I. The Context

The decentralized finance (DeFi) ecosystem is experiencing exponential growth, with numerous Layer 2 solutions emerging to address the scalability and transaction cost challenges that have hindered blockchain networks. These Layer 2 protocols are currently locked in fierce competition, vying for dominance in the rapidly evolving market.

The recent data (https://l2beat.com/scaling/summary) suggests that Arbitrum One is leading the charge, commanding a 55.14% market share with a TVL of $5.4 billion. Other strong contenders include Optimism, with a 27.08% market share and a TVL of $2.65 billion, and zkSync, which has a 4.09% market share and a TVL of $401 million.

As the race for dominance intensifies, the DeFi landscape continues to transform, with the market witnessing significant growth and adoption of various Layer 2 solutions.

At the moment, not just Layer 2 War is happening, the battle of SocialFi is no less intense. We have projects that tackle the SocialFi infrastructure like Lens Protocol or DeSo. We have dApps that serve a special niche of socializing like Hooked or Audius. Most recently, we have witnessed the enormous growth of friend.tech, even in its beta phase.

Now a new player shows up, to challenge both Layer 2 and SocialFi. It’s DeBank.

DeBank is a familiar name in the industry, most DeFi degen has heard of it, a long time ago. It has been around since 2020, as a go-to place for all your DeFi needs. It is a DeFi dashboard that allows you to keep track of all your assets, on multichain, in one place.

They have done an extremely good job as a DeFi portfolio tracker. But why do they even need to battle in the L2 War? Why do they want to jump into the SocialFi battle?

With the vision of becoming the “asset layer for social”, we think that DeBank is not just making a bold move, rather it is a carefully-calculated step forward for the platform itself. Imagine, a Layer 2 and a social platform that already has 200,000-plus active daily users.

In this article, we will uncover what is DeBank and does it’s worth your attention.

II. What is DeBank?

The journey of DeBank is quite impressive, to fully understand DeBank, we need to walk in its history.

