I. Market Context

The Crypto Market 2020-2021 is crazy. If only half a year ago, anyone hypothesized that XRP will out of the top 5 Coinmarketcap, or BNB will be in the top 2 Coinmarketcap, that person will be considered crazy.

However, the second year of Covid in the world has proven that this is a miraculous year. At the time of writing, Binance Coin (BNB) is stagnant at the top 3 Coinmarketcap, behind only Bitcoin and Ethereum, while Ripple's XRP is pushed down to the seventh place.

What makes the Binance miracle? And is this the beginning of a second ETH, or will it be a second Mt.Gox? So many questions are being asked, and no one knows the answer. However, through this analysis, we hope that readers will understand somewhat about the BNB FOMO wave, as well as find out for themselves the answer on whether to invest in BNB long-term or not

II. Binance Chain vs Binance Smart Chain.

1. The Birth and Failure of Binance Chain

Looking back at 2020-2021, BNB is indeed one of the most magical stories of the village of Crypto. In early 2020, there was a time when BNB hit $ 8 with the spectacular Black Swan Black Thursday, March. Since then, BNB has been steadily increasing and peaked at nearly $ 300 in early 2021 with Binance Smart. Chain is on track to overtake ETH.

This story actually started a long time ago, with the full ups and downs of the crypto market. And to be asked if it's worth it, I believe BNB does. And everything started from March, March 13, 2018 to be exact, with a small announcement from the Binance Team:

On March 13, 2018, Binance Chain was officially announced. A year later, in April 2019, Binance Chain was officially born with Binance DEX. And do not know if they were born in downtrend or not, but Binance DEX and Binance Chain have ... failed miserably.

Binance DEX - Binance Chain's main product has no users. Binance DEX's original IDO - Raven Protocol, as well as the Binance Chain-based projects at that time had a negative ROI after the list, even though BNB was still flying.

The main reasons for the failure of Binance Chain are speed (faster than ETH, BTC but still slower than TRX or other 3.0 Blockchain), structure (difficult to build due to fewer documents than ETH that exists from long) and lack of support from other projects and organizations in the industry. However, the main reason why Binance Chain failed in the opinion of that writer is that in 2019, Binance Chain has no DeFi and Money Game.

There is one basic thing that many exchanges, as well as many Crypto projects, have accidentally forgotten after going through a long uptrend. It is a new source of money that will only be poured in, when it has the ability to generate more money. In other words, without the Money Game, there would be no game at all. Looking back, ICO, MLM / Lending, IEO etc all went up when everyone made money together. When everyone makes money, people will invite more people to join. In the financial world, there is no better PR / Marketing form than raising prices.

In fact, Binance and CZ did very well throughout 2018 and 2019. The fact that Binance lived well through the downtrend season is a clear testament to how good CZ and Binance are in making money as well as attracting players. But with Binance Chain and Binance DEX, they may have taken a mistaken move. During 2018-2019, most of the Volume on Binance came from Market Maker using bots to push prices and pump. And on Binance Chain as well as Binance DEX, there is no Orderbook, no limit orders and no bots. The results of Binance Chain and Binance DEX are shown below.

In the list above, we see that there are only 10 names that have positive ROI after the floor list, the rest are pretty strong negative. This is a consequence of many factors, but the biggest one is probably the fact that they are all normal projects, and the inability of users to make money. And when users don't make money, failure is understandable.

And of course, DeFi and Yield Farming are a game-changer. DeFi and Yield Farming not only help ordinary users make money, but it also does one more thing that seemed impossible after the ICO bubble: Advertising and helping new money push into the market. Moreover, Uniswap and AMM also help a new generation of investors born: Market Buy generation, just press swap without knowing the Orderbook.

But Binance Chain and Binance DEX cannot do this, because it does not support Smart Contract and EVM, two of the most important things of Defi. And of course, after the first failure, CZ learned a lot of experience before launching Binance Smart Chain. And this time, Binance was successful.

