Lately, a number of DAOs have started to grab the attention of more conventional investors, including billionaire Mark Cuban, who called them "the ultimate combination of capitalism and progressivism." Venture capital firm Andreessen Horowitz (a16z) has also led multimillion-dollar fundraising rounds in individual DAOs and companies that support DAO creation.

Many crypto enthusiasts believe that DAOs will become the "next big trend" in the space.

So, what exactly is a DAO?

I. Definition of DAO

DAO stands for Decentralized Autonomous Organization. It is a community-led entity with no central authority.

Since there is no central governing body, every member of a DAO automatically attempts to act in the entity's best interest. DAOs are used a bottom-up management approach when it comes to decision-making.

We can break the term DAO into individual letters to better understand it.

Decentralized means that a DAO is community-led. In theory, a DAO would have no central, hierarchical structure.

Autonomous means that DAOs can operate automatically and effortlessly. DAO usually runs on an open-source blockchain protocol. They're powered by cryptocurrencies called governance tokens.

Think of DAOs like an internet-native business collectively owned and managed by its members.

No one has the authority to access the common treasury without the approval of the group. Decisions are made through proposals and voting. This is to make sure that everyone has their voice.

No CEO can authorize spending funds based on his interest, and no CFO can manipulate the books.

The rules around spending are written into the DAO via its code. Everything is open and transparent.

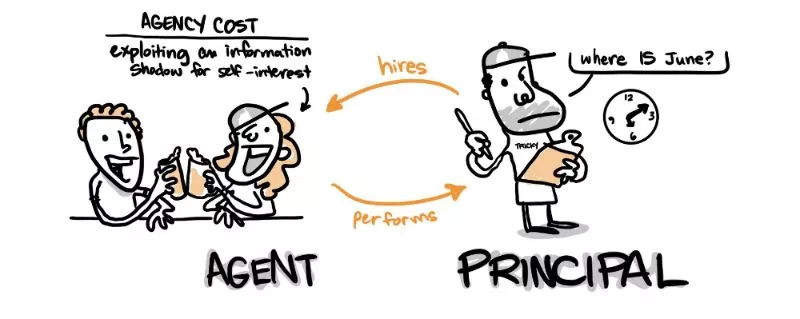

DAOs tackle an age-old governance problem, which political scientists and economists call the principal-agent dilemma. The principal-agent dilemma occurs when one agent has the power to make decisions on behalf of (or impact) another person/entity in the organization. Examples hereof could be politicians that act on behalf of citizens or managers that act on behalf of shareholders.

In those cases, a moral hazard occurs when one takes more risks than one usually would because others bear the cost of those risks. More generally, it occurs when the agent acts in his interest rather than the interest of the whole group. And when there is underlying information asymmetry at play, this dilemma increases.

The principal-agent dilemma is a common challenge affecting a broad spectrum of public and private entities. DAOs aim to address this problem by reducing or bypassing the need for hierarchical human intervention or centralized coordination.

DAOs ensure that the incentive structures and information flow within an organization are properly aligned in a codified format. They play a central role in mitigating the typical problems of the principal-agent dilemma. Because of that, DAOs are often referred to as "trustless" systems.

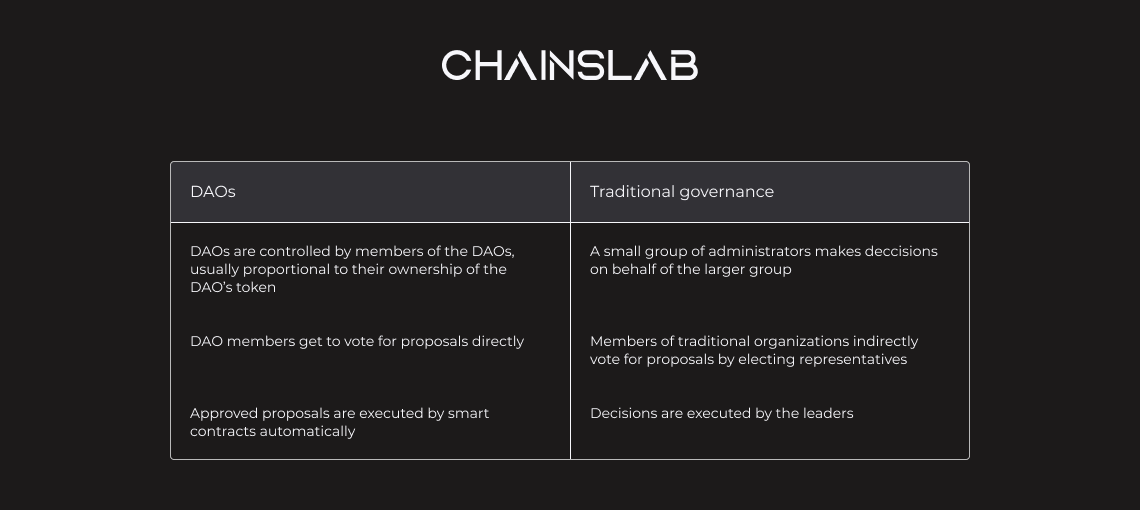

In comparing DAOs vs. Traditional Bussiness, the main difference between them is the decision-making process.

