Thursday, September 15th, 2022 marks the day of "The Merge", the biggest milestone for not only the second largest blockchain in the world, Ethereum, but the whole Web3 space. With The Merge, Ethereum is casting out the famous Proof-of-Work consensus mechanism (introduced by Bitcoin), and replacing it with the Proof-of-Stake mechanism. Is it the right move for Ethereum, and which one is better, Proof-of-Work or Proof-of-Stake?

I. Blockchain Consensus Mechanism Explained

In traditional finance, there's always a middleman, a gatekeeper like banks or brokerages. They existed in order to keep everything going the right way and no bad actor can exploit the system.

But that comes at a cost of centralization. Meaning that the power is centered around this entity. That leads to the single point of failure. Of course, your bank will always play by the rule, they don't want to lose customers, but what if their system fails because of technical problems, not the human factor?

Well, blockchain technology can fix that. Blockchain removes the need for a third party, a central entity, a single point of failure, by empowering individuals with peer-to-peer digital exchanges. Blockchain solves the trust issue by the consensus mechanism.

The consensus mechanism is a mechanic that allows everyone in the network to achieve the necessary agreement on a single data value or a single state of the network. The consensus mechanism is like an automated set of rules that decides the legitimacy of every action in the network. It keeps everyone playing fair and square.

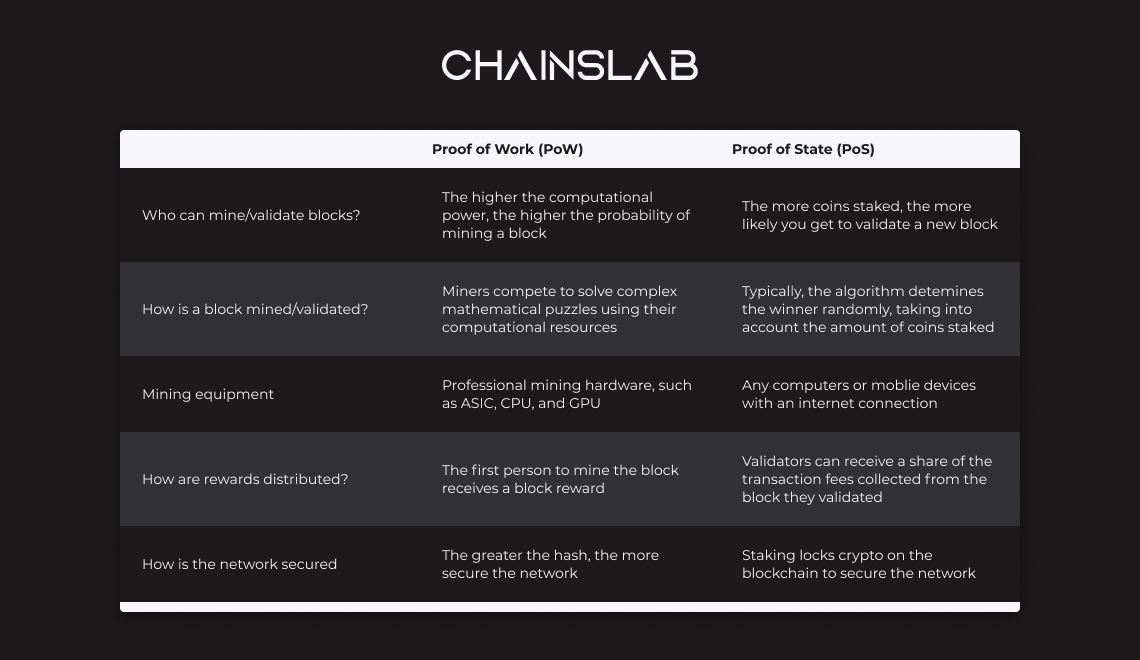

The two most widely used consensus mechanisms (and also the two we will discuss in this article) are Proof of Work (PoW) and Proof of Stake (PoS). They are adopted by major cryptocurrencies to secure their network. The major difference between PoW and PoS is the way they determine who gets to validate a block of transactions. PoW involves solving complex cryptographic mathematical equations using computing power. In contrast, PoS requires a potion of cryptocurrency (or stake) for the right to validate new block transactions.

