luna, 3AC, Celsius, Voyager, and Vauld declaring bankruptcy over the last few months, there are concerns about the viability of Lido Finance. Lido has become a market leader in the crypto space for offering users the ability to exchange ETH for stETH. Lido currently accounts for 31% of deposits on Beacon Chain with more than 4.27 million ETH locked up in Lido’s smart contracts — approximately $7.25 billion at today’s prices. However, with the market volatility of the last few months, many of the aforementioned bankrupt crypto firms have had to liquidate their stETH positions causing the depeg from ETH that many are trying to arbitrage. The interconnectivity of crypto firms has on multiple occasions resulted in a chain reaction. When a major firm like 3AC collapses, there is the potential for the contagion to take down other firms. Some have referred to this chain reaction as the Web 3 domino effect. It is unclear if Lido will be able to withstand the Web 3 domino effect and survive until Ethereum 2.0 is deployed.

It is worth considering macroeconomic conditions and the potential implications for the crypto market. Those who are buying up stETH are assuming markets will go up or at least remain stable. There is the possibility for ETH to tank further by the time The Merge happens and could negate any potential gains from the arbitrage opportunity. This is unlikely but then again we saw 3-digit ETH this year so anything is possible.

So What Does It Mean For Investors?

Billionaire Mark Cuban has been quoted saying he’s bullish on Ethereum’s upcoming merge. The signs are all there for the Ethereum blockchain to maintain its status as the leading smart contract blockchain and possibly become the new leader in cryptocurrency.

For ETH holders, the transition to PoS mechanism will easily help you become a solo validator on the network when you only need to stake a minimum of 32 ETH and with a node operating cost of only about 10$/month provided by clients. While you get back up to 4.2% APR. After the Merge, this yield will jump higher as transaction fees, which currently go to miners, will go to stakers and validators instead. In addition, when ETH 2.0 officially comes into operation, it is also the time when projects on layer 2 scaling solutions may explode. And the necessary requirement for an ecosystem to develop is liquidity. You can deposit ETH into liquidity pools to get juicy APY.

For non-ETH holders, although the ETH price has increased quite strongly in the past few weeks, there is still a chance to flip for quick profit. According to the announcement from the Ethereum team, the Merge will officially take place on September 19. So we can expect a new money flow pouring into Ethereum's ecosystem, DeFi and NFT from retail investors in upcoming months, leading to an increase in token price.

Bottom Lines

With numerous delays already, many are justifiably concerned about if and when The Merge will actually happen. The Merge has already been delayed 6 times with the most recent occurrence happening back in June when the “difficulty bomb” was pushed back to September 2022.

The Merge is the biggest blockchain upgrade in history. We should believe the upgrade will be a crucial step towards delivering a highly scalable and environmentally friendly framework, allowing users to interact with dApps living on a very secure and decentralized platform, while also paying low transaction fees and experiencing a less congested network. The long-awaited merge is a pivotal point for Ethereum as well as for the whole crypto industry.

A reduction of Ethereum supply in circulation would almost certainly be positive for the price. Supply should contract rather than expand over time. So the author thinks that will be a huge boost to Ethereum’s investment narrative as a store of value, against inflation. But in terms of buying and selling decisions, “buy the rumor, sell the news” makes the crypto market more susceptible to a phenomenon. Prices soar on speculation about a particular event then fall when it actually happens. As an investor, try to keep a long-term perspective rather than just buying a bunch of tokens in the short-term hype.

In conclusion, the impact of the Merge on the price of ETH is an incredibly important milestone for Ethereum that will make the network more valuable and maintain its position as the “Queen” in crypto market as the dominant smart contract platform for the foreseeable future.