DAOs are formed for many reasons, often (but not necessarily) for monetary gain. Here are some ways that DAOs are currently used.

- Investment DAOs: An investment DAO is a decentralized organization that invests funds as a group. Anyone who owns the investment DAO's governance token can participate in the decision-making process on how and where to invest it. Profits and losses are shared equally to all members' stakes proportional.

- Protocol DAOs: One of the primary uses for DAOs right now is protocol DAOs govern decentralized protocols. Protocols such as Uniswap, SushiSwap, and Curve utilize DAO governance to enable their users to influence the development of their projects, define the parameters of features, and tinker with incentive structures.

- Social DAOs: Most DAOs have some social aspect to them, but social DAOs are purely created to gather people with similar interests. Treasury is used to fund mostly social activities.

- NFT DAOs: The NFT community also makes use of DAOs. They focus on collecting and investing in digital art NFTs and have amassed substantial collections. Additionally, some NFT projects choose DAO as a new approach, allowing their collectors to influence the roadmap of projects and how the funds are spent. In this case, users must hold an NFT from the project's collection to join the DAO.

II. How do DAOs operate

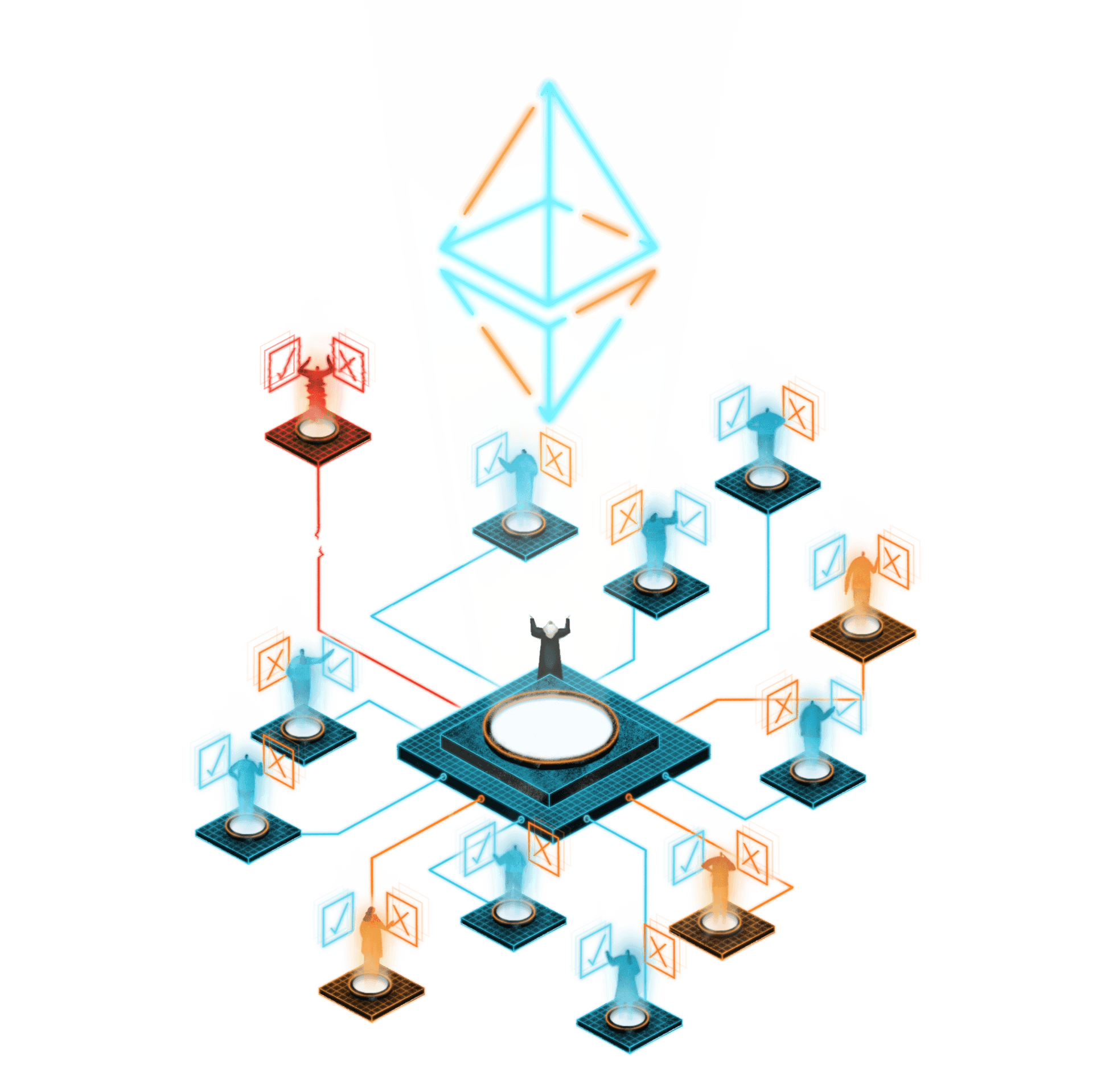

The backbone of a DAO is its smart contract. The smart contract defines the organization's rules and holds the group's treasury. Once the contract is live, no one can change the rules except by a vote. If anyone tries to do something that's not covered by the rules and logic in the code, it will fail. And because the smart contract defines the treasury, no one can spend the money without the group's approval. This means that DAOs don't need a central authority. Instead, the group makes decisions collectively, and payments are automatically authorized when votes pass.

Each DAO works slightly differently, but commonly, to participate in a DAO, users need to own the DAO's governance token. These tokens allow users to participate in governance by making and voting on proposals.