Proof of Work Explained

Proof of Work (PoW) was introduced in the early 1990s as a means to mitigate email spam. The idea was computers might be required to perform a small amount of work before sending an email.

The technology was later adopted by the first blockchain ever, Bitcoin, to secure its network and prevent the double-spending problem. Many other cryptocurrencies then applied it, including Ethereum (before The Merge).

In blockchain terms, Proof-of-work is a system where computers compete against each other to be the first to solve complex puzzles. This process is commonly referred to as mining because the energy and resources required to complete the puzzle are often considered the digital equivalent of the real-world process of mining precious metals from the earth.

The problems are solved using trial and error. The first miner to complete the puzzle or cryptographic equation gets the authority to add new blocks to the blockchain for transactions. When the block is authenticated by a miner, the digital currency is then added to the blockchain. The miner also receives compensation with coins.

In simple words, these computers are competing in a guessing game, and the fastest wins the prize. Nathaniel Popper’s book "Digital Gold" uses an analogy to describe proof-of-work in the Bitcoin system:

“It is relatively easy to multiply 2,903 and 3,571 using a piece of paper and pencil, but much, much harder to figure out what two numbers can be multiplied together to get 10,366,613.”

Using this analogy, we can imagine that a miner in Bitcoin’s network must figure out which two numbers can be multiplied to reach 10,366,613 by guessing combinations of numbers until it hits the correct answer. Once a computer determines that 2,903 can be multiplied by 3,571 to make 10,366,613, the computer presents the solution to the other computers in the network, which can easily verify that 2,903 and 3,571 do, in fact, equal 10,366,613 when multiplied.

When a miner solves this “puzzle” before other miners, they are allowed to create a new block (a batch of transactions) and broadcast it to the network of nodes, which will then individually perform audits of the existing ledger and the new block. Should everything check out, the new block is "chained" onto the previous block, creating a chronological chain of transactions, or blockchain. The miner is then rewarded with bitcoins for supplying their resources (energy).

A proof-of-work system requires high-powered computers that use large amounts of energy resources. And the requirement can keep going up as the network continue to grow.

Proof of Stake Explained

Proof of Stake is the most popular alternative consensus mechanism to Proof of Work. Both PoW and PoS share the same goal of reaching a consensus in the blockchain, but PoS has a different approach.

In the proof-of-stake system, validators (the proof-of-stake equivalent of miners) are chosen to find a block based on the number of tokens they hold rather than having an arbitrary competition between miners to determine which one can add a block. The idea is pretty straightforward, one coin equals one chance.

Miners pledge an acquisition of digital currency (or stake) in order to validate transactions with PoW. The choice for who validates each transaction is randomly using a weighted algorithm, which is weighted based on the amount of stake and the validation experience. Of course, the more you stake, the greater your chance of “winning the lottery.”

In this system, the “stake” amount, or quantity of crypto a user holds, replaces the work miners do in proof-of-work. This staking structure secures the network because a potential participant must lock up a portion of their asset to be chosen to create a new block and earn rewards.

Participants are required to spend money and dedicate financial resources to the network, similar to how miners must expend electricity in a proof-of-work system. Those who have spent money on coins to earn these rewards have a vested interest in the network's continued success.

Proof-of-stake prevents attacks and counterfeit coins with essentially the same mechanism as proof-of-work. Instead of controlling 51% of the mining hash rate and nodes, like with proof-of-work, attackers of a proof-of-stake system would need to hold at least 51% of the coin’s supply and control at least 51% of the network's nodes.

II. Proof-of-Work Vs. Proof-of-Stake

Now we have the controversy on which mechanism is better.

Proof of Stake supporters argues that PoS has some benefits over PoW, especially regarding scalability and transaction speed. It’s also said that PoS coins are less harmful to the environment when compared to PoW.