2. Binance Smart Chain and Rockefeller of Crypto village.

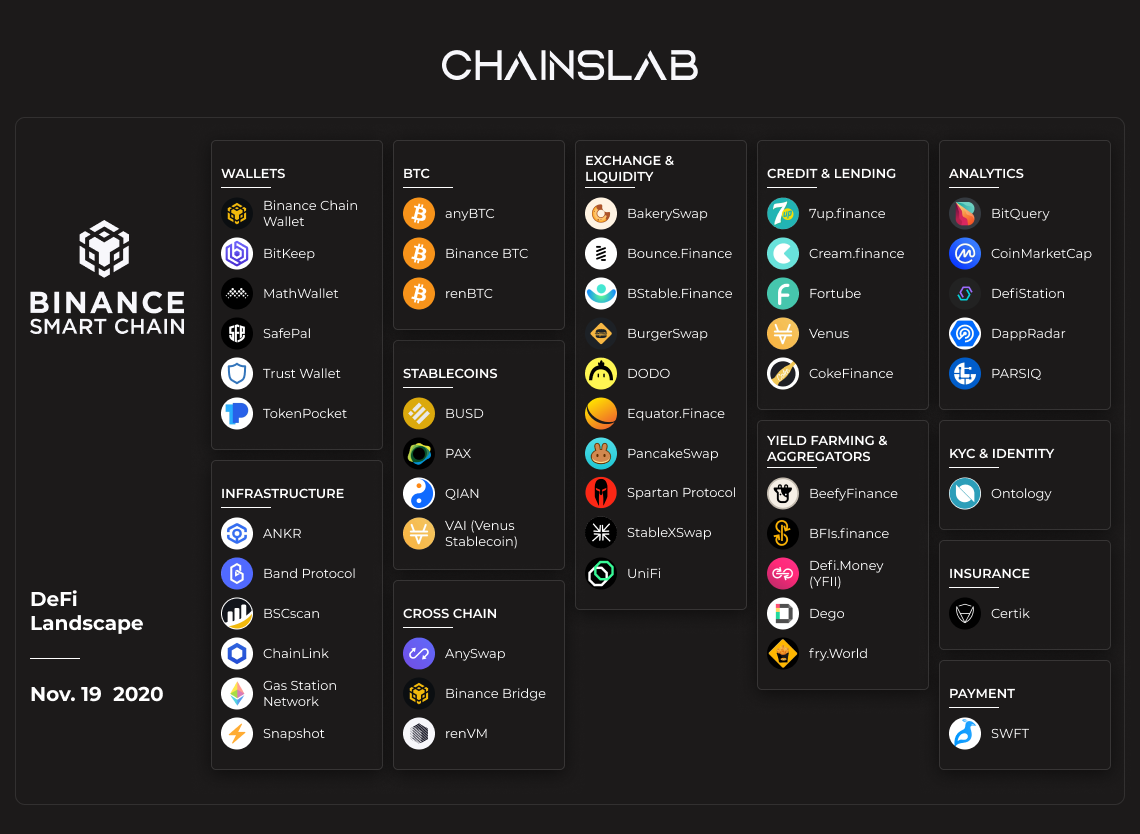

Perhaps it is not an exaggeration to say that up to now, Binance Smart Chain is a great success of Binance. BNB reached the top 3 of Coinmarketcap, PancakeSwap volume reached $ 1.1 billion, Venus Protocol TVL reached $ 3.5 billion, DeFi projects moved to Binance Smart Chain…. However, for the overall picture, we need to go back to where Binance Smart Chain started and what made it a success first.

The first thing to remember, is that Binance Smart Chain is NOT a Binance Chain. Binance Smart Chain is not Layer-2 or Off-chain, but it is a separate Blockchain, running in parallel with Binance Chain. In fact, Binance Smart Chain is even more like Ethereum than Binance Chain.

Created in September 2020, at the heart of DeFi storm, the biggest difference between BSC and Binance Chain lies in two main factors:

- Smart Contracts support.

- Supports compatibility with the Ethereum virtual machine (EVM).

These two factors create the key that makes BSC grow faster than the rest of DeFi Blockchains, even for Polkadot, Tron, and NEO to smoke: EVM compatibility allows projects to easily switch tools. and dApps from ETH to BSC. For example, Metamask is fully compatible and can connect to BSC without too much effort. This makes it easy for both programmers and users to switch to the BSC.

Another question arises, so why should users switch from ETH to BSC?

There are 3 factors to answer this question: Proof of Staked Authority (PoSA), gas fees, and the Binance ecosystem itself.

First, in terms of consensus mechanism, Binance Smart Chain uses the Proof of Staked Authority. This is a mechanism quite similar to Polkadot's Proof of Stake, created by Dr. Gavin Wood. Unlike traditional Proof of Stake, the Proof of Staked Authority of Binance Smart Chain limits the maximum number of Validators. This constitutes 2 main results. The first is that the fees and speeds on Binance Smart Chain will be faster than traditional PoS. The second result coming from this, would be concentration. But I will talk about this more later in the article.