DeFi Dashboard

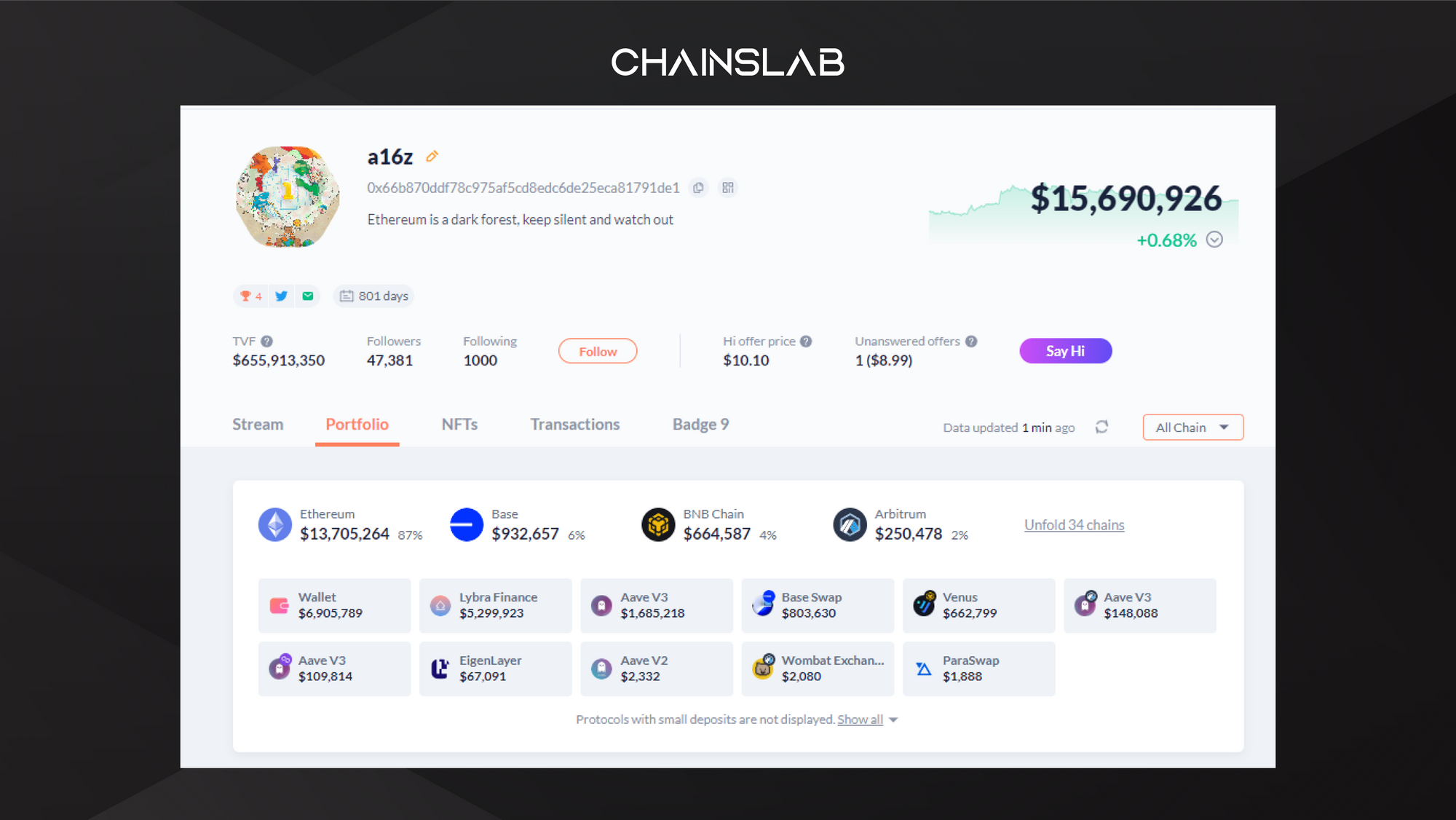

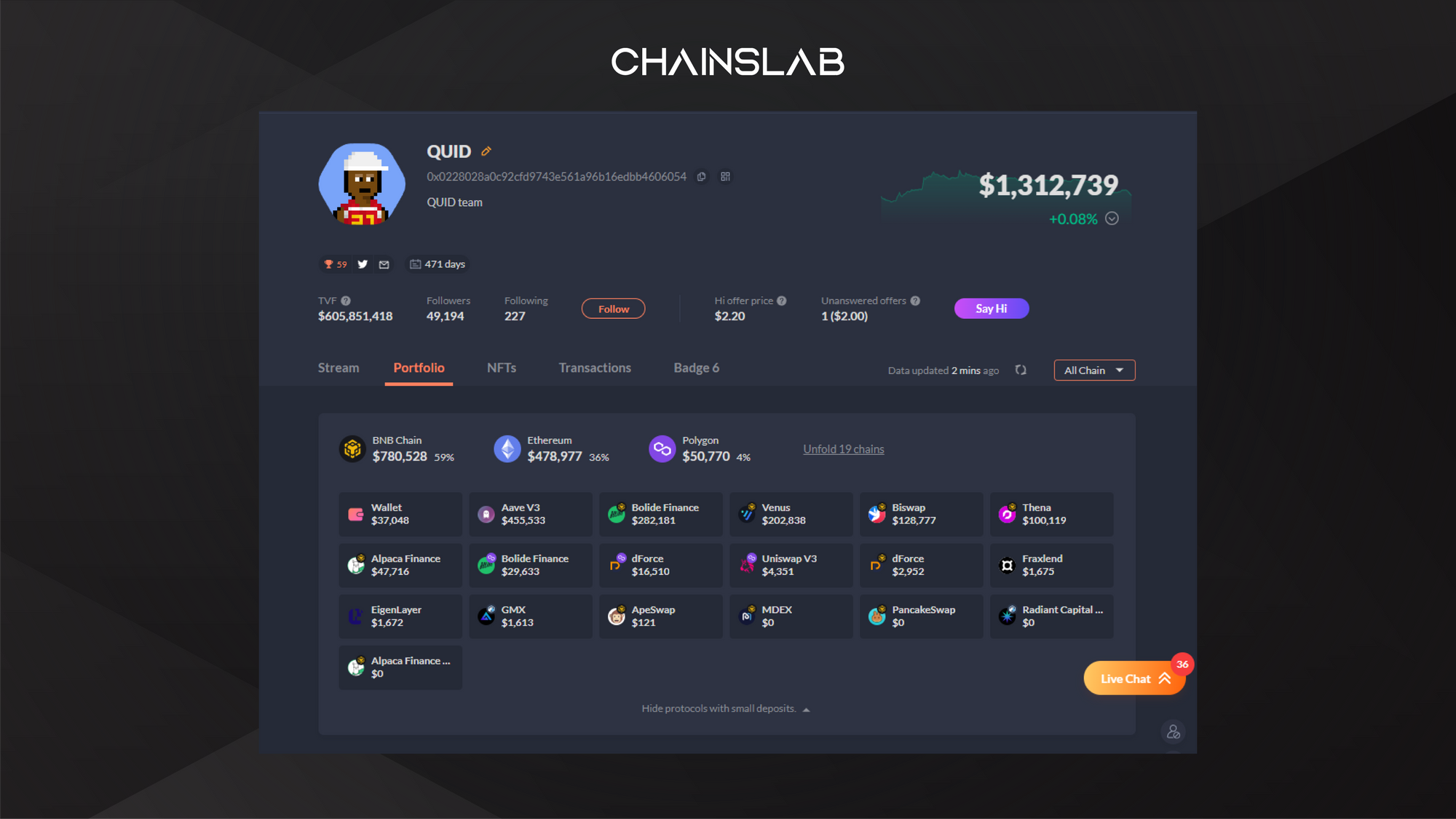

When DeBank was launched in 2019, its selling point was the portfolio management feature. Back then, DeBank was only a DeFi dashboard that allowed you to keep track of your DeFi portfolio, on more than 800 protocols and 15 different chains.

It provides users with a simple and visually appealing overview of their holdings, positions, outstanding debt on loans, and pending rewards. The platform offers a range of features, including:

- Portfolio Tracking: Users can view and manage their DeFi holdings, track their asset allocation, and monitor the performance of their investments in real time.

- Yield Farming Analytics: Debank provides data on yield farming opportunities, showing users potential returns, risks, and rewards for participating in various liquidity pools and farming strategies.

- Lending and Borrowing Statistics: Users can access data on lending and borrowing platforms, including interest rates, total value locked (TVL), and other relevant metrics.

- Protocol Overviews: Debank offers detailed information and insights into various DeFi protocols, helping users make informed decisions about which platforms to use for their specific needs.

- Wallet Connectivity: Users can securely connect their wallets, such as MetaMask or other compatible wallets, to DeBank to access and manage their DeFi assets conveniently.

Until now, DeBank has gained popularity among DeFi enthusiasts, traders, and investors for its user-friendly interface and real-time data tracking, making it easier for users to navigate the rapidly evolving and complex DeFi ecosystem.

Web3 Messenger

In October 2022, DeBank launched a new feature called DeBank Hi, which enables users to send on-chain and encrypted messages from wallet to wallet. According to the DeBank Hi whitepaper, they are selling Attention-as-a-Service (AaaS).

They want to monetize the user’s attention so that every time a user logs into DeBank Hi to read a message sent to them, their attention to the sender of the message is rewarded. https://debank.com/hi-whitepaper

The mechanism is quite interesting, when your attention is your asset, and that asset is represented as an NFT with its own price structure. Users on the platform are paid to receive messages, creating a “market for attention.”