In contrast, many PoW supporters argue that PoS, as a newer technology, is yet to prove its potential in terms of network security. The fact that PoW networks require significant amounts of resources (mining hardware, electricity, etc.) makes them more expensive to attack. This is particularly true for Bitcoin, as the biggest PoW blockchain.

Let's break down The Clash of Titans into pieces to better understand the situation:

Electricity Demand

Ethereum (pre Merge) uses 113 terawatt-hours per year—as much power as the Netherlands, according to Digiconomist. A single Ethereum transaction can consume as much power as an average US household uses in more than a week. Bitcoin’s energy consumption is even worse, touching 200 terawatt-hours per year in May 2022.

In contrast, a proof of stake cryptocurrency like Tezos (XTZ) has an energy cost per transaction of just 30mWh or 60MWh per year.

Right now the world is facing a power crunch, which is partly why China banned crypto mining last year, and why countries like Kosovo and Kazakhstan, where the miners scattered off to, are pushing miners out and cutting off their electricity. These countries need the power to keep their businesses running and their homes warm.

Not only does proof of work waste electricity, it generates electronic waste as well. Specialized computer servers used for crypto mining often become obsolete in 1.5 years, and they end up in landfills.

That carbon footprint problem is one of the reasons why Ethereum decide to move on to PoS, which it promises will use 99% less energy, allow the network to scale, and potentially help it reach 100,000 transactions per second.

Security Risks

As of December 2021, the top 4 mining pools together control around 50% of the total Bitcoin hashing power. The domination of mining pools makes it more challenging for individual crypto enthusiasts to mine a block on their own.

This could potentially increase the risk of a 51% attack. A 51% attack refers to a potential attack on the security of a blockchain system by a malicious actor or organization that manages to control over 50% of the total network hashing power. The attacker could override the blockchain consensus algorithm and commit malicious acts to benefit themselves, such as double spending, rejecting or altering transaction records, or preventing others from mining. However, this is unlikely to happen on Bitcoin due to the size of its network.

In contrast, if someone were to attack a PoS blockchain, they would have to own more than 50% of the coins on the network. This would cause the demand in the market and the coin price to rise, which could cost tens of billions of dollars. Even if they do commit a 51% attack, the value of their staked coins would go down drastically as the network gets compromised. Therefore it is not very likely for a 51% attack to happen on crypto that uses the PoS consensus, especially if it's a large market cap one.

Re-Centralization

In addition to the security risk, the fact that the top four mining pools have the majority of the hashing power of the Bitcoin network could lead to the so-called re-centralized.

Certain areas, mining equipment producers, and energy producers still dominate mining and reduce overall decentralization for proof of work blockchains. The power of a decentralized network now centers around some farming pools, how ironic.

The Proof of Stake consensus mechanism takes a different approach and replaces mining power for staking. This mechanism lowers the barriers to entry for an individual to confirm transactions, reducing the emphasis on location, equipment, and other factors.

However, due to the reward distribution mechanism, validators with more assets staked can increase their chances to validate the next block. The more coins a validator accumulates, the more coins they can stake and earn, which some people criticize as “making the rich richer”. These “richer” validators then have even more chances to be selected to validate the next block.

III. The Verdict

Proof of Work and Proof of Stake both have their place in the crypto ecosystem, and it is hard to say with certainty which consensus protocol works better.

PoW might be criticized for creating high carbon emissions during mining, but it has proven itself as a secure algorithm to protect blockchain networks.

In terms of transaction throughput and speed, proof-of-stake cryptocurrencies are still ahead of proof-of-work cryptocurrencies.

Also, PoS proved to allow networks to scale more effectively.

In the case of Ethereum, switching from PoW to PoS is a must. Since it provides a necessary platform for decentralized apps to run on. PoS allow Ethereum to scale and help it reach 100,000 transactions per second.

Ethereum needs to move to proof of stake but the question is, will its new system fulfill all the promises made for proof of stake? And how decentralized will it really be? If a public blockchain isn’t decentralized, what is the point of proof of anything? You end up doing all that work—consuming vast amounts of energy or staking all those coins—for nothing other than maintaining an illusion.