The second factor that causes users to gradually switch to BSC is that gas fees on Ethereum are quite horror, especially when the pump / dump market is strong

With BSC, this doesn't happen. Or at least, it has NOT happened yet. The gas fee on BSC is quite cheap, depending on the time, it will fluctuate around 2-4 $. However, we have to remember one thing: BSC shares the same structure as ETH, and ETH already has a crowded ecosystem. More users, will bring more traffic, network congestion and expensive fees are inevitable. With BSC, this has not happened yet, as the ecosystem on Binance Smart Chain is few. Volume, as well as TVL, is only focusing on a few main projects, so in the short term, of course, Binance Smart Chain will have an advantage over Ethereum. But in the long run, they will have to find ways to overcome the problems that Ethereum also faces.

And the final reason to make the BSC wave increasingly spread, with new projects pouring into BSC as much as possible is the power of the Binance ecosystem. Let's take a look at what Binance has in this uptrend season.

They are the spot floor with the largest volume in the world. At the same time, their derivative volume is also in the leading position. They have a large user base, a strong ecosystem of projects, from Launchpad to Launchpool. In terms of marketing, they are one of the strongest marketing units on Twitter, from Binance's Twitter to CZ. Even Armanda Cerny - the famous playboy supermodel also works as an affiliate/advertiser for them. And imagine a new player's cycle like this. First, they transfer money from their bank account or visa card to Binance through the Fiat portal. If there is no Fiat in the player's country, players can purchase Crypto directly at no charge through Binance P2P. Then, they can directly buy Spot coin on the app, or transfer money and buy projects on BSC with just one click. This is a lot more convenient than what users have to do to buy Crypto on Uniswap. And because of this ability, BSC will thrive in the future. However, this is also one of the writer's main concerns about the development of this ecosystem - dictatorship and centralization.

Let's go back to history a little bit, back to America in the late 19th century, early 20th century. In 1911, an American Supreme Court ruling laid the basis for all American industries to go up. That was the decision to dissolve Standard Oil - America's largest oil and gas corporation, owned by John D. Rockefeller.

In a word, John D. Rockefeller was the richest man in the United States at the time, with an estimated net worth of US $ 418 billion (in 2019 values). Rockefeller got rich by founding Standard Oil, one of the pioneers with First-mover advantages in the US oil and gas industry. At its peak, Rockefeller once controlled 90% of all oil in the US thanks to the guise of acquisitions and monopolies. To put it simply, any of Rockefeller's rivals were bought by him, until his arm reached out enough to control the entire oil and gas industry. And of course, exclusivity isn't good for growth. Absolute power corrupt absolutely.

Now, let's go back to the present. In the current Blockchain industry, there is a man to go ahead and get the First mover's advantages. He established the Exchange with the largest volume in the world. He had enough money to swallow smaller opponents. Without even buying back, the customer automatically switched to his product, simply because the competitors' products couldn't keep up. His ecosystem includes most of the market's best projects. He also acquired independent rating agencies (eg Coinmarketcap). There is nowhere without his hand reaching out. Probably speaking up here, you already know who this man is. In case you don't already know, it is CZ - CEO Binance.

This is also the biggest problem of the entire Binance ecosystem and the Binance Smart Chain. With the number of Validator on BSC limited AND almost controlled by both CZ and Binance, it is not a decentralized Blockchain anymore. And DeFi on BSC is actually CeDeFi, the Decentralized Economy. Someone will think, oh, that doesn't matter too much. Binance will know for himself what is right and what is wrong to judge.

If so, they probably forgot the May 2019 story. At that time, Binance was hacked more than 7,000 BTC, a figure worth tens of millions of dollars. And CZ "boldly" proposed that miners should cooperate to "rollback" the entire Bitcoin Blockchain, in order to bring those 7,000 BTC back to Binance's wallet, as well as bring all Bitcoin transactions. back to before Binance was hacked. It is an opinion that is not only stupid, but will destroy the entire decentralized nature of Blockchain, as well as the entire industry.

https://twitter.com/cz_binance/status/1125996194734399488

Of course, CZ's proposal was not approved. But what will stop CZ from doing so with its own Blockchain? When power is concentrated in the hands of an individual, a single wrong decision will have unpredictable consequences. And that is also the vision of Satoshi Nakamoto made clear in the Bitcoin whitepaper, as well as a guide to the entire industry.

Only one thing, at present, BSC is going against that guideline. And there won't be a Supreme Court that can disintegrate Binance

III. Conclude

The above analysis by Chainslab is only intended to provide readers with an overview, as well as the best overview of Binance Smart Chain, from history to the present, and some questions for the future. Of course, the story of BSC is far from over, which also means that there are still many potential projects on BSC for us to exploit. In the next article, Chainslab will focus on clarifying the future, as well as potential projects on Binance Smart Chain worth investing.

Thank you for reading here, and would like to see you again in the following article