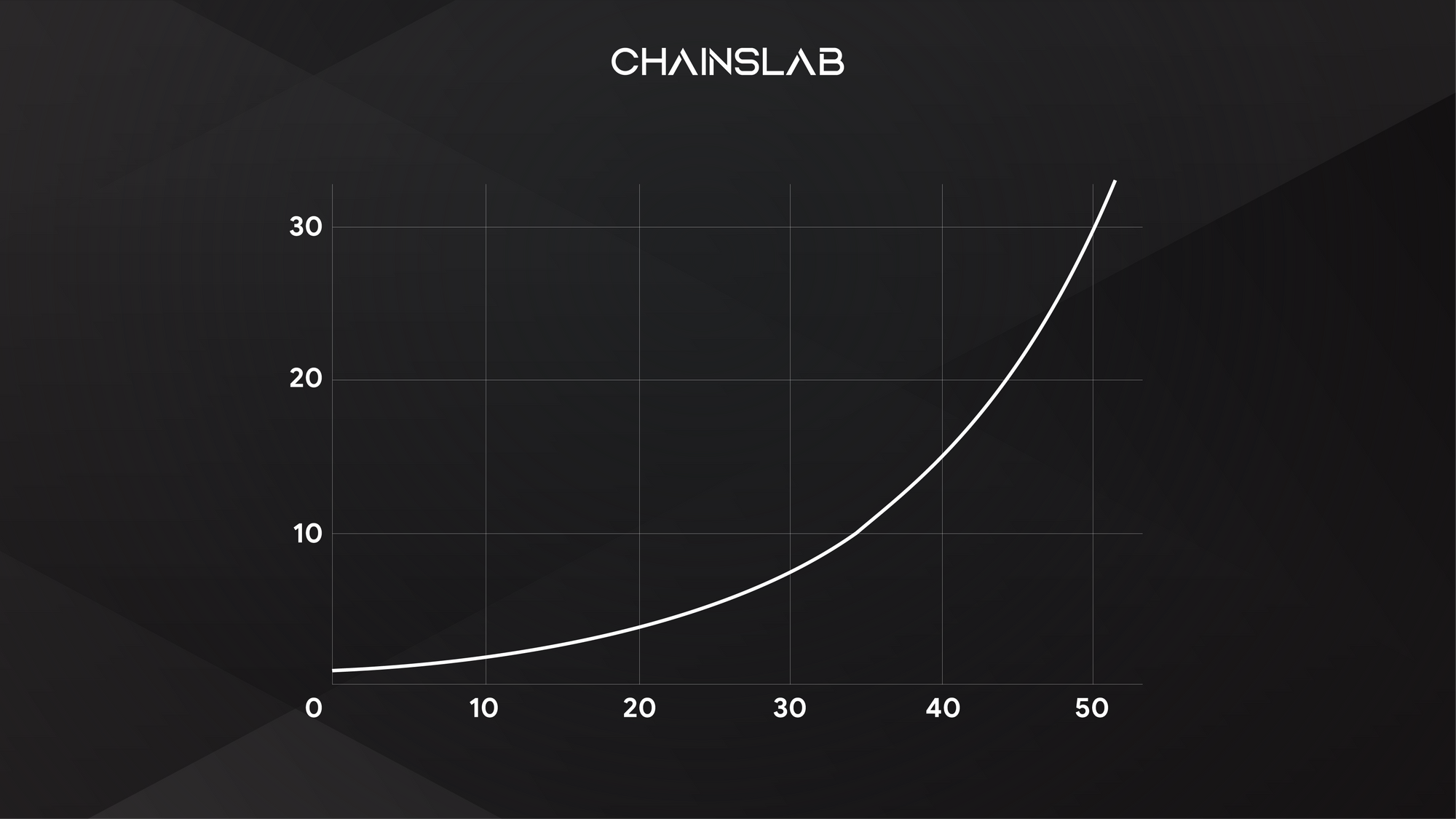

The message price will be determined by an offer price curve. The price of sending user X a message will increase as that user receives more messages (and the messages remain unanswered).