Proposals can concern any number of things that suit the need of the DAO itself. Some proposals pertain to actions that the DAO will take, like deciding which assets a DAO should buy or selecting a venue to host a private party. While others can address the function of the DAO itself, such as changes in the DAO's code and protocol.

With smaller DAOs, creating a proposal can be relatively simple. But as a DAO grows and more members join, the number of proposals the community faces can overwhelm.

To avoid having too many proposals, larger DAOs will ask members to stake governance tokens or charge an entry fee to submit a proposal.

When someone makes a proposal, the community votes on it. A member's number of votes will be proportional to the amount of governance tokens they own. If a proposal is approved, it will be carried out automatically via a smart contract.

So, you might be wondering how a DAO makes money.

A DAO first raises capital by exchanging fiat for its native coin. This native token indicates a member's voting power and ownership proportion. If a DAO is successful, the native token's value will rise. The DAO can then issue future tokens with a higher value to raise additional funds. A DAO can also invest in assets if its members agree to do so. A DAO, for example, can buy firms, NFTs, or other tokens. If the value of those assets rises, so will the value of the DAO.

III. Pros and Cons of DAOs

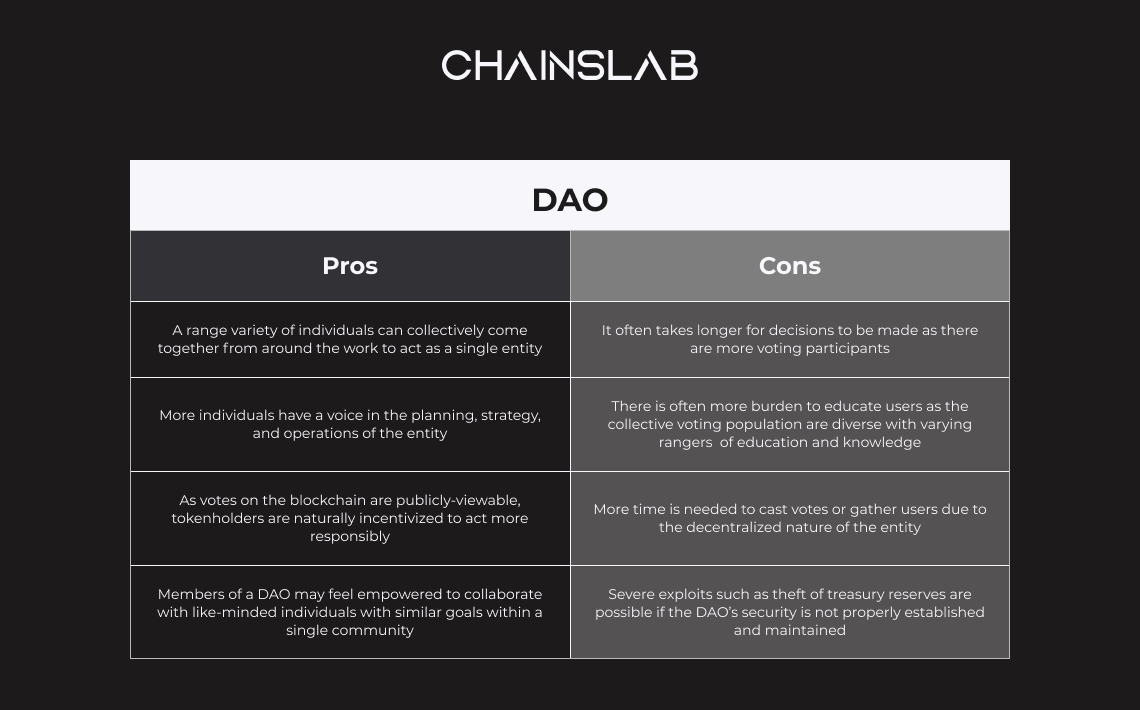

There are several reasons why a company or group of individuals may desire to pursue a DAO structure. Among the advantages of this management style are:

- Decentralization: In contrast to a central authority that is frequently considerably overwhelmed by their peers, a collection makes decisions affecting the organization of individuals. Instead of relying on the acts of a single person (CEO) or a small group of people (Board of Directors), a DAO can decentralize authority across a wider spectrum of users.