Simply put, your Attention Asset is much more expensive when you become more popular.

DeBank has over 200,000 users registered on its Ethereum layer-2 network, per a Dune dashboard by Stakeridoo.

Once again, the idea of DeBank is not new, but its approach and execution are what make it different. This feature indicates the shifting of DeBank, not only as a DeFi service, but as a potential enormous super-app.

Social Platform

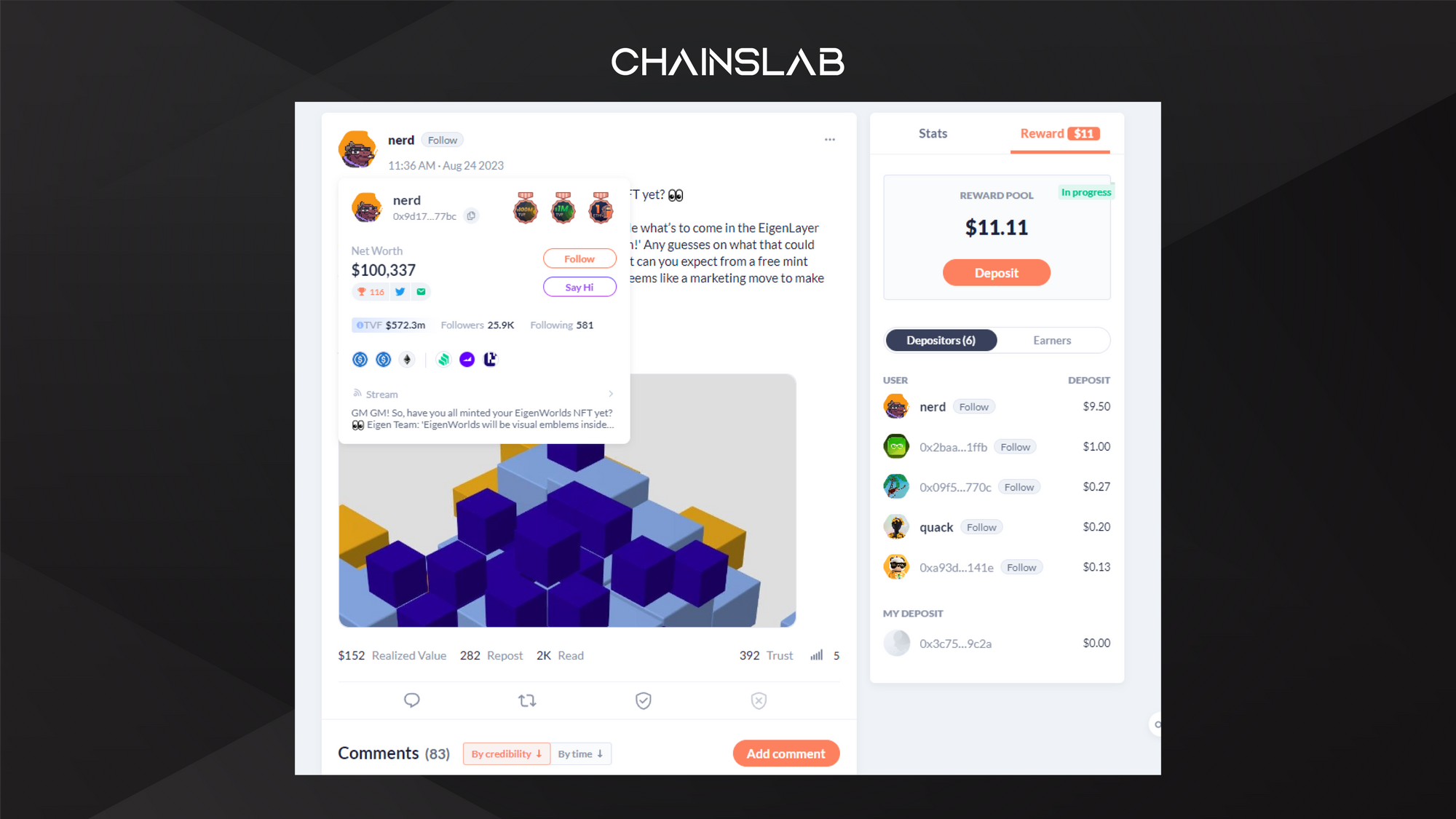

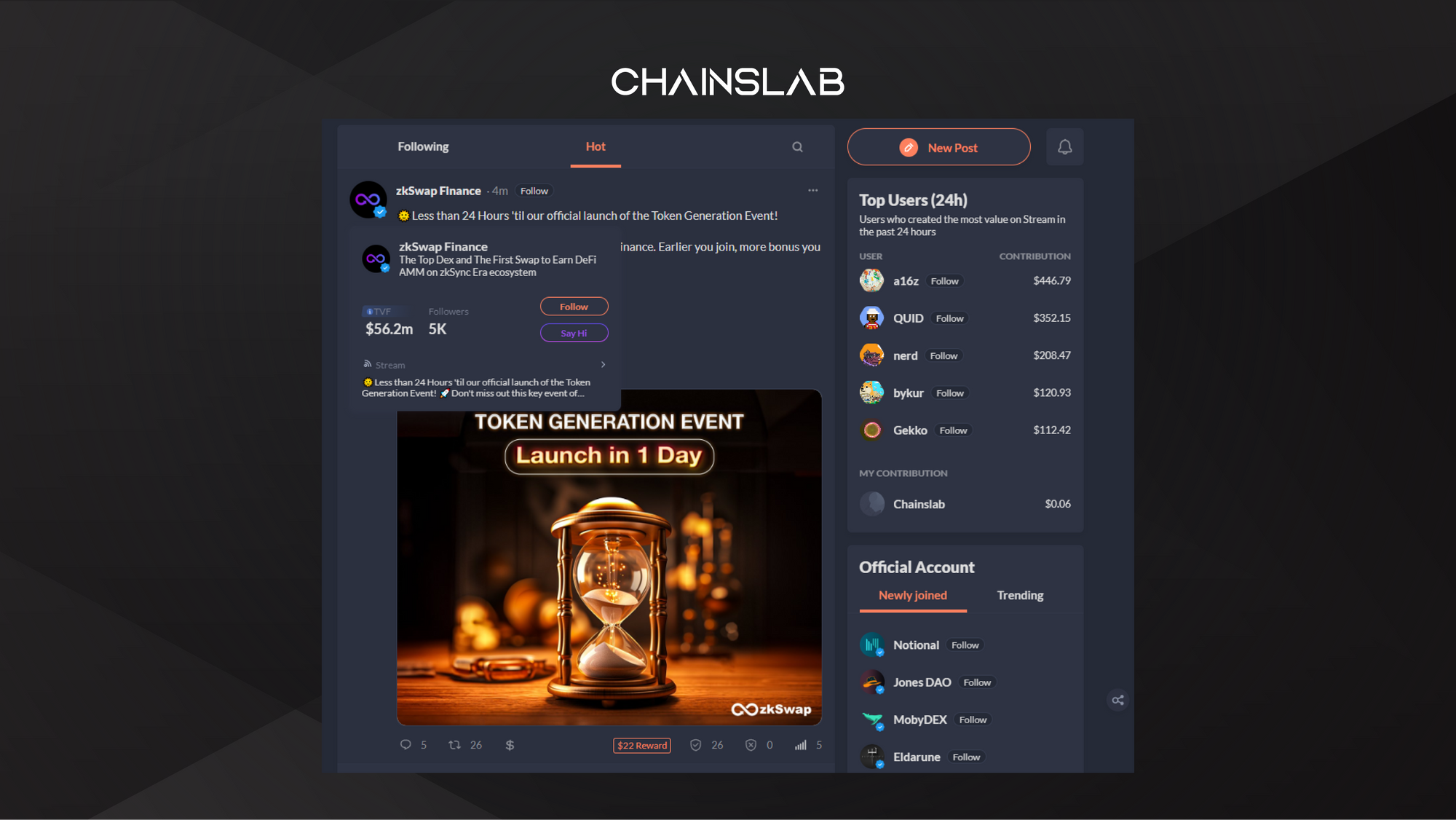

DeBank Stream was later released this year, and this one really caught my attention, since we are in a complicated market, and the term SocialFi is on the verge of exploding.

DeBank introduced its social media feature in April 2023. The DeBank Stream works like Twitter but for crypto enthusiasts, users can post and engage with other users’ posts. DeBank Stream will credit users for their every action on the platform, including posting, reading, commenting, and reposting.

Once again, DeBank proved that it is a well-designed and very well-constructed platform. No lagging, no bugging, and the platform operates smoothly, with more transparent info about the money.

The cool thing about DeBank Stream is it is based on its existing wallet-tracking platform. When you see an influencer talking about a new alpha, you can see whether their wallet has a stake in that token or not. Everything is recorded on-chain, so there is no liar here.

Another interesting idea of DeBank Stream is the TVF (Total Value of Followers). You may not have a lot of money in your wallet, but you might be a good content creator. The more good content you have, the more followers you have, and therefore the more TVF you have. This reminds me of the model of Friend Tech: Your network is your net worth.

The system may sound rather complex but it is pretty simple: Engagement is the fuel of Streams; the bigger bag you have, the more you earn!

The Layer 2

The landmark moment arrived on August 11, 2023, as DeBank unveiled its game-changing product, DeBank Chain, to the community. This innovation, built on Optimism’s OP Stack technology, strives to redefine the concept of social asset management.

1/7

— DeBank (@DeBankDeFi) August 11, 2023

We're excited to announce DeBank Chain, aiming to become the Asset Layer for Social!

We're launching the Testnet today and it's planned to roll out the Mainnet in 2024. pic.twitter.com/Do1hwJtPGj

Called itself the “Asset Layer for Social”, DeBank Chain promises to: minimize gas costs, offer a native Account-Abstraction-like experience, and ensure the safety of L1 assets.

- DeBank Chain has made significant progress in optimizing the consensus mechanism, and the gas cost of a single transaction can be reduced by 100 to 400 times. Officials also said.

- In terms of bringing a next-generation level of user experience, the chain provides an account abstraction system similar to the chain le in vel and integrates it natively. This allows users to enjoy a near-Web2 experience while remaining 100% compliant with the EVM standard.

- In the new account system, transactions support the use of exclusive L2 private keys for signatures, which reduces the use of L1 private keys in usage scenarios and enhances the security of users’ L1 assets. This also provides a basis for users to perform more frequent operations.

By becoming Layer 2, DeBank offers its available resources in terms of users, technology, and data for new protocols built on DeBank Chain. Moreover, DeBank includes totally new components and experiences for users with projects created on the DeBank Chain in terms of lending, borrowing, farming, trading, and so on.

In Summary, DeBank is not just a portfolio tracker, but rather a super app that helps you connect with the DeFi world. It is an Asset Layer for Social.

III. What’s good about DeBank?

DeBank was founded in Shanghai in 2018. The DeBank founding team is Chinese software engineer Hongbo Tang and his partner Xu Yong. Other prominent members of the group include Guo Haochuan, Ma Yiwen, Sacho and Wang Yanqing.