- Participation: Individuals inside an entity may feel more empowered and connected to it if they have a direct say and voting ability on all issues. Although these individuals do not have significant voting power, a DAO encourages token holders to vote, burn tokens, or utilize their tokens in ways that they believe are best for the company.

- Publicity: Votes are cast via blockchain within a DAO and are publicly available. Because their votes and actions will be publicly visible, users must act in the ways they believe are best. This encourages behaviors that boost voters' reputations while discouraging acts that harm the community.

- Community: The concept of a DAO encourages people all over the world to collaborate to create a unified vision. Tokenholders can communicate with other owners from anywhere in the world using only an internet connection.

However, not everything about DAOS is great. Improperly establishing or maintaining a DAO might have serious repercussions. Here are some of the DAO structure's constraints.

- Speed: If a CEO leads a public corporation, a single vote may be required to decide on a specific action or course of action for the organization. Every user has the ability to vote in a DAO. This necessitates a substantially longer voting period, especially when time zones and priorities outside the DAO are taken into account.

- Education: A DAO, like a speed issue, is accountable for educating many more people about pending entity action. A single CEO is considerably easier to keep up with corporate advances, whereas DAO tokenholders may have varying educational backgrounds, comprehension of initiatives, motivations, or access to resources. DAOs have the common difficulty of bringing together a varied group of people who must learn how to grow, strategize, and communicate as a single unit.

- Inefficiency: DAOs have a considerable danger of inefficiency, as summarized by the first two items. Because of the time required to administratively educate voters, communicate objectives, explain methods, and onboard new members, a DAO can easily spend far more time discussing change than implementing it. Due to the requirement to manage many more people, a DAO may become mired down in petty administrative activities.

- Security: Security is a concern for all digital platforms for blockchain resources. A DAO takes extensive technical competence to implement; without it, votes or decisions may be invalidated. If users cannot rely on the entity's structure, trust may be shattered and users may quit the entity. DAOs can still be exploited, treasury reserves stolen, and vaults emptied despite the adoption of multi-sig or cold wallets.Benefits and Limitations of DAOs

IV. Future of DAOs

At the moment, community-governed protocols are the most popular stories in crypto. It is nearly impossible for blockchain-based applications to lack on-chain voting functionality. Even new projects will eventually launch a DAO.Despite the unknowns, many crypto enthusiasts in the space think that DAOs will be disruptive to traditional business structures.

The recent wave of mainstream institutional investment in DAOs also shows growth for the industry. It also shows the potential for more widespread adoption, leading to potential competition with traditional businesses and organizations.

DAOs are supposed to take a major role in the web3 ecosystem.

While building and executing highly sustainable, value-generating DAOs presents major hurdles, DAOs represent a potentially game-changing new form of corporate governance. As the legal ambiguities surrounding DAOs are resolved, an increasing number of firms may consider implementing DAO platforms to automate certain portions of their fundamental business operations. While the rising complexity of modern-day business models necessitates DAO stakeholders adapting their systems, the objective of developing transparent and self-governing organizations is becoming a reality.

Some DAOs to check out:

DAOhaus: DAOhaus is a no-code platform for launching and running DAOs. It is owned and operated by the community. Look no further if you're interested in starting your own DAO or exploring the vibrant landscape.

MakerDAO: If you would like to contribute to the protocol that introduced the world's first unbiased stablecoin, DAI, you can get involved in governance by voting on changes to the Maker protocol.

BanklessDAO: Interested in spreading the Web3 word and educating the masses through content? This media-centric DAO might be of interest to you.

BitDAO: a DAO that attempts to support the growth of open finance and develop decentralized, tokenized economies. Launched through and with Bybit, a derivatives exchange, BitDAO deploys capital in tranches from its treasury to fund long-term projects such as art, R&D, venture, events, grants, education, and more.

V. Closing thought

DAOs stand as a perfect example, an essential part of Web3. They will continue to grow and have the potential to compete with traditional business structures.

But DAOs model still needs to evolve to eliminate its existing limitations. It will need more tools to function effectively. It will also need to overcome many potential regulatory and legal challenges, especially in the U.S.

The current state of DAO is DAO 1.0, so the next state will be DAO 2.0. Till then, it will be the next big thing.