On December 28, 2021, DeBank announced that it raised $25 million in a new round of funding that was led by venture capital firm Sequoia China, bringing the company’s total valuation to $200 million.

Although DeBank did not elaborate on how it plans to use the funds. But with what we have seen by now, the firm has used the cash to scale its products and attract new DeFi users as the landscape sees continued growth.

User Experience

My personal experience with DeBank is the best experience I have had with DeFi so far.

DeBank’s platform serves as a dashboard that aggregates data from various DeFi protocols, providing users with real-time insights into their DeFi assets, liquidity pools, and investments. With a single glance, users can get a holistic view of their DeFi portfolio and make informed decisions regarding their assets.

In terms of DeFi Dashboard, DeBank gave me a feeling of perfection, the team must be composed of perfectionists. The platform allows me to have all of my assets and my holdings in front of my eyes. The UX is simple and very easy to navigate. The process is silky smooth and lightning fast.

The platform’s user-friendly interface is designed to cater to both experienced DeFi users and newcomers to the space. For seasoned DeFi enthusiasts, DeBank provides advanced analytics and detailed data on DeFi protocols, enabling them to optimize their strategies and maximize their returns.

On the other hand, DeBank’s platform is designed to simplify the onboarding process for newcomers to DeFi. With clear and concise explanations of DeFi terms and functionalities, DeBank aims to empower more people to participate in the decentralized finance revolution.

Next-gen Social Platform

As the DeFi ecosystem continues to evolve, DeBank remains committed to staying at the forefront of innovation. The latest innovation is the Social Platform, a wild idea of how SocialFi should progress.

In terms of SocialFi, DeBank offers me everything I need, but better, and in one place. It is a more friendly version of Lens Protocol, saving me from all the confusion and complications. DeBank Hi is a better-looking, and more straightforward version of Friend Tech. DeBank Streams is a smoother version of BitClout, with the enhanced features of Networth.

DeBank emerged as a transformative force in the world of DeFi, playing a pivotal role in the ongoing revolution that is reshaping the financial landscape.

At its core, DeFi represents a paradigm shift in how financial services are designed and delivered. By leveraging blockchain technology and smart contracts, DeFi protocols enable the creation and execution of financial applications without the need for intermediaries. This decentralized approach offers a host of benefits, including increased transparency, reduced costs, and enhanced accessibility to financial services for individuals around the world.

Additionally, DeBank’s user community plays a crucial role in the platform’s growth and development. The community actively engages in discussions, provides feedback on the platform’s functionalities, and proposes new ideas for improvement. This collaborative approach not only enriches the platform’s offerings but also fosters a sense of ownership and collective responsibility among its users.

IV. Conclusion

In conclusion, DeBank stands as a beacon of innovation in the DeFi space, offering a user-friendly and comprehensive platform that empowers individuals to participate in the decentralized finance revolution.

With its commitment to security, education, and community engagement, DeBank embodies the core values of the DeFi movement, driving the democratization of finance and challenging the traditional financial status quo. As the DeFi ecosystem continues to evolve, DeBank’s dedication to continuous improvement and adaptation will undoubtedly play a crucial role in shaping the future of decentralized finance.

Me personally really enjoy DeBank. It is one of the best experiences I have had with DeFi by far. DeBank gives me a pleasant feeling when managing my on-chain portfolio, playing around with its platform, interacting with others, and making money out of it.

However, there are a few things that can be fixed to help DeBank achieve its goal. For example, a document, or user guide would be helpful. The $96 for ID is quite a high barrier for most people. Or whitepaper, informative post would help people explore the dynamics of the platform. These are minor things and can be modified easily.

In conclusion, if you asked me “What is DeBank?”, my answer would be “a one-stop-shop for all your DeFi needs” or “the most interesting, and the only, DeFi platform you’ll need”.

One more thing, Chainslab is actually on DeBank right now. Come say Hi @Chainslab.